This paper was prepared by the authors under the Lamfalussy Fellowship Programme sponsored by the ECB. Any views expressed are only those of the authors and do not necessarily represent the views of the ECB or the Eurosystem.

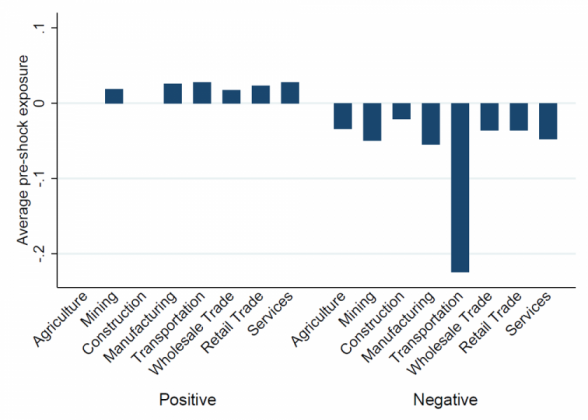

Figure 1 illustrates a few key stylized facts about the distribution of regulatory risks by displaying firms’ average pre-Paris exposure at one-digit industry level separately for the group of positively and negatively exposed firms. We define negatively exposed firms as companies that consider themselves to be negatively impacted by the introduction of climate change regulation as it can negatively influence operating costs, earnings, and cash flows as well loss probabilities (Huang et al., 2018; Nguyen, 2018; Seltzer et al., 2020). Meanwhile, certain firms consider themselves to benefit from the introduction of regulation as these policies might, for example, correct relative cost disadvantages of greener business models, by either providing subsidies to greener technologies or increasing the operating costs of more polluting competitors (Holburn, 2012). We refer to these firms as positively exposed firms.

United Nations Environment Programme Finance Initiative. The data is hand-collected from the official website: http://www.unep.org/members/ (accessed on July 20, 2021)