Climate change and measures to avert global warming affect financial stability as well. In the pilot climate stress testing project, we estimate the indirect consequences of the transition to a carbon-neutral economy on the Slovak banking sector. We focus on the credit risk of households and non-financial corporations. We estimate that banks’ credit losses should remain systemically negligible in the case of a smooth and rapid substitution of emission-intensive industries in favor of their ecological alternatives. On the contrary, the uneven path to a carbon-neutral economy increases credit losses, which in certain circumstances exceed losses under adverse stress testing scenarios.

This policy brief embarks on a journey to recognize the dynamic interplay between climate and finance and to dissect the indirect repercussions of climate transition risks on the banking sector in Slovakia. Our in-depth analysis seeks to discern the intricacies of potential adverse macroeconomic developments triggered by the shift towards a carbon-neutral global landscape. Specifically, our examination is tailored to gauge the influence of this transition on the credit quality of households’ and non-financial corporations’ (NFCs) loans granted by Slovak banks. This attempt underscores the urgency of understanding and addressing climate transition risks to safeguard financial stability and foster resilience within the Slovak banking sector.

A thorough approach to climate risk scenario design is imperative for a forward-looking analysis. Conventional stress testing scenarios do not incorporate climate-related risks; hence, we use the scenarios developed by the Network for Greening the Financial System (NGFS). These NGFS scenarios are constructed upon various assumptions encompassing climate policies, average temperature trends, and carbon emissions trajectories, culminating in distinct levels of physical and transition risks (NGFS, 2021). Our analysis focuses on two specific NGFS scenarios, namely “Net Zero 2050” and “Divergent Net Zero”, where the prevalence of transition risks surpasses physical risks. We utilize the “NGFS Baseline Scenario” as a benchmark against which to compare the results of climate stress tests. This baseline scenario represents the most likely macroeconomic projections and serves as a standard economic forecast that does not incorporate climate-related risks. These scenarios are integrated into the stress test framework established by the National Bank of Slovakia (NBS). Further details of the framework are described in Klacso (2014, 2023).

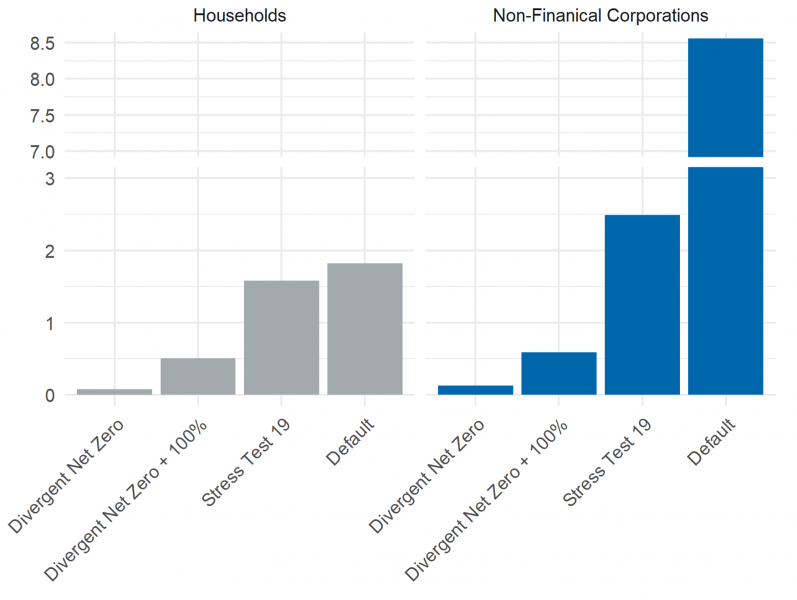

Again, the “Net Zero 2050” scenario expects a smooth transition, yielding a negligible impact on economic growth. Hence, corporate loan losses stay under 0.1% of the aggregate volume of corporate loans compared to the baseline scenario. The “Divergent Net Zero” scenario embodies a shift toward a carbon-neutral economy, reducing demand for products from sectors with elevated Scope 1 and 2 emissions. Consequently, compared to the baseline scenario, a decrease in GDP ranging from 4% to 6% corresponds to a surge in credit losses of 0.2% to 0.3% of all loans provided to companies. In this case, losses are also significantly lower compared to the results of standard stress testing.

The stringency of this assumption can be balanced by the high risk of transferring losses to other sectors. This contagion cannot be directly embedded in the analysis due to the lack of suitable data. Therefore, the results are interpreted as losses from the failure of loans equivalent to loans provided to the most emission-intensive sectors or losses due to increased unemployment corresponding to the number of workers in the most emission-intensive sectors. In such an instance, the losses would outpace those derived from standard stress testing, emerging as a more substantial concern for households and NFCs.

Note: All results are relative to baseline, as a percentage of the outstanding amount of loans. Divergent Net Zero represents NGFS scenario, Divergent Net Zero +100% represents NGFS scenario plus energy price hike of 100% NGFS gas price scenario, Stress Test 19 represents results of adverse scenario of conventional NBS stress test as of end 2019, and Default represents failure of the twelve most emission-intensive sectors.