Disclaimer: This policy brief summarizes the main findings of a recently published paper: D’Orazio (2025), “Climate risks and financial stability: Evidence on the effectiveness of climate-related financial policies.”, International Review of Financial Analysis 105, 104304, DOI: https://doi.org/10.1016/j.irfa.2025.104304

Abstract

This policy brief summarizes key findings from D’Orazio (2025), which investigates the role of climate-related financial policies in promoting financial stability. Drawing on a panel of 88 countries from 2000 to 2020 and using the Climate-Related Financial Policy Index (CRFPI), the study shows that these policies help reduce credit risk and strengthen banking sector liquidity. However, their impact on insolvency risk is less pronounced. The analysis reveals diminishing returns to policy intensity and significant cross-country variation shaped by climate vulnerability. The results provide evidence-based guidance for integrating climate risk into macroprudential and supervisory frameworks.

The financial sector is increasingly exposed to the risks posed by climate change, which threaten financial stability through their impact on asset valuations, credit risks, and market volatility (BCBS, 2021b). Existing literature highlights the destabilizing effects of climate-related financial risks, with growing concerns about their implications for financial institutions worldwide (NGFS, 2019, 2020). Climate change disrupts financial stability through physical risks, such as hurricanes and rising sea levels, which damage assets and disrupt economic activity, and transition risks, driven by policy shifts and technological advancements that devalue carbon-intensive investments. These risks increase loan defaults, strain liquidity, and heighten insolvency risks for financial institutions. Climate-related financial policies (CRFPs) aim to address these challenges by embedding climate considerations into financial regulation. Despite these benefits, there is an ongoing debate on whether market-based mechanisms, such as improved disclosure and risk pricing, are sufficient to address climate risks or whether regulatory interventions – such as capital requirements and climate stress tests, are more effective in safeguarding financial stability (BCBS, 2021a; EBA, 2022; Eren et al., 2022; Schnabel, 2020; TCFD, 2021). However, despite the increasing discussion on climate-related financial policies, empirical evidence on their impact on financial stability remains scarce. Against this backdrop, the study developed in D’Orazio (2025) empirically investigates the relationship between climate-related financial policies, climate risks, and financial stability, focusing on credit, solvency, and liquidity risks.

The empirical analysis integrates data from both advanced economies and emerging markets and developing economies (EMDEs), as classified by the World Bank, allowing for broad cross-country comparisons.

Financial stability is assessed across three key dimensions: credit risk, liquidity risk, and insolvency risk. These are proxied respectively by the non-performing loans (NPL) ratio, the liquidity ratio (liquid assets to deposits and short-term funding), and the Bank Z-score. The core explanatory variables include CRFPI, which quantifies the degree of adoption and bindingness of climate-related financial policies; CO₂ emissions per capita, capturing transition risk; the ND-GAIN Vulnerability Index, reflecting chronic physical climate risk; and the Global Climate Risk Index (GCRI), representing acute physical risk due to extreme weather events.

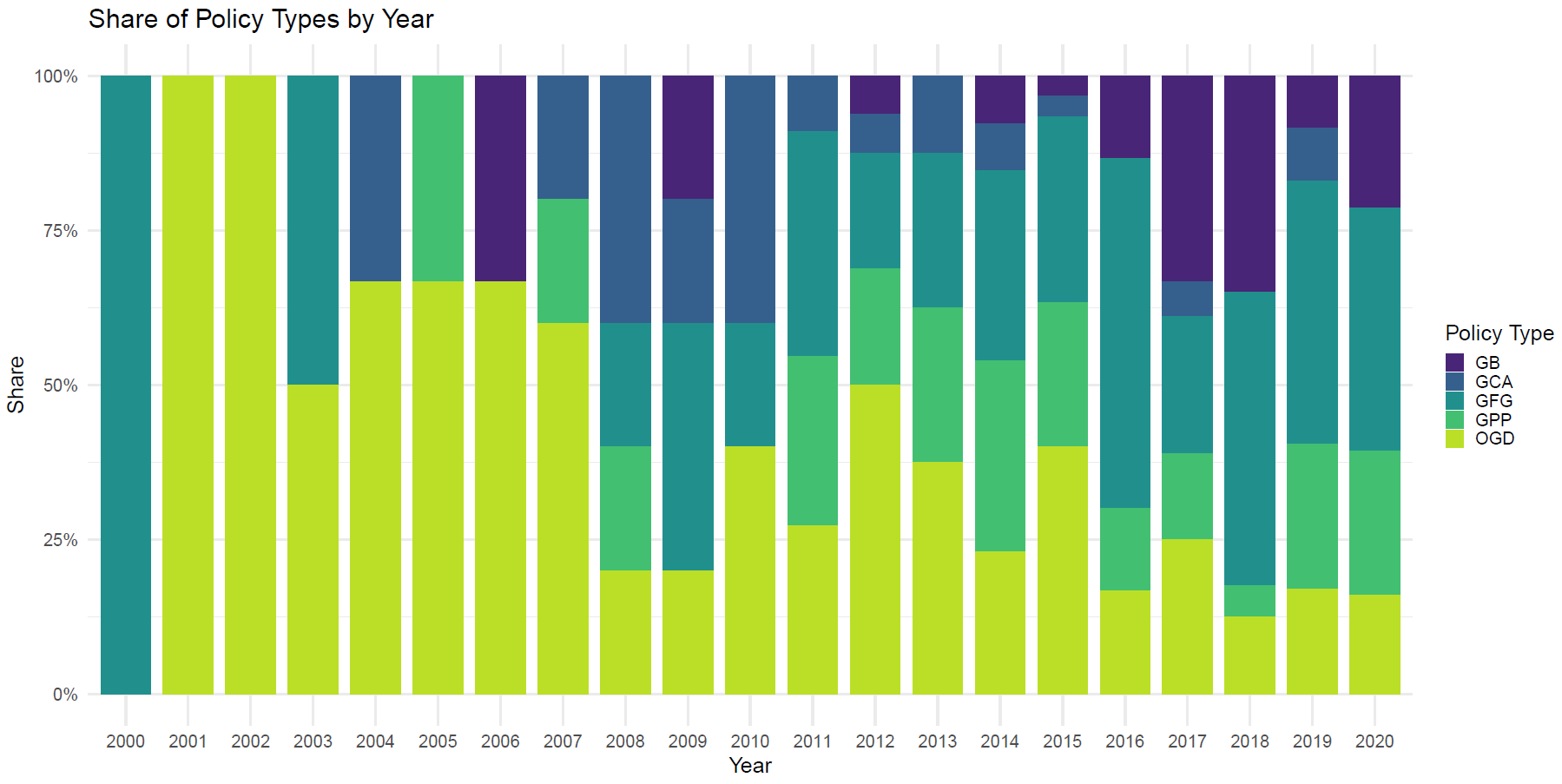

The CRFPI, developed by D’Orazio and Thole (2022), incorporates five policy pillars: green prudential regulation (GPP), green credit allocation (GCA), green financial principles (GFG), disclosure requirements (OGD), and green bond frameworks (GB), aggregated using a min, max normalization and weighted composite index methodology. The composition of CRFPI over time is shown in Figure 1.

To control for other macro-financial influences, the models include variables such as inflation, bank capital adequacy, regulatory quality, political stability, bank market concentration, and a banking crisis dummy. Fixed effects panel regressions are estimated to control for unobserved country heterogeneity and global time trends. In response to identified econometric concerns – heteroskedasticity, serial correlation, and cross-sectional dependence – Driscoll, Kraay standard errors are applied to ensure robust inference. The stationarity of the panel variables is confirmed through unit root tests, and multicollinearity and endogeneity are ruled out through variance inflation factor analysis and Durbin, Wu, Hausman testing, respectively.

Figure 1. Share of Climate-Related Financial Policy Types by Year (2000, 2020)

Annual composition of climate-related financial policies across five categories: Green Bonds (GB), Green Credit Allocation (GCA), Green Financial Guidelines (GFG), Green Prudential Policies (GPP), and Other Green Disclosures (OGD). Each bar represents the relative share of each policy type in the total number of climate-related financial policies adopted each year.

The analysis focuses on three critical dimensions of banking sector vulnerability – credit risk, liquidity risk, and insolvency risk – using the non-performing loan (NPL) ratio, the liquidity ratio, and the Bank Z-score, respectively, as dependent variables. The central explanatory variable is the Climate-Related Financial Policy Index (CRFPI), which captures the breadth and stringency of policies aimed at integrating climate considerations into financial regulation, supervision, and market practices.

The empirical findings indicate that stronger climate-related financial policy frameworks are associated with enhanced financial stability, particularly through reductions in credit risk and improvements in banking sector liquidity. The negative and statistically significant association between CRFPI and NPLs suggests that more stringent climate-related regulatory environments contribute to improving loan quality, possibly by fostering more prudent lending standards and better risk management practices. Similarly, the positive and significant relationship between CRFPI and the liquidity ratio implies that these policies support more resilient short-term funding structures, potentially by encouraging higher levels of liquid asset holdings in the face of climate-related uncertainties.

By contrast, the evidence regarding insolvency risk is more limited. The CRFPI does not exhibit a consistently significant effect on the Bank Z-score, except in model specifications that incorporate acute physical risks. This finding suggests that while climate-related financial policies can strengthen banks’ immediate risk buffers, their influence on longer-term solvency outcomes may be shaped by broader structural, macroeconomic, or institutional factors not fully captured by the policy index.

The study also examines the direct impact of climate risks themselves. Chronic physical risks, proxied by the ND-GAIN vulnerability index, are positively and significantly associated with higher credit risk, reflecting the heightened financial fragility observed in structurally climate-vulnerable economies. Acute physical risks, measured through the Global Climate Risk Index (GCRI), do not have significant effects on either credit or solvency risks. However, they are positively correlated with higher liquidity ratios, which may reflect precautionary behavior by financial institutions operating in disaster-prone regions. Regarding transition risk, proxied by CO₂ emissions per capita, the analysis uncovers a negative and statistically significant relationship with both credit and solvency risk. Although seemingly counterintuitive, this result may reflect the more advanced and diversified financial systems of high-emission economies, which are better positioned to absorb shocks – at least in the short term – despite their elevated exposure to long-term transition challenges.

To assess the robustness of the core results, the analysis incorporates several alternative specifications. First, a non-linear formulation of the CRFPI is introduced by including a squared term. The results confirm the presence of diminishing returns: while the initial adoption and strengthening of climate-related financial policies are associated with improved stability, the marginal effectiveness of additional regulatory intensity declines. This suggests the existence of a threshold beyond which further policy tightening may generate regulatory burdens or unintended distortions without commensurate gains in resilience.

Second, the specification for transition risk is refined by substituting the absolute level of CO₂ emissions with its annual growth rate, allowing for a more precise capture of the dynamic nature of decarbonization processes. The results remain robust across specifications, thereby reinforcing the empirical relationship between transition dynamics and financial risk exposure.

Third, a subsample analysis based on countries’ structural climate vulnerability is undertaken. The findings reveal that the stabilizing effects of climate-related financial policies (CRFPs) are significantly stronger in countries with lower levels of climate vulnerability. In contrast, in structurally vulnerable economies, the effectiveness of these policies appears markedly attenuated. This suggests that, in such contexts, the successful implementation of CRFPs may require complementary measures, such as institutional reforms or targeted adaptation support, to ensure their efficacy in enhancing financial stability.

This study presents robust empirical evidence on the role of climate-related financial policies in enhancing financial stability amid escalating environmental risks. Drawing on panel data from 88 countries over the period 2000-2020, the analysis demonstrates that the adoption of comprehensive policy frameworks, quantified through the Climate-Related Financial Policy Index (CRFPI), is associated with a measurable reduction in credit risk and improved liquidity conditions within the banking sector. These findings reinforce the relevance of integrating climate considerations into macroprudential supervision and financial regulatory architectures.

Structural characteristics, particularly a country’s degree of climate vulnerability, play a critical role in shaping the transmission channels of climate-related financial policies. In economies with lower climate vulnerability, these policies tend to be more effective in mitigating credit risk. In contrast, in more climate-exposed contexts, their influence is more significant in strengthening liquidity buffers. This variation highlights the importance of designing policy frameworks that are adapted to national circumstances, taking into account institutional capacity, exposure to climate-related hazards, and the maturity of financial markets.

The analysis also presents evidence of diminishing marginal returns. While the initial implementation and moderate intensification of regulatory measures provide meaningful improvements in financial stability, further tightening may reduce policy effectiveness and produce unintended consequences, particularly in relation to bank solvency. These findings underscore the importance of a carefully calibrated regulatory strategy that balances ambition with implementation capacity and the structural features of the financial system. Addressing the systemic nature of climate-related financial risks requires a comprehensive and coordinated response by regulatory and supervisory authorities. Strengthening mandatory climate-related disclosure requirements can enhance risk transparency and improve market discipline. Credit allocation reforms that channel investment toward low-carbon sectors may reduce exposure to transition-related vulnerabilities and support the stability of the financial system. Additionally, integrating forward-looking climate scenarios into supervisory frameworks and stress testing exercises is essential for assessing the resilience of financial institutions under a range of transition and physical risk scenarios. These measures should be tailored to each country’s specific risk profile, with a focus on credit risk mitigation in less vulnerable economies and liquidity support in jurisdictions with higher exposure to climate-related shocks.

BCBS (2021a). Climate-related financial risks – measurement methodologies. Technical report, BCBS – Basel Committee on Banking Supervision – Bank for International Settlements.

BCBS (2021b). Climate-related risk drivers and their transmission channels. Technical report, BCBS – Basel Committee on Banking Supervision – Bank for International Settlements.

D’Orazio, P. and S. Thole (2022). Climate-related financial policy index: a composite index to compare the engagement in green financial policymaking at the global level. Ecological Indicators 141, 109065, DOI: https://doi.org/10.1016/j.ecolind.2022.109065

D’Orazio, P. (2025). Climate risks and financial stability: Evidence on the effectiveness of climate-related financial policies. International Review of Financial Analysis 105, 104304, DOI: https://doi.org/10.1016/j.irfa.2025.104304

EBA (2022). The role of environmental risks in the prudential framework. Discussion paper EBA/DP/2022/02, 2 May 2022, European Banking Authority.

Eren, E., F. Merten, and N. Verhoeven (2022, December). Pricing of climate risks in financial markets: A summary of the literature. Bis papers no 130, Bank for International Settlements b(BIS).

Schnabel, I. (2020). When markets fail – the need for collective action in tackling climate change speech by Isabel Schnabel, member of the executive board of the ecb at the european sustainable finance summit, Frankfurt am Main, 28 september 2020. European Central Bank .

TCFD (2021). TCFD: 2021 status report. Task Force on Climate-related Financial Disclosures.