Various borrower-based macroprudential policies have become widespread across the world after the Great Financial Crisis. This brief quantifies the direct and indirect effects on housing demand of different policies influencing borrowing conditions across residential housing market segments in Denmark. We focus on three conventional measures: the loan-to-value (LTV), debt-to-income (DTI) and debt-service-to-income (DSTI) ratios, and present two sets of results showing that restrictions on these measures impact households and housing units differently. First, while tighter regulation on the LTV ratio directly impact young and less wealthy households, restrictions on the DTI and DSTI ratios primarily impact housing buyers in the largest cities. Second, by modelling housing buyers’ preferences and budget constraints, we find that while any regulation would push net demand to suburban areas, restrictions on the DTI ratio leaves demand for small apartments in the Copenhagen area unaffected.

The contribution of loose credit conditions to the house price bubble and the Great Financial Crisis has led regulators in Denmark and abroad to propose and implement macroprudential measures in order to safeguard the financial system and the real economy.1 A subset of these measures is borrower-based, which limit credit availability for highly leveraged households.

While the direct implications of borrower-based measures on individual households are relatively well-understood ex-ante, this brief quantifies and compares the impact of tightening borrowing conditions on housing demand across residential housing market segments, both directly and indirectly, i.e. how households would substitute between different housing units once their budget constraints are affected by regulation.2

Specifically, we compare a strict borrowing constraint based on the loan-to-value (LTV) ratio versus a comparable constraint on the debt-to-income (DTI) ratio or the debt-service-to-income (DSTI) ratio of housing buyers.3 For comparability, we calibrate the tightening of the restrictions on DTI and DSTI ratios to match the nationwide number of affected households to a corresponding restriction resulting from an increased down payment requirement from 5 per cent to 10 per cent of the transaction price, equivalent to tightening the LTV ratio from 95 to 90 per cent. Imposing a 350 per cent constraint on DTI or a DSTI constraint to 25 per cent of a household’s income would roughly match this number.

We investigate housing transactions and define a household as restricted if the purchase we observe would not have been possible given the hypothetical restrictions we impose, considering households’ pre-existing wealth, savings, and income. We find that tighter restrictions on the LTV ratio directly impacts young and less wealthy households relatively more than others. For example, households younger than 30 years old or older than 60 years old represent 18 per cent and 13 per cent of the population of buyers respectively. While a tightening of LTV limits would only restrict 2 percent of the older buyers, it would restrict 31 per cent of the younger buyers, who are often first-time buyers. As older buyers have accumulated more wealth, also due to previous capital gains in the housing market, LTV constraints rarely bind.

Restrictions on the DTI or DSTI ratio would impact the two groups of buyers relatively similarly, with approximately 20 percent of buyers becoming restricted across the two groups of older and younger households. Overall, the impact of restrictions on the DTI ratio is about evenly distributed across the age and wealth distribution of the population. However, restrictions on the DTI and DSTI ratios disproportionately impact households at the bottom of the income distribution,4 but these households more rarely purchase housing. Households in the bottom half of the income distribution account for only 17 per cent of purchases countrywide. Overall, the impacts of restrictions on DSTI and DTI are more evenly spread out across age and financial characteristics than those of LTV restrictions.

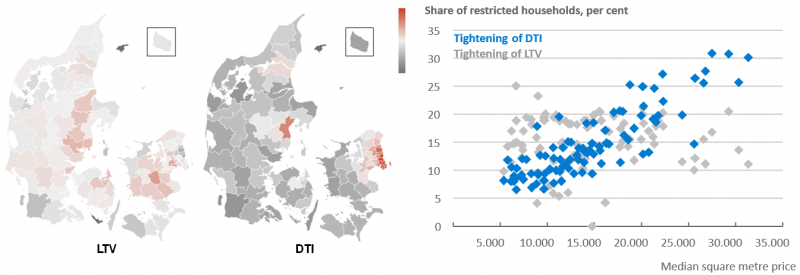

Chart 1: Restrictions on the DTI ratio have the highest impact where house prices are highest

Note: Left: The two maps show the share of restricted households within each municipality due to tighter restrictions on the LTV ratio (left) and the DTI ratio (right). The colour scale ranks from dark grey to light grey to red for a higher share of restricted households within each municipality. Each map is coloured such that light grey is equivalent to the nationwide share of restricted buyers. Right: The share of DTI-restricted households relative to median square metre price. Each dot represents a housing segment as defined in Nissen, Rikke Rhode, Alessandro Tang-Andersen Martinello, Simon Juul Hviid, and Christian Sinding Bentzen (2022) Effects of borrower-based regulation on housing demand, Danmarks Nationalbank Economic Memo No. 13.

Source: Own calculations based on data from Statistics Denmark.

Geographically, the impacts of DTI and DSTI restrictions are heavily concentrated, with the largest impact in urban areas and high-price suburbs, see chart 1. While a larger down payment requirement has little effect in the relatively expensive municipalities in and north of Copenhagen, a limit on DTI is highly concentrated in these areas. Overall, imposing a limit on the DTI ratio has larger impacts in more expensive areas.

When the imposed borrowing restrictions prevent buying in relatively more expensive segments, households can substitute into relatively more affordable housing segments. Based on observed moving patterns and household characteristics – including borrowing constraints – we apply a revealed-preferences approach, and exploit a flexible machine learning model to estimate housing demand across segments conditional on the current state of the housing and credit markets. The model uses microlevel data and outputs household specific probabilities of buying in each of the 91 defined housing segments.5

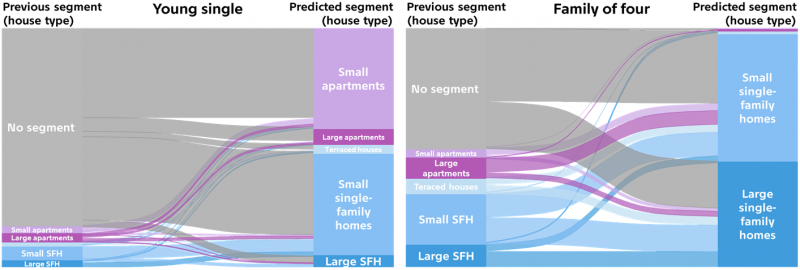

Chart 2 illustrates the model output, and shows the flows from the previously owned segment to the predicted, most-likely, segment for two types of households, considering only housing type and disregarding the geographic segmentation here for easier exposition. The left-hand graph shows the predicted flows for a young single-person household. Only a few such households were initially housing owners before buying before buying and hence pertains to no segment. The majority of the young households prefer either small single-family homes or smaller apartments.6 Most family households prefer either small or large single-family homes. The two examples confirm the intuition embedded in the model; housing preferences vary across family characteristics.

Chart 2: Two examples of the prediction model

Note: The charts show flow charts from households’ previous segment (LHS) and predicted segment (RHS). The chart to the left presents the predicted flows across segments of households with a young single person under 35 years and without children. The chart to the right presents the predicted flows across segments of a family of four, two adults between 35 and 45 years and two children. Flows originating from no segment correspond to first-time buyers. Both previous and predicted segment shows only the housing type of the segment (small and large apartments, terraced houses, and small and large single-family homes). The predicted segment is the most likely segment based on the raw preferences.

Source: Own calculations based on data from Statistics Denmark.

Based on the estimated preferences, we simulate the effects of tightening the borrowing constraints of the housing buyers due to stricter macroprudential policies. We find that tightening of borrower-based measures, in general, creates a negative net demand effect in the largest cities, and pushes demand toward single-family homes in less populated areas and towards the suburbs. This effect is particularly pronounced for restrictions on LTV ratios, whose direct impact is spread geographically across the country, and which affect buyers with relatively elastic preferences in terms of location. Furthermore, we find that limits on the DTI ratio, in particular, will reduce demand for large apartments and large single-family homes in Copenhagen.

However, introducing restrictions on the DTI ratio has mixed substitution effects in the Copenhagen area. Restrictions on the DTI ratio directly reduce demand for large single-family homes and large apartments. Yet the substitution effects of these restrictions push demand not only towards the suburbs, but also towards smaller housing units within the city, counteracting the direct negative impact on smaller units. Households’ preferences for living in the Copenhagen area are strong enough for restrictive regulation to substitute demand within the region, and not just further away from the city center, leading to ambiguous effects on housing prices across segments in the capital region.

See Hviid, Simon Juul (2017), A leading indicator of house price bubbles, Danmarks Nationalbank Working Paper No. 114; Engsted, Tom, Simon Juul Hviid, and Thomas Quistgaard Pedersen (2016) Explosive bubbles in house prices? Evidence from the OECD countries, Journal of International Financial Markets, Institutions and Money, vol. 40; and Hviid, Simon Juul and Andreas Kuchler (2017) Consumption and savings in a low interest-rate environment, Danmarks Nationalbank Working Paper no. 116.

House prices developments tend to ripple across geographical housing segments, see Hviid, Simon Juul (2017) A regional model of the Danish housing market, Danmarks Nationalbank Working Paper No. 121 and Meen, Geoffrey (1999) Regional House Prices and the Ripple Effect: A New Interpretation, Housing Studies, vol. 14. Similarly, tightening borrowing conditions could ripple towards the countryside. On Israeli data it is found that restrictions on LTV limits make households move further away from city centres and to more affordable neighbourhoods, see TzurIlan, Nitzan (2020) The Real Consequences of LTV Limits on Housing Choices, Working Paper.

While LTV is currently capped at 95 per cent in Denmark (and at 80 per cent for mortgage loans), there are no general regulatory requirements for DTI and DSTI, although restrictions apply for some types of loans in some areas, see Bentzen, Christian Sinding, Cokayne, Graeme, Gerba, Eddie and Roulund, Rasmus Pank (2020), Stricter lending requirements have made homeowners more robust, Danmarks Nationalbank Analysis, No. 1 for an overview of current regulations. As of the third quarter of 2022, the median LTV for Danish home owners is 56 per cent, the median DTI is 271 per cent, and the median DSTI is 13 per cent. Among new loans (issued during the third quarter of 2022), the median LTV is 76 per cent, the median DTI is 325 per cent, and the median DSTI is 20 per cent. See Nissen, Rikke Rhode, Alessandro Tang-Andersen Martinello, Simon Juul Hviid, and Christian Sinding Bentzen (2022) Effects of borrower-based regulation on housing demand, Danmarks Nationalbank Economic Memo No. 13 for how these constraints are computed in the data.

Restrictions on the DTI and DSTI ratio would impact about 30 per cent of buyers in the bottom half of the income distribution, and about 12 percent of buyers in the top half.

The segments group housing units with similar characteristics, such that units within a segment can be seen as very close substitutes for each other. The segments are defined based on housing types and geographical location. See Nissen, Rikke Rhode, Alessandro Tang-Andersen Martinello, Simon Juul Hviid, and Christian Sinding Bentzen (2022) Effects of borrower-based regulation on housing demand, Danmarks Nationalbank Economic Memo No. 13 for a detailed description.

Preferences depend also on geographical location: Young households tend to buy small apartment in the cities, and small single-family homes in rural areas.