This paper is based on Banca d’Italia, Working Paper, No 1486. The views expressed in the article are those of the authors and do not involve the responsibility of the Bank.

Abstract

This policy brief presents the key findings of a Bank of Italy working paper that investigates the effects of balance sheet asset revaluations (AR) on the credit conditions of unlisted Italian firms. Drawing on a unique opportunity offered by the 2020 exceptional revaluation measure introduced by the Italian government, the study finds that firms opting to revalue their assets benefited from better credit terms: they paid lower interest rates on overdrafts, obtained more generous credit lines, and were more likely to initiate new banking relationships. The analysis identifies the main mechanism behind these improvements as enhanced financial disclosure, which mitigates information asymmetries in the credit market. In contrast, potential tax savings from increased amortization, which could have strengthened firms’ financial soundness, played a marginal role. The effects were especially pronounced for firms typically characterized by lower transparency—such as small and medium-sized enterprises—, as well as for those with moderate default risk and for those dealing with banks that do not use internal rating-based (IRB) models. These findings suggest that AR can serve as an effective policy tool to improve credit access in bank-centric economies dominated by opaque, unlisted firms.

Can a change in accounting treatment influence the cost and availability of credit for firms? This question lies at the heart of the study summarized in this brief, which examines the impact of asset revaluations on credit conditions for unlisted Italian firms. The analysis takes advantage of a temporary accounting measure introduced by the Italian government in 2020, which allowed unlisted firms to depart from the traditional historical cost principle and adjust the book value of certain assets to better reflect their current market worth. This one-time policy window, aimed at helping firms navigate the economic turbulence of the pandemic, also created a natural setting to assess whether higher transparency in balance sheets translates into improved access to bank credit. The study explores the channels through which AR affects credit conditions, its heterogeneous effects across firms and banks, and the broader implications for financial regulation and policy.

The broader academic literature has already established that transparency and quality of financial information play a crucial role in capital and credit markets. Studies like those by Biddle and Hilary (2006) highlight that accounting quality is particularly important for reducing informational frictions. Ball et al. (2008) demonstrated how accounting information can alleviate information asymmetries in syndicated loans, improving risk allocation.

When it comes to asset valuation specifically, an extensive body of research has looked at the effect of AR and fair value accounting on the stock market, primarily for publicly listed companies. Many studies, including Easton et al. (1993), Barth and Clinch (1998), and Aboody et al. (1999), found a positive stock price reaction to asset value updates, suggesting AR can provide a better summary of a firm’s current financial state. Others, such as Muller III et al. (2011), found that fair value reporting for tangible assets reduced information asymmetry in the real estate industry, evidenced by narrower bid-ask spreads of stock prices.

In the credit market, research like that by Demerjian et al. (2016) suggests fair value accounting may reduce contracting costs. Bonacchi et al. (2024) found firms using fair value accounting were more likely to issue new debt and had lower borrowing costs. Similarly, Florou and Kosi (2015) showed that adopting IFRS led to more public debt issuance and lower bond yields. However, the existing literature on an explicit credit market premium directly tied to an AR episode is limited. Cho et al. (2021) focused on listed Korean firms and found an increase in medium-long term debt following a revaluation option during the global financial crisis. To the best of our knowledge, no previous studies have examined the impact of asset revaluations on unlisted firms.

In Italy, unlisted firms are generally required by law to adopt the historical cost criterion in preparing their financial statements. While this approach ensures consistency and conservatism, it often results in an undervaluation of assets relative to their market value. This can distort financial indicators and potentially affect firms’ access to external finance, particularly in a credit system that heavily relies on financial statement information.

To alleviate pandemic-related financial stress, the Italian government introduced a one-off revaluation option in 2020. This measure allowed unlisted firms to revalue tangible assets, protected intangible assets (patents, trademarks, copyrights, etc.), and equity holdings, purely for accounting purposes and without any mandatory fiscal outlay. However, firms could choose to pay a tax (3% of the revalued amount) to activate the fiscal benefit of higher depreciation deductions in future years—an option that could reduce corporate taxes, which are otherwise levied at 26%.

The introduction of this measure opened the door for two possible channels of influence on credit conditions. First, a disclosure channel: by improving the reported financial position, revaluation could reduce lenders’ perceived credit risk and increase their willingness to offer credit. Second, a tax-saving channel: future reductions in tax liabilities could improve firms’ financial outlook and enhance creditworthiness. The study seeks first to assess the benefits in terms of credit conditions brought by the AR and then to disentangle the relevance of these two mechanisms.

The analysis is based on a novel dataset covering approximately 120,000 Italian unlisted firms from October 2018 to September 2022. It combines detailed balance sheet data from the Cerved database with contract-level information from AnaCredit, which tracks almost all loans granted by euro area banks. A key focus is on overdraft facilities, which are especially responsive to changes in perceived credit risk. In Italian banking practice, these lines are typically revocable by banks without prior notice, allowing interest rates and credit limits to be adjusted quickly in response to shifts in credit risk. Overdraft credit accounts for nearly half of total bank debt of Italian firms.

Firms that opted for the 2020 AR measure are identified by the appearance or increase of a revaluation reserve in their financial statements. About 13% of the sample revalued their assets, with higher uptake among larger firms, manufacturers, and those located in northern regions.

To estimate the causal effects of AR, the study adopts a difference-in-differences approach within a panel event study framework. A propensity score matching (PSM) procedure ensures that treated firms are compared to observably similar firms that did not revalue assets. Matching variables include structural characteristics (size, age, sector, location), financial indicators (leverage, liquidity, profitability, default probability), and loan features (collateral, interest rates, relationships, use of pandemic credit support). The outcomes analyzed include interest rates, credit granted and used, and relationship indicators such as the number of banking partners and the likelihood of forming new bank-firm ties.

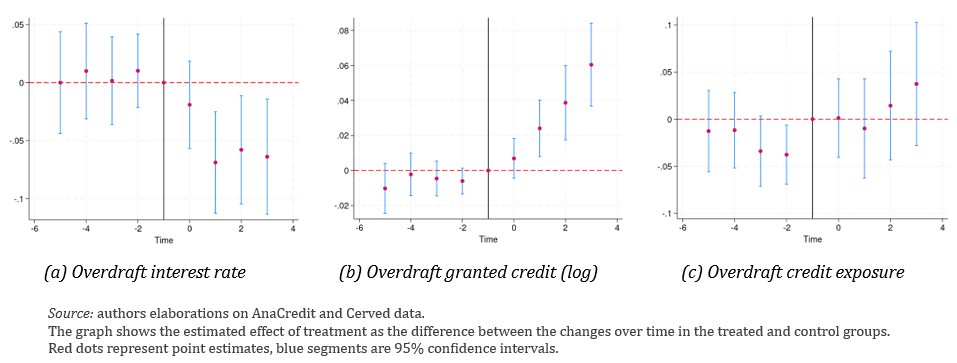

The results reveal the existence of a clear “revaluation premium” for firms that revalued their assets (Figure 1). These firms experienced a reduction in overdraft rates by nearly 6 basis points, which is economically significant given the average rate of 3.4% (Figure 1). The gap stayed steady over time, suggesting persistent benefits. Moreover, revaluing firms saw a 3.7% increase in total overdraft credit granted, indicating enhanced supply from banks. Notably, there was no significant change in credit utilization, implying that the observed increase in credit lines was not driven by greater demand, but rather by banks’ increased willingness to lend, supporting the supply-side interpretation of the results.

Figure 1. Asset revaluation impacts on loan rates and credit

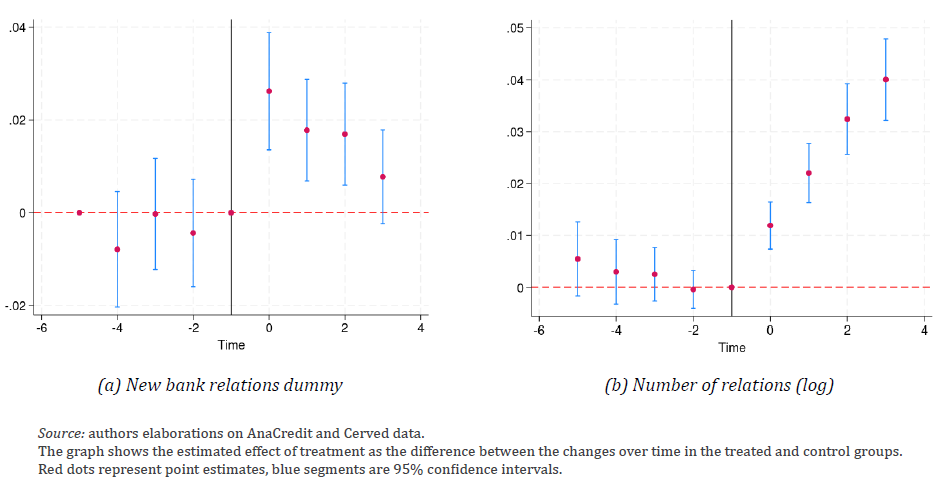

The study finds that the disclosure mechanism is the main channel through which asset revaluations (AR) improve credit conditions. While firms using higher amortization deductions could benefit from both tax and disclosure effects, the disclosure channel only applies to firms that revalue assets without opting for the tax benefit. To distinguish between the two, the authors used a text-mining method to detect references to the special substitute tax (“imposta sostitutiva”) in the notes to financial statements. This expression within Italian fiscal terminology denotes a special or extraordinary tax imposition and represents a precise and relatively rare expression. The similar credit premium observed for both groups points to disclosure as the key driver. Further support comes from the finding that the revaluation premium is smaller and only marginally significant for existing bank-firm relationships, suggesting that long-standing lenders already possess much of the relevant information. In contrast, AR fosters transparency in new relationships: treated firms are 2 percentage points more likely to form a new banking relationship each semester, and their total number of relationships increases by 2 percent post-treatment (Figure 2). This growth, concentrated where information gaps are larger, underscores the importance of the disclosure effect.

Figure 2. Asset revaluation impacts on new bank relationships

Conversely, the tax-saving channel – which capitalizes on fiscal benefits due to increased amortization costs – receives limited support. Firms that paid the substitute tax experienced gains statistically indistinguishable from accounting-only adopters. A triple-difference analysis using corporate tax rates confirms the weak role of fiscal motives.

The effects of asset revaluations vary across firms and banks. Among firms, stronger benefits are observed for those with the greatest potential to improve clarity in credit risk assessment—namely, small and medium-sized firms with intermediate default probabilities tend to benefit more than those with very low or very high risk. The premium increases with the intensity of revaluation but becomes less pronounced for firms in the top quartile of revaluation relative to total assets. By sector, manufacturing firms show improvements across all outcomes. Construction firms benefit mainly through lower interest rates. Service firms gain mostly in terms of new banking relationships. Older firms (over 10 years) experience reductions in interest rates, more credit granted, and more bank relationships. Younger firms (10 years or less) mainly show an increase in new banking relationships.

The type of bank also plays a role. The positive effects of AR are concentrated among firms borrowing from banks that do not use internal ratings. These institutions might have limited access to advanced risk assessment tools and rely more on public financial disclosures. For these firms, AR significantly improves both the pricing and availability of credit. By contrast, banks using internal models show limited responsiveness to AR, suggesting that they already have robust mechanisms to assess firm risk, independent of accounting adjustments.

The findings suggest that temporary asset revaluation measures can have a positive impact on improving credit conditions in contexts where bank lending plays a central role, most firms are unlisted and report their financials using historical cost accounting. By enhancing balance sheet transparency, revaluations help mitigate information asymmetries, improving credit terms and expanding access to banking relationships.

The effects are more significant for opaque firms—such as small and medium-sized enterprises and firms with intermediate credit risk—and are concentrated in relationships with banks that do not use internal rating models. These institutions appear to rely more on publicly available financial information.

In conclusion, asset revaluations offer a pragmatic policy tool to reduce information asymmetries towards external stakeholders, while also having positive effects on credit markets—especially in systems characterized by traditional accounting practices and bank-based finance. However, since revaluations entail a one-off adjustment rather than ongoing updates, their effects are by nature temporary. Sustained improvements in credit conditions therefore require targeted and structural measures to strengthen financial disclosure and credit risk assessment.

Aboody D., Barth, M.E., and Kasznik, R. (1999). Revaluations of fixed assets and future firm performance: Evidence from the UK. Journal of Accounting and Economics, 26(1-3):149–178.

Ball R.T., Bushman, R.M., and Vasvari, F.P. (2008). The debt contracting value of accounting information and loan syndicate structure. Journal of Accounting Research, 46(2): 247-287.

Barth M.E., and Clinch, G. (1998). Revalued financial, tangible, and intangible assets: Associations with share prices and non-market-based value estimates. Journal of Accounting Research, 36:199–233.

Biddle, G.C., and Hilary, G. (2006). Accounting quality and firm-level capital investment. American Accounting Association, 81(5):963–982.

Bonacchi, M., Marra, A., and Shalev, R. (2024). The effect of fair value accounting on firm public debt – evidence from business combinations under common control. European Accounting Review, pages 1–29.

Cho, H., Chung, J. R., and Kim, Y. J. (2021). Fixed asset revaluation and external financing during the financial crisis: Evidence from Korea. Pacific-Basin Finance Journal, 67:101517.

Demerjian, P.R., Donovan, J., and Larson, C. R. (2016). Fair value accounting and debt contracting: Evidence from adoption of SFAS 159. Journal of Accounting Research, 54(4):1041–1076.

Easton, P.D., Eddey, P.H., and Harris, T.S. (1993). An investigation of revaluations of tangible long-lived assets. Journal of Accounting Research, 31:1–38.

Florou, A. and Kosi, U. (2015). Does mandatory IFRS adoption facilitate debt financing? Review of Accounting Studies, 20(4):1407–1456.

Muller III, K.A., Riedl, E.J., and Sellhorn, T. (2011). Mandatory fair value accounting and information asymmetry: Evidence from the European real estate industry. Management Science, 57(6):1138–1153.