This policy brief is based on “Do banks practice what they preach? Brown lending and environmental disclosure in the euro area”, BIS Working Paper, No 1143/2023. The views expressed are those of the authors and do not necessarily reflect those of the European Central Bank and/or Bank for International Settlement.

The reduction of information asymmetries between banks and their stakeholders is essential to ensure the functioning of the market discipline mechanisms that allow investors, depositors and other actors to monitor bank risk-taking practices. Despite regulatory requirements, there is still a risk that banks may engage in “environmental window dressing”, which involves increasing the environmental disclosure in their financial reports without actually acting as environmentally responsible lenders (i.e., not practising what they preach). In this policy brief, we investigate whether the level of environmental disclosure in banks’ financial reports matches less brown lending portfolios. We find a negative relationship between environmental disclosure and brown lending. However, this effect is contingent on the tone of the financial report. Banks that express a negative tone, reflecting genuine concern and awareness of environmental risks, tend to lend less to more polluting firms. Conversely, banks that express a positive tone, indicating lower concern and awareness of environmental risks, tend to lend more to polluting firms.

Transparency is key to market discipline in banking. Without sufficient transparency, investors and other stakeholders are unable to hold banks accountable for risky practices and promote the growth of sound and socially responsible financial institutions. Regulatory initiatives to improve non-financial and, particularly, environmental disclosure have recently gained momentum. The Task Force on Climate-related Financial Disclosure by the Financial Stability Board (2020) emphasises the importance of including specific environmental disclosure in annual financial reports to inform investors about the impact of environmental risks. With reference to banks, the European Central Bank (ECB, 2020) has published supervisory expectations on environmental disclosure, including “business model, policies and due diligence processes, outcomes, risks and risk management and key performance indicators (KPIs)”.

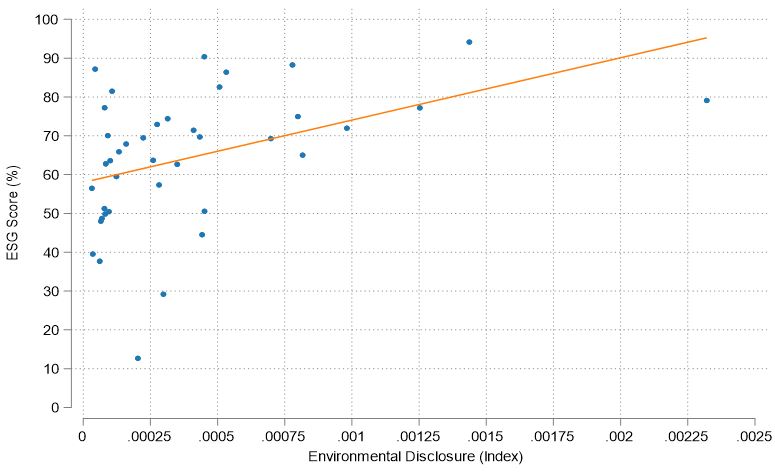

The analysis of the link Environmental, social, and governance (ESG) scores and banks’ disclosure index shows a positive correlation (see Figure 1). However, there is always a risk that banks may engage in “environmental window dressing”, which involves increasing the environmental disclosure in their financial reports without actually acting as environmentally responsible lenders (i.e. not practising what it is preached).

In Gambacorta et al (2023), we attempt to identify the possible presence of environmental window dressing practices and assess whether such unethical behaviour is influenced by bank managers’ beliefs and level of awareness concerning environmental risks as reflected in the tone of bank disclosures.

Figure 1: Correlation between the ESG score and the Environmental Disclosure index

Note: Authors’ elaborations. The disclosure index has been computed by the authors. The ESG scores have been collected from Thomson Reuters Eikon.

There are two competing theoretical frameworks to analyse the link between bank environmental disclosure and their lending practices. According to the signalling theory (Spence, 1973), banks that provide high levels of lending to brown firms are (indirectly) more exposed to environmental risks, as brown firms are potentially more affected by the negative consequences of climate change, renewable energy transition costs, etc. In contrast, those banks that lend more to less brown firms are less affected by such risks. Therefore, the latter group of banks has an incentive to signal their low levels of environmental risk exposure by providing higher levels of environmental disclosure. In light of this, we could expect that there is a negative relationship between bank environmental disclosure and lending to brown firms.

On the other hand, there are also arguments that could reverse the relationship entirely. According to the Impression management theory (Goffman, 1959), banks could intentionally reveal positive aspects while hiding others to manipulate stakeholders’ perceptions. Banks may use a ‘cheap talk’ approach and engage in window dressing by disclosing environmental information without actually committing to environmentally responsible lending and continue lending to polluting firms. Therefore, we could also hypothesise that there is a positive or absent relationship between bank environmental disclosure and lending to brown firms.

Another important aspect to consider is the tone of bank disclosures, which is influenced by the beliefs, awareness, and attitudes of bank managers. If bank managers are not fully aware of environmental risks, they may be more optimistic about the impact of banks on the environment and less concerned about the negative consequences of environmental risks. Therefore, we expect that banks with a positive tone will provide higher levels of lending to brown firms. In contrast, those bank managers who are more aware and genuinely concerned about environmental problems and climate change are likely to inform investors about the negative financial and environmental consequences. They can achieve this by adopting a negative tone in their disclosure. Therefore, a plausible expectation is that banks using a positive tone in their disclosures engage in environmental window dressing, while banks using a negative tone do not.

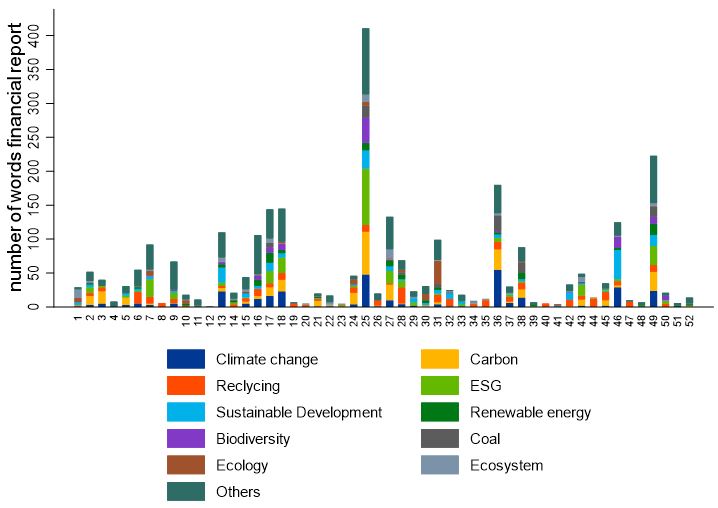

We employ a content analysis methodology based on a tailored disclosure dictionary designed to examine bank annual reports. To develop this dictionary, we followed the methodology of Lang & Stice-Lawrence (2015) and selected the most relevant words to analyse environmental disclosure from various sources including regulatory requirements by the ECB, EBA and EC. We use this dictionary to compute our environmental disclosure index by counting the occurrences of the words of the dictionary in the annual report and dividing by the total number of words. We adopt a similar approach also to measure the tone by using the dictionary developed by Loughran & McDonald (2011). Figure 2 shows the number of the most used environmental words in bank reports.

Figure 2: Number of environmental words in bank reports

Note: Authors’ elaborations. The word occurrences are computed considering both the annual financial report and the sustainability reports (when available).

We match this environmental disclosure index with loan-level data from AnaCredit (the credit register of the European System of Central Banks) and with firm-level data on GHG emissions from Urgentem, which covers the full spectrum of Scope 1, 2 and 3 emissions. Our study focuses on the year 2019 for 52 banks.

To detect environmental window dressing behaviour by banks we regress the outstanding amount owed by a debtor to a bank on the interaction between our disclosure index, the level of GHG emissions and, in a separate model, also with the positive / negative tone index.

Our results show that more environmentally transparent banks provide less lending to highly polluting firms. This effect is also economically meaningful. In particular, a one standard deviation increase in the environmental disclosure index is associated with about 6.4% lower lending volume to the most polluting firms relative to the least polluting. In addition, lending to the least polluting firms is not lower for banks reporting higher environmental disclosure. Our results are in line with the signalling theory, because it emerges that banks use environmental disclosures as a signal of their actual commitment to mitigate climate change by reducing lending towards highly polluting firms. Hence, overall, we reject the environmental window dressing hypothesis associated to the impression management theory.

To delve deeper into the relationship between disclosure practices and lending behaviour, we analyse also the joint effect of the level of environmental disclosure, GHG emissions and the tone of the disclosures.

Our results indicate that banks with a more negative tone in their annual reports provide less lending to highly polluting firms (i.e. they engage in environmental window dressing). Hence, we contend that bank managers who are more pessimistic and aware of the consequences of environmental risks and their exposure to environmental risks tend to provide less lending to brown firms, reducing their environmental impact and risk exposure. On the other hand, those banks that use a more positive tone tend to provide more lending to polluting firms. These banks’ managers are more optimistic and less aware and, therefore, concerned about the negative effects of environmental risks.

This policy brief shows that more environmentally transparent banks lend more to low polluting firms and less to highly polluting firms.

However, we did observe evidence of environmental window dressing behaviour depending on the tone adopted in bank reports. Specifically, we found that banks that use a more negative tone (i.e. those that are more aware and genuinely concerned about environmental risks and climate change) lend less to brown firms, while banks that use a more positive tone (i.e. those that are less aware and concerned about environmental risks) tend to finance more brown firms. Therefore, we show that the tone of disclosures plays a crucial role in assessing whether a bank is engaging in window dressing.

These results have important policy implications as they show that, although banks in general do not engage in window dressing, the amount of environmental disclosure provided is not the only factor to be considered. Bank managers’ attitude, as reflected in the tone of their disclosures also play a crucial role in determining environmental window dressing behaviour.

In perspective, while disclosure requirements can be helpful, they alone may not be sufficient to encourage banks to reduce their brown lending. It is essential to raise awareness of environmental risks and climate change to ensure that they are perceived as urgent and pressing threats by banks. This would result in a strong commitment to avoid financing highly polluting firms and act as environmentally responsible lenders. Therefore, policy measures to increase awareness and promote environmentally responsible lending should be a priority to promote sustainable economic growth.

European Central Bank (2020). Guide on climate-related and environmental risks: Supervisory expectations relating to risk management and disclosure. Available at: https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.202011finalguideonclimaterelatedandenvironmentalrisks~58213f6564.en.pdf.

Financial Stability Board (2020). Task Force on Climate-related Financial Disclosures 2020 Status Report. Available at: https://www.fsb-tcfd.org/publications/.

Gambacorta, L., Reghezza A., Polizzi S., & Scannella (2023). Do banks practice what they preach? Brown lending and environmental disclosure in the euro area, BIS Working Paper, 1143.

Goffman, E. (2021). The presentation of self in everyday life. Doubleday: New York.

Lang, M., & Stice-Lawrence, L. (2015). Textual analysis and international financial reporting: Large sample evidence. Journal of Accounting and Economics, 60(2-3), 110-135.

Loughran, T., & McDonald, B. (2011). When is a liability not a liability? Textual analysis, dictionaries, and 10‐Ks. The Journal of Finance, 66(1), 35-65.

Spence, M. (1973). Job market signaling. The Quarterly Journal of Economics, 87(3), 355–374.