The views expressed are those of the authors and not necessarily those of the institutions the authors are affiliated with.

Abstract

In the ongoing race between new digital currencies, a crucial factor for success will be their relative ability to gain acceptance as a medium of exchange, shaping the demand for money. Focusing on the emerging competition between stablecoins and CBDCs, this analysis offers quantitative insights into which of the two is gaining more attention among different audiences, exploring both academic and public interest in recent years. The observed cycles of attention for the two digital currencies highlight the importance of specific events, as well as the relevance of contextual and country-specific factors.

How to evaluate the emerging phenomena of new digital media of payments, as the private stablecoins and the public central bank digital currency (CBDC)? The economic interest of this question – as well as its legal relevance (Avgouleas and Blair, 2020; Bossu et al., 2021; Lubello, 2023) – is evident, and its importance emerges even more if we underline the fact that these innovations can have a deep impact on trust and decentralization, with implications in terms of markets and social functioning (Limata, 2024). In the ongoing race between new digital currencies, a crucial factor for success will be their relative ability to gain acceptance as a medium of exchange, shaping the demand for money, given their properties as medium of exchanges, store of value and store of information (Masciandaro 2018, Borgonovo et al. 2021).

On the one side, the recent wave of innovation in private payment systems has been characterized by the issuance of cryptocurrencies. Cryptocurrencies are private supplies of means of payment that are produced and distributed using a decentralized, peer-to-peer transfer system, which is known as the blockchain technology (or distributed ledger technology, DLT) (Halaburda, 2016; Bech and Garratt, 2017; Chiu and Koeppl, 2017; Huberman et al., 2017; Abadi and Brunnermeir, 2018; Casey et al., 2018; Halaburda et al., 2020). The cryptocurrency issuing can potentially destabilize the monetary policy action (Benigno, 2019; Benigno et al., 2022) and at the same time the individuals that are interested in using cash for illegal reasons can consider the cryptocurrencies as close substitutes (Hendrickson et al., 2021). Recently, in this perimeter, the stablecoins experience took the stage.

In the perimeter of cryptocurrencies, stablecoins have been regarded as a solution to the high volatility of cryptocurrencies, which weakens their likelihood of becoming widely used as a medium of exchange, unit of account, and store of value. They are crypto assets whose value is pegged to specific safe financial assets or currencies, to safe government assets, or to a basket of assets or currencies, with the aim of maintaining stable values at par.

While cryptocurrencies still fail to be recognized as money for the above-mentioned reasons, stablecoins aim to be used increasingly as tools for online, peer-to-peer, and micro-payments, as well as digital monetary instruments for DLT applications such as programmable money and smart contracts (Arner et al., 2020). Their monetary feasibility raises concerns among institutions worldwide for multiple reasons, and the magnitude of the phenomenon is growing in relevance. To give some figures, in September 2025 the most important stablecoins – Tether (USDT) and USD Coin (USDC) – had market capitalizations of approximately USD 175 and USD 74 billion respectively, with the total stablecoin market capitalization surpassing USD 300 billion at the beginning of October 2025. Growth in recent years, aside from some setbacks, has been exponential and remarkable.

On the other side, given the above-mentioned emerging interest in new private electronic currencies, a question naturally arises: Is it necessary to have a public digital currency? It has been suggested that a central bank digital currency could transform all aspects of the monetary system, as a CBDC could serve as a costless medium of exchange, a store of value and a stable unit of account, all of which would benefit consumers (Bordo and Levin, 2017 and 2019; Moghadam, 2018; Berentsen and Schar, 2018), and it has been theoretically shown that a CBDC can increase welfare by competing with banking means of payment as a safe asset that is provided through a public narrow banking service (Williamson, 2022). Under some circumstances such function of a CBDC could transform the central bank as a deposit monopolist (Fernandez-Villaverde et al., 2020), as well as enabling unconventional monetary policies, as negative nominal interest rates and helicopter drops (Mishra and Prasad, 2024).

In the last decade the issuance of a CBDC is an option that both academics and central bankers are carefully considering (Fung and Halaburda, 2016; Skingsley, 2016; Danezis and Meiklejohn, 2016; Bordo and Levin, 2017; Bech and Garratt, 2017; Hileman and Rauchs, 2017; Lowe, 2017; Segendorf, 2017; Coeurè, 2018). Nevertheless, this topic requires still deep consideration of both the economic and the political economy perspectives (Tucker, 2017), as well as the role of technological innovation (Velde, 2017).

A CBDC, which would simultaneously be a public and virtual medium of exchange, should be completely different from existing forms of virtual monies, which are issued by private regulated firms (banks) and private unregulated entities (blockchain networks), and from paper currencies. In other words, the existence of a CBDC should change the possibilities each agent has to allocate her/his funds (hereafter “her”) given her financial preferences.

Therefore, in the ongoing money race between new digital currencies, a crucial factor of success will be their relative ability to gain acceptance as a medium of exchange. Focusing on the emerging competition between stablecoins and CBDCs this analysis offers quantitative insights on which of the two is gaining more attention among different audiences, exploring both a specialized public – the academia – and the general one.

Given the consolidation of the two main contestants in the race for digital currencies, it is natural to ask which is more likely to prevail. Stablecoins and CBDCs share some peculiarities, but they differ substantially in their purposes, designs, and the effects they can have on financial and economic systems worldwide.

However, in a “money race”, it is necessary to return to the core of the question: what is money? As discussed, the simplest yet most effective definition is that money is what money does. Hence, money must be accepted and used, and the more it is recognized as money, the more it functions as such. One of the most relevant criteria for this contest is therefore the network effects each system can build – that is, their ability to gain acceptance as a medium of exchange.

On the one hand, some might argue that CBDCs, as offspring of national fiat money, are likely to inherit the network effects of existing currencies. On the other hand, this conservative inheritance carries drawbacks: if digital innovation challenges tradition, those network effects may be transmitted less efficiently. Beyond the above-mentioned technical and macroeconomic concerns, citizens may also resist transitioning from physical to digital cash, even when this does not imply the total disappearance of the former.

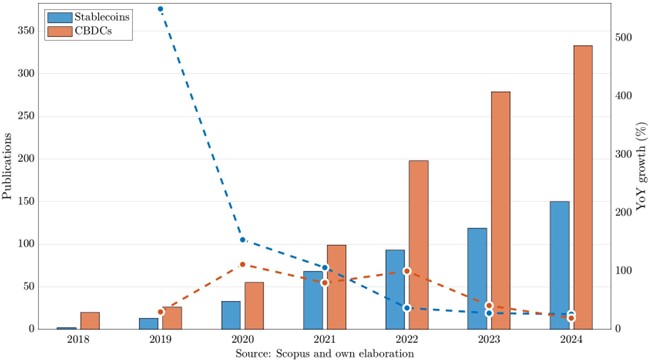

Given the novelty of the topic, it is useful to complement qualitative analysis with quantitative insights into which of the two is gaining more attention among different audiences. A first perspective comes from examining the growth in academic publications on stablecoins and CBDCs. Figure 1 illustrates the number of papers indexed in Scopus from 2018 to 2024 and their year-over-year growth.

Figure 1. Academic Publications on Stablecoins and CBDCs: Counts (Bars) and Growth (Lines)

After this initial spike, the growth in publications on stablecoins continued but at a steadier pace. CBDCs, by contrast, have consistently experienced a more constant increase in academic attention. The last five years show an alternation between the two topics in having higher growth. Overall, after 2023, the growth rates of publications on stablecoins and CBDCs appear to converge, though it is uncertain whether this stabilization will last. However, it seems unlikely, given the renewed interest in stablecoins following recent U.S. regulatory developments. Furthermore, the “digital currency race” increasingly encourages comparative analysis, making it likely that future research will focus more on the relationship and competition between CBDCs and stablecoins. Notably, CBDCs have overtaken stablecoins in publication volume since 2021, with a widening gap that has resulted in more than twice as many CBDC publications as those on stablecoins, though the renewed policy and regulatory focus on stablecoins could shift academic attention back toward them.

Another relevant consideration is the potential institutional bias of academia in choosing topics of study. CBDCs have always been directly connected to central banks and monetary policy, giving them institutional prominence. Stablecoins, by contrast, were long regarded as part of the broader cryptocurrency world and, as private innovations, struggled to be recognized early as a consolidated topic for research.

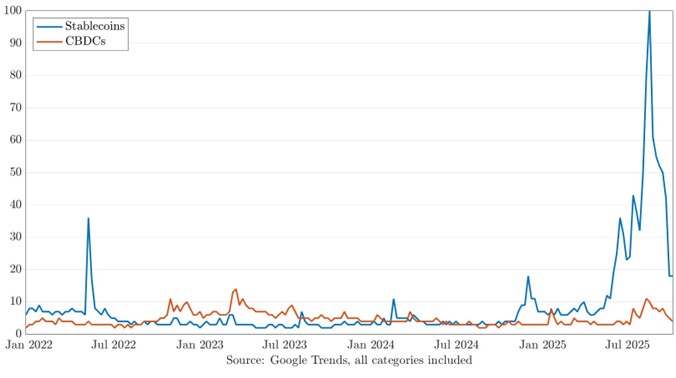

Beyond academia, public interest can be observed through the use of Google Trends. Figure 2 confirms the possibility of stablecoins catching up in terms of relevance in the public debate. Over time, the two topics have alternated in public attention.

Figure 2. Worldwide topic trends

Between the end of 2021 and the first half of 2022, stablecoins attracted greater interest, with a sharp spike in May 2022 likely linked to the collapse of TerraUSD. From mid-2022 onward, however, CBDCs captured more attention, reflecting the progress of numerous central bank projects worldwide. By 2024, the two topic trends converged, receiving similar levels of public interest. At the end of that year, stablecoins regained momentum. This resurgence may be explained by Donald Trump’s re-election campaign, during which he became a strong supporter of private digital currencies. His advocacy, combined with regulatory reforms favoring stablecoins and the decision to dismantle any research on a U.S. CBDC, likely drove public interest in stablecoins to surge in 2025, maintaining a positive gap with CBDCs so far.

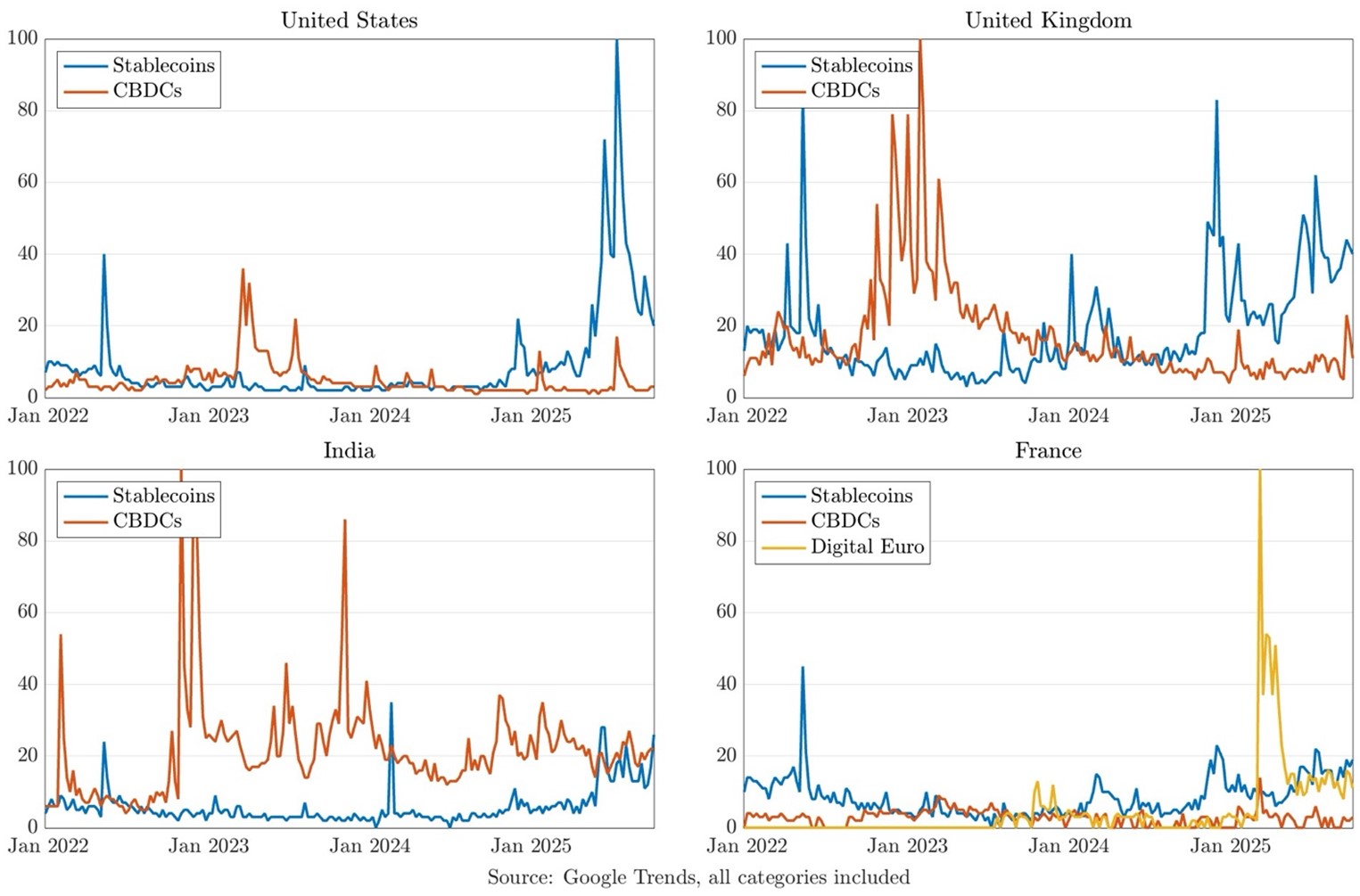

Contextual and country-specific factors are also essential to interpreting these trends. Figure 3 decomposes Google Trends data by country, showing how public attention also depends on regional contexts. Four countries are highlighted as useful examples. The general trend resembles those of the United States, France (taken as a proxy for the EU after analysis of member states), and, to some extent, the United Kingdom. For Europe, the Digital Euro was added as a third topic, given its importance as one of the most advanced and relevant CBDC projects. Data show that, in Europe, the trend mirrors that of the U.S., but the most recent spike in stablecoin interest is overshadowed by skyrocketing attention to the Digital Euro in 2025, which is now approaching the same level of public attention. A particularly interesting case is India: here, attention to CBDCs has consistently and distinctly surpassed that to stablecoins. Public interest rose significantly after the pilot launches of the wholesale and retail Digital Rupee and has maintained an overall positive gap through 2025. This provides evidence that active implementation of CBDCs can itself boost their popularity by encouraging use.

Figure 3. Cross-country comparison of topic trends

In the end, the race between CBDCs and stablecoins remains an open challenge. As the data show, stablecoins are rapidly gaining public interest worldwide and continue to grow in market capitalization. They are already well underway and attracting global attention.

If the United States can be seen as the epicenter of this phenomenon – with multiple banks expressing their intention to issue their own stablecoins – it is important to note that, in the absence of a strong response, European countries are beginning to join the “stablecoin team” as well. This is evidenced by the recent initiative of a group of European banks planning to issue a euro-denominated stablecoin.

The private sector of digital currency is clearly advancing faster than the public one. For this reason, CBDCs must gain momentum as soon as possible. In particular, all eyes are on the digital euro, which could have the scale and credibility to compete meaningfully in this race. The European Central Bank and EU policymakers are therefore called upon to provide a credible and appealing alternative without delay.

The evidence presented in this paper confirms that, while CBDCs could lead in academic attention, stablecoins are rapidly catching up in public debate and online visibility. This divergence between scholarly focus and popular interest reflects a deeper asymmetry between institutional deliberation and private innovation. Visibility itself can become a driver of legitimacy and adoption.

Abadi, J., and Brunnermeier, M. (2018). Blockchain Economics, Princeton.

Arner, D., Auer, R., and Frost, J. (2020). Stablecoins: Risks, Potential and Regulation, BIS Working Paper Series, n. 905.

Avgouleas, E., and Blair, W. (2020). The Concept of Money in the 4th Industrial Revolution – a Legal and Economic Analysis, Singapore Journal of Legal Studies, forthcoming.

Bech, M., and Garratt, R. (2017). Central Bank Cryptocurrencies, BIS Quarterly Review, September.

Benigno, P. (2019). Monetary Policy in a World of Cryptocurrencies, CEPR Discussion Paper Series, n. 13517.

Benigno, P., Schilling, L.M., and Uhlig, H. (2022). Cryptocurrencies, Currency Competition, and the Impossible Trinity, Journal of International Economics, 136, May, 103601.

Berentsen, A., and Schar, F. (2018). The Case for Central Bank Electronic Money and the Non-Case for Central Bank Cryptocurrencies, Federal Reserve Bank of St. Louis Review, Early Edition.

Bordo, M. D., and Levin, A.T. (2017). Central Bank Digital Currency and the Future of Monetary Policy, NBER Working Paper Series, n.23711.

Bordo, M.D., and Levin, A.T. (2019). Improving the Monetary Regime: The Case for U.S. Digital Cash, Cato Journal, 39(2), 383-406.

Borgonovo, E., Caselli, S., Cillo, A., Masciandaro, D., and Rabitti, G. (2021). Money, Privacy, Anonymity: What Experiments Tell Us?, Journal of Financial Stability, 56, 100934.

Bossu, W., Itatani, M., Margulis, C., Rossi, A., Weenink, H., and Yoshinaga, A. (2021). Legal Aspects of Central Bank Digital Currency, IMF Working Paper Series, n.20/254.

Casey, M., Crane, J., Gensler, G., Jonson, S., and Narula, N. (2018). The Impact of Blockchain Technology on Finance: A Catalyst for Change, Geneva Report on the World Economy, n.21, CEPR.

Chiu, J., and Koeppl, T. (2017). The Economics of Cryptocurrencies – Bitcoin and Beyond, Bank of Canada, mimeo.

Coeurè, B. (2018). Bitcoin’s Ascent is Forcing Central Banks to Rethink a Future Without Cash, The Financial Times, March 13th, p.20.

Danezis, G., and Meiklejohn, S. (2016). Centrally Banked Cryptocurrencies, University College of London, mimeo.

Fernandez-Villaverde, J., Sanches, D., Schilling, L.M., and Uhlig, H. (2020). Central Bank Digital Currency: Central Banking for All?, CEPR Discussion Paper Series, n. 1437.

Fung, B.S.C., and Halaburda, H. (2016). Central Bank Digital Currencies: A Framework for Assessing Why and How, Bank of Canada, Staff Discussion Paper, n.22.

Halaburda, H. (2016). Digital Currencies: Beyond Bitcoin, NYU-Stern and Bank of Canada, mimeo.

Halaburda, H., Haeringer, G., Gans, J.S., and Gandal, N. (2020). The Microeconomics of Cryptocurrencies, NBER Working Paper Series, n. 27477.

Hendrickson, J.R., Hogan, T.L., and Luther, W.J (2021). Cash, Crime and Cryptocurrencies. Quarterly Review of Economics and Finance, forthcoming.

Hileman, G., and Rauchs, M. (2017). Global Blockchain Benchmarking Study, Cambridge Centre for Alternative Finance, University of Cambridge.

Huberman, G., Leshno, J.D., and Moallemi, C. (2017). Monopoly without a Monopolist: An Economic Analysis of the Bitcoin Payment System, Bank of Finland, Discussion Paper Series, n. 27.

Limata, P. (2024). Blockchain and Institutions: Trust and (De)centralization, International Review of Economics, 71, 1-17.

Lowe, P. (2017). An eAUD?, Address to the 2017 Australian Payment Summit, mimeo.

Lubello, V. (2023). Central Bank Digital Currencies and the Digital Euro: A Comparative Prism between Sovereignty and Technology, Department of Law, Bocconi University, mimeo.

Masciandaro, D. (2018). Central Bank Digital Cash and Cryptocurrencies: Insights from a New Baumol–Friedman Demand for Money, Australian Economic Review, 51(4), 540–550.

Mishra, B., and Prasad, E. (2024). A Simple Model of a Central Bank Digital Cash, Journal of Financial Stability, 73, 101282.

Moghdam, R. (2018). A Central Bank Digital Cash System Will Benefit Consumers, The Financial Times, March 19th, p.9.

Segendorf, B. (2017). Swedish E-Krona: Motivations, Drivers and Obstacles, Zurich, mimeo.

Skingsley, C. (2016). Should the Riksbank Issue E-Krona?, Fintech Stockholm, Berns, mimeo.

Tucker, P. (2017). The Political Economy of Central Banking in the Digital Age, SUERF Policy Note, n.13, June.

Velde, F.R. (2017). Technological Change and the Future of Cash, SUERF Policy Note, n.15, August.

Williamson, S. (2022). Central Bank Digital Currency: Welfare and Policy Implications, Journal of Political Economy, htpps://doi.org/10.1086/720457.