Macroprudential policy focuses on the different and complex interactions within and between the financial system and the macro-economy. In this context, it is particularly important to monitor and address housing market developments, because they often contribute to procyclical fluctuations and financial crises. It is important to develop a macroprudential framework for the housing market to timely and adequately address risks to financial stability. This article provides a case-study on the macroprudential framework for the housing market in the Netherlands reflecting lessons from capital-based, borrower-based and structural measures.

The traditional approach of financial stability has relied on three main elements. First, monetary policy focuses on price stability, supported by a well-functioning payment system. Second, as lender of last resort, the central bank can provide liquidity to the financial system during times of stress. Third, microprudential regulation and supervision aims at ensuring sound individual institutions. The conventional assumption was that – taken together – these three aspects create the necessary conditions for a stable macro-economic environment in which the financial system can operate efficiently and financial stability is automatically achieved.

However, this assumption has been proven wrong. Risks can emerge from systemic developments within the economy or financial system as a whole. Drawing on this lesson, the so-called macroprudential perspective of supervisory policy has emerged in recent years as a separate responsibility and expertise within central banks, with its own objectives and instruments.

Both micro- and macro-perspectives are relevant. To illustrate this point, a parallel can be drawn with the safety of cars and traffic. Microprudential regulation and supervision can be compared to regulations for safe cars, such as brakes, crumble zones and airbags. This ensures a proper functioning of the car and reduces the chance and impact of an accident on the car and its passengers. Macroprudential policies are more like traffic rules such as speed limits and traffic signs that make the roads and traffic safer. To avoid accidents you need both safe cars and effective traffic rules. Similarly, macroprudential policy is a necessary complement to microprudential supervision to address systemic risks and achieve financial stability.

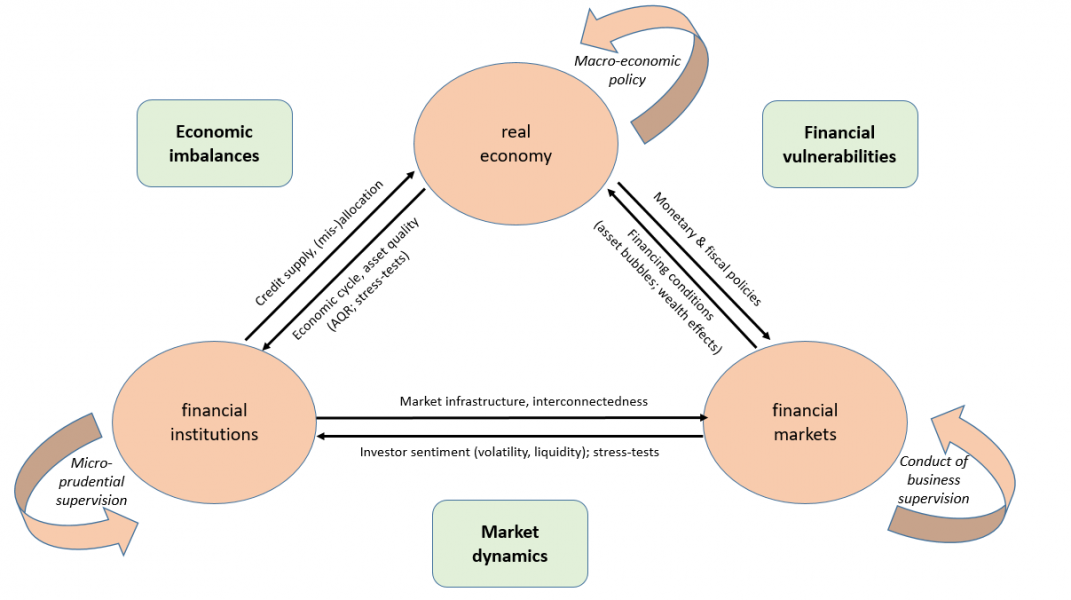

The discerning feature of this systemic perspective is that while other policy disciplines specifically look at individual segments, macroprudential policy focuses on the linkages and interactions between the economy, individual institutions and financial markets. Figure 1 provides an overview.

Figure 1. Macroprudential interactions within the financial system

First of all, there are important linkages between the real economy and the solidity of financial institutions. Economic imbalances can lead to economic shocks, making it more difficult for firms and households to meet their redemptions and interest payments. This creates losses to financial institutions and can undermine their solidity. At the same time, imprudent or unproductive lending by banks can lead to suboptimal investments and misallocation within the economy with negative repercussions for growth. Such interactions can also have a dynamic effect. If the capital position of a bank deteriorates, it may further reduce its lending to the economy in order to repair its balance sheet. The decline in credit supply leads to a further deterioration of the economic cycle, amplifying the initial effect.

Second, there is a direct interaction between the real economy and financial markets. Financial vulnerabilities may ultimately trigger a financial crisis. For example, an unsustainable mix of fiscal and monetary policies can lead to a debt crisis. Conversely, conditions in the financial markets can affect developments in the real economy. A clear example from recent years, is the existence of excess liquidity in financial markets within an environment of low interest rates. This leads to a search for yield which can result in distortions in the price setting in financial markets and increases risks of asset price inflation.

Systemic risks can also develop as a result of the interaction between financial markets and financial institutions. The financial sector is a complex network, where institutions are highly interconnected, both between banks as well as cross-sectoral. Market dynamics can undermine financial stability, because of sudden changes in risk sentiment and herd behaviour. For example, market volatility or liquidity stress increases risk premiums and reduces financing available to the economy. Problems in financial institutions can spread to other institutions as a result of direct or indirect contagion. The extent of which depends on the structure of the market.

Systemic risks thus focus on the different and complex interactions within and between the financial system and the macro-economy. Although stress tests can help gauge these relationships, the associated risks and network externalities are inherently difficult to determine. Moreover, macroprudential policy is still a relatively new field of expertise which continues to evolve.2 In this context, the remaining part of this article shares some experiences and lessons for macroprudential policy design, based on a case study for the Dutch housing market.

The housing market is a typical example of a sector that plays a central role in macroprudential policy. The most evident example is the US housing market and subprime mortgages during the global financial crisis of 2008/2009, but in many other financial crises, the housing market has been a determining factor in causing or amplifying financial instability.3

In the Netherlands, the housing market is particularly important. The regulatory framework is characterized by a favorable tax regime for mortgage lending and generous lending criteria.4 Moreover, housing supply is limited.

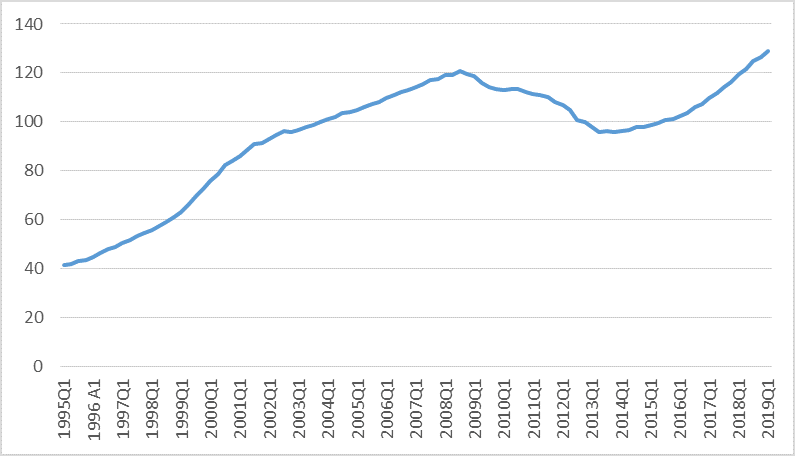

Figure 2. Nominal house prices in the Netherlands (index; 2015 =100)

Source: Statistics Netherlands (CBS).

Figure 2 shows the developments in the housing sector in the Netherlands in recent years. House prices strongly increased for many years, well above economic growth, before dropping almost 25% during the crisis. With the economy recovery, prices have rebounded again and are now above pre-crisis levels.

From a micro-prudential perspective, the elevated price level and volatility of the Dutch housing market does not directly pose a financial problem. Mortgage portfolios of large banks performed well during the crisis and experienced limited losses.5

However, from a macroprudential perspective, the housing market is an important threat to financial stability, because of its procyclical effects. Supply in the short run is fixed. As a result, during an economic boom, the demand-supporting factors and ample availability of mortgage credit fuel a strong increase in house prices. This creates wealth effects and stimulates private consumption. It can also translate into a strong rise in household debt, which has reached over 100% GDP in the Netherlands. In contrast, during the economic downturn, the negative effects prevail. Many households see their house values drop, often even below the level of their outstanding mortgage, creating negative equity effects (in the Netherlands commonly called ‘the underwater problem’). In turn, this has a strong, depressing effect on consumption. This boom-bust scenario in the Dutch housing market leads to more volatile economic growth in the Netherlands with associated inefficiency and adjustment costs.

The functioning of the housing market also leads to vulnerabilities in the financial sector. The financial system is characterized by a deposit funding gap, because total available consumer deposits in the Netherlands are not sufficient to finance total mortgage demand. Financial institutions need to rely on more volatile market lending to fund their activities. Moreover, financial institutions have relatively large mortgage portfolios on their balance sheets, which can make them more vulnerable to an unexpected increase in interest rates or decline in house prices.

Tax incentives and fiscal subsidies also distort the broad functioning of the Dutch housing market. There are significant gaps between homeownership and the rental sector and between the commercial and social segments of the housing market. Moreover, because of local building constraints and a time-lag, housing supply only reacts slowly to changes in demand. This leads to a misallocation and limits social and economic mobility.

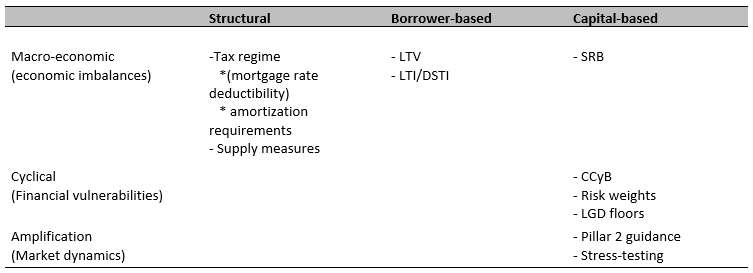

A macroprudential framework to address vulnerabilities in the housing market can consist of different types of measures (table 1).

Table 1. Macroprudential measures aimed at the housing market

Structural measures directly affect the functioning of the housing market. The tax regime determines the level of net monthly payments for households and thereby the level and elasticity of the demand curve. Correspondingly, government policies to stimulate new building projects directly affect the supply curve. In recent years, important steps have been taken by the Dutch government to reduce mortgage interest rate deductibility, by lowering the marginal tax subsidy and introducing mandatory amortization requirements as a condition for preferential tax treatment. These measures reduce borrowing capacity for households and – all else equal – have a mitigating effect on house prices. Nonetheless, in recent years this effect has been more than offset by declining interest rates pushing payment capacity and thereby house prices further upwards. Limiting tax incentives has particularly been effective in curbing the total level of mortgage household debt. However, increasing the supply of houses has proven to be more difficult, because of public zoning policies and planning requirements which also require a longer time horizon to realize. Environmental regulations are also becoming more and more an important factor limiting housing supply.

Borrower-based measures affect the lending capacity of households and thereby have an indirect effect on the housing market. The maximum value of the mortgage lending in relation to the underlying housing price (the loan-to-value limit) has been reduced to 100%. This has only been partly effective to reduce pressure in the housing market, because the LTV-limit is not always a binding constraint. Moreover, it does not capture the procyclical effect of increased lending possibilities within a booming market, when house prices also increase. It has also proven to be a politically sensitive measure, because it directly affects the capacity of individual households to finance their house. For example, the government has decided not to follow-up on the advice of the Dutch Financial Stability Committee (FSC) to further lower the LTV limit to 90%.6

Similarly, the experiences with restricting the LTI-limit are also mixed. In the Netherlands, the methodology is determined by an independent body, which takes a microprudential perspective that is primarily based on the available income for individual households. This approach has an inherently upward effect during an economic boom and is therefore not effective to capture systemic risks.

Finally, within the macroprudential framework, capital-based measures can be applied, although they can be considered second best. They do not improve the functioning of the housing market, but only increase the resilience of the financial sector. Macroprudential measures that are available to a macroprudential supervisor include imposing higher risk buffers or more targeted measures, under the so-called flexibility package within the European legislation (art. 458 CRR).

These considerations have been taken into account by DNB in response to an observed increase of systemic risk in the Dutch housing market in recent years. DNB has reaffirmed its advice to the government to address structural vulnerabilities, by further limiting mortgage interest rate deductibility and lowering the LTV-limit. In addition and as part of its own set of instruments, DNB deemed it appropriate to increase the resilience of Dutch banks. It is important in this context to choose the right macroprudential instrument. The systemic risk buffer is not an adequate measure, because it addresses risks of a structural rather than cyclical nature. Also, it is a generic measure that is not directly targeted at the real estate sector. By the same token, the activation of the countercyclical capital buffer (CCyB) is not straightforward either. The CCyB is a cyclical measure that can be applied when total credit growth exceeds developments in GDP. Currently, overall credit growth in the Netherlands remains subdued. For these reasons, DNB has decided to impose higher risk weights on mortgage portfolios.7

Current risk weights for Dutch mortgage loans are among the lowest in the EU. Moreover, these risk weights have been on a downward trend, in part because of the backward looking character of internal risk models that focus on historical losses. The measure that has been proposed has a more forward-looking approach and introduces a floor for risk weights of domestic mortgage loan portfolios of Dutch banks to address systemic risks. The calibration of the measure is consistent with the Basel capital framework. It is risk sensitive, because the floor increases with the LTV ratio of the underlying mortgage loans. Due to this measure Dutch banks that use internal models must hold additional capital against their mortgage portfolios. The measure is expected to have a limited effect on mortgage interest rates or the housing market, but it enhances the resilience of Dutch banks against possible future shocks.

The recent experiences with different policy measures in the Netherlands, provide several lessons for an effective macroprudential framework for the housing market.

First, it is important to apply a combination of measures. Although capital-based measures increase the resilience of the financial sector, they cannot prevent the development of structural imbalances in the housing market, such as overvaluation, price volatility and household indebtedness. In microprudential terms: capital-based measures only reduce the loss-given-default and – if any – only have a marginal effect on lending costs and the total level of mortgage financing. Structural and borrower-based measures on the other hand, are more effective in addressing the underlying factors by reducing the probability of default. This specifically applies to a tax system that does not unduly promote debt financing as well as the introduction of strict lending criteria to prevent excessive lending.

Another important observation is that in current circumstances, the effectiveness of the macroprudential framework is significantly hindered by the fact that the most effective measures do not fall under the responsibility of the supervisor. Most measures that are relevant for the systemic stability of the housing market are ultimately determined by the Ministry of Finance and the Ministry of the Interior. This is based on the argument that they are part of the broader tax system and socio-economic policies. For example, some macroprudential measures also have distributional income effects that the government uses to deliver affordable housing for specific income groups. Similarly, borrower-based measures have an impact on the accessibility of the housing market, if it would create obstacles for specific groups, like young starters, to buy their first home. These examples indicate that the design of macroprudential measures is constrained by other, often political, considerations. The absence of a well-developed toolbox for macroprudential supervision that can be applied independently by a single authority responsible for financial stability, implies that macroprudential policy is not always fully capable to counterbalance all the vulnerabilities that may arise from macro-economic, financial and monetary developments.

The different measures towards the housing market also need to be well- coordinated. There is a complex interaction of effects and the design should not be counterproductive. For example, the effective functioning of the housing market also depends on sufficient investments in new houses and a well-developed and efficient rental segment. Economic distortions in one part of the market, can have negative effects on the effectiveness of other segments. A comprehensive approach is needed to be effective and meet the changing needs of different stakeholders and improve mobility within the housing market.

Finally, authorities also need to take into account unintended effects of their macroprudential policies. Measures may induce risk-shifting in lending behavior of households or credit supply. For example, the strengthening of banking regulation after the crisis has led to a growing role of insurers and pension funds within the mortgage market. This can be a welcome development, because of diversifying effects, but it can also lead to new risks and transmission effects. In addition, there are more long-term trends that need to be taken into account, such as the increase of buy-to-let practices, the emergence of foreign investors and changing consumer preferences between large cities versus the periphery.8 These trends may require an alternative calibration of policy measures.

Macroprudential policy is a new, challenging and ever developing field of financial sector supervision, because of its complex and dynamic interactions. Putting macroprudential policies to work is therefore more of an art than a science and sharing best practices and experiences is useful to deepen our knowledge and understanding. The Dutch housing market provides a relevant case study: it is a key element of the Dutch economy that currently requires a comprehensive mix of macroprudential policy measures to ensure financial stability.

Marco van Hengel is senior expert at De Nederlandsche Bank (DNB). Paul Hilbers is Director Financial Stability at DNB and professor at Nyenrode Business University. The views in this note reflect those of the authors and do not necessarily represent the position of DNB.

European Systemic Risk Board (2018), The ESRB handbook on operationalising macroprudential policy in the banking sector.

Reinhart, C.M. and Rogoff, K.S. (2009), This Time is Different: Eight Centuries of Financial Folly, Princeton University Press.

“Mortgage interest tax deduction in the Netherlands: a welcome relief”, speech Governor Klaas Knot at the macroprudential policy conference in Vilnius, 2 July 2019.

DNBulletin: Focus on banking mortgage portfolios, (Nov. 2016): https://www.dnb.nl/en/news/news-and-archive/dnbulletin-2016/dnb349156.jsp .

https://www.financieelstabiliteitscomite.nl/nl/nieuws/nieuwsbericht/38

https://www.dnb.nl/en/news/news-and-archive/Persberichten2019/dnb385941.jsp

DNB (2019), Hot Property, the housing market in major cities, https://www.dnb.nl/en/news/news-and-archive/Nieuws2019/dnb384913.jsp