The issue of non-performing loans (NPLs) in Europe continues to be a focal point of attention for the banking system, both at national and European level. This note explores the origins and causes of the accumulation of NPLs in Europe, and explains why they have been and continue to be an important challenge that needs to be tackled. Substantial and encouraging progress in reducing NPLs in the EU banking sector has been made. Nevertheless, NPLs remain a significant challenge to the profitability and viability of EU banks, and economic growth at large. Attention also needs to be drawn to the clear and important EU dimension to reducing NPLs, as well as preventing their renewed build-up in the future, as the banking system of the EU and particularly of the euro area is highly interconnected. This is clearly underlined by the “Action Plan To Tackle Non-Performing Loans In Europe”, which was endorsed by finance ministers in the ECOFIN Council in July 2017. The note also touches upon the link with the wider agenda of advancing risk reduction and risk sharing in the EU. Most importantly, the contribution elaborates upon the actions that the European Commission has taken to address NPLs, what their main objectives are and how they could affect the EU banking sector.

The financial crisis and subsequent recessions led to a more widespread inability of borrowers to pay back their loans, as more companies and people faced continued payment difficulties, or even bankruptcy. This was particularly so in Member States that faced long or deep recessions. Consequently, many banks saw a build-up of non-performing loans (NPLs) on their books. NPLs are loans where the borrower has difficulties to make the scheduled payments to cover interest and/or capital reimbursements. When the payments are more than 90 days past due, or the loan is assessed as unlikely to be repaid by the borrower, it is classified as an NPL.

Elevated levels of NPLs may affect financial stability as they weigh on the viability and profitability of the affected institutions and have an impact, via reduced bank lending, on economic growth. More specifically, high stocks of NPLs can weigh on bank performance through two main channels:

For these reasons, the Commission and other EU authorities have long highlighted the urgency of taking the necessary measures to address the risks related to NPLs. In order to reduce the high NPL stocks, the EU agreed on a comprehensive set of measures outlined in the “Action Plan to Tackle NPLs in Europe”3, which is currently being implemented. The ongoing decline of NPLs has been and continues to be one of the key areas for reducing risk in the European banking sector. Still, high NPL ratios remain an important challenge, for some Member States in particular. In response, the Commission and other authorities (at national and at EU level) have introduced targeted measures to further reduce the current stock of NPLs and to prevent their renewed accumulation in the future.

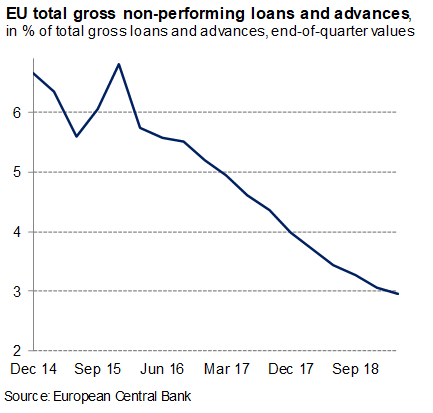

Over the past years, NPLs and NPL ratios have declined markedly. The overall quality of banks’ loans portfolios has shown a sustained improvement. The latest figures show that the gross NPL ratio for all EU banks has declined to 3 % (Q1-2019), down by 0.8 percentage points year-on-year (see Figure 1). The ratio has thus continued its downward trend since Q4-2014. The NPL ratio is approaching pre-crisis levels. The provisioning ratio4 has also improved and stood at 59.5 % in Q1-2019.

Figure 1: Non-performing loans ratio in the European Union

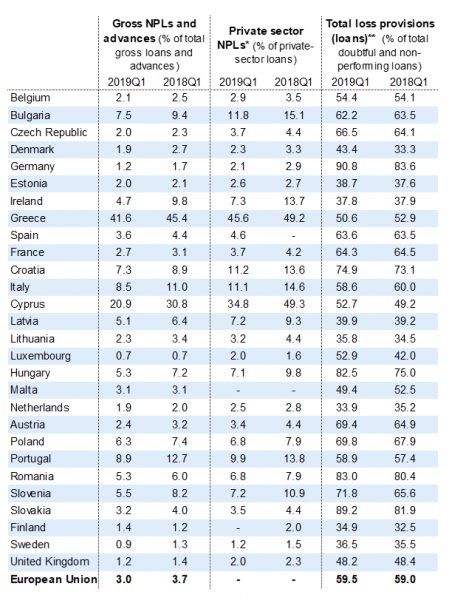

NPL ratios have fallen in nearly all Member States. However, the situation continues to differ significantly between countries (see Table 1). At the end of Q1-2019, 13 Member States had NPL ratios below 3 %, while some still have considerably higher ratios – 2 Member States had ratios above 10 %.

This reduction has been facilitated by determined action – by bank management and policymakers – particularly in Member States with relatively high NPL levels. There has been a trend across Member States towards further improving risk management practices (especially in vulnerable banks) and strengthening provisioning of NPLs, hence improving banks’ capital positions.

Table 1: Non-performing loans and provisions by Member State5

Source: European Central Bank, Consolidated Banking Data. Calculations by Commission services (DG FISMA).

There is hence evidence of encouraging progress in tackling NPLs, due to a combination of policy actions and economic growth. Despite such advances, NPLs continue to pose risks to economic growth and financial stability. The total volume of NPLs across the Union still stands at EUR 734 billion.6 Structural impediments continue to hamper a faster decline in NPL stocks. Among other elements, debt restructuring, insolvency and debt recovery processes continue to be a significant hurdle in some cases, as they remain too slow and unpredictable. Activity on secondary markets for NPLs is growing in some Member States, supported by relevant policy actions (as explained above), although it is not yet sufficient to substantially contribute to NPL reduction efforts on a structural basis. That being said, the development of the secondary market is encouraging, as it has sustained continued momentum in several Member States, with banks selling large portfolios. Interest from investors is rising and the volume of NPL-related transactions is increasing.

The primary responsibility for tackling high NPL ratios remains with the affected banks and Member States. However, there is also a clear EU dimension to reducing current NPL ratios, as well as preventing any build-up of NPLs in the future, given the interconnectedness of the banking system of the EU and particularly of the euro area. In particular, there are important spillover effects from Member States with high NPL ratios to the EU economy as a whole, both in terms of economic growth and financial stability.

The Commission and other institutions and bodies at EU level have therefore devoted significant attention to addressing the issue of NPLs since the outset of the financial crisis in 2008/9. For banks, whose viability was threatened by high NPL ratios, the Commission has assisted Member States in setting up ad-hoc and system-wide measures with the objective of reducing NPL stocks (sometimes as part of a financial assistance programme) through solutions compatible with State aid rules such as specific impaired assets measures for banks, winding down vehicles and/or market compatible structures, which entailed a substantial reduction of the stock of NPLs present in the banking sector. In this way, it has incentivised banks to manage and reduce their NPLs via market mechanisms and thus protected tax payers from bearing the costs via adequate burden sharing and in-depth restructuring. The need to take determined action to address high NPL ratios has also been underlined in the European Semester recommendations to relevant Member States. The European Central Bank (ECB) in its supervisory capacity (the Single Supervisory Mechanism), national competent authorities and the European Banking Authority (EBA) have also played an important role in enhancing the supervision and reporting of NPLs in Europe, while the ECB has had an integral part in safeguarding financial stability in the EU.

Reflecting this EU dimension and building on the high level of agreement on the need to continue and extend the actions already initiated by the Commission and others, the ECOFIN Council adopted in July 2017 an “Action Plan To Tackle Non-Performing Loans in Europe”. This Action Plan calls upon various institutions – including the Commission – to take appropriate measures to further address the challenges of high NPL ratios in Europe. It does so by setting out a comprehensive approach, focusing on a mix of complementary policy actions in four core areas: (i) bank supervision and regulation; (ii) further reforms of national restructuring, insolvency and debt recovery frameworks; (iii) developing secondary markets for distressed assets, and (iv) fostering, as appropriate and necessary, restructuring of banks. Action in these areas should be at national level and at Union level where appropriate.

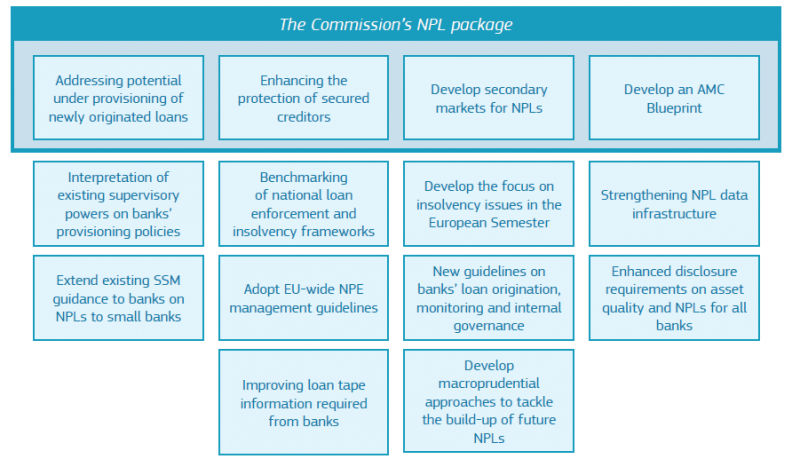

Despite good progress in tackling the NPL challenge in Europe, further legislative measures appeared necessary to address the remaining issues linked to high levels of NPLs. In this context, a comprehensive approach is needed and should focus on a mix of complementary policy actions. Continuing its commitment to tackle NPLs, the Commission therefore adopted a comprehensive package addressing the four areas described above, thereby fostering financial stability in the EU. With this package of measures, the Commission delivered a large part of those elements of the NPL Action Plan that are under its direct responsibility (see Figure 2).

Figure 2: Elements of the Council “Action Plan to Tackle Non-Performing Loans in Europe”, including the Commission’s NPL package of measures.7

Source: Commission Services (DG FISMA).8

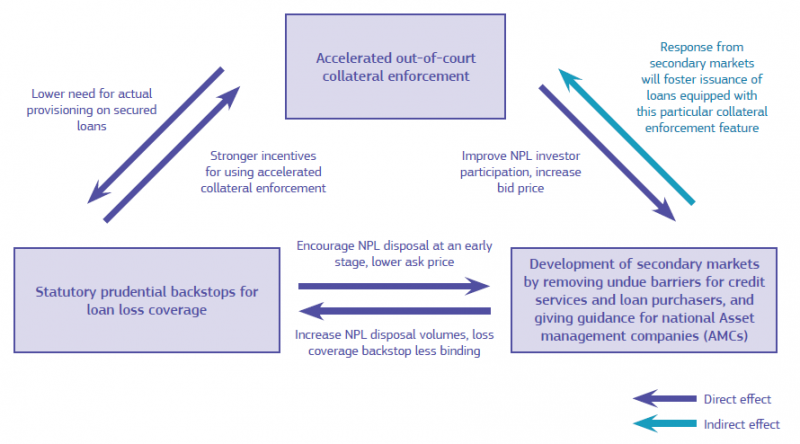

The proposals in this package mutually reinforce each other and would not be as effective if implemented in isolation (see Figure 3). The statutory prudential backstop will ensure that credit losses on future NPLs are sufficiently covered, making their resolution or sale easier. These effects are complemented by the push to further develop secondary markets for NPLs as these would make demand for NPLs more competitive and raise their market value. Furthermore, accelerated extrajudicial collateral enforcement as a swift mechanism for recovery of collateral value reduces the costs for resolving NPLs.

Figure 3: NPL Package: Reinforcing effects between actions.

Source: Commission Services (DG FISMA).9

3.1. Sufficient Loan Loss coverage by banks for future NPLs

The Regulation10 amending the Capital Requirements Regulation11 requires banks to have sufficient loan loss coverage for newly originated loans if these become non-performing exposures. The amendment introduces a ‘statutory prudential backstop’ in order to prevent the risk of under-provisioning of future NPLs. Such a backstop amounts to minimum coverage levels of provisions and deductions from own funds that banks will be required to have for incurred and expected losses on newly originated loans that later turn non-performing. In case a bank does not meet the applicable minimum level, deductions from own funds would apply.

To ensure consistency in the prudential framework, the Commission also introduces a common definition of non-performing exposures (NPE), in line with the one already used for supervisory reporting purposes. The prudential backstop will reduce financial stability risks arising from high levels of insufficiently covered NPEs, by avoiding the build-up or increase of such NPEs with spillover potential in stressed market conditions. It will also ensure that institutions have sufficient loss coverage for NPEs, therefore protecting their profitability, capital and funding costs in stressed times. In turn, this would ensure that stable, less pro-cyclical financing is available to households and businesses.

The prudential backstop would work as a function of two main input variables:

The coverage requirements for banks are to increase progressively up to 100%, i.e. after 3 years (for unsecured NPEs) and 9 / 7 years (for NPEs secured by immovable / other credit protection, respectively). This approach reflects the increased risk resulting from “aged” NPEs: the longer NPEs remain on banks’ balance sheets, the less banks succeed in recovering. The objective is to incentivise pro-active and timely NPE management. This is important as successful loan recoveries and viable forbearance measures usually happen during the first years after classification as non-performing.

3.2. A proposal for a Directive on credit servicers, credit purchasers and the recovery of collateral

The proposed Directive enables banks to deal in a more efficient way with loans once these become non-performing by improving conditions to either enforce the collateral used to secure the credit or to sell the credit to third parties. Accelerated extrajudicial collateral enforcement as a swift mechanism for recovery of value would reduce the costs for resolving NPLs and would hence support banks in recovering value. In cases where banks face a large build-up of NPLs and lack the staff or expertise to properly service them, the proposed Directive facilitates the outsourcing of the servicing of these loans to a specialised credit servicer or the sale of the credit agreements to a credit purchaser that has the necessary risk appetite and expertise to manage it.

The two avenues for banks to deal with NPLs facilitated by this proposed Directive reinforce each other. Shorter time of resolution and increased recovery, as expected with accelerated extrajudicial collateral enforcement, increases the value of the NPLs as well as bid prices in possible NPL transactions. It is also easier to price a collateralised NPL than an unsecured one in secondary markets because the value of the collateral sets a minimum value of a NPL. Hence, credit purchasers will prefer NPLs with the accelerated extrajudicial collateral enforcement feature. This, in turn, would give additional incentives for credit institutions to use this feature at the origination of new loans. Moreover, the harmonisation achieved by accelerated extrajudicial collateral enforcement would foster the emergence of pan-European NPL investors, which would further improve market liquidity.

3.2.1. Further develop secondary markets for NPLs

The proposed Directive would contribute to the further development of secondary markets for NPLs by removing undue impediments to loan servicing by third parties and to the transfer of loans to loan purchasers, while fully respecting the existing Union civil law acquis and Member States’ consumer protection rules.

Currently, banks are not always able to manage their NPLs in an effective or efficient manner. In such cases, banks will recover less from their portfolio than would otherwise be possible. This may occur, for example, when banks face a large volume of NPLs and are unable to properly service their NPLs. Banks may also find themselves with a portfolio of NPLs where the nature of the loans falls outside of the banks’ core expertise to recover. In these instances, the best option may be to either outsource the servicing of these loans to a specialised loan servicer or sell the credit agreement.

For these reasons, the proposal creates a common set of rules that credit servicers need to abide by to operate cross-border within the Union. The proposal sets common standards to ensure proper conduct by and supervision of loan purchasers and credit servicers across the Union, while allowing more competition by harmonising market access rules across Member States. This will lower the cost of entry for potential loan purchasers by increasing the accessibility of credit servicing and by reducing the costs of credit servicing. A higher number of purchasers on the market means a more competitive market, leading to higher demand and transaction prices.

In order to have a sound secondary market for NPLs and a solid framework for credit servicers, clear rules are proposed to protect consumers’ rights and interests. The proposal includes legal safeguards and transparency rules, making sure that the level of consumer protection is not impacted by the transfer of the debt. Particular attention is paid to the most vulnerable and over-indebted consumers. For example, credit servicers should have appropriate policies in place for dealing with borrowers and, where needed, should refer the consumer to debt-advice or social services.

3.2.2. More efficient value recovery from secured loans

The proposed Directive will also provide secured creditors with a more efficient method of value recovery from secured loans through an accelerated extrajudicial collateral enforcement. This refers to an expedited and efficient out-of-court enforcement mechanism that enables secured lenders to recover value from collateral granted solely by companies and entrepreneurs to secure loans. Such mechanisms already exist in 25 Member States (yet in half of these, the scope of such mechanisms is limited to either movable or immovable assets).

The proposal would help banks to improve their current workout processes, and manage NPLs by increasing the efficiency of debt recovery procedures through an accelerated extrajudicial collateral enforcement. In the majority of cases, banks address their NPLs themselves by recovering value through workout. A large share of loans that become NPLs are loans secured by collateral. While banks are able to enforce collateral under national insolvency and debt recovery frameworks, the process can often be slow and lack legal certainty. In the meantime, NPLs remain on banks’ balance sheets, keeping the bank exposed to prolonged uncertainty and tying up its resources. This prevents the bank from focusing on new lending to viable customers. Therefore, the proposal includes an efficient method for banks and other undertakings authorised to grant loans, in order to allow them to recover their funds from secured loans to business borrowers, in an out-of-court procedure. This efficient extrajudicial procedure would be accessible when agreed upon in advance by both lender and borrower, in the loan agreement. It will not be available for consumer credits, and is designed to not affect early restructuring or insolvency proceedings. It will not impact the insolvency laws of the Member States on issues such as the hierarchy of creditors in insolvency.

Restructuring and insolvency proceedings prevail over the accelerated extrajudicial collateral enforcement procedure set out in this proposal. In order to ensure full consistency and complementarity with the Restructuring Proposal, the following principle will apply: the extrajudicial enforcement of collateral would be possible only as long as a stay of individual enforcement actions, in accordance with applicable national laws, is not applicable. The Restructuring Proposal already foresees that creditors, including secured creditors of a company or an entrepreneur that is undergoing restructuring proceedings, are subject to a stay of individual enforcement actions. In this case, the debtor in difficulty can negotiate a restructuring plan with creditors and avoid insolvency.

3.3. A technical Blueprint for how national Asset Management Companies (AMCs) can be set up

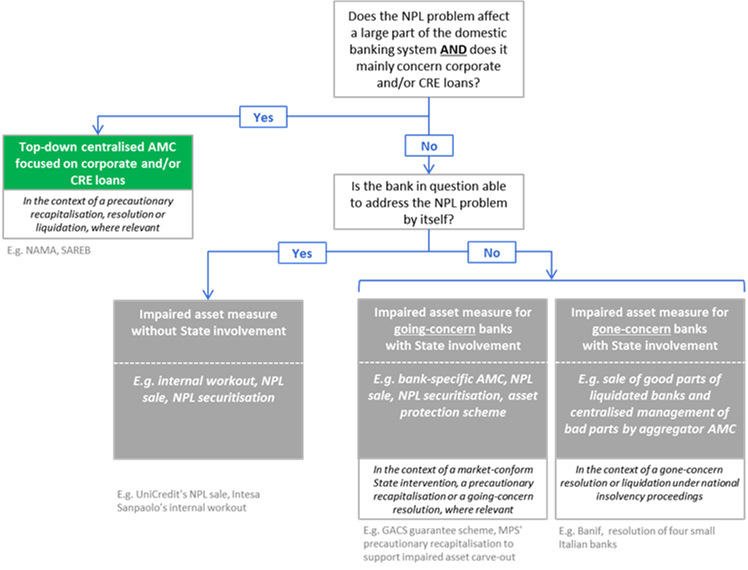

As part of the package, the Commission also provided Member States with non-binding guidance on how they can set up, if they so wish, national AMCs in full compliance with EU banking and State aid rules. The AMC Blueprint provides practical guidance for the design and set-up of AMCs at the national level, building upon best practices from past experiences in Member States, to the extent applicable. AMCs can be private or (partly) publicly supported with no need for State aid, if the State can be considered to act as any other economic agent. The option of an AMC involving State aid should not be seen as the default solution (see Figure 4). That said, considering AMCs with a State aid element as an exceptional solution, the Blueprint aims to clarify the permissible design for such AMCs, fully consistent with the EU legal framework, particularly the BRRD, the SRMR and State aid rules.

Figure 4: Example decision tree for authorities in the face of an NPL crisis

Source: Commission Services (DG COMP).12

The Blueprint suggests a number of common principles, such as the relevant asset perimeter, the participation perimeter, considerations on the asset-size threshold, asset valuation rules, the appropriate capital structure, and the governance and operations of the AMC. In addition, the Blueprint describes certain alternative impaired asset relief measures that do not constitute State aid, such as market-conform State guarantees enabling the securitisation of NPLs. The Commission has in the past years also assessed other measures proposed by Member States to deal with legacy NPLs and will continue to do so in individual cases, in order to ensure that these measures fully respect the BRRD, SRMR and State aid rules.

3.4. NPL transaction platforms

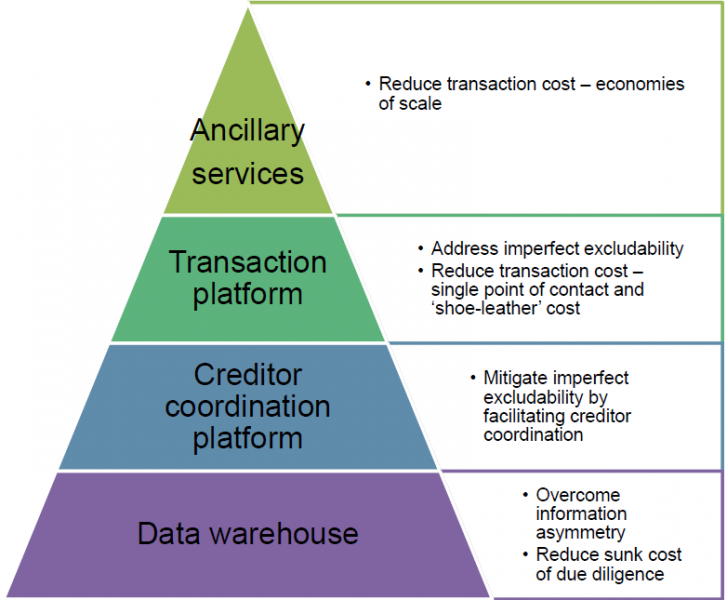

The Council Action Plan also called on the ECB, the EBA and the Commission to consider setting up an NPL transaction platform in order to stimulate the development of secondary markets. Commission services therefore published, end November 2018, a staff working document on the potential set-up of an NPL transaction platform, drafted jointly with staff from the ECB and EBA. It outlines the Commission services’ view on how the arrangements for such a vehicle could work in practice.

A Union-wide NPL transaction platform would be an electronic marketplace where holders of NPLs – banks and non-bank creditors – and interested investors can exchange information and trade. Such a platform has the potential to address several current sources of market failure in the secondary market for NPLs, including asymmetry of information between sellers and buyers and high transaction costs (see Figure 5). As a result, it could help banks increase sales and obtain higher sales prices than currently possible, ease investor access to NPL markets, and thereby allow banks to dispose of NPLs and clean up their balance sheets faster. Such a platform could help deal with current stocks of NPLs and provide a permanent channel for the efficient disposal of future NPLs as they arise. In this sense, it could be an important, yet low-cost, infrastructure investment preventing a new build-up of large stocks of NPLs in the future. It could therefore be an essential means of contributing to a sustainable solution to the NPL issue in Europe.

Figure 5: Potential functions for a platform.

Source: European Central Bank.

The Commission invited industry stakeholders to a roundtable in order to kick-start work on achieving Union-wide NPL platforms. Two meetings of this roundtable with industry experts have taken place in 2019, delivering a useful exchange of information and views with, and between, private stakeholders. First steps have been taken to realise the objective of reaching an agreement among stakeholders on the concrete forms for developing and issuing industry standards for European NPL platforms. With this objective in mind, the Commission, together with the ECB and the EBA, will continue to play a key role in facilitating the taking of the necessary steps to promote the emergence of Union-wide NPL platforms by all relevant stakeholders.

In line with the overall significant progress on risk reduction in the EU banking sector, the stock of NPLs has seen a marked decline and is continuing this trend. Despite this positive development, high NPLs remain a challenge for the EU as a whole and for some Member States in particular. This affects the individual banks, hinders the proper functioning of Banking Union and affects the lending to the economy. Tackling this issue has in fact been supported by the economic recovery. In concert with targeted policy actions, this has led to declining NPL volumes and ratios across Member States, albeit at various speeds. Yet more is needed. Especially in some Member States, the current trends of NPL reduction ought to accelerate. Furthermore, a renewed build-up of NPLs needs to be prevented overall.

The Action Plan agreed by the Council in July 2017 was a major step in addressing the NPL challenge. Substantial progress has been made in its implementation. However, to be able to address NPLs in the most effective manner, the Action Plan should be fully implemented by all actors. This is crucial to addressing the challenge of high NPLs, both in terms of reducing existing stocks to sustainable levels and preventing a renewed future accumulation.

The comprehensive package of measures launched by the Commission in March 2018 constituted a significant step in implementing the Action Plan and hence in addressing NPLs across the EU, now and towards the future. Beyond this package, the Commission continues to follow up on this important topic, suggesting relevant policies, as appropriate, to tackle the problem at hand.

Also the other parts of the Action Plan are mostly well on track or completed. It is necessary to maintain this pace of progress in implementing all envisaged measures in the coming months and years, if the challenge of high NPLs is to be addressed both in terms of reducing existing stocks to sustainable levels and preventing future accumulation. Individual banks and Member States concerned need to maintain their efforts at a sustained pace, and the Action Plan’s full implementation must remain the objective of all relevant stakeholders. This is essential to support the ongoing joint efforts to reduce risk in the European banking sector.

The information and views set out in this publication are those of the authors and do not necessarily reflect the official opinion of the Commission. The Commission does not guarantee the accuracy of the data included in this study. Neither the Commission nor any person acting on the Commission’s behalf may be held responsible for the use which may be made of the information contained therein.

Report of the FSC Subgroup on Non-Performing Loans. See http://data.consilium.europa.eu/doc/document/ST-9854-2017-INIT/en/pdf .

See the Council conclusions on Action plan to tackle non-performing loans in Europe, 11 July 2017: https://www.consilium.europa.eu/en/press/press-releases/2017/07/11/conclusions-non-performing-loans/ .

This ratio indicates the extent of funds a bank has kept aside to cover loan losses. Source: European Central Bank. Due to the unavailability of provisioning data for loans, the provisioning ratio for the EU was calculated by considering impairments and NPLs for all debt instruments (loans and debt securities).

Notes: Figures correspond to domestic credit institutions and foreign-controlled subsidiaries and branches.

* Sector-specific data for the EU, for Malta and for Spain (i.e. Q1 2018) are not available. Sector-specific data (i.e. total exposure to households and non-financial corporations) for Bulgaria, Germany and Hungary are only available in carrying amount.

** Data for the provisioning of loans are unavailable for Bulgaria, Germany, Hungary and the EU. In these cases, figures are based on impairments for all debt instruments (i.e. loans and debt securities).

Source: European Central Bank.

Note on abbreviations: AMC (Asset management company), SSMR (Single Supervisory Mechanism Regulation) CRD IV (Capital Requirements Directive IV).

See also the Factsheet attached to the European Commission Communication (COM/2018/0133 final) to the European Parliament, the European Council, the Council and the European Central Bank on Second Progress Report on the Reduction of Non-Performing Loans in Europe. Link: https://ec.europa.eu/info/files/180314-non-performing-loans-factsheet_en .

See also the Factsheet attached to the European Commission Communication (COM/2018/0133 final) to the European Parliament, the European Council, the Council and the European Central Bank on Second Progress Report on the Reduction of Non-Performing Loans in Europe. Link: https://ec.europa.eu/info/files/180314-non-performing-loans-factsheet_en.

Regulation (EU) 2019/630 of the European Parliament and of the Council of 17 April 2019 amending Regulation (EU) No 575/2013 as regards minimum loss coverage for non-performing exposures.

Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012.

European Commission Staff Working Document (SWD/2018/072 final) on AMC Blueprint accompanying the document Communication from the Commission to the European Parliament, the European Council, the Council and the European Central Bank on Second Progress Report on the Reduction of Non-Performing Loans in Europe.