These brilliant lines by the poet Robert Frost capture the world”s current economic prospects. Some warn that today’s world of high debt and low interest rates will end in the fire of inflation. Others prophecy that it will end in the ice of deflation. Others, again, such as Ray Dalio of Bridgewater, are more optimistic: the economy will turn out to be neither too hot nor too cold, just like the baby bear”s porridge, at least in countries that have had the fortune (and wit) to borrow in currencies they can create freely.

If we are to make any sense of the strange place in which the world economy is today and the even stranger places in which it might be tomorrow, we need a story about where it came from. By “here”, I mean our world of ultra-low real and nominal interest rates and populist politics. The simplest story about how we ended here is one about the interaction between real demand and the ups and then downs of global credit. Crucially, the story is not yet over.

The discussion below will begin by delineating today’s strange world. It will then look at how it got there. A discussion of what comes next will follow.

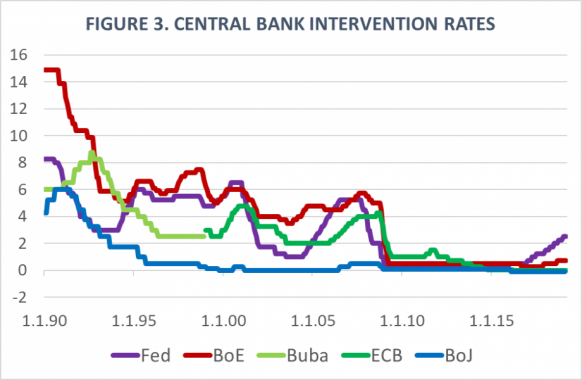

US policymakers were the most successful in reacting comprehensively. Back in the 1990s, Japan took too long to adopt the right combination of policies. So did the eurozone after 2008, largely because of obstacles to active fiscal policy in the currency union, but also because of ideological resistance to using the full capacities of the central bank. The UK”s response fell between that of the US and that of Japan and the eurozone.

Even if the needed policies are successfully adopted, they are always unpopular. So, not least, is the aftermath of any financial crisis. Sharing out losses generated by a financial crisis, followed by the inevitably weak recovery, always creates public rage.

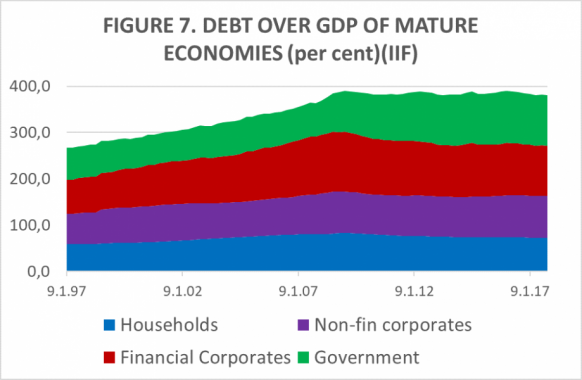

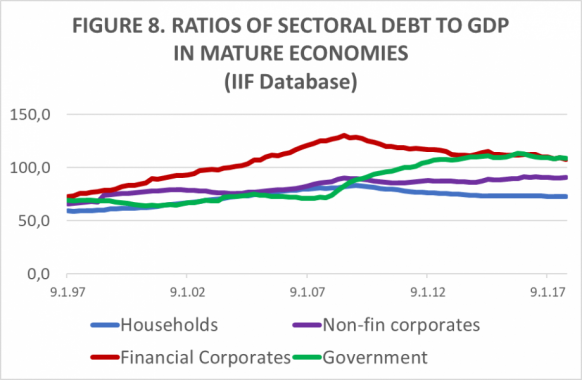

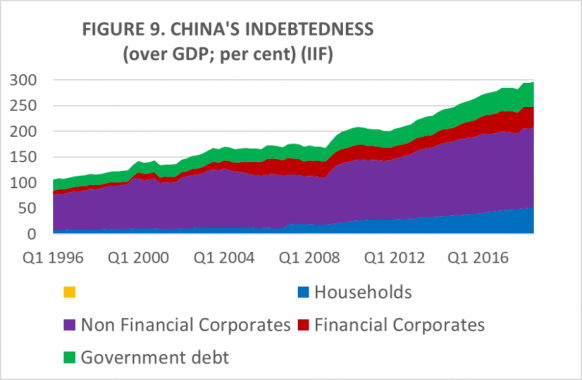

Where has this left us today? Not where we would like to be, is the answer, in three respects. First, while financial and household debt have fallen relative to incomes in mature economies, that is not true for debts of governments or non-financial corporates. (See Figures 7 and 8.) Second, the transatlantic crisis triggered offsetting debt explosions elsewhere, notably in China. (See Figure 9.) That debt explosion was no accident: the surge in credit in China was needed to make higher investment offset the disappearance of the huge current account surplus, which had peaked at close to 10 per cent of gross domestic product prior to the global financial crisis. Third, crisis-hit economies are still far below pre-crisis trend output levels. Productivity growth is also low. Finally, the populist politics of left and right remain in full force. All this is in keeping with past experiences with big debt crises. They have always thrown long shadows into the future.

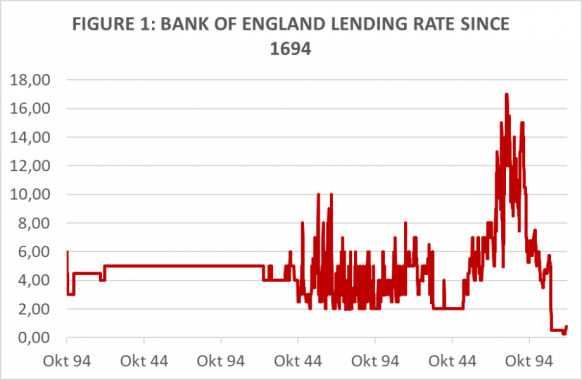

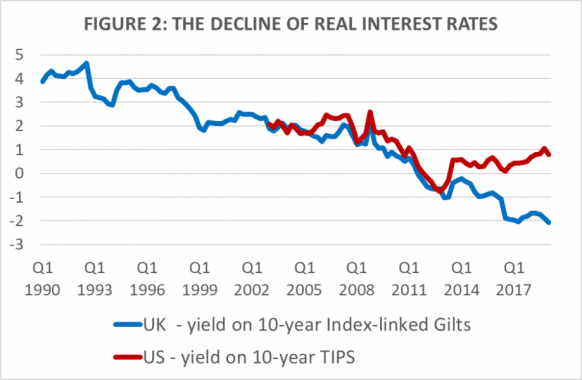

So how did we end up in this strange world? Crucially, the world of falling real interest rates on safe assets preceded the crisis. Larry Summers has described that phenomenon as “secular stagnation” that is, a world of structurally weak aggregate demand.5

A decisive moment was the Asian financial crisis, after which the world”s most dynamic economies became net exporters of capital. But there are other significant factors: high gross savings rates in important emerging economies, above all, China; persistently weak productivity growth in high-income economies; ageing in many economies and so a declining demand for physical capital; and deindustrialisation in high-income economies. Also important have been rapid falls in the relative prices of capital goods and shifts in the distribution of income towards profits and the highly paid. The overall effect has been to shift the balance between potential income and desired spending, against the latter. The result has been the falling real interest rates we have experienced.

The financial crisis was itself the consequence of this environment.6 Low (nominal and real) interest rates triggered rising property prices and an associated credit explosion, especially in the US and peripheral Europe. This was not somehow accidental: these credit bubbles were needed to drive demand in the early 2000s. They proved unsustainable, so bequeathing the post-crisis world we have lived in since 2008. But that post-crisis world has not ended. The persistently ultra-low interest rates we see today demonstrate that.

We can divide the last two decades into two periods. “Pre-crisis secular stagnation” was a world characterised by low and falling real interest rates and hugely destabilising credit and property-price-cum-investment bubbles. It was a world in which credit bubbles offset the underlying forces of secular stagnation.

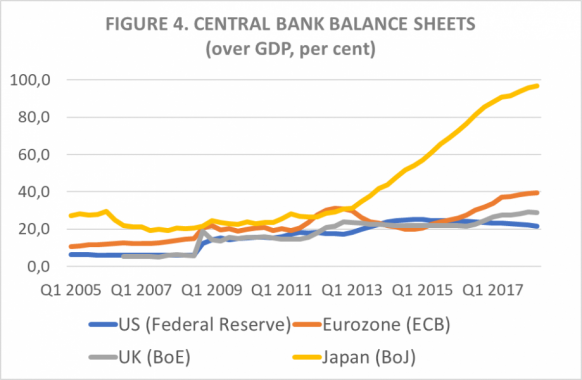

“Post-crisis secular stagnation” has been a world of near-zero real interest rates, partial deleveraging, weak growth and pervasive populist politics, also assisted by the huge post-crisis Chinese stimulus. It is a world in which, at first, extreme fiscal and monetary policy kept demand going and then just extreme monetary policy. Hyper-aggressive monetary policy has been needed since the crisis because the credit channel no longer works very well. Central banks have had to rely on the less efficient asset-price channel instead. That in turn has driven them to policy extremes. No central bank actually wanted to run the monetary policies they have been following. They had no acceptable alternative. Deflationary debt-destruction is politically intolerable. They know that.

In sum, pre-crisis secular stagnation in the West looked like the Japan of the 1980s. Post-crisis secular stagnation in the West looks like Japan of the 1990s and 2000s. The developed world as a whole has, alas, followed the Japanese trajectory.

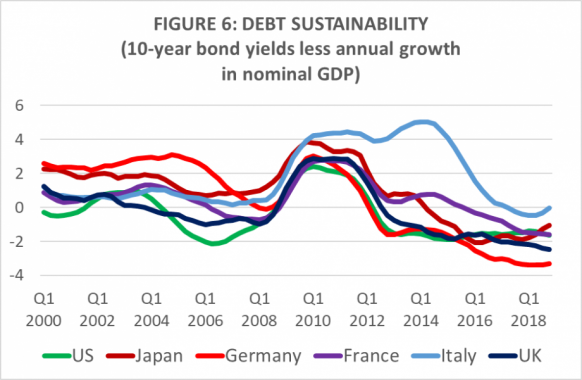

William White, former chief economist of the Bank for International Settlements, presciently warned of financial risks before the 2007-09 financial crisis. Last year, he warned of another crisis, pointing to the continuing rise in non-financial sector debt, especially of governments in high-income countries and corporations in high-income and emerging economies.7 Those in emerging countries are particularly vulnerable, because much of their borrowing is in foreign currencies. This causes currency mismatches in their balance sheets. Meanwhile, monetary policy fosters risk-taking, while regulation discourages it – a recipe for instability.

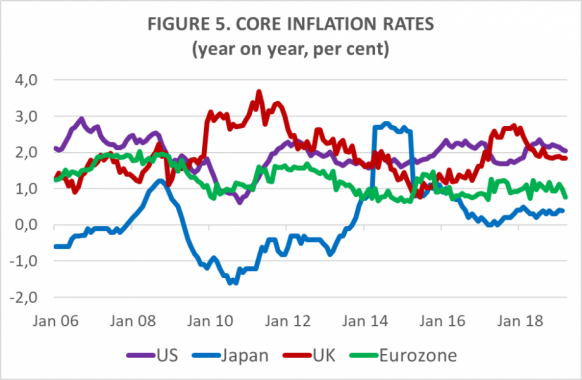

Consider first the risks of inflationary fire. Much of what is going on right now in the US recalls the early 1970s: an amoral US president (then Richard Nixon) determined to achieve re-election, pressures the Federal Reserve chairman (then Arthur Burns) to deliver an economic boom. He also launched a trade war, via devaluation and protection. A decade of global disorder ensued. This sounds rather familiar, does it not? In the late 1960s, few expected the inflation of the 1970s. Similarly, a long period of stable and low inflation has calmed fears of an upsurge, even though unemployment rates have fallen to 50-year lows in the US. Some suggest that the Phillips curve – the short-term relationship between unemployment and inflation – is dead, because low unemployment has not raised inflation. More likely, it is sleeping. Inflation expectations may now be anchored. But a strong surge of demand might still sweep that anchor away.

Such a rise in inflation could even be helpful. It would reduce debt overhangs, notably of public debt, as the inflation of the 1970s did. Moreover, central banks know what to do in response to a surge in inflation. Yet higher inflation would also lead to a rise in long-term nominal interest rates, which front-load the real burden of debt service. Short-term rates would ultimately jump, as they did in the early 1980s. Inflation- and term-risk premia would surely rise. High-flying stock markets could well collapse, as they did in the 1970s. Labour relations would inevitably become more strife-prone, as would politics. This disarray would hit unevenly, causing bouts of currency disorder. The loss of confidence in public institutions, notably central banks, would be severe. In the end, the likely stagflation would end in severe recession, as in the 1980s. None of this would be fun. It could even be politically disastrous.

Now turn to deflationary ice. This might begin with a sharp negative economic shock: a worsening trade war, a war in the Middle East or a crisis in private or public finance, possibly in the eurozone, where the central bank is relatively constrained in its ability to respond effectively. The result could be a deep recession, even a lurch into deflation, so worsening the debt overhang. The big difficulty would be knowing how to respond given that interest rates are already so low. Conventional policy (lower short-term rates) and conventional unconventional policy (asset purchases) might well be insufficient.

A range of other possibilities exists: still more negative rates from the central bank; lending to banks at lower rates than the central bank pays on their deposits; purchase of a much wider range of assets, including foreign currencies; monetisation of fiscal deficits; and even “helicopter drops” of money. Much of this would be technically or politically problematic. Some of it would require close co-operation with the government. Meanwhile, if governments acted too slowly (or not at all) a depression might ensue, as in the 1930s, via mass bankruptcy and debt deflation. Many fools recommended just those policies in 2008.

Yet none of these disasters is inevitable. They would be chosen catastrophes. As Mr Dalio argues, a golden mean is also conceivable. Fiscal and monetary policy would then co-operate to generate non-inflationary growth. Changes in fiscal incentives could be used to discourage debt and encourage equity. Government fiscal policy could shift income towards spenders, reducing reliance on debt-fuelled asset bubbles for sustaining demand. More debt could be moved out of the balance sheets of financial intermediaries directly on to the balance sheets of households.

Even if real interest rates rose, perhaps because productivity growth strengthened durably or income shifted towards spenders, the impact of robust non-inflationary growth on the debt burden would almost certainly outweigh a move to somewhat higher interest rates. The world would, above all, be moving out of “secular stagnation” into something less bad. That shift might be tricky to manage But it would at least be to a much better world.

It is not necessary to repeat the mistakes of either the 1930s or the 1970s. But we have made enough mistakes already and are, collectively, making enough more mistakes right now to risk such outcomes. A breakdown of the global economic and political order now seems conceivable. The impact on our debt-encumbered world economy and increasingly fraught global politics is impossible to calculate. But it could be horrendous. Above all, the nationalistic strongmen now in power – in the US, above all – would be unable to co-operate if things went seriously wrong, as they might, perhaps even soon. A fragile world economy needs sober and co-operative policymaking. But that seems highly unlikely, in another crisis. That is, arguably, the single most worrying feature of our world.

Associate Editor and Chief Economics Commentator, Financial Times, London.

James Politi, “Fed chair cements case for cut in interest rates”, 10 July 2019, Financial Times, https://www.ft.com/content/8bf10bf0-a30c-11e9-974c-ad1c6ab5efd1.

Ray Dalio, Principles for Navigating Big Debt Crises (Bridgewater, 2018).

Larry Summers, “The threat of secular stagnation has not gone away”, 6 May 2018, Financial Times, https://www.ft.com/content/aa76e2a8-4ef2-11e8-9471-a083af05aea7.

This is a core argument of Martin Wolf, The Shifts and the Shocks: What We’ve Learned – and Have Still to Learn – from the Financial Crisis (London: Penguin, 2015).

William White, “Bad Financial Moon Rising”, 3 October 2018, Project Syndicate, https://www.project-syndicate.org/commentary/global-economy-weak-fundamentals-by-william-white-2018-10?barrier=accesspaylog