The European Central Bank justifies the introduction of the digital euro with the role of a central bank digital currency as a monetary anchor. Three anchor roles for a CDBC can be distinguished: First, as an anchor for commercial bank deposits, guaranteeing their convertibility into central bank money. Second, as an anchor to maintain the national currency as a unit of account. Third, as an anchor for maintaining the central bank’s control over the financial system. We discuss the different anchor roles and analyse whether the introduction of a CBDC is necessary for these anchor functions. We argue that a CBDC can be justified as an anchor for bank deposits, but this would require unlimited access to a store of value, whereas the ECB envisages very limited CBDC holdings as a means of payment. Anchoring the national currency as a unit of account requires the stability of the currency. For the central bank’s control over the financial system, it is crucial that banks need central bank money as a means of payment and settlement. Thus, it is the holding of central bank money by banks, and not by non-banks, that is required as the ultimate monetary anchor for the financial system. Finally, the experience of several major central banks shows that the appropriate response to the declining use of cash in retail payments is not a CBDC, but the orchestration of competitive national retail payment systems.

In trying to justify the need for a digital euro, the ECB is increasingly referring to the argument that a central bank digital currency is needed as a “monetary anchor”. While this is an interesting argument, it is not entirely clear what the anchor role entails. In our view, it confuses three interrelated but distinct aspects:

We will show that each of these three perspectives has different implications for the role of a monetary anchor. A clear case can be made for anchoring commercial bank deposits with the possibility of converting them into CBDCs. This “anchor” would require full convertibility, whereas the ECB seems to envisage only very limited holdings of the digital euro and which de facto implies no convertibility for the corporate sector and non-bank financial intermediaries. But as long as banks are required to hold reserves with the central bank, the banking system remains anchored to the central bank even without convertibility of bank deposits into cash or a CBDC. As far as the anchoring of the unit of account role is concerned, the main requirement is the stability of the currency, not the use of a CBDC in daily payments. For the central bank’s control over the financial system, the main requirement is the final settlement of payment balances with central bank money. While one could imagine payment platforms with settlement systems based on stocks, this is not very likely for the time being. But a CBDC used for daily payments could not avoid such developments. Finally, the discussion on the role of the monetary anchor shows that the ECB’s approach to the dynamic processes in the retail payments landscape has the wrong focus. The example of several major central banks shows that it is possible to establish competitive national retail payment systems and thus financial sovereignty without a CBDC.

In sum, the ECB’s justification of the need for a digital euro in daily payments as a monetary anchor is not convincing. All that is required for the safeguarding of the role of public money in a digital economy is the need for the banks to use and to hold reserves with the central bank.

Fabio Panetta (2021) explains the need for a monetary anchor as follows:

“Convertibility into central bank money is therefore necessary for confidence in private money, both as a means of payment and as a store of value”.

Panetta is right, because demand deposits carry the bank’s promise to convert them into cash at any time. In fact, even now it would be technically very difficult to manage large cash withdrawals, especially in a situation of banking crisis when many depositors want to withdraw quickly. As the use of cash for day-to-day payments declines, the technical infrastructure for cash withdrawals can be expected to shrink even further.

The ability to transfer deposits from a commercial bank account to a central bank account would therefore contribute to the convertibility of private money into central bank money, which is particularly valuable in a crisis.

In this way, a valid argument can be made that a digital euro would help to ensure that confidence in private money is maintained. But the institutional design of the digital euro, as far as it can be discerned so far, is not compatible with an anchor role derived in this way.1

However, the means of payment function is exactly what the ECB envisions, while at the same time explicitly ruling out the store of value anchor function:

“(…) a digital euro would have to be designed in a way that makes it attractive enough to be widely used as a means of payment, but at the same time prevents it from becoming so successful as a store of value that it crowds out private money and increases the risk of bank runs.” (Panetta 2021).

One proposal that would allow for unlimited digital euro holdings is the two-tier remuneration system proposed by Bindseil (2020). CBDC holdings above a certain threshold would receive a maximum remuneration of zero and a negative remuneration if the difference between the deposit rate and a one percentage point discount is negative. However, in crisis situations, such a low discount would not be sufficient to prevent a digital bank run. A higher discount, especially in a crisis, would be incompatible with the ECB’s argument for convertibility as a monetary anchor.

Convertibility would imply a zero remuneration for digital euro holdings in line with the remuneration of cash. In this case, however, large digital euro holdings by corporates and wealthy investors cannot be ruled out, as they might be willing to accept a zero remuneration as an insurance premium for holding an absolutely safe asset.

If there is a further tendency towards a cashless society and unlimited convertibility into the digital euro is not envisaged by the ECB, does this mean that “private issuers would lose the discipline of public money and their issuance would instead be shaped by other market forces” (Brunnermeier et. al. 2019, p. 26)?

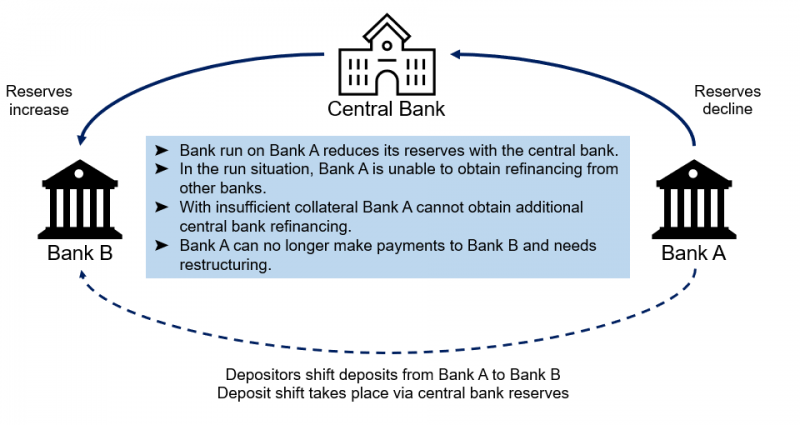

Even without convertibility into some form of central bank money, an individual bank must always be willing and able to make payments to other banks. If depositors lose confidence in a particular bank, they will transfer their deposits to other banks. For the affected bank, this means a reduction in its reserves at the central bank. Since other banks may be unwilling to lend to the problem bank on the interbank market, it can only refinance itself with the central bank. Since central banks require good collateral for their refinancing, a problem bank will soon reach its financial limits. This mechanism is illustrated in Figure 1.

Figure 1: Bank run in a cashless economy

In other words, even in a world without convertibility of demand deposits into central bank money, there is a strong discipline for individual banks to pursue sound policies.2 In addition, banking supervision is another disciplining factor for individual banks. The central bank could also decide to strengthen the role of central bank money for commercial banks, for example by introducing additional reserve requirements on commercial bank assets.

In the context of the euro area, the discipline exerted by transfers to other banks even applies to entire national banking systems. Because of the single currency, depositors who doubt the stability of their national banks can transfer their deposits to banks in other Member States.

Therefore, as long as central bank reserves provide the monetary anchor for the banking system, there is no threat to “singleness of the currency” (Panetta 2021) and no need for households and firms “to monitor the safety of private money users in order to value each form of money” (Panetta 2021).

Another argument in favour of CBDCs as a monetary anchor is the fear that a decline in the use of cash in daily payments could threaten the unit-of-account role of the national (euro area) currency (Panetta 2021). Brunnermeier et al. (2019, p.28) describe this in more detail:

“The most important consequence of a system based on digital platforms may be that agents begin to write contracts in a unit of account specific to a platform rather than the central bank’s unit of account. A change in the unit of account convention may become more likely with a large technological change that eliminates the use of cash and shifts economic activity towards platforms with their own units of account.”

But this fear is based on a misperception of the rationale behind payment platforms. Brunnermeier et al. (2019) expect payment platforms to start developing their own currencies and their own payment objects.3 Brunnermeier et al. (2019) therefore coined the term “digital currency areas“:

“A digital currency area is defined by possessing one or both of the following characteristics: The network uses its own unit of account, distinct from existing official currencies. (…) The network operates a medium of exchange that can only be used internally, between its participants.” (Brunnermeier et al. 2019, p. 19).

The authors were obviously inspired by Facebook’s announcement in 2019 that it would establish a retail payment platform based on a new currency, initially called Libra. To make payments within the system, users would have to hold deposits in Libra.

The Libra project was an absolute failure. While it is often argued that rigid regulations killed Libra, the reason was that its founders, like Brunnermeier and his co-authors, misunderstood the economic benefits of a payment platform. As PayPal shows, a successful payment platform does not need its own currency. Instead, its advantage is that it can deal with a variety of existing currencies. Similarly, a user of PayPal is not required to hold specific deposits with PayPal. Instead, the system is open to a variety of payment objects (bank deposits held at commercial banks) and payment instruments (credit cards, online payments). Thus, Brunnermeier and Landau (2022, p. 11) are wrong when they argue:

“Digitalisation may therefore lead to an excessive fragmentation of the monetary space.”

As PayPal shows, successful digital platforms enable an unprecedented integration of the international monetary space. The concept of a “digital currency area” is therefore misleading.

History shows that national currency units do not change easily. As Brunnermeier et al. (2019) rightly argue, a common currency unit is like a common language (Issing 1999). If individuals decide to use a second currency in parallel, they face transaction and information costs. Therefore, people will only abandon their national currency as a unit of account if it suffers from high inflation. The instability of a currency destroys its ability to convey price signals to market participants. In such cases, the national currency is de facto replaced by a stable foreign currency, typically the US dollar (“dollarisation”).

The dominance of established currencies is also reflected in the design of stablecoins. So far, all stablecoins are denominated in the US dollar.

This leads to the fundamental question of whether the ECB would be able to maintain its control over the financial system in a completely cashless economy. The key mechanism that maintains the central bank’s dominant role in the financial system even in the absence of non-bank holdings of central bank money is the need for banks to use the interbank payment system operated by the central bank (in the case of the euro area: TARGET2). This mechanism and the need to hold central bank reserves ensure the substitutability of commercial bank deposits and prevent that “[t]he relative prices of different banks’ deposits, or different networks’ currencies, would be free to float, at least in principle” (Brunnermeier et al. 2019, p. 26).

Thus, even in a system in which non-banks hold neither CBDC nor cash, there is still a strong monetary anchor due to the need for commercial banks to hold reserves with the central bank for the settlement of balances in the payment system.

However, one could argue that it might become technically feasible to organise interbank payments without the involvement of the central bank:

“Digitalization may allow to dispense from base money and settle payments differently. Inside large digital networks most transactions can be settled internally, thus bypassing central banks. The larger the network, the smaller its need for an outside settlement asset.” (Brunnermeier et al. 2019, p. 27).

A model for such a network is Schumpeter’s (2014, p. 215) “idea of social central bookkeeping”, which he describes as “an economy-wide equivalence system” with “an economy-wide clearing process” (Schumpeter 2014, p. 215). It illustrates how a financial system could be completely decoupled from the central bank. It could be thought of as a global payments platform where all payments are processed and recorded.

The question is which settlement assets are used in such a payment system. If central bank money is used, the central bank can still control the system with the interest rate on central bank deposits or on its refinancing loans. This would be different in a payment system that uses other assets for settlement, such as equities. Participants with a positive balance would receive a transfer of shares from debtors equal to the euro amount of the settlement. In other words, de-anchoring requires settlement objects other than bank deposits. However, such a development is not very likely for the time being.

Here, too, we disagree with Brunnermeier et al. (2019, p. 27), who argue that the central bank’s control over the financial system depends only on the role of the unit of account:

“As long as transactions are made using that unit of account, the central bank will keep its power in all circumstances. It can fix the overnight interest rate on its own liabilities and, by arbitrage, influence the whole set of monetary and financial parameters. This will be the case even if no payment was made using central bank money, and if (almost) no value was stored in the central bank balance sheet.”

However, the authors leave it open how the overnight interest rate on central bank liabilities can affect the interest rate on other financial assets if no one has a need to hold central bank deposits. As mentioned above, the true monetary anchor of the monetary system is the reserves held at the central bank. As long as commercial banks have a need to hold reserves, the central bank can influence the interest rates on bank loans and deposits. Through this channel, the central bank can influence the whole spectrum of interest rates.

This leads to the question of how the ECB should respond to the dynamic processes taking place in the global payments landscape. Our critical assessment of the ECB’s case for the digital euro as a monetary anchor does not imply a wait-and-see approach for the ECB.

In our view, the ECB’s approach to the digital euro suffers from a wrong focus. As the discussion of the CBDC as a monetary anchor shows, it is mainly based on the digital euro as a payment object and leaves unclear how the payment system in which it would circulate would be organised.

An alternative approach is offered by other major central banks which have been able to promote national digital retail payment systems, which have grown rapidly and are able to compete with global payment platforms:

In addition, there exist already many bilateral initiatives linking these national systems for cross-border payments (Economist Intelligence Unit 2022).

For the ECB, the important lesson from these approaches is that in none of these platforms a central bank digital currency is required as a payment object. Therefore, Oli Rehn is wrong when he argues that a digital euro is needed for the stability of digital payment platforms and to avoid confusing people’s understanding of what qualifies as money:

“So why should we introduce a digital euro alongside cash? Would it not be enough to rely on the private sector to provide us with efficient payment means for the digital age? (…) An economy dominated by digital payments but without a strong monetary anchor would be inherently unstable. (…) People using a digital euro, or a digital dollar, should have the same level of confidence as they would when using cash, since both fiat and digital forms of currency would be backed by a central bank. A digital payment landscape without a monetary anchor provided by the central bank would simply confuse people’s understanding of what qualifies as money.” (Rehn, 2022).

Our paper shows that a digital euro is not needed as a monetary anchor for the euro area. It is true that, from a legal point of view, commercial bank deposits should be fully convertible into central bank deposits. Since such convertibility is technically difficult to achieve with cash, convertibility into digital central bank deposits offers an easy alternative. For good reasons, however, the ECB envisages only a very low ceiling for digital euro accounts. The ECB should therefore be careful in its rhetoric and avoid claiming a need that it is not prepared to meet. Moreover, even if non-banks do not hold cash or CBDCs, it can be shown that individual banks still have the discipline to pursue sound policies.

What matters for the unit of account role of the euro, is not the use of a CBDC in daily payments, but a monetary policy that maintains price stability.

As far as the monetary anchor is concerned, a closer analysis reveals that this role is sufficiently fulfilled by the need of commercial banks to hold central bank reserves. In other words, the monetary anchor is not the holding of central bank assets by non-banks, but the holding of central bank assets by commercial banks.

Finally, the discussion on the monetary anchor role of the digital euro shows that the ECB’s approach to the challenges posed by the dynamic global payments landscape is flawed. The example of several major central banks demonstrates that it is possible to develop a competitive national retail payment system without the need for a CBDC.

Bindseil, Ulrich. 2020. “Tiered CBDC and the financial system.” ECB Working Paper Series, No. 2351.

Bofinger, Peter and Haas, Thomas. 2021. “Central bank digital currencies: can central banks succeed in the marketplace for digital monies?” ECMI Working Paper No. 14.

Bofinger, Peter and Haas, Thomas (2022): “What business model for the Digital Euro? Lessons from Brazil and Switzerland.”, SUERF Policy Note, Issue No 277. May 2022

Brunnermeier, Markus K., James, Harold, and Landau, Jean-Pierre. 2019. “The Digitalization of Money.” NBER Working Paper Series, September, No. 26300.

Brunnermeier, Markus K. and Landau, Jean-Pierre. 2022. “The digital euro: policy implications and perspectives”. Study requested by the ECON committee of the European Parliament.

Economist Intelligence Unit (2021). “Going digital Payments in the post-Covid world.”

Economist Intelligence Unit (2022). “Beyond borders a new era for digital payments.”

Issing, Otmar. 1999. “Hayek – Currency Competition and European Monetary Union.” BIS Review.

Panetta, Fabio. 2021. “Central bank digital currencies: a monetary anchor for digital innovation.” Speech by Fabio Panetta, Member of the Executive Board of the ECB, at the Elcano Royal Institute, Madrid, November 5.

Rehn, Olli. 2022. “Beyond crypto-mania – digital euro as monetary anchor.” Speech by Mr Olli Rehn, Governor of the Bank of Finland, at an panel at University of California, Berkeley, California, August 23.

Schumpeter, Joseph A. 2014, “Treatise on Money”, Wordbridge Publishing, Aalten, The Netherlands, English Translation of “Das Wesen des Geldes“ published 2008 by Vandenhoeck u. Ruprecht.

It is also incompatible with the claim by Brunnermeier and Landau (2021, p.22) that “public money must be present and freely available in all sectors and parts of the economy. The ubiquity of central bank money is essential to its role as anchor. All households must be given the opportunity to hold and use central bank money. The same is true for corporates and financial institutions.”

See also Brunnermeier and Landau (2022, p. 23): “It could be argued that the combination of those three tools − tight bank regulation with regulators that can shut down banks, lender of last resort, and deposit insurance − makes it possible to have a system in which 100% of the money held by the general public is issued by private banks and nevertheless considered as safe.”

Brunnermeier et al. (2019) speak of “payment instruments”, which must and can only be used to make payments within the platform.

The Economist Intelligence Unit (2021): “India’s UPI illustrates how an enabling policy framework and supportive regulation can create the infrastructure needed for swift adoption. Government institutions, particularly the central bank, encouraged the use of tools such as QR codes for merchants and radio-frequency identification (RFID) tags for toll gates.”