The views expressed in this SUERF policy note are those of the authors and do not necessarily reflect the views of the ECB or the Eurosystem.

Since 2012 institutional investment in euro area real estate assets has more than quadrupled, according to official data. Given that such data seems to be underestimating the size of the real estate fund industry investing in the euro area for a variety of reasons, this pattern is particularly remarkable. We report on the development of a quantitative euro area DSGE model that captures the main features of this industry to study macroprudential policy. Our analysis reveals leakages in the existing macroprudential framework and calls for the introduction of a macroprudential leverage limit – similar to the one recently introduced in Ireland – to strengthen the stabilization and welfare-improving capacity of macroprudential policy.

The financial reforms adopted in the aftermath of the Global Financial Crisis (GFC) resulted in a tightening of bank lending standards that has revitalized rental housing markets, leading to higher rents and depressed homeownership rates (Gete and Reher 2018). In this new regulatory environment, institutional investors have found incentives to steadily increase their presence in the real estate sector. Recent empirical studies have shown that: (i) real estate funds and other housing investment firms (henceforth REIFs) leverage large-scale buy-to-rent real estate investments, a pattern that seems to have conferred them with some capacity to set rents in the areas where they have concentrated (Mills et al. 2019; Daly 2023); (ii) more stringent prudential requirements on banks have incentivized REIFs to rely more on non-bank funding (Hoesli et al. 2020); and (iii) such patterns in the REIF industry are behind the recovery in housing investment and property prices that followed the GFC (Lambie Hanson et al. 2019).

This SUERF policy note summarizes the main empirical observations on institutional investments in euro area real estate assets and draws some conclusions on macroprudential policy based on a quantitative euro area DSGE model that captures the main features of the REIF industry. The findings underscore the importance of closing data gaps on institutional real estate investment as the presence of REIFs in real estate and financial markets can have significant implications for the design and calibration of macroprudential policy.

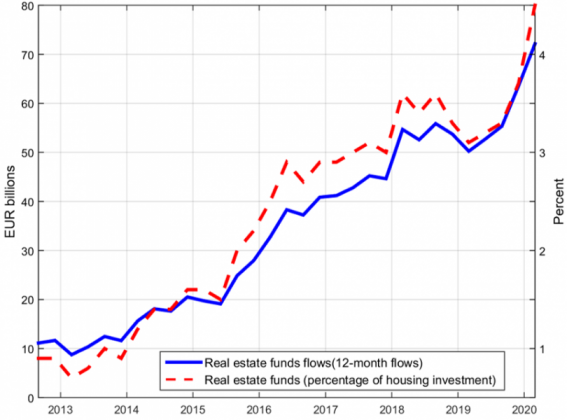

The euro area is one of the economies in which the increasing presence of institutional investors in housing markets has been more evident. Since 2012 institutional investment in euro area real estate assets has more than quadrupled in absolute terms and as a share of total housing investment (Figure 1). This pattern is remarkable since available data underestimates the size of the REIF industry investing in the euro area by only relying on the information reported by funds domiciled in the EU.1

Figure 1: Real estate funds flows in the euro area

Notes: This figure reports real estate funds flows (12-month flows) in the euro are both, in absolute terms and as a percentage of aggregate housing investment in the euro area. Time series are at quarterly frequency and have been plotted for the period 2012:III-2020:I. The figure is based on Battistini et al. (2018). Sources: ECB, Eurostat and own calculations.

Given that the bulk of institutional investments in euro area real estate assets comes from abroad and the lack of incentives that REIFs have to disclose information on their financial accounts and transactions, this translates into significant data gaps that have implications for policymaking.

Beyond the above-mentioned legislative considerations, there are other reasons to suspect that actual leverage of REIFs domiciled in the EU could be high. First, real estate funds operating in the EU fall within the category of funds that are subject to the AIFMD (Alternative Investment Fund Managers Directive), for which no leverage limits apply. Second, investment funds often lever up synthetically through the use of derivatives, which makes the measurement of their leverage particularly challenging. Third, the Central Bank of Ireland recently conducted a deep dive survey on the Irish REIF industry concluding that leverage levels of REIFs domiciled in Ireland are high (Daly et al. 2021). The Irish property fund industry is a case of study that, arguably, can help to better understand the patterns of institutional investments in euro area real estate assets since property funds domiciled in Ireland represent a significant share of total institutional investment in the Irish real estate sector and a non-negligible fraction of total REIFs domiciled in the EU (ECB 2020).

Some years ago, market analysts and real estate experts started to recurrently report that a significant proportion of these institutional investments is being leveraged via direct lending (i.e., lending that is not subject to regulatory LTV limits), often provided by debt funds; something that eventually raised fears of a credit bubble building up in the debt fund industry.2 In addition, recent empirical studies have found that debt funds are among the most leveraged investment funds in Europe, with fund managers in leveraged funds reacting in a relatively more procyclical manner (than those in non-leveraged funds) and leverage reportedly amplifying financial fragility in the investment fund sector (van der Veer et al. 2017; Molestina Vivar et al. 2020).

Either because REIFs are – in most jurisdictions – not subject to sectoral macroprudential (leverage) regulation and/or because their increasing activity is, to a large extent, being funded with non-bank lending (which is not subject to regulatory LTV limits), these empirical studies suggest that there is ample room for strengthening the macroprudential regulatory framework on this front. The exception is Ireland, again. On 24 November 2022 the Central Bank of Ireland became the first member of the EU (and, probably, of all advanced economies) to introduce a macroprudential leverage limit on REIFs (Central Bank of Ireland 2022).3 This is the first time that Article 25 of the AIFMD has been triggered.4

To the best of our knowledge, the first contribution to the literature on macroprudential regulation proposing this measure is our work (Muñoz and Smets 2022) and a previous version of it (Muñoz 2020). Similar to the tool that we propose and study in our research, the Central Bank of Ireland has introduced a 60% limit on REIFs’ leverage (total debt-to total assets) ratio, which can be temporarily relaxed or tightened depending on the state of the economy, the housing markets and the financial sector.

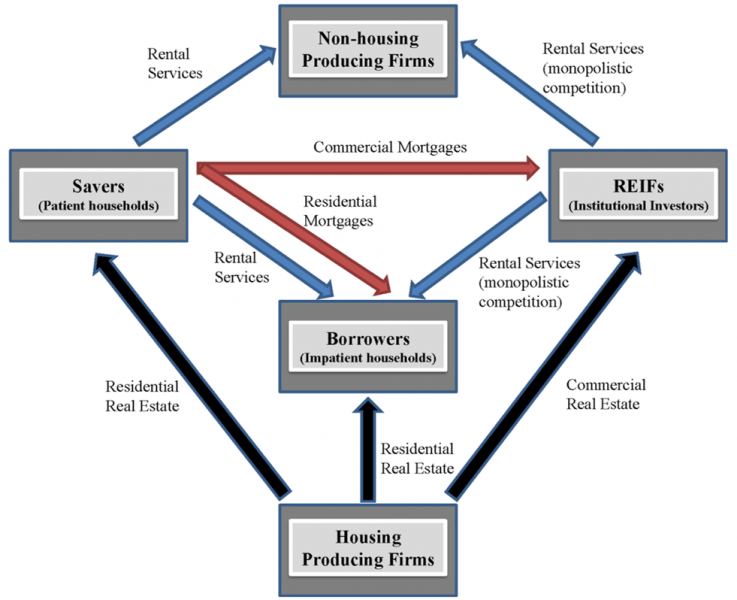

To analyze macroprudential policy in this environment, in Muñoz and Smets (2022) we develop a quantitative two-sector DSGE model with REIFs and rental housing markets calibrated to the euro area economy. The supply side of the model differentiates between housing producing firms and non-housing producing firms. The demand side accounts for two types of representative households who crucially differ in the role they play in housing and credit markets. Patient households save and purchase housing (as savers) to live in and supply homogeneous rental services under perfectly competitive conditions (as landlords). Impatient households get indebted against eligible (housing) collateral (as borrowers) to acquire property for their own use and to demand rental housing services (as renters). There is a certain degree of imperfect substitutability between property and rental housing services.

In addition, REIFs demand loans to buy real estate assets and transform them into slightly differentiated rental housing services that are supplied under monopolistic competition.5 That is, the real estate sector of this economy consists of an owner-occupied housing market and a rental housing market. As in reality, patient households and institutional investors simultaneously supply services in the rental housing market to impatient households (borrowers) and (non-housing) producing firms. For both borrowers and non-housing producers, there is a certain degree of substitutability between saver and REIF rental services (and across REIF rental varieties). Figure 2 illustrates the interactions across the different types of agents that populate this economy in the real estate and credit markets by means of a flow of funds diagram.

Figure 2: Flows in real estate and credit markets

Notes: Black arrows indicate the direction of supply in property markets. Blue arrows refer to the direction of supply in rental housing markets. Red arrows refer to the direction of supply in mortgage markets.

In a first step, we analyze the workings of already existing countercyclical LTV limits on residential mortgages (i.e., those that affect impatient households in the model). If we shut down rental housing markets and the REIF industry, our set-up becomes a standard two-sector DSGE model with housing collateral constraints in which this macroprudential rule unambiguously stabilizes the financial and the business cycle through a smoothing effect on lending supply, as already shown in the literature (e.g., Lambertini et al. 2013).6

In contrast, in our calibrated model (with rental markets and REIFs) – depending on its degree of countercyclical responsiveness – this rule can destabilize lending, housing prices and real GDP through two main mechanisms. The imperfect substitutability between owner-occupied and rental housing services, and the capacity savers have to revitalize rental markets directly (by increasing rental housing supply themselves) and indirectly, by reallocating lending towards the REIF industry.

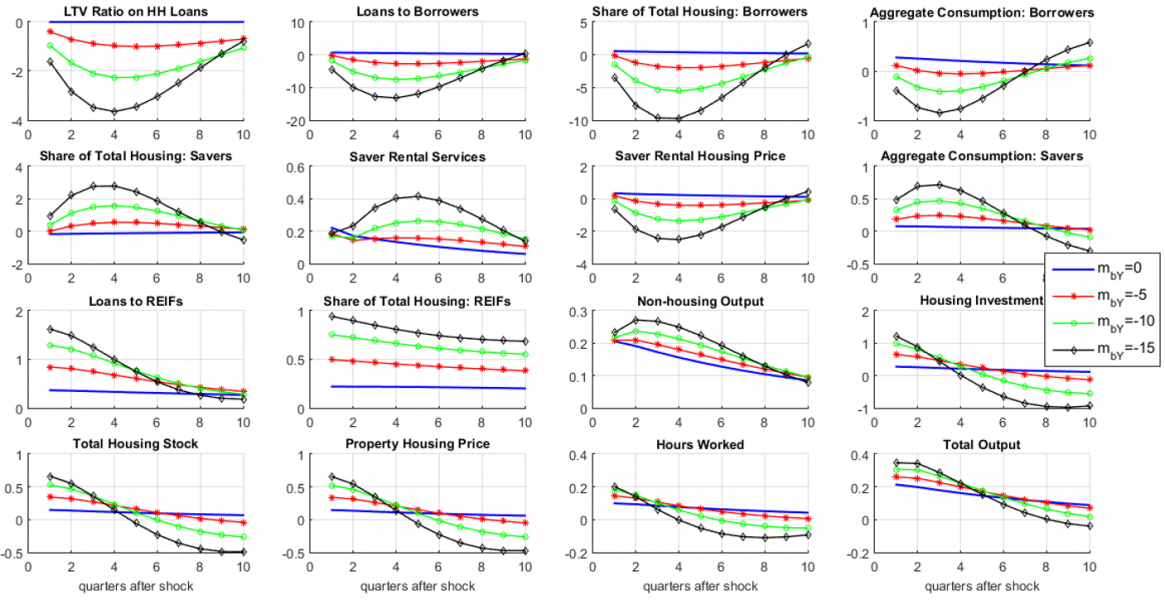

To illustrate this, Figure 3 displays the impulse responses of selected aggregates to a positive non-housing technology shock that triggers a (countercyclical) tightening in the LTV limit on residential mortgages. Savers are forced to restrict their lending supply to borrowers. They reallocate their resources to increase rental supply directly and indirectly (by expanding lending supply to REIFs). That exerts a downward pressure on rents, which incentivizes borrowers to partially replace owner-occupied housing with rental services. Such reaction exerts an additional downward pressure on lending to borrowers, which can eventually fall and become more volatile. As rental services become cheaper, non-housing producers further expand their output (in response to the shock) by renting more real estate services. In response, housing producers further increase housing investment ultimately causing property prices and total output to increase more than in the absence of the macroprudential rule.

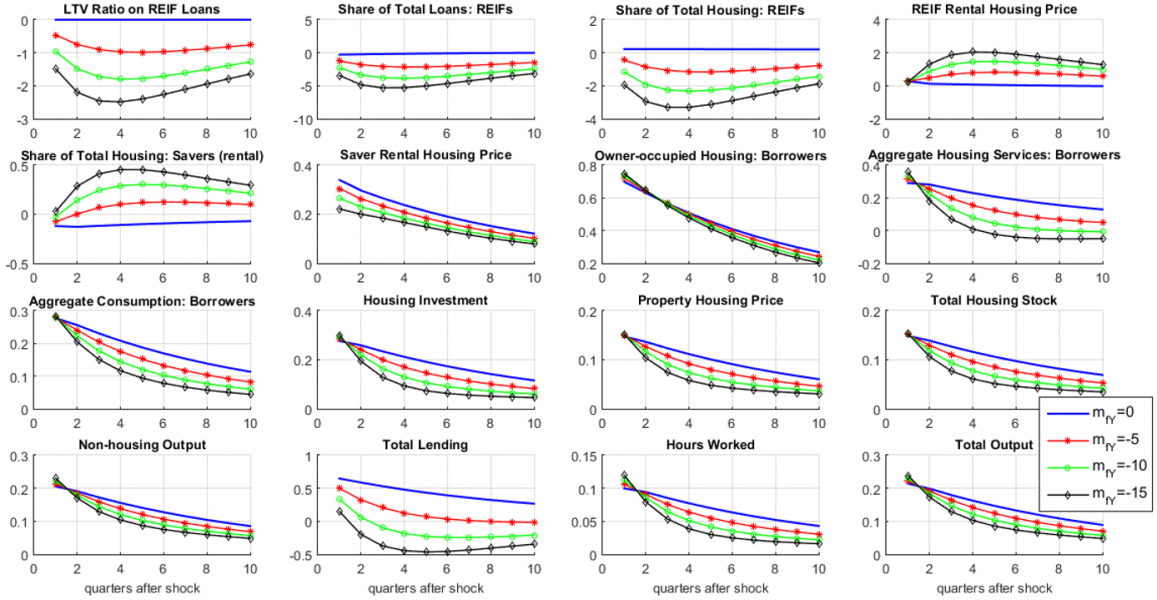

Against this background, we then study the transmission of countercyclical LTV limits on lending to REIFs or macroprudential leverage limits on REIFs.7 Figure 4 plots the impulse responses of selected aggregates to the same shock under the baseline (i.e., no macroprudential) scenario and three alternative scenarios in which the macroprudential leverage limit for REIFs is active (with a varying degree of countercyclical responsiveness) and the countercyclical LTV on residential mortgages is not. In response to the tightening in the REIFs’ leverage limit induced by the expansionary shock, borrowers partially replace REIF rental services with saver rental services, since the later have become relatively cheaper. Importantly, the model captures the empirically relevant fact that the degree of substitutability across types of rental services is higher than that between owner-occupied housing and rental housing. This implies that with this macroprudential rule, the substitution effect mainly takes place in the rental housing market while the property housing stock (i.e., collateral) of borrowers – and, thus, their lending – remains roughly unchanged. The substitutability between saver and REIF rental services is nevertheless imperfect, so total demand for rental services responds less prominently to the shock under this macroprudential rule than under the baseline scenario. Consequently, housing production (as well as total output) and property prices also evolve in a smoother fashion.

Figure 3: A countercyclical LTV limit on residential mortgages

Notes: Variables are expressed in percentage deviations from the steady state. The solid line refers to the baseline (i.e., no macroprudential policy) scenario. The starred, dotted, and diamond lines make reference to scenarios in which the LTV rule on residential mortgages is active and differ from one another in the degree of countercyclical responsiveness of such rule.

Figure 4: A macroprudential leverage limit for real estate funds

Notes: Variables are expressed in percentage deviations from the steady state. The solid line refers to the baseline (i.e., no macroprudential policy) scenario. The starred, dotted, and diamond lines make reference to scenarios in which the macroprudential leverage limit is active and differ from one another in the degree of countercyclical responsiveness of such rule.

Lastly, we perform a welfare analysis of both policy rules. Interestingly, each of the two rules triggers not only volatility but also level effects through the above-described transmission mechanisms. This results in savers and borrowers facing non-trivial welfare trade-offs for each of the macroprudential rules. Even if the macroprudential leverage limit on REIFs is more desirable from the stabilization perspective, the quantitative importance of the welfare-improving level effects induced by the LTV rule on residential mortgages and, ultimately, the fact that each rule operates through different mechanisms implies that jointly, the two policy rules yield larger welfare gains for savers and borrowers than in isolation.

Our analysis reveals leakages in existing macroprudential regulation. The countercyclical response of already existing LTV limits on residential mortgages triggers a reallocation of credit towards the unregulated sector (i.e., the REIF industry) that limits its stabilization capacity. By way of contrast, a macroprudential leverage limit on REIFs effectively contributes to smoothing the financial and the business cycle, even if housing and debt holdings of REIFs are comparatively low. Nevertheless, due to the different mechanisms through which they operate and to the quantitative importance of the non-trivial level effects they generate, both types of policy rules are welfare-improving and jointly induce more sizable welfare gains than in isolation.

These findings may shed light on some of the potential avenues for strengthening the macroprudential policy framework for non-banks. There are at least two policy instruments that could be considered in practice in order to improve the effectiveness and stabilization capacity of the macroprudential toolkit through the mechanisms outlined in the paper and which are still not in place: Countercyclical LTV limits on non-bank lending and macroprudential leverage limits on REIFs.8 Moreover, the quantitative analysis shows that such quantity regulation would allow for reference (competitive) prices in rental housing markets to increase less abruptly during the boom, an issue that policymakers in several countries of the euro area have attempted to handle via price regulation; an alternative that could generate price distortions.

Battistini, N, Le Roux, J, Roma, M, and J Vourdas, (2018). “The state of the housing market in the euro area“, ECB Economic Bulletin Articles, 7.

Central Bank of Ireland (2022). “The Central Bank’s macroprudential framework for Irish property funds.” report, Central Bank of Ireland.

Daly, P, Moloney, K, and S Myers (2021). “Property funds and the Irish commercial real estate market.” Financial Stability Notes 1/FS/21, Central Bank of Ireland.

Daly, P., (2022). “Institutional Investment in Housing: Financialisation 2.0 in the Case of Ireland.” mimeo.

European Central Bank (2020). “Financial stability review, May 2020”. European Central Bank.

Gete, P, and M Reher, (2018), “Mortgage Supply and Housing Rents“, The Review of Financial Studies, 31 (12), 4884-4911.

Hoesli, M, Milcheva, S, and S Moss, (2017), “Is Financial Regulation Good or Bad for Real Estate Companies? – An Event Study“, The Journal of Real Estate Finance and Economics, 5 (1/2), 1 – 39.

Lambertini, L., Mendicino, C., and Punzi, M. T. (2013). “Leaning against boom–bust cycles in credit and housing prices.” Journal of Economic Dynamics and Control, 37(8):1500–1522

Lambie-Hanson, L, Li, W, and M Slonkosky, (2019), “Institutional Investors and the U.S. Housing Recovery“, Working Papers 19-45, Federal Reserve Bank of Philadelphia.

Mills, J., Molloy, R., and R Zarutskie, (2019). “Large-scale buy-to-rent investors in the single-family housing market: The emergence of a new asset class”, Real Estate Economics, 47(2):399–430.

Molestina Vivar, L, Wedow, M, and C Weistroffer, (2020) “Burned by leverage? Flows and fragility in bond mutual funds“, ECB Working Paper Series 2413.

Muñoz, M. A. (2020). “Institutional real estate investors, leverage, and macroprudential regulation”, VoxEU. org, 14 November.

Muñoz, M. A. (2021). “Rethinking capital regulation: The case for a dividend prudential target.” International Journal of Central Banking, 17(3):271–336.

Muñoz, M A and F Smets, (2022). “Macroprudential policy and the role of institutional investors in housing markets,” ESRB Working Paper Series 137, European Systemic Risk Board.

van der Veer, K, Levels, A, Lambert, C, Molestina Vivar, L, Weistroffer, C, Chaudron, R, and R de Sousa van Stralen, (2017), “Developing Macroprudential Policy for Alternative Investment Funds“, ECB Occasional Paper Series 202.

Even if the bulk of institutional investments in euro area real estate assets is coming from abroad, only REIFs domiciled in the EU are obliged (by EU legislation) to report information to the corresponding national competent authority.

See, among others, Evans, J, (2019), “Real Estate: post-crisis boom draws to a close“, Financial Times, June 18, and Wigglesworth, R, (2017), “Rise of private debt creates fears of a bubble“, Financial Times, April 13.

Although other EU members already had a leverage limit for REIFs in place as part of their national legislation, in our view this is the first leverage limit on REIFs that is purely macroprudential as it is the first one that can be temporarily tightened or relaxed depending on macro-financial conditions. See, Central Bank of Ireland (2021), “Macroprudential measures for the property fund sector”, Consultation Paper 145.

See Box 3 of ESRB (2022), “EU Non-bank Financial Intermediation Risk Monitor 2022”, European Systemic Risk Board, No 7, July 2022.

The motivation for that is twofold. Housing markets are, in practice, segmented according to some of their main features (location, type of construction, style, etc) and; the existence of a positive demand for different types of houses suggests that there is a preference for variety at the aggregate level. From the supply side, purchasing a large amount of housing with a common characteristic (e.g., the neighbourhood) grants the REIF market power in that particular segment of the market.

As fairly standard in the literature, we assume that macroprudential rules in our analysis respond to changes in the output gap (e.g., Lambertini et al. 2013; Muñoz 2021).

Given the assumptions of the set-up – including the absence of an explicit distinction between bank lending and non-bank lending and the modelling of debt as one-period loans – a countercyclical LTV limit on lending to REIFs and a macroprudential limit on REIF’s leverage (i.e., debt-to-assets) ratio are roughly equivalent.

They are still not in place with the exception of Ireland, jurisdiction in which a macroprudential leverage limit on REIFs has been recently introduced (Central Bank of Ireland 2022).