A diversified financial services industry, serving multiple purposes for multiple end-clients, does not lend itself to a simple ‘one-size fits all’ set of rules. In designing any regulatory framework, it is important to consider carefully the different risks associated with different entities and products, and their inter-relationship in the broader financial ecosystem. In this note, we review financial reform over the past ten years, and propose a ‘Products and Activities’ approach to the regulation of asset management going forwards. Since the crisis, much work has been done to enhance the resilience and oversight of systemically relevant firms and entities. As policymakers continue to consider regulation of the non-bank sector, it is important to distinguish between the risks associated with different entities. To aid in this, we present a continuum to differentiate ‘market-based finance’ from ‘shadow banking’ based on the funding structure, leverage, and connections with the official sector of the entities. We then discuss how these insights can be applied to both the efforts to measure the ‘shadow banking’ sector, and ongoing considerations about macroprudential tools for asset managers.

The fact that market-based finance – which includes investment funds (such as UCITS) and underpins financial stability – can be distinguished from shadow banking – which presents systemic risk, is not currently reflected in the Financial Stability Board’s (FSB) data collection exercises. This puts the FSB’s data at odds with its own pronouncements that financial stability risks have fallen post-crisis. We highlight that conflating all non-bank products does not allow for proper analysis of risk, and recommend that true market-based finance be broken out from other non-bank financing.

We believe the discussion around the application of macroprudential policies to the asset management sector overlooks the key characteristics of the asset management business model and wider ecosystem: including, crucially, the fact that asset managers are agents on behalf of their clients, and as such do not hold the assets they manage on their balance sheets, and that asset managers only oversee a quarter of total investable assets. This means the risks inherent in financial markets do not pose the same problems for asset managers as for other financial institutions. Likewise, many of the concerns attributed to investment funds, such as liquidity risk and step in risk, have been appropriately addressed by markets regulators and banking regulators as part of the post-Crisis financial regulatory reforms.

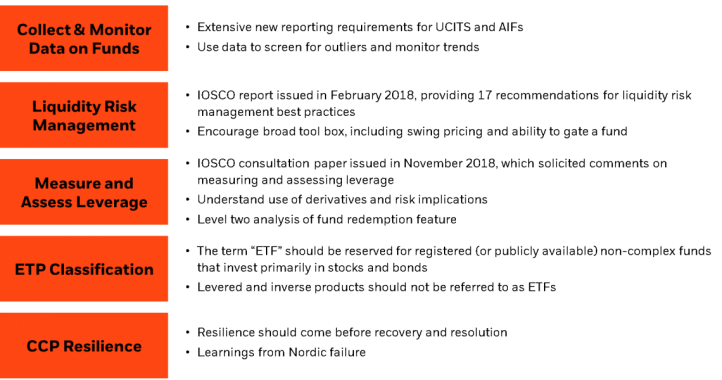

Assessing risk using the current regulatory environment, we do not see a role for macroprudential policies to be applied to asset managers or the investment funds that they manage. We observe that the tools that have been proposed will lead to procyclical outcomes without addressing the risks which can exist in asset management. Instead, we posit a ‘products and activities’ approach to regulating asset management, focusing on rigorous oversight to identify the riskiest funds, raising standards on liquidity risk management, finding suitable measures of leverage in funds, strengthening the resilience of CCPs, and ensuring Exchange Traded Funds (ETFs) are properly differentiated form other Exchange Traded Products (ETPs), such as notes, inverse, and leveraged products. This products and activities approach would be applied across the asset management ecosystem thus eliminating or mitigating risk. Indeed, such an approach has been agreed and endorsed by global markets regulators and standard setters.

Before we progress, it is helpful to step back and evaluate what caused the crisis, and how policy makers and regulators have subsequently responded – as highlighted in Exhibit 1. Once we have done this, we can evaluate how the reforms are working, and whether there are any gaps remaining.

Exhibit 1: Great Financial Crisis led to meaningful new regulation

At the heart of the crisis was a combination of poor underwriting standards, excessive leverage, gaps in the oversight of some financial institutions, and in some areas, fraud.

Since then, there has been considerable focus at the global level on reinforcing bank balance sheets with more capital, stress testing, and stricter liquidity rules. You could say the banking system has been bubbled-wrapped with capital and liquidity requirements. There has also been welcome reform of OTC derivative trading and clearing. Money market mutual funds (MMFs) face stricter rules. And, registration and reporting for alternative and mutual funds have become more comprehensive.

Moreover, Europe has enhanced oversight of systemically relevant firms and entities at the EU level, and continues to analyse ways to enhance the safety of the financial system. Capital requirements for investment firms have been re-calibrated based on the different types of risks inherent in their business model. Transparency has improved with more pre- and post-trade data available under MiFID, and the Securities Financing Transaction Regulation. The framework for Central Clearing Counterparties’ (CCPs) recovery and resolution, to deal with the unlikely event of their failure, remains a work in progress.

Several years ago, policymakers began to discuss extending the macroprudential toolkit to include ‘non-bank financial intermediation’ or ‘market-based’ finance. Often, this discussion does not distinguish between the risks associated with different entities and products or the contribution market-based finance brings in terms of financial stability and long-term economic growth. As we will discuss next, the differences between market-based finance and shadow banking are extremely important, and policy makers may need to reconsider these assumptions.

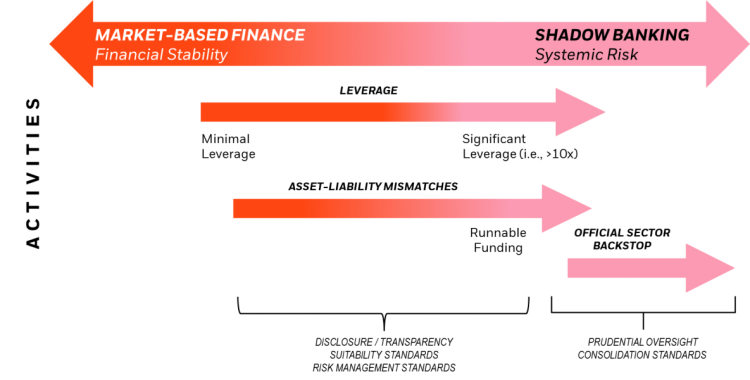

While we welcome the move away from the use of the term ‘shadow banking’ as a catch all phrase, non-bank finance should be viewed as a continuum that reflects the risks of different entities and activities, as shown in Exhibit 2. At one end of the spectrum is market-based finance – which underpins financial stability; at the other is shadow banking – which presents systemic risk.

There are three key criteria for determining what constitutes shadow banking. Firstly, where longer-term investments are funded by short-term (‘runnable’) funding: this introduces a bank-like mismatch between assets and liabilities. Secondly, significant leverage: securities brokers or investment banks typically have significant leverage and are classified as shadow banking. Finally, any entity subject to official sector backstops – such as Structured Investment Vehicles or off-balance sheet conduits – would be considered shadow banking.

By contrast, market-based finance can be identified by use of equity capital, minimal leverage, and absence of official sector backstops.2 For example, mutual funds, ETFs, and MMFs (post-reforms) typically have a floating or low volatility net asset value, use little to no leverage, and explicitly do not offer guarantees or have access to central bank liquidity. Understanding these differences is essential before developing a macroprudential framework for non-banks.

Exhibit 2: Non-Bank Finance risk-based continuum

Some commentators and policymakers have suggested that mutual funds present ‘run risk’ and could be forced into ‘fire sales’ of assets during stressed periods.3 As laid out in the continuum, we agree that shadow bank entities present run risk, due to asset-liability mismatches, which may leave the entity unable to produce enough liquid assets to pay liabilities that are coming due. This can lead to forced sales of assets, or insolvency. In contrast, mutual fund shares reflect equity ownership of the underlying assets, and the value of the shares fluctuates with the value of the assets, meaning the funds’ ‘liabilities’ are equal to that of its assets. Moreover, post-crisis, liquidity risk management oversight has been strengthened (more on this later), and in the EU, UCITS funds have an increasingly broad toolkit of liquidity measures, including ‘swing pricing’,4 gates and other powers for managers to suspend dealing, which taken together eliminate the potential for ‘first-mover advantage’ during stressed periods.

Clearly, both shadow banking and market-based finance should be regulated, but it is critical that rules are tailored to address the risks inherent in each. The conceptual framework I have presented can provide a basis for doing so. Entities that are closer to bank-like activities may pose systemic risk and should be subject to bank-like regulation. On the other hand, entities closer to market-based finance should continue to be covered by securities markets regulation, with a focus on system-wide regulation of products and activities.

Let us now connect the conceptual framework to the attempts to measure non-bank finance. Much has been made of the post-crisis growth of non-bank finance, and the growth in mutual funds’ assets under management.5 There has been less focus on the nature and type of risks associated with different market participants and different investment vehicles.

We will focus here on the FSB’s global monitoring of non-bank financial intermediation. The FSB has rightly noted the benefits of market-based finance in diversifying sources of funding, which promotes financial stability. Additionally, a 2017 letter to the G20 noted that “financial stability risks from the toxic forms of shadow banking…no longer represent a global stability risk”.6 However, these observations are not fully borne out in the FSB’s data reporting.

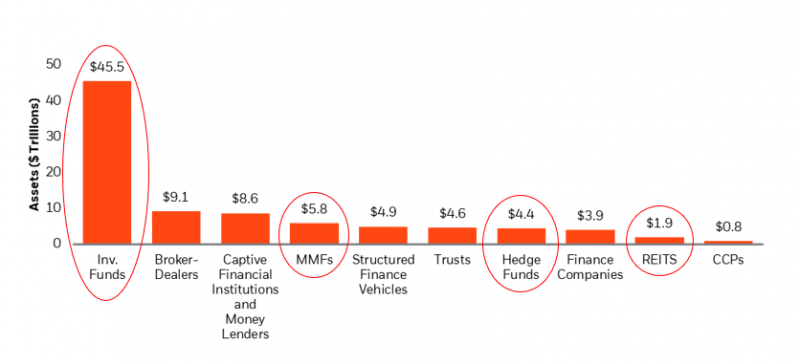

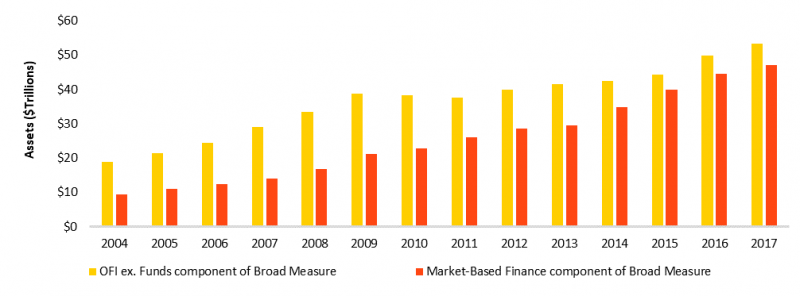

The FSB collects and reports data on non-bank finance in two categories: (i) the ‘broad measure’, which captures ‘Other Financial Intermediaries’ (OFI), including market-based finance, as shown in Exhibit 3; and (ii) the ‘narrow measure’, based on ‘economic functions’, which is dominated by investment funds, as shown in Exhibit 5.

Exhibit 3: Assets held by Other Financial Intermediaries7

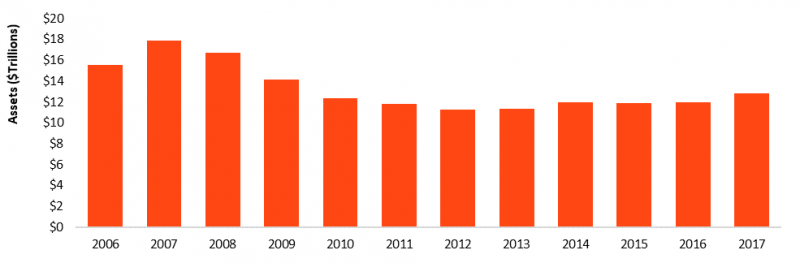

By aggregating together activities regardless of risk characteristics, both the broad and narrow approaches fail to distinguish between positive and negative practices. Exhibit 4 gives a dissagregated view of the data in the broad measure, separating out investment funds, MMFs, hedge funds, and REITS from the broad measure. When viewed in this light, you can see the trends in non-bank financial intermediation where ‘shadow banking’ assets peaked in 2007 and 2008. While the market-based finance component has grown significantly, this reflects a healthier and more diversified financial system.

Exhibit 4: Broad measure separating ‘shadow banking’ and ‘market-based finance’8

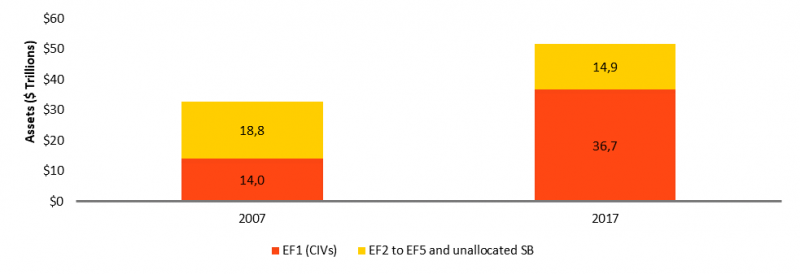

Looking at the ‘narrow measure’ of shadow banking, we see a similar dilemma. Here, the FSB collects data based on five ‘Economic Functions’: EF1 is comprised primarly of investment funds and reformed MMFs. Economic Functions 2 through 5 consist of riskier forms of bank-like lending.9 As with the broader measure, the narrow measure includes all collective investment vehicles covered by the global monitor, regardless of the risks involved, which falsely gives the impression of rapidly growing risk. Exhibit 5 separates out EF1 from EF2 through EF5. Looking at the data this way, it is clear that shadow banking risks have decreased, whilst the size of market-based finance has increased – this is consistent with the language used by the FSB, and demonstrated in Exhibit 6.

Exhibit 5: Growth of assets in open-ended Collective Investment Vehicles (CIVs) compared to other activities10

Exhibit 6: Narrow measure of shadow banking (ex-CIVs)

The aggregated reporting masks the true risks within shadow banking as all of the focus is on the aggregated numbers rather than on the component pieces. We recommend that all of this data continues to be collected, however, we urge the FSB to change their reporting to break out market-based finance from shadow banking to better reflect the risks involved and the areas that warrant additional focus.

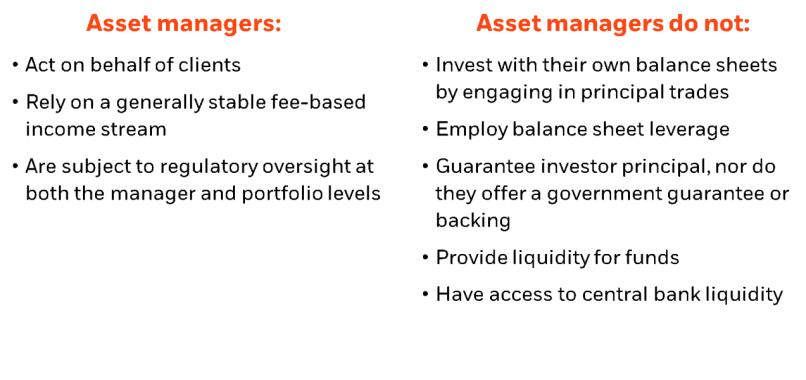

With this in mind, let us now focus on the asset management sector. As you can see in Exhibit 7, the asset management business model is fundamentally different to other financial institutions, such as banks, insurers, and broker-dealers.

Exhibit 7: Asset management business model

Asset managers are fiduciaries, acting on behalf their clients, they rely on a generally stable fee-based income stream, and are subject to regulatory oversight at the level of both the portfolio or fund, and of the manager. Critical differences with the rest of the financial sector are that asset managers make limited use of their balance sheet (funds and client assets are held in separate legal entities – typically prudentially-regulated custodian banks), and do not have access to official sector backstops (i.e. central bank liquidity). Moreover, asset managers do not guarantee investor principal, nor do they provide liquidity for funds.

The work being carried out between the FSB and International Organisation of Securities Commissions (IOSCO) has recognised these differences. The Recomendations put forward by the FSB in its 2017 report, and the subsequent work taken forward by IOSCO, has focused primarly on liquidity risk management in funds and measuring the use of leverage in funds.11 We welcome both of these initiatives. BlackRock has long been an advocate of raising the bar in liquidity risk management, and we believe that, done correctly, collecting data on leverage in funds should help regulators target surpervision on the risks that may eminate from individual strategies.

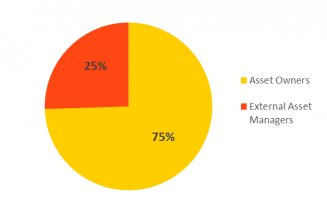

The asset management sector itself is a very diverse ecosytem. There is a persistent misconception that asset managers have oversight of the majority of investable assets in the market. In fact, nearly 75% of assets are managed by asset owners on their own behalf. The remaining 25% managed by asset managers itself contains significant diversity. Firms may vary depending on their product offering – some focusing on equities, others focusing on fixed income; their client focus – some have mostly institutional clients, while others are more oriented towards individual, or ‘retail’ clients; and also on their ownership structure – for example, in Europe, most asset managers are part of a larger financial institution – such as a bank or insurance company – where in the US, many asset managers are independent or privately held. Regulatory initiatives on step-in risk (globally) and Solvency II and MMFR (in the EU) have sought to address related ownership risks.12 This diversity needs to be factored into any analysis of the asset management sector.

Exhibit 8: Who manages the assets?13

With all of this in mind, let us now turn to the focus of the conference, and consider the different concepts of systemic risk and market risk. As the definitions in Exhibit 9 show, systemic risk relates to severe market disruptions that have serious negative consequences for the real economy, transmitted across firms and markets. By contrast, market risk is present in markets at all times, and reflects normal price adjustments.

Clearly, we are all in agreement that systemic risk should be addressed. For today’s discussion, we note that some of the measures proposed conflate the risk of financial loss, or market declines, with systemic risk. It is important to be clear on the implications of market risk for different financial institutions. For example, in the banking sector, market risk can result in direct losses on assets on the bank’s balance sheet, creating solvency issues and – given bank’s leverage and inteconnectedness – could lead to systemic risk.

By contrast, in the asset management sector, market risk may lead to losses within mutual funds, that are dispersed among the fund’s shareholders, or losses in separate accounts that explicitly belong to the asset owners. Since none of these assets are on the asset manager’s balance sheet, they do not translate into solvency or liquidity issues for the asset manager. Simply put, asset managers do not “fail”, and therefore they cannot pose systemic risk, which explains the pivot of the FSB and other systemic risk monitors to focus instead on products and activities.

Exhibit 9: Policymaker definitions of Systemic and Market Risk14

|

What is systemic risk? “a risk of disruption in the financial system with the potential to have serious negative consequences for internal market and the real economy.” – European Systemic Risk Board (ESRB) “the risk of widespread disruption to the provision of financial services that is caused by an impairment of all or parts of the financial system, and which can cause serious negative consequences for the real economy.” – IMF-FSB-BIS “non-bank leverage can support financial market functioning, but it can also expose non-banks to greater losses and sudden demands for high-quality collateral, which could result in forced sales of potentially illiquid assets.” – Bank of England |

What is market risk?

“the risk that an overall market will decline, bringing down the value of an individual investment in a company regardless of that company’s growth, revenues, earnings, management, and capital structure.” – FINRA “the risk of financial loss resulting from movements in market prices.” – Federal Reserve Board “the risk of losses in on and off-balance sheet positions arising from adverse movements in market prices.” – European Banking Authority (EBA)

|

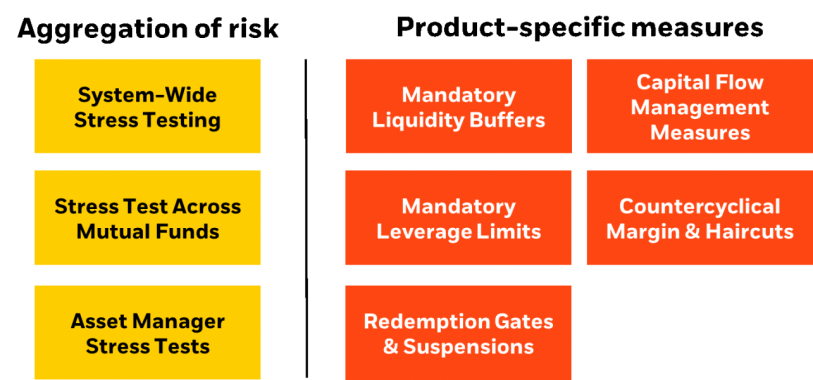

So, let’s now turn to the macroprudential policies and tools currently under discussion in the EU. Conceptually, we group the tools that have been proposed into two categories, as shown in Exhibit 10: firstly, those that aggregate risk across groups of funds; and secondly, product-specific measures applied at the level of the fund. We discuss each of these in turn, before presenting an alternate approach which more effectively addresses risks in asset management.

Exhibit 10: Classifying macroprudential tools under discussion

Stress testing in asset management

Some policymakers have suggested that the stress-tests that take place in the banking sector should be replicated for the asset management sector. Proposals have included system-wide stress tests, stress tests across mutual funds, and top-down stress tests of asset managers.

System-wide stress tests aim to capture the effects of collective selling of assets by funds and other investors, in order to identify potential systemic risks where the application of macroprudential policies may be warranted. Earlier, we saw the diversity of the asset management ecosystem. Clearly, any system-wide stress test would need to include the 75% of assets managed in-house by asset owners in order to capture the dynamics of the asset management ecosystem and how various entities interact with the financial system. This would include pension schemes, insurers, sovereign wealth funds, endowments, and other end investors.

The data required to undertake such an analysis is often lacking. As an alternative, some policymakers have therefore proposed stress tests across only mutual funds, where regulatory reporting requirements make data widely available. The intention in this case would be to perform a partial test of a subset of the financial system. This approach leaves out the majority of asset owners, including many who may be buying when other investors are selling particular securities.

Leaving aside the data availability issues, there are additional challenges in performing top-down stress tests. Often, the framework for such tests assume homogenous behaviour across asset managers. However, it is important to note that asset managers manage money on behalf of mulitiple asset owners who often have different risk tolerances and time horizons. DB pension schemes, DC pension schemes, insurers, sovereign wealth funds, and individual investors, to name a few, each have different investment objectives and constraints. Asset managers control asset allocation decisions within the investment guidelines agreed with the client, and different investment styles lead to different decisions – for example, index portfolios hold benchmark weights, active portfolios are under- or over-weight relative to the benchmark, and absolute return strategies are often unconstrained.

Much of the literature on financial stabilility and proposals around stress testing focuses on understanding the drivers behind shifts in asset allocation. Given the important role that asset owners play in asset allocation, it is critical to have a better understanding of their various objectives and contraints, in order to attempt to model their behaviour in different scenarios.

Another area of continuous discussion is bond funds. Policymakers have considered stress tests across bond funds, with a view to understanding what impact they might have on financial stability in stressed situations. Again, however, bond funds are themselves a diverse subset of mutual funds, with many different strategies representing significantly different risks. Exhibit 11 gives an illustration of this, based on US bond fund data, and Exhibit 12 shows a similar breakdown for EMEA-based funds. Each of these categories have different investment strategies, benchmarks, and types of clients. Notably, most of these funds include a large percentage of highly liquid assets that can easily be sold if necessary.

Given this diversity, it is more sensible to narrow the focus to categories of funds that present unusual risks, following up with industry-wide product regulation – similar to the approach taken with MMFs in both the EU and the US. One category that is often cited is bank loan funds as they present different risks than intermediate term bond funds. In the EU, UCITS and UCITS ETFs are not allowed to hold bank loans, and most AIFs are required to be closed-ended and limited to institutional investors. Taken together, these measures mitigate concerns about ‘bank loan funds’ in the EU.

Exhibit 11: 10 Largest US open-end bond mutual fund categories15

| Morningstar Category16 | AUM ($ millions) |

AUM (%) |

| Intermediate-Term Bond | 1,324,469 | 33.7% |

| Short-Term Bond | 327,924 | 8.3% |

| World Bond | 247,900 | 6.3% |

| High Yield Bond | 240,646 | 6.1% |

| Multisector Bond | 231,163 | 5.9% |

| Muni National Interm | 213,298 | 5.4% |

| Ultrashort Bond | 155,912 | 4.0% |

| Muni National Short | 125,292 | 3.2% |

| Inflation-Protected Bond | 112,907 | 2.9% |

| Nontraditional Bond | 112,439 | 2.9% |

Exhibit 12: Largest fund sectors of EMEA and cross-border open-end bond mutual funds17

| Broadridge Fund Sectors | AUM ($ millions) | AUM (%) |

| Global Currencies | 342,944 | 15.4% |

| EUR | 184,681 | 8.3% |

| Emerging Markets | 161,942 | 7.3% |

| Flexible | 142,880 | 6.4% |

| EUR Short-Term | 142,462 | 6.4% |

| EUR Corporate Investment Grade | 123,188 | 5.5% |

| Global High Yield | 104,613 | 4.7% |

| GBP Corporate Investment Grade | 88,111 | 4.0% |

| Target Maturity | 75,266 | 3.4% |

| Global Corporates | 73,631 | 3.3% |

Macroprudential measures for investment funds

Three measures have been proposed as potential macroprudential tools applied to funds: mandatory liquidity buffers, mandatory leverage limits, and redemption gates and suspensions. We will briefly discuss each of these in turn.

Mandatory liquidity buffers have been proposed, which would entail funds holding a proportion of highly liquid assets in order to meet elevated redemptions, and to dampen the effects of asset sales.18 These proposals have a serious downside; firstly, they imply a level of liquidity which might be overstated. The principle to hold enough liquid assets to meet redemptions seems simple and indeed forms the core of managers’ ongoing liquidity stress testing. In practice, this is subject to significant assumptions and estimates. It also does not reflect that liquidity asset-by-asset class is continually evolving and will depend on a significant number of variables such as market circumstances and size of and latency of trades. A liquidity buffer designed for normal market conditions is unlikely to be sufficient to cover heightened redemptions – in essence, in a ‘real run’, a fund’s liquidity will be quickly depleted, even if funds have tools available to manage redemptions. As an example, Third Avenue had nearly 16% in liquidity assets, but chose to close the fund to protect investors in the fund from further redemptions.19 Hence, requiring funds to maintain a cash buffer – either to be drawn down during stressed periods, or built up during ‘good times’ – would have no benefit for financial stability, would likely be insufficient, whilst also disadvantaging end-investors by introducing a cash drag on performance.

Some have also proposed mandatory leverage limits, to be applied across all funds irrespective of investment strategy. This is also problematic. As IOSCO has realised in its work on developing measures of leverage in funds, there are significant challenges in defining leverage, and especially defining a single measure of leverage. For example, is a currency-hedged bond fund risky or not? Is a long-duration bond fund used to offset long pension liabilities risky or not? Each of these strategies will use derivatives in some form, but simple measures do not account for economic exposure, and therefore risk; in fact, in the two cases just cited, these derivatives are necessary to reduce risk rather than amplify it. On top of this, leverage is not additive across funds as the investment strategies differ significantly; a different, more nuanced approach is needed.

It has also been suggested that policymakers could be given the powers to place redemption gates and suspensions on single funds, or across whole groups of funds. Although asset managers have these tools available themselves, and they have been used as part of their fiduciary duty to investors,20 it is argued that asset managers only consider their own funds, and not the wider impact of the system. While it is true asset managers only have control over funds they manage, asset managers actively think about the system as a whole, incoprorating this into scenario planning and risk management measures. Moreover, the case of asset managers using redemption gates is quite different to a central bank imposing gates to stop the sales of specific types of securities. A central bank closing a single fund or a group of funds to prevent investors from selling assets could be highly procyclical, causing a serious run on other funds holding those assets. Importantly, it would not stop direct holders of the assets, who would likely be more inclined to sell their holdings, from doing so, both exacerbating financial stability concerns and clearly raising fairness issues. In the EU, some securities regulators have powers to intervene in fund redemptions. Where this is the case, it is important to ensure that there is adequate information regarding the asset compsition, liquidity profile, and investor base of a fund to ensure that closing a fund for idiosyncratic reasons does not trigger a systemic risk event. In practise, we have seen regulators requesting enhanced reporting and supervisory oversight in response to stress events – such as the UK referendum in 2016.

A few commentators have suggested that macroprudential tools for mutual funds be paired with providing official sector backstops for funds. In particular, the idea is for central banks to provide a liquidity facility. As we wrote in our comment letter to the US Financial Stability Oversight Council (FSOC) in 2015, we do not recommend pursuing this approach. Banks’ access to central bank liquidity reflects the potential for a bank to become insolvent and/or to face a liquidity crisis based on a run on bank deposits, which in turn triggers a systemic risk event. Asset managers and mutual funds do not present solvency risks, nor do funds present bank-like liquidity risks, since the price of mutual fund shares fluctuate. Rather than providing certainty, an official sector backstop for funds would create the potential for moral hazard, and would socialise risk. In addition, the presence of an official sector backstop would blur the line betwwen bank deposits that have government credit and liquidity backstops, and mutual fund investments that have neither. More detail on each of these concerns can be found in our letter.21

Macroprudential tools for investment funds

This naturally takes us to ‘capital flow management measures’ (CFFM), measures to restrict the size or composition of capital flows. This term has appeared in several IMF, BIS, and FSB publications as part of post-crisis systemic risk discussions.22 CFFM is simply a euphemism for capital controls, and, if applied, the negative consequences for markets – including investor confidence and market distortions – would outweigh any potential benefits. You may recall that during the 2008 crisis, the US and several other countries banned short sales of financial stocks. Looking back, these bans had little impact on stock prices, while significantly lowering market liquidity and increasing trading costs.

Finally, some have suggested that policymakers should be able to set countercyclical margins and haircuts on securities financing transactions and derivatives, in order to address perceived procylicality. These suggestions ignore the fact that haircut setting is an important way to protect against counterparty risk by incorporating the volatility of the collateral’s value. This tool is therefore likely to be pro-cylical – as providers of capital may well refuse to participate – resulting in a reduction in market liquidity when it is needed most.

With all of this in mind, it is important to step back and consider what problems we are trying to solve. As discussed earlier, we agree on the benefits of avoiding or mitigating systemic risk, however, we are concerned that the macroprudential tools that have been suggested are both pro-cyclical and ineffective at addressing risks in asset management. We instead posit an alternative approach which will be effective in addressing risks in asset management while mitigating unintended consequences.

Exhibit 13: Products and Activities approach to addressing risks

Let us now briefly describe the key elements of a system-wide products and activities approach in asset management:23

Finally, let us turn to ETFs, which are often discussed as an area of concern for policy makers.

We recommend differentiating the risks of various types of Exchange-Traded Products (ETPs). We need an ETP classification system where the term ‘ETF’ is reserved for publicly available non-complex funds that invest primarly in stocks and bonds. In this construct, complex products such as levered and inverse products would not be referred to as ETFs. IOSCO is currently working on updating its principles for ETF regulation, and we welcome their ongoing work to address gaps in consumer protection and market structure.

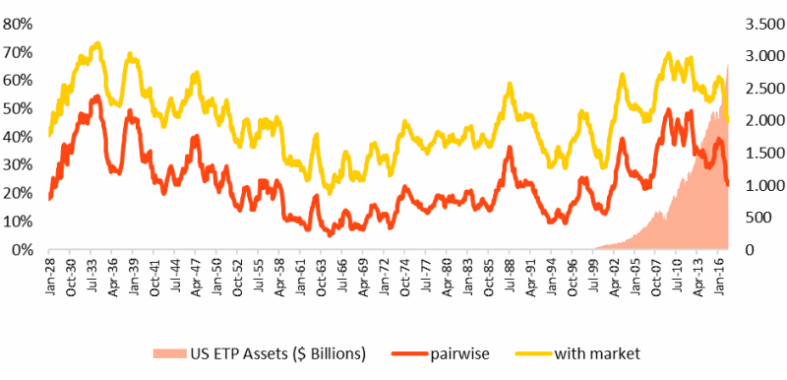

A number of commentators have suggested that ETFs drive market distortions and stock bubbles, however, the data does not substantiate this hypothesis. In fact, correlations in asset class returns are not propelled by index investing. Common macroeconomic factors – such as global interest rate policy and changing supply and demand conditions – can often explain why investors see higer correlations across markets. As Exhibit 14 shows, stock return correlation decreased between 2015 and 2017, despite record growth for index funds. Indeed, correlations were higher in the 1930s, before the advent of index investing, than they are today.

Exhibit 14: Average pairwise stock return correlations from 1926-2017

12-month trailing moving averages

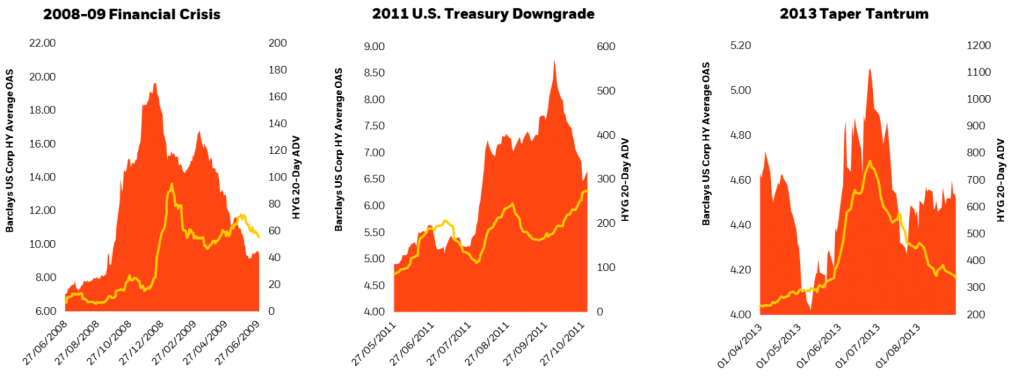

Some commentators have suggested that during stressed conditions, ETFs may amplify market volatility and impact financial stability. Again, the data does not substantiate this hypothesis. In the past decade, ETFs have been tested in numerous stressed markets, including the 2008 financial crisis, 2011 US treasury downgrade, and 2013 ‘Taper Tantrum’. In each event, ETFs have contributed to financial stability by providing additional liquidity, demonstrated by increased trading volumes, materially tighter spreads (as shown in Exhibit 15), and no forced selling.

In April 2019, the SEC’s Fixed Income Market Structure Advisory Committee (FIMSAC) published a report that examines episodes of increased volatility, and finds that in periods of stressed market conditions, ETFs have generally served as vehicles of price discovery.27 In addition, the liquidity of high-yield bond ETFs has tended to increase compared to the liquidity of the underlying high-yield market in times of stress. Amid the 2008 financial crisis, ETFs traded $25 trillion dollars worth of shares – the most ETF volume traded in a single year, ever. These elevated trading volumes show that investors turn to ETFs in times of market volatility to adjust postitions in a fast-changing market.

Exhibit 15: Examples of fixed income ETF liquidity in stressed markets28

Standing here in 2019, we face a different set of issues than in 2009. Much of the work done by policy makers has made the financial system more resilient. That said, we should not be complacent and we should continue to ask questions and analyze potential risks.

To summarise:

i) we all agree on the benefits of avoiding or mitigating systemic risk;

ii) we have genuine concerns regarding the potential negative impacts of applying the macro-prudential toolkit to asset managers and investment funds not just from the perspective of fiduciary to clients but also from the perspective of financial stability;

iii) we believe a products and activities approach for market-based finance will provide benefits to the financial system while avoiding negative consequences associated with the macroprudential measures that have been suggested.

Finally, it is important to note that over the past decade markets regulators have broadened and deepened their oversight of asset managers and investment funds; from increased data collection, to closer supervision, to better coordination across jurisdictions which also changes our perspective on how to effectively address risk.

As a recent example, we have seen very close and continuous monitoring of funds by the CBI and the FCA during the Brexit discussions. This increased focus from markets regulators only adds credence to the products and activities approach, and validates the continued appropriateness of the securities markets regulatory toolkit to monitor and regulate non-bank finance.

This note reflects two recent BlackRock papers: ‘Macroprudential Policies and Asset Management’ , and ‘Taking Market-based Finance out of the Shadows’

Some commentators have suggested that mutual funds still represent a financial stability risk because of connections to sponsoring banks, who may intervene to support the funds during stress. This is known as ‘step-in’ risk. Whilst this may have been a concern before the crisis, there has been work undertaken by the Basel Committee and Financial Stability Board to develop new regulations that preclude this behaviour.

See for example, Luis de Guindos, ECB, November 2018: “Coming to the forefront: the rising role of the investment fund sector for financial stability in the euro area” .

Swing pricing adjusts a funds’ share price to account for the impact of shareholders trading in and out of the fund.

While some attribute the growth to regulatory arbitrage between banks and non-banks, this overlooks the extraordinary monetary policies implemented by central banks since the crisis, increasing demand for non-cash investments and increasing asset prices. In Europe, another factor at play is the ongoing difficulties faced in resolving legacy non-performing loans in the banking sector, which restricts lending capacity.

Mark Carney, FSB Letter to G20 Leaders , July 2017

Source: FSB Global Monitoring Report on Non-Bank Financial Intermediation 2018 . Data shown is as of year-end 2017.

FSB data, see footnote 5.

Specifically: EF2 = Lending dependent on short-term funding; EF3 = Market intermediation dependent on short-term funding or secured funding of client assets; EF4 = Facilitation of credit intermediation; EF5 = Securitization-based credit intermediation.

FSB data, see footnote 5.

See FSB Policy Recommendations to Address Structural Vulnerabilities from Asset Management Activities ; IOSCO Recommendations for Liquidity Risk Management for Collective Investment Schemes; IOSCO Leverage Report .

See BIS’s October 2017 initiative on identification and management of step-in risk.

Source: McKinsey Performance Lens Global Growth Cube. As of year-end 2017. See also FSB report at footnote 10.

See ESRB Regulation (Nov. 24, 2010); IMF-FSB-BIS, Elements of Effective Macroprudential Policies (Aug. 31, 2016); Bank of England Financial Stability Review (Nov. 2018); FINRA Market Risk: What You Don’t Know Can Hurt You (Jun. 24, 2016); Federal Reserve Board Market Risk Management (May 17, 2016); EBA Market Risk .

Source: Simfund. As of March 31, 2019

Morningstar, The Morningstar Category Classifications , April 29, 2016.

Source: Broadridge FundFile. As of February 2019.

ECB, 2019, Macroprudential tools for investment funds

For more detail on the Third Avenue event, see SEC Third Avenue Trust and Third Avenue Management LLC; Notice of Application and Temporary Order.

For example, the 2016 UK referendum on its membership of the EU prompted several managers of UK property funds to suspend redemptions, based on their judgement of the situation.

For further discussion, see BlackRock’s 2015 letter to FSOC’s Notice Seeking Comment on Asset Management Products and Activities .

See, for example, IMF-FSB-BIS (Aug 2016) Elements of Effective Macroprudential Policies .

See also ‘What is a Systemically Important Institution: Leverage and Function are more Significant than Size’ , Barbara Novick Submission to MIT Center for Finance and Policy SIFI Contest.

For further information, see EFAMA-AMIC’s report on Managing fund liquidity risk in Europe.

For further information, see EFAMA-AMIC’s Joint Paper on Use of Leverage in Investment Funds in Europe.

We discuss these issues in more detail in our recent ViewPoint: An End-investor Perspective on Central Clearing – Looking Back to Look Forward

See SEC Subcommittee on ETFs and Bond Funds Report , April 2019.

Source: BlackRock, Bloomberg.