Due to the increasing globalization and digitalization of economic activities and the accompanying significant changes in customer preferences, the share of electronic transactions in the euro area, including Austria, has grown steadily relative to cash in recent years. Twenty years after the introduction of euro cash, electronic payment systems are more important than ever as the financial plumbing of the euro area’s market economies, highlighting the important roles of payment systems for the financial stability and strategic autonomy of all euro area and EU countries.

In this paper, we seek to answer the following questions: How have innovations and regulations impacted retail payment systems in Europe within the past 20 years? (Section 1.) What is the role of retail payments for the EU economies? (Section 2.) How has COVID-19 impacted customer and payment behavior in Europe and Austria? (Section 3.) What is the role of European players in the retail payment chain? (Section 4.) What are the likely scenarios for Europe’s future retail payments architecture (Section 5, which concludes the paper). On top of that, an annex provides an overview of today’s payment systems infrastructures and services.

As a yardstick for analyzing the impact of innovation in payments on European economy, let us first emphasize the benefits retail payment systems are expected to provide. As put forward by Scott (2014, p. 69), the seven desirable benefits of retail payment systems are: “(1) finality and reversibility; (2) universality (ability to use at point of sale (POS) and remotely); (3) recordkeeping; (4) liquidity (maximizing interest earning assets); (5) security and safety; (6) financial inclusion and access; and (7) fungibility and ease of use.” Technological progress, financial innovation and changing consumer preferences have raised the importance of points (6) and (7) – access and ease of use – in particular. New market entrants foster innovation but also create lock-in effects and barriers for competition through the net- work effects they generate. Here is where the need for regulation comes in.

Without any doubt, technological innovations over the past 20 years have hugely changed the payments landscape in Europe and beyond. Payments have been and continue to be the activity affected most by technological innovation (Petralia et al., 2019). In recent years, new payment methods, numerous new platforms and inter- faces have been developed and innovation is ongoing (Bech and Hancock, 2020).

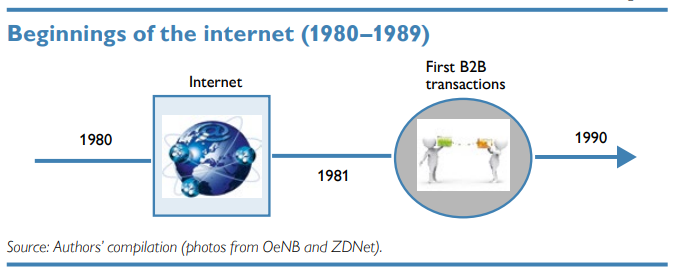

If we look into the history of payment methods, cash has long been the predominant method of payment. When newly emerging plastic, credit and debit cards supplemented the cash-dominated payment landscape from 1950 onward, retail payments in particular started to become more diverse. The biggest game changer in this process has been the development of the internet – the networking infrastructure that connects devices together1 – from 1960 onward, which opened the door for online shops and online payments. Early milestones (figure 1) include the first ever electronic business-to-business (B2B) transaction made in 1981 (Cashbook, 2020).

Figure 1

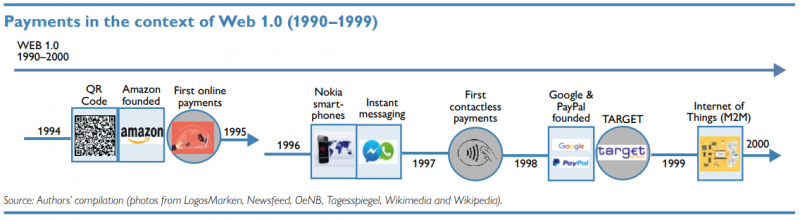

In 1990, the World Wide Web (Web 1.0) came into being as a way of accessing information through the medium of the internet. The World Wide Web started as a proposal for a “hypertext project,” the idea being to link up large bodies of data to grant universal access to them (Berners-Lee and Cailliau, 1990). Figure 2 below gives a brief overview of the most important payments-related developments between 1994 and 1999.

Figure 2

With the founding of Amazon in 1994, the era of customer online payments started. Also in 1994, the quick response code (QR code) was developed, by the Japanese automotive company Denso Wave, as the next generation of bar codes for accessing online information through scanning.2 In 1996, Nokia developed the first smartphone, which would usher in the mobile payments revolution. In 1997, US Mobil gas stations started to use “Speedpass,” the first ever contactless payment system. It ran on contactless payment devices that clipped onto a key ring (NFC, 2017).

Another milestone in the history of payments was the incorporation of Google and PayPal in 1998. While Google did not start to provide payment services until 2015, PayPal was founded on the very promise of low-cost, almost effortless digital payments for consumers and businesses. The founders’ idea was to convince customers to share their emails, banking, and credit card information in return for fast, low-cost payments. Today, PayPal services are available in more than 200 markets worldwide (PayPal, 2022).

The creation of the euro area and the changeover to the euro as the common currency of the euro area economies in 1999 went hand in hand with the creation of the high-value payments system TARGET, which also became operational in 1999 (ECB, 2004). TARGET was meant to further stimulate economic activity, European integration and stability, and designed to ensure safe and efficient payments between national central banks of the euro area. Ultimately, it became the first payments system to exchange final, real-time payments between companies in Europe.

1999 was also the birth year of peer-to-peer (P2P) technology. Within a P2P network, the “peers” are computer systems which are connected to each other via the internet. P2P would later play an important role in the rollout of nearfield communication (NFC) payments.

In 2000, the Internet of Things emerged, which refers to the growing network of noncomputing devices that are engineered to be able to connect and exchange data over the internet.3

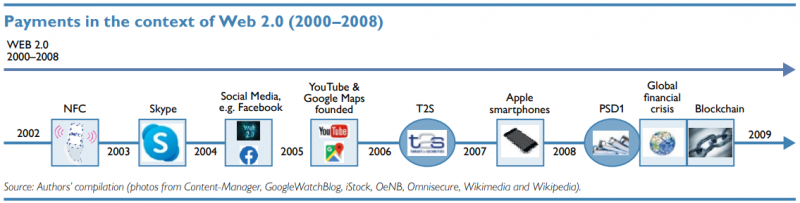

What came after 2000 was a whole new generation of the web, or Web 2.0 (Pacelt, 2021). Figure 3 below gives a brief overview of the most important developments between 2002 and 2008, as outlined below (electronic payments-related legislation at the EU level is addressed in table 1).

In 2002, the development of NFC technology marked a technological break- through for electronic payments. NFC is a radio frequency identification technique (RFID) used for the electronic exchange of data. Yet, it took until 2013 for NFC to be used for contactless payments. More recently, NFC became particularly popular during the COVID-19 pandemic (see section 4).

Social media services, in particular Facebook, have almost become a synonym for Web 2.0. Facebook, which was founded in 2004, has its own peer-to-peer payment tool: In addition to its chat function, the Facebook messenger can also be used for sending and receiving funds (Cautero, 2021). Another important innovation of the Web 2.0 era was the video portal YouTube, which was officially launched in 2005 and has been a Google subsidiary since 2006.

With the further development of smartphones and the introduction of Apple smartphones in 2007, payment behavior was lifted to a new level – now, people were able to pay directly via their smartphones without using a PC. This was the beginning of m-commerce, driven by the specific properties that made mobile phones particularly suitable for processing payment transactions, their ease of handling and their high prevalence in the population (Pacelt, 2021).

The transition to Web 3.0 was marked by the development of the blockchain technology in 2008, which constitutes the technical basis for crypto assets such as bitcoin. A blockchain is a continuously expandable list of records in individual blocks and an application of distributed ledger technology (DLT). A financial blockchain is defined as “an open, distributed global ledger that can record transactions be- tween two parties efficiently and in a verifiable and permanent way” (Cashbook, 2020). What the web does for the exchange of information, the blockchain does for the exchange of value.4 Therefore, the blockchain is also referred to as the “Internet of Value” (Bundesverband ITNM, 2016).

Figure 3

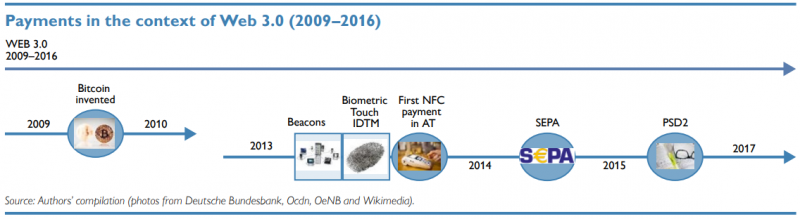

Figure 4

Figure 4 above gives a brief overview of the most important developments between 2009 and 2015, as outlined below (electronic payments-related legislation at the EU level is addressed in table 1).

Bitcoin, the world’s first and strongest crypto asset, was developed in 2009. It was designed as a decentralized accounting system in which payments are crypto-graphically legitimized and proceed peer to peer, that is to say without the need for intermediaries such as banks and without the need for a bank account – unlike more recent digital currency designs, such as the digital euro that the Eurosystem is in the process of exploring.

An important technological phase with a positive influence on m-commerce in particular followed in 2013 with the development of beacons and biometric touch. A beacon is a small Bluetooth device that transmits signals that other devices like your smartphone can see. Biometric touch, the use of electronic fingerprint recognition (Touch ID), was established by Apple in 2013 for unlocking devices. By now, both Apple Pay and Google Pay, but also most banking institutions, use Touch ID for payments authentication.

Launched in 2015 as an integrated platform for processing securities against central bank money, TARGET2-Securities (T2S) revolutionized securities settlement in Europe by bringing to an end complex cross-border settlement procedure and the difficulties caused by different settlement practices among countries (ECB, 2022a).

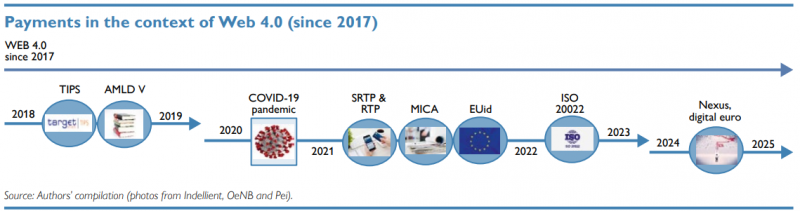

The next paradigm shift, to Web 4.0, started in 2017. Figure 5 below gives a brief overview of the most important developments since 2017, as outlined below.

Figure 5

Web 4.0 is known as the symbiotic web and characterized by a blurring of the boundary between human minds and machines (Pacelt, 2021). Web 4.0 will bring, for instance, virtual reality meetings and artificial systems communicating the way humans do using natural language.5

The need for real-time interaction in social and economic terms created the trend toward instant payments systems. The first real-time payments system established in Europe was Faster Payments System (FPS) introduced in the UK (2008), followed by Swish in Sweden (2012), MobilePay in Denmark (2013) and Vipps in Norway (2015). In 2017, RT1 and in 2018 TIPS (TARGET Instant Payment Settlement) Systems were launched as the first pan-European instant payments systems (OeNB, 2022a). TIPS enables payment service providers to offer fund transfers to their customers in real time and around the clock, every day of the year. TIPS was developed as an extension of TARGET2 and settles payments in central bank money – in euro only at the time of writing, but other currencies can be supported as well. TIPS was scheduled to begin settling instant payments in Swedish krona as of May 2022 (ECB, 2022b).

Yet, instant payments have been no effective substitution for cards payments at the point of sale because some issues remain unresolved, in particular payment initiation and requests for payment (also referred to as pull payments, in contrast to push payments).

In June 2021, the SEPA Request-to-Pay (SRTP) rulebook became effective, paving the way for from-account payment solutions at the point of sale (see annex). Growing SRTP use for real-time payment initiation is set to bring benefits for trade merchants, banks, acquirers, billers and consumers.

Regulatory action to tighten and harmonize payment regulations on the European level has had the single greatest impact on payments in the last 20 years, with heightened requirements driven by changing payment behavior as well as two key events.

The first event were the attacks of September 11, 2001, that led to increased monitoring for banks of anti-money laundering (AML) and terrorist financing (EC, 2022a). The second event was the global financial crisis starting in 2008, which resulted in regulations such as Basel III introduced to help restore the balance in perceived risk versus confidence in leveraged institutions. These two regulations also marked the beginning of the continuous need for banks to adapt to new requirements and dedicate significant resources to compliance (Hocking, 2018), in line with the emerging regulatory framework (see table 1).

Table 1: Electronic payments-related legislation at the EU level

| Regulation/ directive | Scope/objectives | ||

| Payment Services Directive (PSD I) | The PSD I, which was created to foster a more integrated EU payments market, entered into force in December 2007. The directive aimed to increase competition and participation in the payments industry, including nonbanks, and to create a level playing field by harmonizing consumer protection and the rights and obligations for payment service providers and users (EC, 2022b). The PSD I was updated in 2009 and 2012. | ||

| Single European Payments Area (SEPA) | In 2014, SEPA was implemented in Europe. SEPA refers to the common payments area of 36 European countries, including all 27 EU countries plus the EFTA countries Iceland, Liechtenstein, Norway and Switzerland as well as Andorra, Monaco, San Marino and Vatican City. SEPA enables customers to make cashless euro payments in an easy, efficient and safe way from just one account by using harmonized payment instruments (OeNB, 2022b). | ||

| Payment Services Directive II (PSD II) | In 2015, the PSD I was replaced by the PSD II. Next to enhanced security requirements, the update also included enhanced data protection (Cash-book, 2020). The new rules are intended to better protect banks from fraud when their customers pay online, promote the development and use of innovative online and mobile payments, and make cross-border payment service providers in Europe more secure (EC, 2015). The PSD II is also intended to strengthen financial start-ups (“fintechs”). | ||

| Regulation on electronic identification, authentication, and trust services (eIDAS) | While working on the PSD, the European Commission also made efforts to develop a comprehensive European identity (eID). The outcome was a regulatory framework, adopted in 2014, that was to enable all European citizens to use digital identification services across the EU. By September 2018, it was mandatory for every member state to make the service available. However, only 19 member states have introduced an eID to date, and not all eIDs are compatible. | ||

| 5th Money Laundering Directive(AMLD V) | The AMLD V was published on June 19, 2018. By end-November 2021, all EU member states except Ireland and the Netherlands had reported full implementation. However, infringement procedures were launched against 21 EU member states for the lack or delay of notification of national transposition measures. The AMLD V directive focuses not only on sanctions but also on the redesign of the know-your-customer processes to meet the standards and procedures proposed by the AML and eIDAS regulations (EC, 2020) | ||

| Regulation on crypto-asset markets (MICA) | As part of the digital finance strategy, the European Commission proposed MICA in September 2021. The regulation supports regulatory safety, enhancing investor protection, innovation, competition and market integrity, reducing market fragmentation and increasing financial stability regarding stable coins. In its proposal, the European Commission differentiates between crypto assets already covered by EU regulations and assets currently exempt from these regulations. For the latter, including stable coins, the European Commission foresees stringent rules for issuers or companies applying for permission to offer services within the common market (EC, 2020). | ||

| Regulation on a European digital identity (EUid) | Furthermore, in June 2021, the European Commission proposed a European digital identity (eID) framework. In the future, all citizens and companies should be able to provide proof of their identity, pass on documents in electronic form using an eID wallet and use Europe-wide online services (EC, 2020 and BKA, 2021). |

Source: Authors’ compilation

In the years ahead, the focus in Europe will be on the design and implementation of the digital euro, and on better facilitating cross-border payments and implementing data-reach payment formats such as ISO 20022 to support the digital transformation and the emergence of machine-to-machine payments.

The investigation phase of the ECB’s digital euro project is scheduled to run until October 2023. The Governing Council will then decide whether to move to the next phase, which would involve the development of integrated services as well as testing and possible live experimentation of a digital euro. This phase could take around three years.6

With technological change and enhanced cross-border payment systems, subject to enhanced security and data protection, payments will become cheaper and faster. A promising project in this context is Nexus, a model developed for connecting instant national payment systems into a cross-border platform. Nexus is a joint effort of the BIS Innovation Hub, Banca d’Italia, the central bank of Malaysia, BCS in Singapore and PayNet in Malaysia. The project has already moved to the testing phase, connecting the payment systems of Singapore, Malaysia and the euro area in order to provide an experimental proof of concept.7

Baselga-Pascual, L., O. Orden-Olasagasti and A. Trujillo-Ponce. 2018. Toward a More Resilient Financial System: Should Banks Be Diversified?. In: Sustainability. Sustainability | Free Full-Text | Toward a More Resilient Financial System: Should Banks Be Diversified? (mdpi.com).

Bech, M., Y. Shimizu and P. Wong. 2017. The quest for speed in payments. In: BIS Quarterly Review. March. 57−68. BIS Quarterly Review March 2017 – International banking and financial market developments.

Bech, M. and J. Hancock. 2020. Innovation in Payments. Bank for International Settlements (BIS). Quarterly Review. https://www.bis.org/publ/qtrpdf/r_qt2003f.pdf.

Berners-Lee, T. and R. Cailliau. 1990. WorldWideWeb. Proposal for a HyperText Project. CERN.

Bundesverband Informationswirtschaft, Telekommunikation und neue Medien e.V. (Bundesverband ITNM). 2016. Blockchain #Banking. Ein Leitfaden zum Ansatz des Distrib- uted Ledger und Anwendungsszenarien. https://web.archive.org/web/20171222051930/http:/www.digitalestadt.org/bitkom/org/noindex/Publikationen/2016/Leitfaden/Block- chain/161104-LF-Blockchain-final-2.pdf.

Cashbook. 2020. Changes in payment trends over the last 10 years. https://www.cashbook.com/ changes-in-payment-trends-over-the-last-10-years/.

Cautero, R. M. 2021. How Social Media Payments are Changing the Way We Buy. The Balance. https://www.thebalance.com/how-millennials-use-social-payment-apps-4597677.

Dorfmeister, C., D. Höpperger, A. Pölzlbauer and C. Rusu. 2022. Bargeld immer noch gefragt, kontaktlose Kartenzahlungen auf dem Vormarsch. OeNB. https://www.oenb.at/Presse/ thema-im-fokus/2020-2021/bargeld-kartenzahlungen.html.

European Banking Authority (EBA). 2020. EBA provides clarity to banks and consumers on the application on the prudential framework in light of COVID-19 measures. https://www.eba. europa.eu/eba-provides-clarity-banks-consumers-application-prudential-framework-light-COVID 19-measures.

European Central Bank (ECB). 2004. Future Developments in the Target System. Monthly Bulletin. https://www.ecb.europa.eu/paym/pdf/target/future/mb-target2-future.pdf.

European Central Bank (ECB). 2020. Study on the payment attitudes of consumers in the euro area (SPACE). https://www.ecb.europa.eu/pub/pdf/other/ecb.spacereport202012~- bb2038bbb6.en.pdf.

European Central Bank (ECB). 2022a. TARGET2-Securities Annual Report 2020. Introduction (europa.eu).

European Central Bank (ECB). 2022b. What is TARGET Instant Payment Settlement (TIPS). https://www.ecb.europa.eu/paym/target/tips/html/index.en.html.

European Commission (EC). 2015. European Parliament adopts European Commission proposal to create safer and more innovative European payments. Press release, 8 October 2015. https://ec.europa.eu/commission/presscorner/detail/en/IP_15_5792.

European Commission (EC). 2020. Anti-money laundering directive V (AMLD V) – transposition status. https://ec.europa.eu/info/publications/anti-money-laundering-directive-5-transposition- status_en.

European Commission (EC). 2022a. Anti-money laundering and countering the financing of terrorism. https://ec.europa.eu/info/business-economy-euro/banking-and-finance/financial- supervision-and-risk-management/anti-money-laundering-and-countering-financing-terrorism_en.

European Commission (EC). 2022b. Guidance on the implementation and interpretation of the law. https://ec.europa.eu/info/law/payment-services-psd-1-directive-2007-64-ec/implementation/guidance-implementation-and-interpretation-law_en.

EUR-Lex. Access to European Union Law. 2022. Directive (EU) 2015/2366 of the European Parliament and of the Council of 25 November 2015 on payment services in the internal market, amending Directives 2002/65/EC, 2009/110/EC and 2013/36/EU and Regulation (EU) No 1093/2010, and repealing Directive 2007/64/EC. https://eur-lex.europa.eu/legal-content/EN/ TXT/?uri=CELEX%3A32015L2366.

EUR-Lex. Access to European Union Law. 2022. Proposal for a regulation of the European Parliament and of the Council on Markets in Crypto-assets, and amending Directive (EU) 2019/1937. EUR-Lex – 52020PC0593 – EN – EUR-Lex (europa.eu).

Hasan, I., H. Schmiedel and S. Liang. 2009. Return to retail banking and payments, Working Paper Series No 1135. ECB. http://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1135.pdf.

Hocking, M. 2018. The payments revolution: the biggest changes to the transaction industry in the last 20 years. Payment Eye. https://www.paymenteye.com/2018/02/09/the-payments-revo- lution-the-biggest-changes-to-the-transaction-industry-in-the-last-20-years/.

Humphrey, D. 2019. Payments. The Oxford Handbook of Banking (3 ed.) DOI: 10.1093/oxfordhb/9780198824633.013.11.

IFES-Institut für empirische Sozialforschung GmbH. 2020–2021. OeNB-Barometer: Zahlungsverhalten. 2. Halbjahr 2020 bis März 2021.

IFES-Institut für empirische Sozialforschung GmbH. 2021. OeNB-Barometer. Teil B. 2 HJ 2021.

IMF. 2019. Cash Use Across Countries and the Demand for Central Bank Digital Currency. Working Paper WP/19/46. Cash Use Across Countries and the Demand for Central Bank Digital Currency (imf.org).

Kim, C., T. Wang and N. Shin. 2010. An empirical study of customers’ perceptions of security and trust in e-payment systems. February 2010. Electronic Commerce Research and Applica- tions 9 (1): 84–95; DOI:10.1016/j.elerap.2009.04.014.

McKinsey. 2021. Global Digital Sentiment Survey 2021. Ergebnisse für den deutschen Markt. https:// www.mckinsey.de/~/media/mckinsey/locations/europe%20and%20middle%20east/deutschland/ news/presse/2021/2021-05-24%20digital%20sentiment%20survey%202021/mckinsey_digital_sen- timent_survey_germany_2021.pdf.

Mersch, Y. 2014. ECB/Banca d’Italia Workshop on Interchange Fees, Rome. Efficient retail payments: key in strengthening the competitiveness and growth potential of the EU (europa.eu).

Morales Resendiz, R. 2017. The role of payment systems and services in financial inclusion – the Latin American and Caribbean perspective. The role of payment systems and services in financial inclusion – the Latin American and Caribbean perspective (bis.org).

Moody’s. 2016. The Impact of Electronic Payments on Economic Growth. the-impact-of-electronic-payments-on-economic-growth-moodys-analytics-visa-february-2016.pdf (tralac.org).

Near Field Communication (NFC). 2017. History of Mobile and Contactless Payment Systems. http://nearfieldcommunication.org/payment-systems.html.

Österreichisches Bundeskanzleramt (BKA). 2021. Schaffung einer digitalen Identität für alle Europäerinnen und Europäer – Bundeskanzleramt Österreich. https://www.bundeskanzler- amt.gv.at/themen/europa-aktuell/schaffung-einer-digitalen-identitaet-fuer-alle-europaeerin- nen-und-europaeer.html#:~:text=Juni%202021%20einen%20Rahmen%20f%C3%BCr,europa- weiter%20Online%2DDienste%20erm%C3%B6glicht%20werden.

Oesterreichische Nationalbank (OeNB). 2022a. TARGET Instant Payment Settlement (TIPS). https://www.oenb.at/Zahlungsverkehr/tips.html.

Oesterreichische Nationalbank (OeNB). 2022b. Single Euro Payments Area (SEPA). https:// www.oenb.at/en/Payment-Processing/cashless-payments/SEPA.html.

Pacelt, O. 2021. Story of the Internet. From Web 1.0 to Web 4.0. Botland. https://botland.store/ blog/story-of-the-internet-from-web-1-0-to-web-4-0/.

PayPal. 2022. About PayPal. PayPal – Über uns – PayPal.

Petralia, K., T. Philippon, T. Rice and N. Véron. 2019. Banking disrupted? Financial intermediation in an era of transformational technology. Geneva Report on the World Economy 22.

Scott, H. S. 2014. The Importance of the Retail Payment System (December 16, 2014). Working Paper. In: SSRN: https://ssrn.com/abstract=2539150 or http://dx.doi.org/10.2139/ssrn.2539150.

Scott, H. S. 2015. The Importance of the Retail Payment System. hal-scott—mastercard-retail- payment-systems.pdf (harvard.edu).

Shin, D. H. 2009. Towards an understanding of the consumer acceptance of mobile wallet. Computers in Human Behavior. 25(6). 1343−1354.

Sorensen, E. 2021. QR code payment: what is it and how does it work? Mobile Transaction. https://www.mobiletransaction.org/qr-code-payment-works/.

UNCTAD. 2018. Mobile money holds key to financial inclusion in Africa, experts say | UNCTAD.

van der Heijden, H. 2002. Factors Affecting the Successful Introduction of Mobile Payment Sys- tems. BLED 2002 Proceedings. 20. https://aisel.aisnet.org/bled2002/20.

Weber, B. and P. Niederländer. 2022. Payment initiatives and lessons learned for the digital euro. OeNB Working Paper. Oesterreichische Nationalbank.

See A short history of the internet | National Science and Media Museum .

History of QR Code | QRcode.com | DENSO WAVE and Sorensen (2021).

Difference Between Internet of Things and Internet of Value | Difference Between .

See Story of the Internet. From Web 1.0 to Web 4.0 – Botland .