Abstract: The Russian economy is exposed. Wars in Ukraine and Syria are costly. Sliding oil prices and Western sanctions imply falling revenues from exports. Against this background, most observers would expect Russia’s macroeconomic performance to be poor. The author of this SUERF Policy Note has taken a closer look at Russian data. After examining numbers concerning profitability of Russian enterprises, the balance of payments, the Government budget, unemployment and the risk-situation of the banking sector, the author concludes that the economy of Russia is doing surprisingly well. This is obviously a surprise with serious political implications.

Some seeming paradoxes or interesting points of Russia’s economy and banking sector

Key points:

Why – despite weak oil prices and recession – are corporate profits still there and partly even growing in Russia?

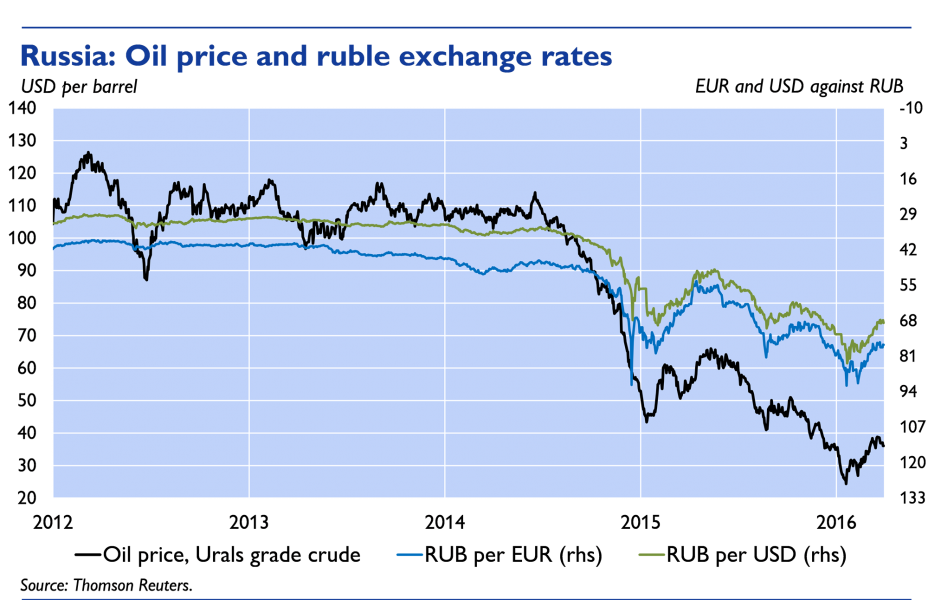

Overall, Russian enterprises’ net income (in rubles) grew by about 30% in Jan-Sep 2015. Operating profits of extractive enterprises, particularly in metallurgy and coal, but also oil and gas, have remained strong. Why? Because Russia’s exporters are “protected” by the weaker ruble and by producerfriendly taxation. Exporters’ revenues are mostly earned in foreign exchange, and the lion’s share of their costs accrues in rubles. In this sense, the liberalization of the ruble exchange rate in November 2014 has supported competitiveness substantially.

This is a kind of quasi-automatism (the alignment of the ruble with oil seems to be as close as rarely before) that immediately if only partially blunts any impact of declining oil and metal prices on the Russian economy. Import substitution is reported to have helped increase production and profits in farming, the food and chemical industries, agricultural machinery, medical equipment and pharmaceuticals, albeit at the cost of lower quality in some areas, and higher prices.

Actually, the situation of non-financial enterprises is very heterogeneous, since there are of course also many branches (incl. wholesale and retail trade) oriented toward the domestic market. These branches suffered a sharp decline of turnover and revenue due to the contraction of consumer demand. Finally, the most exposed branches are those with predominantly ruble revenues and forexdenominated financing: e.g. automobile manufacturing, construction companies, and others. These sectors are most in need of, and receiving, government support.

CHART 1

The floating ruble protects Russia’s competitiveness, its international reserves and its budget, at the cost of elevated inflation, declining living standards and capital formation

The flexible exchange rate has strongly reduced Russian costs vis-a-vis competitor countries and has protected the country’s FX reserves in that the CBR no longer has to draw down reserves to support a

possibly unsustainable ruble, at least as long as financial stability is not endangered. Apart from raising competitiveness of exports, the flexible ruble has created stimuli for import substitution. It has also partly sheltered the budget (via increased tax intake) from the impact of the oil price slide.

On the other hand, it has pushed up inflation sharply, thereby painfully cutting real incomes and causing poverty to spread. Another drawback of the Floating ruble: its strong depreciation forced the Inflation targeting CBR to raise interest rates, thereby curtailing investment; and it increased the debt burden for unhedged FX borrowers.

Table 1

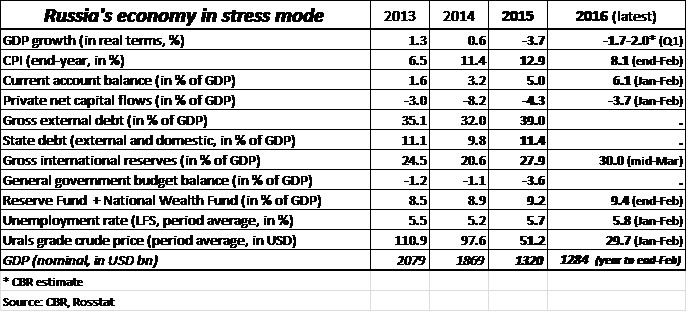

Despite Western sanctions and plummeting oil prices, Russia’s current account surplus increased further in 2015, and net capital outflows contracted substantially.

In 2015 the current account surplus increased by more than one tenth to USD 66 bn or 5.0% of GDP. Why? Largely due to a sharp contraction of imports (on the back of shrinking domestic incomes and demand, and also on the back of Russia’s countersanctions), moreover due to a shrinkage of the balance of services deficit (with less Russian tourists that could afford to go abroad), and to a shrinkage of the income balance deficit (due to declining debt interest payments).

After spiking at a record level in 2014, private net capital outflows from Russia shrank by almost two thirds to USD 57 bn in 2015 – which is still 4.3% of GDP – so somewhat less than the current account surplus. Why the contraction? Because debt repayment declined and the purchase of foreign assets declined. The turnaround was thus also due to Russian residents (banks and corporates) repatriat-ing assets. Russian households’ reaction to the ruble’s continuing depreciation in 2015 (and early 2016) has been much calmer than in the previous year. No panicky rushes to convert rubles into FX were recorded. Moreover, the CBR’s banking sector cleansing campaign (see also below) has probably been influencing capital flight as the reduction of so-called “questionable transactions” in the national accounts has fallen in line with the number of bank licenses withdrawn.

Another caveat: Western sanctions make financing Russian budget deficits more difficult:

The recession-stressed domestic market is shallow, and while external markets are not formally closed to the Russian state and many international investors appear underexposed to the country’s debt, sanctions could possibly be extended. This leaves the possibility either to use or exhaust the Reserve Fund (which at end-February 2016 stood about 3.9% of GDP), take recourse to the National Wealth Fund (5.5% of GDP), carry out partial privatizations (which is now being planned, although relatively strict conditions attached may raise doubts: possible candidates: Rosneft, Sberbank, VTB, Aeroflot), or execute substantial budget cuts (which the authorities also envisage, despite the parliamentary election year 2016), or finally, mix various options, which appears most probable. In any case, President Putin’s “red line” of capping the federal budget deficit at 3% is still there.

One more interesting point: Despite Russia’s dive into recession, the unemployment rate (according to labor force surveys) has not increased much and remains rather low (currently below 6%), compared e.g. to average EU Levels

Why? There are a number of reasons: Russian wages are relatively flexible, the tariff-based fixed part of the wage is quite low (on the average only about 60%). Therefore, instead of – so to say – adjusting the head count and staff numbers in the case of a recession, the pay count or de-facto paid wages are adjusted. That contributes to explaining why there are few dismissals despite the weak position of labor unions in Russia. In addition, the high flexibility of using migrant workers’ labor as well as stagnating demography have their impact on joblessness.

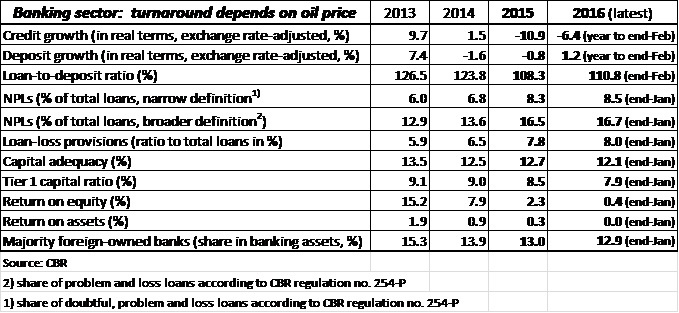

Finally, a quick look at current banking sector risks: One can perceive them as credit risk, exchange rate risk, liquidity risk, and connected lending risk

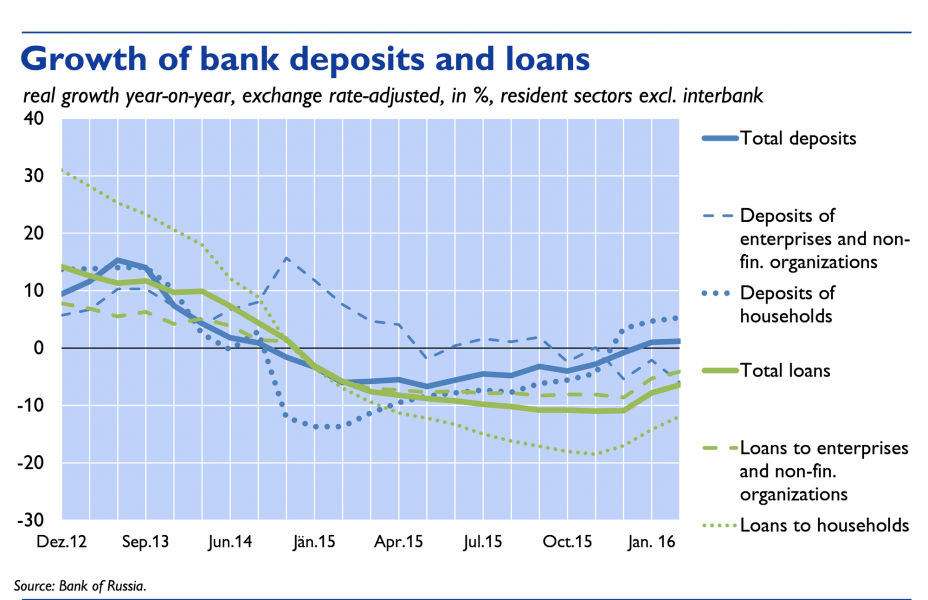

Credit risk: Non-performing loans (NPLs, in a broad definition) have increased over the last year by about one fifth to 16.5% by end-2015. With the continuing recession in 2016 and the lackluster economic recovery to be expected later, NPL ratios are likely to swell further, before they eventually stabilize or decline.

Exchange rate risk: With the renewed oil price cum ruble slide (Dec 2015-Jan 2016), this category of risk has most recently come to the fore again. Besides making it more difficult for unhedged borrowers to service their debts, intensified exchange rate pressures may prevent the inflation rate from falling as quickly as originally expected and prevent the CBR from further key rate cuts, which could halt the recovery of interest margins. On the other hand, the fact that there has been no rush to buy goods in reaction the slide of the ruble, unlike twelve months ago, moreover continuing weak demand, and possibly, the sharp contraction of the ratio of imports to GDP, may have contributed to the most recent decline of inflation to 8.1% at end-February 2016 (year on year).

Both credit risk and exchange rate risk have had consequences for credit growth, which has been negative in real and exchange rate-adjusted terms for almost a year now. Deposit developments and confidence of savers have held up remarkably better (see below).

Liquidity and refinancing risk: with the likelihood that Western sanctions remain in place for the time being, while no more large disruptive foreign debt payment deadlines can be expected in the coming years, restricted access to EU and US capital markets will continue to render many Russian banks financially more fragile than they otherwise might be.

Connected or related party lending risk (a chronic risk): In recent years many small and medium-sized banks engaging in risky activities and often practically functioning as extended financial departments of owner firms (so-called pocket banks) have lost their licenses due to CBR intervention. This has helped improve the institutional quality of the banking sector. However, it cannot be excluded that underlying structural financial problems un-expectedly erupt in a systemically important institution, which cannot simply be wound up. As a case in point, in 2011, Bank Moskvy (Bank of Moscow), Russia’s fifth-largest credit institution at the time, became insolvent and was bailed out for over USD 13 bn, which was the largest bank bailout in CESEE history. Most recently, Vneshekonombank (VEB), which is however a state development bank, ran into structural trouble with its credit portfolio. Its bailout may amount to up to USD 18 bn.

CHART 2

Shock-absorbing factors (for the bank-ing sector) have eroded in recent years, but are still sizable

Loan-loss provisions are at best partly adequate to cover NPLs. Capital adequacy, while having improved through recapitalization measures in 2015, remains under pressure from the continuing economic downturn and is eroding; further capital injections in 2016 will almost certainly be necessary. However, raising state liabilities for this purpose should not be a problem because Russian state debt continues to be modest (end-2015: about 11% of GDP). While depositors have become very sensitive to inflation and inflation expectations have remained elevated, at least so far depositors have maintained a fair degree of confidence, which actually strengthened in late 2015. (Retail deposits expanded 5.3% in real and exchange rate-adjusted terms in the course of the year to end-Feb 2016). Another factor providing a cushion are credit institutions’ net external assets, which stood at 6.9% of their total assets at end-Jan 2016. The fact that state-owned banks account for the majority of Russian banking assets implies that the authorities are directly responsible for the survival of most of the largest players, which may generate some confidence in crisis times.

Russia’s FX reserves (incl. gold), after declining substantially in recent years, have recovered some-what over the last year (mid-March 2016: USD 384 bn or about 30% of GDP). As mentioned above, Russia’s current account surplus expanded further in 2015. Finally, the country boasts a positive and large net investor position (around 18% of GDP).

But for the (banking) outlook the oil price remains the major risk factor:

If the average oil price in 2016 comes to 30 USD per barrel the CBR expects a further decline of Russian GDP of about 1.5% this year. In this case (which includes a further devalued ruble on the average in 2016 compared to the previous year), net exports will continue to support economic activity (due to stable or slightly falling exports combined with further shrinking imports on the back of a further contraction of domestic demand).

At the same time inflation expectations, inflation itself and risks for financial stability would remain elevated. If the oil price trend improved in the second half of 2016, this would ease adjustment pressure on the ruble, the economy, and a fortiori, the banking sector.

Table 2

Barisitz, S. 2015, The Russian banking sector – Heightened risks in a difficult environment, Financial Stability Report, No. 30, OeNB.

Barisitz, S., 2013, Nonperforming loans in CESEE – An ever deeper definitional comparison, Focus on European Economic Integration, Q3/13, OeNB.

Barisitz, S., Gunter, U. & Lahnsteiner, M., 2012, Ukrainian banks face heightened uncertainty and challenges, Financial Stability Report, No.23, OeNB.

Barisitz, S., Holzhacker, H., Lytvyn, D. & Sabyrova, L., 2010, Crisis-response policies in Russia, Ukraine, Kazakhstan and Belarus – Stock-Taking and comparative assessment, Focus on European Economic Integration, Q4/10, OeNB.