A number of factors have pointed towards more persistently elevated inflation pressures. Recently we noted that measures of underlying inflation appear to be unanchoring (see An unanchoring of underlying inflation?). This is happening as inflation pressures are increasingly driven by demand forces rather than supply factors, and as wages have accelerated to the fastest pace in decades, pushing the trend in unit labor cost growth to levels that are inconsistent with inflation returning towards 2%.

One element of the inflation picture that has not been flashing red are long-term inflation expectations. After showing broad evidence of rising briskly over the past year, long-run inflation expectations have since moderated. According to our common inflation expectations index (CIE), various measures suggest that inflation expectations are now, broadly speaking, only a few basis points above the typical levels that prevailed prior to the 2014 oil price collapse. Fedspeak in general, as well as a few recent Fed research pieces, have emphasized this development as a reason to not be overly worried about runaway inflation dynamics. (see What are consumer inflation expectations telling us today?).

However, in past work we have shown that inflation expectations – even long-run measures – are heavily influenced by movements in contemporaneous and past inflation, particularly those driven by energy price movements (see From secular stagnation to secular stagflation? Inflation post supply shocks). In light of recent energy price moves in response to events in Ukraine, these facts suggest long-run inflation expectations could be at risk of moving to an uncomfortable level for Fed officials, especially given the backdrop of these other forces pointing to persistently elevated inflation.

In this piece we take a closer look at the relationship between energy prices and inflation expectations. In particular, we ask whether the nature of the oil price shock matters for the impact on inflation expectations. That is, are inflation expectations at greater or lesser risk of moving higher if the oil price shock is driven by supply side innovations, as it is today, or demand side changes?

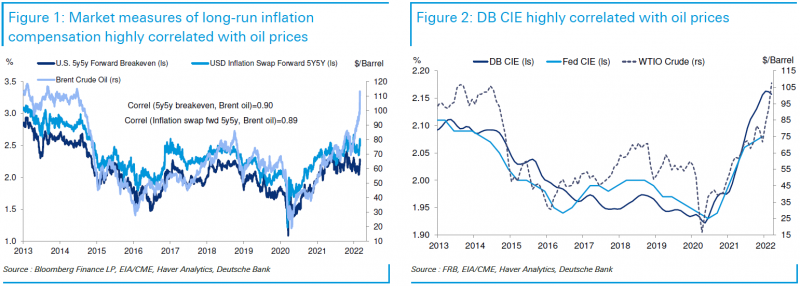

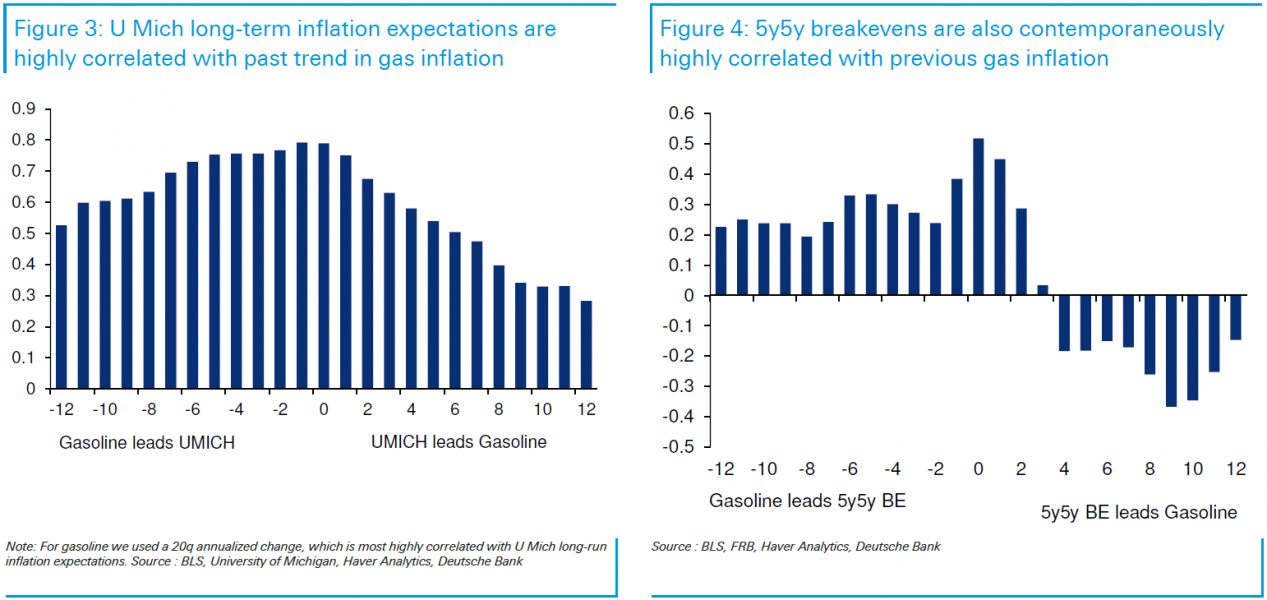

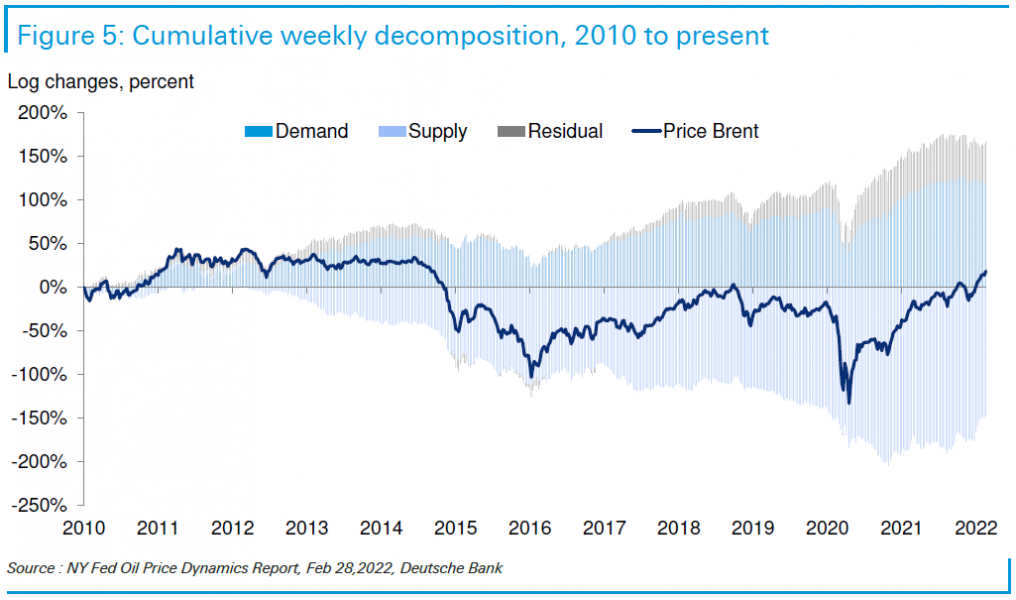

In a number of past research pieces we have documented a surprisingly strong positive relationship between spot oil prices and a variety of measures of long-run inflation expectations (see Market inflation expectations ignore FAIT and oil). For example, since 2014 the correlation between long-run measures of market inflation compensation, five-year, five year breakevens and inflation swaps, and spot Brent oil prices, is very high. The relationship is also pretty strong between gauges of longrun inflation expectations from consumer surveys and oil (Figures 1 and 2). For instance, there is a greater than 60% correlation between a smoothed year-overyear change in University of Michigan expectations and year-over-year energy price growth over the past twenty years. Beyond this contemporaneous relationship, there is also evidence that energy price moves lead changes in inflation expectations across a number of metrics (Figures 3 and 4).

This strong long-term relationship is a bit of a puzzle. Energy price movements tend to be transitory and dissipate or reverse over time. For that reason, an oil price shock should theoretically have little long lasting impact on inflation five to ten years ahead. These oil prices moves therefore should not have material effects on long- run inflation expectations. However, the nature of the oil price shock could matter for this relationship, in ways that we explore next.

Why might long-run inflation expectations be linked to current oil price developments? Theoretically the nature of the oil price shock should matter. For example, if higher oil prices are driven by stronger demand, it could portend firmer demand pressures moving forward, and thus higher future inflation. If this is the driver, we may expect to see a positive relationship between today’s oil price movements and long-run inflation expectations. Alternatively, if higher oil prices are driven by supply side developments, they should be negative for aggregate demand and growth and could thus lead to softer inflation pressures further down the road. While the Fed response should dampen these effects, monetary policy restrained by the zero lower bound could imply more persistent effects on inflation and thus inflation expectations in response to adverse demand shocks. This logic at least implies that there should be greater scope for higher energy prices driven by positive demand shocks to lift long-run inflation expectations, all else equal.

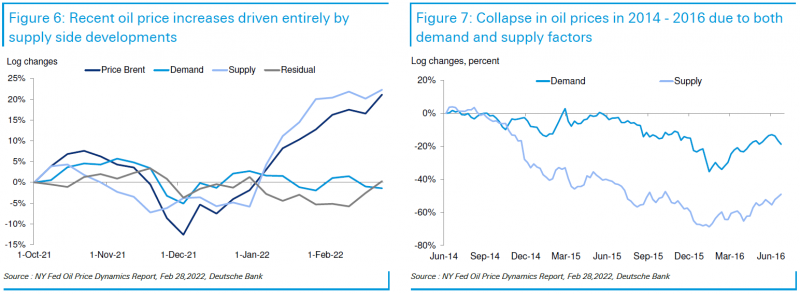

To explore this theory, we utilize the Federal Reserve Bank of NY’s oil decomposition (see Oil price dynamics report). This analysis uses a variety of financial market variables and sign restrictions for how different fundamental factors should simultaneously move these variables in order to recover the share of oil prices moves driven by supply forces, demand forces, and an unexplained residual component. Accumulated over time since 2010, this approach has shown that supply has been an important force keeping oil prices lower while demand has been a force putting upward pressure on oil prices (Figure 5). Up until recently, these forces offset to keep oil prices well below their peak levels in 2014.

However, more recently the oil market has experienced a negative supply shock that has put significant upward pressure on oil prices. According to the NY Fed’s decomposition, the entire rise in oil prices since the start of the year is attributable to supply forces, while demand and the residual have contributed virtually zero to the rise (Figure 6). This decomposition differs from the negative oil price shock between 2014 and 2016, which was driven both by supply and demand forces, though the former were quantitatively more important according to the NY Fed approach (Figure 7). Given our brief discussion earlier, this could matter for whether the recent oil price shock could risk an unanchoring of inflation expectations to the upside. So what do the empirics say?

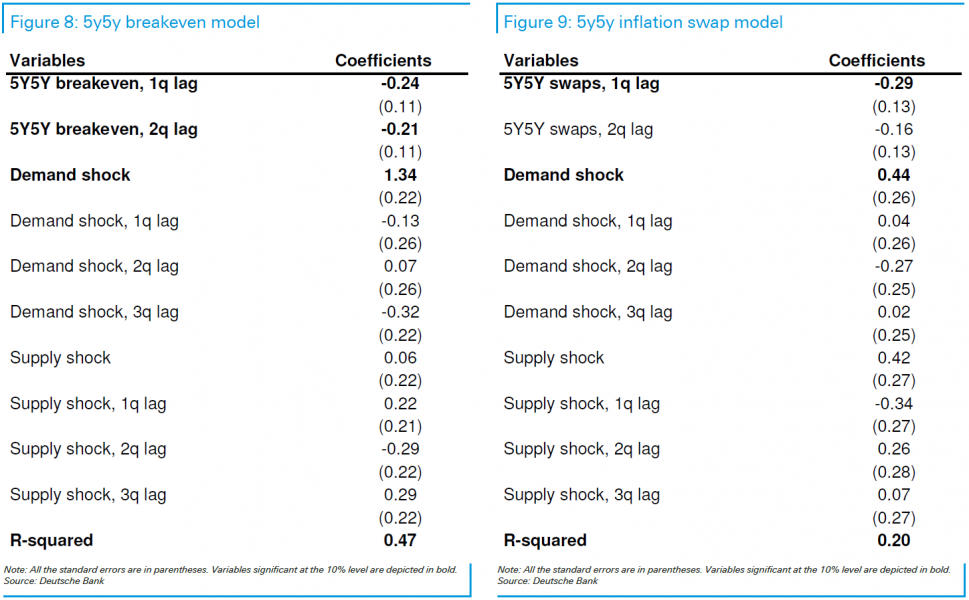

To assess whether the fundamental drivers of the oil price shock matter for the reaction of long-run inflation expectations, we run regressions of changes in longrun inflation expectations on lags of itself, contemporaneous supply and demand forces, and lagged supply and demand shocks. We consider quarterly data to smooth through the weekly and monthly volatility. This approach is similar to that from earlier Fed staff work (see The relationship between oil prices and inflation compensation), except that we include both supply and demand forces rather than a dummy for demand shocks as that work did, as well as consider the impact on a broader range of measures of inflation expectations, including surveys.

Beginning with the market measures, we find that movements in 5y5y breakevens and inflation swaps are persistent and are also positively impacted by demand shocks to oil prices (Figures 8 and 9). However, supply shocks, as the current period is experiencing, do not have a statistically significant impact on long-run inflation compensation. This is consistent with prior Fed work and is also intuitive given the results mentioned above, particularly during a period where monetary policy was constrained by the zero lower bound and thus may not have been able to fully offset a negative demand shock that lowered oil prices, as during the 2014-16 period. These results suggest that the recent disconnect that has emerged between oil prices and long-run inflation expectations could persist, something that would be encouraging from the Fed’s perspective.

Less encouragingly, the same does not hold for survey-based measures of long-run inflation expectations. For example, long-run inflation expectations from the University of Michigan are positively associated with higher oil prices regardless of the driver of the move (Figure 10). In fact, oil price moves driven by supply-side shocks tend to have statistically significant and more persistent impacts on inflation expectations. The same is broadly true for long-run inflation expectations in the Federal Reserve Bank of Philadelphia’s Survey of Professional Forecasts (Figure 11).

From the preceding analysis, we conclude that, although market measures of inflation expectations seem to respond more forcefully to higher oil prices driven by demand side factors, survey-based measures, particularly from consumers, could well respond to a supply-side shock. We next use these results to gauge the potential impact on various measures of long-term inflation expectations in response to a large oil price shock.

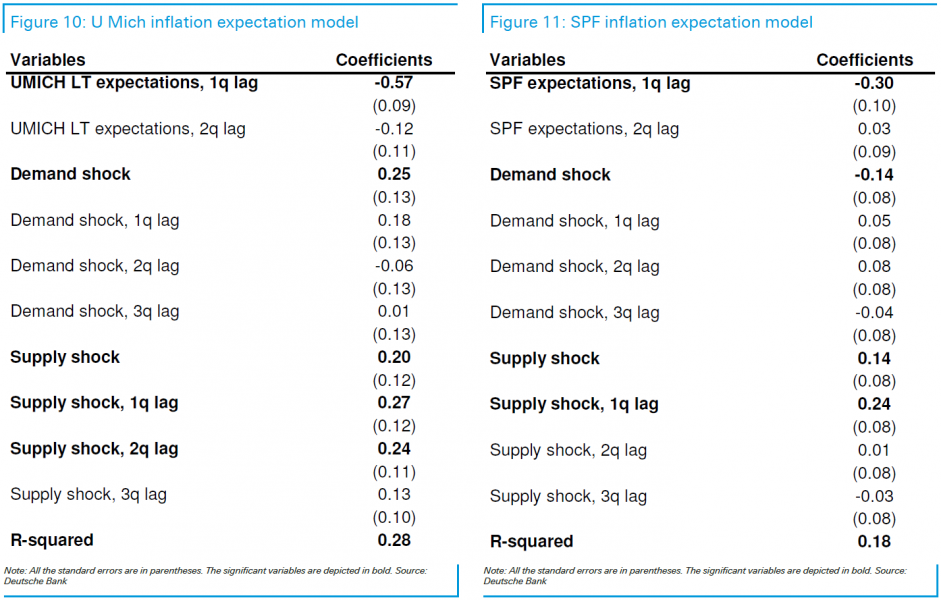

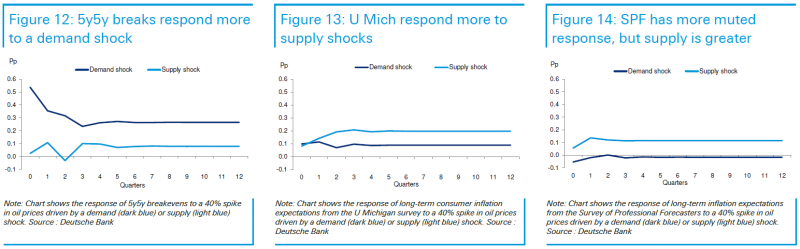

In particular, we consider a 40% rise in oil prices – along the lines of the current episode – that is driven by either a demand or supply shock, and feed this through the dynamics of the regression results just presented. For 5y5y breakevens, we find that a 40% oil price shock driven entirely by demand forces lifts inflation expectations initially by about 50bps (Figure 12). Over the long-term, 5y5y breakeven inflation rates rise by about 20bps. The impact of a similar oil price shock driven by a supply side move is significantly more muted and likely statistically insignificant.

These dynamics are not similar for survey-based measures of long-run inflation expectations. For example, a similarly sized supply side shock has a larger impact on University of Michigan long-run inflation expectations, with a 40% spike in oil inducing a roughly 20bps permanent rise in expectations (Figure 13). The impact on SPF inflation expectations is qualitatively similar, though the quantitative impact is far more muted (Figure 14).

The preceding analysis reaches several conclusions. First, how long-term inflation expectations respond to oil price shocks depends on whether those shocks are driven primarily by demand or supply forces. Second, different measures of inflation expectations respond differentially to these shocks. Market gauges are more sensitive to demand forces and respond less to supply shocks, while survey measures, particularly for consumers, are sensitive to supply driven spikes in oil even more than demand driven. These results are important for assessing how the current episode of a supply driven spike in oil prices could impact long-run inflation expectations. In particular, it suggests that market measures of long-run inflation expectations may not rise meaningfully in response to the current period. However, long-run inflation expectations from consumer surveys appear to be the most at risk. The upshot is that the tentative peaking of inflation expectations we observed in our CIE could be short-lived, with this oil price shock possibly spilling over into higher inflation expectations in the coming months. Along with a broadening of price pressures and a tight labor market leading to wage gains, a renewed rise in inflation expectations could add to concerns that inflation pressures are likely to prove to be far more persistent.