Digitization leads us to rethink the basic phenomenology of money. This short note critically examines the relevance of (i) Menger’s explanation of money as a social institution of spontaneous order, (ii) Wieser’s hypothesis of the dematerialization of money, (iii) Schumpeter’s conception of money as a universal ledger of accounts, and finally, (iv) Hayek’s call for a system of competing private currencies – relating them to the current development of the increasing importance of digital money. The paper closes with a brief discussion of central bank digital currencies (CBDCs) as a public response to the challenges posed by private digital currencies.

In a recent article I have argued that money co-evolves with technology and financial innovations thus force us to re-examine its basic phenomenology.2 This short note revisits selected arguments and explains why the Austrian School of Economics – a more diverse group than generally acknowledged – is a good place to start. One reason is their strong interest in monetary economics in connection with the processes of social coordination. Another reason is their rare and profound concern with phenomenology, if we define phenomena as the essential nature and “meanings things have in our experience”.3 This is also true of Joseph Schumpeter (1883-1950), who refused to ‘swim in schools’, but shared a common intellectual heritage with his Austrian kin. He further contributed a special interest in technological change and industrial organisation that is highly relevant to the current agenda.

In what follows, I aim to highlight and critically examine the relevance of four Austrian ideas in the context of the recent waves of digitalisation with respect to money:

The latter idea has fuelled the imagination of many founders and proponents of private cryptocurrencies, such as Bitcoin. By consuming the requisite variety, however, processes of spontaneous order tend to converge towards a dominant form.4 In keeping with the beliefs of Ludwig Mises, Bitcoin, for example, is a bet that money as digital gold will become the winning design. In line with Hayek’s confidence in the benefits of currency competition, stablecoins and other cryptocurrencies aim to exploit and improve on Bitcoin’s obvious weaknesses.5

Economies of scale and scope, as well as direct and indirect network effects, suggest that the spontaneous market order resulting from currency competition is unlikely to remain contestable. Instead, control over the units of account may become a strategic decision variable in the competition between major digital platforms to expand their market power. Depending on the design, success and reach of private cryptocurrencies, they may create parallel systems that are widely trusted and convenient to use, and which ultimately also affect the ability of central banks to conduct monetary policy and act as lenders of last resort (‘digital dollarisation’).6 However, given the need for policy to respond to this challenge, money itself is unlikely to emerge from a purely spontaneous order arising from private self-interest and free markets even in the digital age. Instead, it will result from deliberate policy choices about the regulation of private crypto coins and the design of digital central bank currencies (CBDCs).

The leading authorities of the marginalist revolution viewed money primarily as a commodity that facilitates exchange. Among them, Carl Menger (1840-1921) combined a distinctive focus on social coordination with an interest in the fundamental nature and function of the constitutive elements of a phenomenon. By focusing on the emergence of money as a medium of exchange, Menger elaborated an evolutionary narrative of spontaneous order and emphasised the varying saleability of commodities. In this context, precious metals have intrinsic advantages, such as their durability, homogeneity, and divisibility, as well as comparably lower price fluctuations. As people strive to exchange less saleable goods for more saleable goods, the institution of money arises out of pure economic self-interest as a common mechanism of social coordination. Once they are adopted as a medium of exchange, network effects render such advantages self-reinforcing and cumulative. In other words, money did not have to be generated by law: “In its origin it is a social, and not a state-institution.”7

Menger’s interest in the economics of social coordination has become a defining characteristic of the heterogeneous members of the Austrian School and its kin. They all stand out as resolute adversaries of purely legalistic explanations of economic phenomena. Schumpeter pointedly expressed their attitude when he described the competing state theory of money8 as a mere “tempest in a teapot”:9

“Money is as little and in no other sense a creature of the law than is any other social institution such as marriage or private property. … Rather, the relevant legal provisions themselves are comprehensible only on the basis of the social nature and the social functions of the relations and modes of behaviour which these legal provisions regulate.”10

In other words, when government monopoly to issue fiat currency came to dominate the global monetary system, these were not merely sovereign choices. Though policy can seek to stabilise, improve on, or replace a spontaneous market order by deliberate design, it must thereby reflect the social and economic functions of money and enhance its resilience to crises.

Now asking what digitalisation means for the phenomenology of money, we must first acknowledge that radical technological changes can severely disrupt the current order of monetary circulation and enable the emergence of new varieties. If innovations are clustered, as Schumpeter claimed, swarms of incremental changes will follow in order to exploit the opportunities opened by punctuated radical breakthroughs.

In the current wave of radical changes, blockchain and distributed ledger technologies (DLT) challenge the state monopoly on money by means of new social consensus mechanisms that seek to displace the traditional backing of money with state authority, trust, and liabilities, just as the latter had once displaced the reliance on intrinsic commodity values. If unimpeded by public intervention, a new spontaneous order is therefore likely to evolve, as postulated by Menger. Whether such an uninhibited new order is ultimately desirable remains to be examined in the following sections.

Menger’s disciple Friedrich Wieser (1851-1926) had reservations about the paradigmatic individualism of his teacher’s theory of money. He placed a distinctive emphasis on the role of adoption because the masses establish “the universal practice which gives to a rule its binding force and social power.”11 Moreover, while Menger had laid the emphasis on spontaneous order and the intrinsic advantages of specie, Wieser stressed that the evolution of money is in flux. In particular, he pointed at a historical tendency towards its dematerialisation by an increasing separation of its services from the substance matter:12

“I confess to the often fought and, I believe, not refuted heretical opinion that … money is conceivable which, without receiving any value from its materials, i.e., without receiving any value from its ‘use’, would quite exclusively serve circulation and would thus be good money held in full value” (Wieser, 1904, p. 167).

At the time, Wieser’s non-commodity view stood in sharp contrast to the general view of sound money, which most economists regarded to be synonymous with a metallic standard. Ludwig Mises (1881-1973) in particular was an unconditional supporter of the classical gold standard. He took it for granted that policymakers would never manage a currency to the benefit of the public and demanded no less than that “[g]old must be in the cash holdings of everybody”.13 Conversely, Friedrich Hayek (1899-1992) generally preferred a managed currency, if it were less volatile than the supply of gold. Schumpeter most clearly sympathised with the principle of a managed fiat currency.14 What matters in practice, however, is the level of trust and security a society can place in its public institutions and especially in money as legal tender.

From today’s perspective, Wieser’s assertion that money is evolving into ever more immaterial forms has obviously come true and should no longer be disputed. From the early debasement of coins to the evolution of novel credit instruments, bills of exchange or banknotes, the expansion of business and trade has generally induced the use of more economical and less material forms of circulation. Digital transfers, digital accounts, and digital cash are merely the latest and logical steps in this evolution. However, these developments have not laid to rest the classic controversy about what constitutes ‘sound money’. Bitcoin in particular was deliberately conceived as the digital reincarnation of gold,15 thus implicitly reconciling Mises’ conviction with Wieser’s hypothesis of the dematerialisation of money.

Joseph Schumpeter regarded money neither as a commodity nor as a good, but as a claim ticket to the social product. It originates in the liability of an issuer, who is trusted to hold the according assets. Attention must accordingly shift from money as a definite object to its representation of shares in the mass of goods and from its functions as a medium of exchange and store of value to that of a unit of account.16

While his concept of money has generally received little attention so far, its importance and appreciation in the canon of economics are bound to change with digitalisation. An important example is Brunnermeier et al (2019), who define an independent currency as a collection of payment instruments denominated in the same unit of account and fully convertible. In doing so, they explicitly aim “to ensure that monetary instruments are linked to a currency via their unit of account rather than their properties as exchange media.”17

Early on, Schumpeter had worked out the importance of money for the formation of equilibrium prices through implicit trade in a common unit of account, as it enables the efficient comparison of relative prices for different goods. Money therefore matters even if no actual transaction takes place, and no medium is exchanged.18 He later illustrated this function with the hypothetical case of a fully socialised clearing mechanism that could eventually obviate the need for direct monetary transactions (just as coins and other forms of money had once eliminated the need for physical barter). His primary intention was to show that even an idealised socialist system must be monetised in some way. Long before the age of electronic payments and digital currencies, he thereby envisioned a system of universal current accounts:

“The generalized notion of this current account relationship, i.e. the idea that everyone’s economic acts are recorded on a real or imaginary current account, is extremely revealing and so useful for grasping the social connections and processes that make up the monetary and credit system that one could call it the basic concept of monetary theory” (Schumpeter, 1970, p. 127).

In short, Schumpeter’s concept of money corresponds strikingly well with the abstract notion of a general ledger that maps all relevant economic data (including contracts, production and transactions) and records their changes.19 At the end of the 20th century, this idea became more intelligible with the notion of money as memory, i.e., a record-keeping device to maintain balances.20 Since digital data can be easily copied for multiple uses, digitisation brings this aspect further to the fore. Nakamoto (2008) untied the Gordian knot of the double-spending problem by conceiving Bitcoin as a blockchain of digital signatures. Thereby, the modern technology of distributed ledgers must no longer be trusted to a single central authority but can be distributed to the individual members of a network.

Aiming to automate trust through rules and algorithms, the redundancy of distributing a real-time copy of the general ledger to each participant (or to a restricted group of authorised members) is essential for securing the integrity of the accounts. It also impedes the shift of control from the individual to the state. But as Auer et al. (2021) point out, the optimal design of such ledgers requires a balance between the goal of decentralisation and the goals of scale and security of a network. Whether this should happen through self-organisation and spontaneous order from pure market processes or through deliberate public regulations and political choices is up for debate. At this point, however, it is safe to say that technological progress has finally brought the idea of a complete ledger of past transactions “within the reach of every economic agent”.21

In his early years Friedrich Hayek had elaborated ideas of Mises and others into a monetary theory of the business cycle. In the 1970s, after the convertibility of the dollar into gold had ended, he turned again to monetary questions and advocated free competition between privately managed currencies. This differed from the well-known principle of free banking, which he considered valid only as long as commercial banks had to redeem in specie the notes they issued in the form of a single national currency.22 Instead, Hayek proposed more radically to abolish the national monopoly of legal tender and to open currencies to free competition even within a national territory. Provided that international capital flows between participating countries were fully liberalised, and believing in the virtues of long-term competitive equilibrium, Hayek argued that only the most stable currencies would survive without government intervention:

“I have now no doubt whatever that private enterprise, if it had not been prevented by government, could and would long ago have provided the public with a choice of currencies, and those that prevailed in the competition would have been essentially stable in value and would have prevented both excessive stimulation of investment and the consequent periods of contraction” (Hayek, 1976/90, p. 14).

Hayek introduced these ideas at a time of high inflation and turbulence in the international monetary system. Accordingly, he considered currencies to compete primarily in their function as liquid stores of value. Although his proposal had little impact at the time, the idea was vigorously revived in the later movement for decentralised finance (DeFi), which combined Hayek’s libertarian ideals with the technical prowess of the internet generation.

Schumpeter would certainly have endorsed the idea of contestability and discipline imposed on governments by the constant stream of financial innovation. However, he would have doubted Hayek’s confidence in an enduring welfare-optimal equilibrium of unfettered competition between currencies within a national territory. Instead, he would have paid particular attention to the impact of technological change on the industrial organization of digital markets. The extraordinary growth and market dominance of the big American tech companies (MAMAA)23 are a clear reminder of his late warning and gloomy predictions about the increasing trustification of a post-capitalist society.24

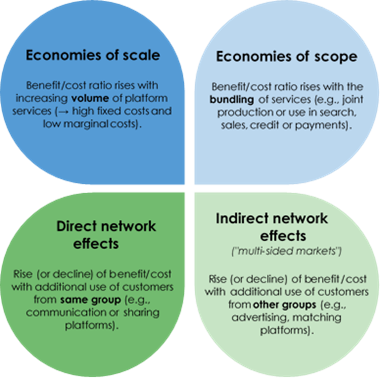

A tendency towards market concentration and winner-take-all dynamics is evident, as today’s most successful digital platforms thrive on leveraging their dominant position in one area to extend their competitive advantage in others. The factors for their success are manifold, ranging from traditional economies of scale and scope to direct and indirect network effects (Figure 1). When different customer groups interact on a common platform, there are many opportunities for platform operators to optimise their business models and pricing strategies accordingly.25 In money and payments, economies of scale and network effects arising from the costs of reporting, searching, and comparing prices in different competing currencies also favour the emergence of a dominant unit of account. Similarly, transactions within an integrated universal ledger should ultimately be faster, more reliable, and cheaper. Yet there can also be exceptions where people prefer to use different ledgers for specific purposes within relatively small and closed communities (e.g., because they trust them more in terms of data and the security of accounts).

To conclude, within a well-integrated platform ecology of related activities, the low marginal costs of individual transactions, combined with the fixed costs borne by the platform, leave much scope to favour transactions in a preferred unit of account, e.g., a proprietary platform coin. In addition, the platforms’ privileged access to data on their customers’ financial transactions and social networks raises concerns about data protection and fair competition in associated financial services, such as information-sensitive lending.26 Even as transaction costs fall rapidly due to the fast-paced progress of information and communication technologies, consolidation is therefore likely to prevail at least in the most populated virtual marketplaces. Hence, one should rather abandon idealised speculations about unfettered currency competition in the long run. In the age of digital platforms, a likely scenario for the new spontaneous order resulting from currency competition is that the largest digital platforms may ultimately seek to contract in their own unit of account, thereby cementing their dominance and further extending their reach at the expense of smaller contenders.

Figure 1: Typology of general platform effects

Note: See, e.g., Belleflamme and Peitz (2021).

The above considerations aimed to highlight both the diversity and relevance of many Austrian ideas about money and its evolution to some of the key issues in the context of digital money. Finally, the following discussion will turn to the question of digital central bank currencies (CBDCs) as a likely consequence of these developments. Again, the scholars mentioned above could not have anticipated any of it in concrete form at their time. Yet one can safely assume that it would have attracted their utmost interest and attention, as well as sparked intense scholarly debates, if they had ever encountered it.

The above scenario of unfettered currency competition with dominance of (a few) big tech commercial platforms threatens to undermine the existing monetary order and leave the responsibility for the efficiency of the system and the public good of financial stability to the rationale of private profit maximisation.27 The traditional policy tools to address such challenges are regulatory rules and restrictions. But the global reach of digital platforms and initiatives renders international coordination particularly difficult and regulatory arbitrage very likely. An alternative policy option is for the monetary authority to expand its current activities and make greater use of the technological opportunities by itself. In particular, it may decide to issue a CBDC as a means of payment available to the public and representing liabilities of the central bank.28

While some authors call CBDCs a solution in search of a problem29 or fault them for lacking a unique selling proposition,30 others already consider them a foregone conclusion.31 With the notable exception of the People’s Bank of China (PBC),32 the major central banks continue to take a cautious stance. However, when the ECB recently announced the launch of experimental investigations into a digital euro,33 Panetta (2021) explicitly addressed the above-mentioned fears of a growing dominance of the large technology platforms in the retail payments market:

“A digital euro would level the playing field and encourage innovation by enabling competing providers – large and small – to build on it. By providing services with ‘digital euro inside’, European intermediaries would be in a position to strengthen the services they offer to their customers and stay competitive even as global tech giants expand into payments and financial services. And central bank money would remain at the heart of the payment system, strengthening Europe’s autonomy in the age of digital money” (Panetta, 2021).

The Federal Reserve has generally shown less enthusiasm for a CBDC than its European counterpart. Yet, if we replace the European interest in greater strategic autonomy with the US concern to defend the dominant international position of the dollar,34 we find the same rationale of preserving competition and innovation in financial services among the main arguments in favour of a CBDC:

“A CBDC might also help to level the playing field in payment innovation for private-sector firms of all sizes. For some smaller firms, the costs and risks of issuing a safe and robust form of private money may be prohibitive. A CBDC could overcome this barrier and allow private-sector innovators to focus on new access services, distribution methods, and related service offerings” (Board of Governors of the Federal Reserve System, 2022, p. 15).

The proponents of a CBDC also point to other advantages, such as low transaction costs, especially cheaper cross-border payments. In times of crisis, the use of smart contracts can also be used to condition public aid on desired (spending) activities by recipients. Better targeting of interventions could therefore help to reduce their extent. Also, the possible interest paid on CBDCs is an additional monetary policy tool, which some believe could even allow targeting a stable price level with zero inflation. Others point at the possibility of lowering the interest rate beyond the effective lower bound (ELB) at which people would exchange their account balances for cash.35

To allow for the latter option, however, CBDCs must largely displace cash from circulation. This would raise at least three new problems:36 To begin with, cash does not require special technical devices and is therefore the most inclusive means of payment. Second, cash adds variety and thus increases the resilience of the payment system in the event of a technical breakdown of the digital infrastructure. Finally, cash is the most anonymous and least traceable medium of exchange. Unlike blockchains, no records are kept of who paid or what was paid for.

But money co-evolves with technology. And once problems are properly perceived, they are likely to lead to new solutions. One example could be hybrid banknotes, which can serve as a physical store of value and an anonymous medium of exchange, but also enable electronic transactions that bring the money back into the digital circulation if desired.37 If introduced in combination with a CBDC, such smart cash may address prevalent problems of financial inclusion and privacy. Wieser’s hypothesis of an increasing dematerialisation of money notwithstanding, the costly redundancy of maintaining a hybrid cash-based and electronic payment system would also be justified as a civil defence measure that increases the resilience of an economy should natural disasters, technical failure or targeted cyber attacks ever paralyse the electronic payment infrastructure.

There is also ample scholarly discussion about the dangers and potential pitfalls of a CBDC. Particularly prominent is the fear of bank disintermediation and an associated greater risk of bank runs. Various design principles are discussed to prevent such effects.38 Nevertheless, many savings in transaction costs will be realised at the expense of current bank revenues, which must lead to considerable political resistance to such reforms.39 Panetta (2018) therefore points out that disruptions in the banking sector could be mitigated if central banks only offer demand deposits with low remuneration, while banks can compete on additional services (e.g. credit and payment services) and have better access to wholesale funding. Overall, central banks seem determined to maintain the current division of labour, credibly emphasising that commercial banking is way beyond their competences. In this way, the banking sector may ultimately prefer a monetary system anchored by the central banks and offering recourse to a lender of last resort instead of an anchorless system likely to be dominated by a few global big tech players.

To conclude, digitalisation reduces the technical barriers to currency substitution, which in turn affects the ability of central banks to conduct monetary policy, act as lenders of last resort and earn seigniorage. As CBDCs become more attractive and convenient to use, their issue can ceteris paribus strengthen an economy’s position in global currency competition. However, CBDCs cannot compensate for or mask underlying economic weaknesses, such as a lack of trust in macroeconomic policies and institutions or inferior productivity growth in an economy. On the contrary, economic areas that fail in this regard may be punished more severely and swiftly than before. Apart from the need to catch up with the private sector in terms of technology, the rise of digital currencies will therefore demand more rather than less discipline and prudence in public policy.

Agur I., Ari A., Dell’Ariccia G., 2022. Designing Central Bank Digital Currencies, Journal of Monetary Economics 125, 62-79, https://doi.org/10.1016/j.jmoneco.2021.05.002

Allen S., Capkun S., Eyal I., Fanti G., Ford B., Grimmelmann J., Juels A., Kostiainen K., Meiklejohn S., Miller A., Prasad E., Wüst K., Zhang F., 2020. Design Choices for Central Bank Digital Currency: Policy and Technical Considerations, Global Economy & Development Working Paper 140, Washington: Brookings Institution.

Ahya C., Kam D., Richers J., 2021. Digital Disruption: The Inevitable Rise of CBDC, SUERF Policy Note No. 241, https://www.suerf.org/policynotes/25525/digital-disruption-the-inevitable-rise-of-cbdc

Auer R., Cornelli G., Frost J., 2020, Rise of the Central Bank Digital Currencies: Drivers, Approaches and Technologies, BIS Working Papers No. 880, Basel: Bank for International Settlements.

Auer R., Monnet C., Shin H.S., 2021. Distributed Ledgers and the Governance of Money, Munich: CESifo Working Papers.

Barrdear J., Kumhof, M., 2016. The Macroeconomics of Central Bank Issued Digital Currencies, Staff Working Paper No. 605, London: Bank of England.

Belleflamme P., Peitz M., 2021. The Economics of Platforms, Cambridge UK: Cambridge University Press.

Berg C., Davidson S., Potts J., 2019. Understanding the Blockchain Economy. An Introduction to Institutional Cryptoeconomics, Cheltenham UK: Edward Elgar.

Bindseil U., 2019. Controlling CBDC Through Tiered Remuneration, SUERF Policy Note No. 95, https://www.suerf.org/policynotes/7321/controlling-cbdc-through-tiered-remuneration.

Bindseil U., Papsdorf P., Schaaf J., 2022. The Encrypted Threat: Bitcoin’s Social Cost and Regulatory Responses, SUERF Policy Note No. 262, https://www.suerf.org/policynotes/38771/the-encrypted-threat-bitcoins-social-cost-and-regulatory-responses.

Bofinger P., Haas T., 2021. CBDC: Where is the Unique Selling Proposition? SUERF Policy Note No. 228, https://www.suerf.org/policynotes/21529/cbdc-where-is-the-unique-selling-proposition

Bordo M.D., Levin A.T., 2018. Central Bank Digital Currency and the Future of Monetary Policy, in: Bordo M.D., Cochrane J.H., Seru A. (eds.), The Structural Foundation of Monetary Policy, Hoover Institution Press, Stanford, 143-178.

Brooks S., 2021. Revisiting the Monetary Sovereignty Rationale for CBDCs, Staff Discussion Paper 2021-17, Ottawa: Bank of Canada.

Brunnermeier M.K., James H., Landau J.-P., 2019. The Digitalization of Money, Working Paper No. 26300, Cambridge MA: NBER.

Brunnermeier M.K., Niepelt D., 2019. On the Equivalence of Private and Public Money, Journal of Monetary Economics 106, 27-41.

Catalini C., de Gortari A., 2021. On the Economic Design of Stablecoins, Available at SSRN: https://ssrn.com/abstract=3899499 or http://dx.doi.org/10.2139/ssrn.3899499

CSIS, 2020. How Will a Central Bank Digital Currency Advance China’s Interests? London: Center for Strategic and International Studies, https://chinapower.csis.org/china-digital-currency (accessed on 20. 08. 2020).

Cukierman A., 2019. Welfare and Political Economy Aspects of a Central Bank Digital Currency, Discussion Paper No. 13728, London: CEPR.

Economic Affairs Committee, 2022. Central Bank Digital Currencies: A Solution in Search of a Problem? London: House of Lords.

Engert W., Fung B.S.C., 2018. Motivations and Implications of a Central Bank Digital Currency, in: Gnan E., MasciandaroB D. (eds.), Do We Need Central Bank Digital Currency? Conference Proceedings 2018/2, Vienna: SUERF – the European Money and Finance Forum, 56-71.

Eichengreen B., 2022. Digital Currencies – More than a Passing Fad? in: Current History, January 2022, 24-29.

European Central Bank, 2020. Report on a Digital Euro, Frankfurt: European Central Bank.

Evans D.S., Schmalensee R., 2016. Matchmakers. The New Economics of Multisided Platforms, Boston MA: Harvard University Press.

Board of Governors of the Federal Reserve System, 2022. Money and Payments: The U.S. Dollar in the Age of Digital Transformation, https://www.federalreserve.gov/publications/money-and-payments-discussion-paper.htm

Gnan E., Masciandaro D. (eds.), 2018. Do We Need Central Bank Digital Currency? Conference Proceedings 2018/2, Vienna: SUERF – the European Money and Finance Forum.

Gorton G.B., Ross C.P., Ross S.Y., 2022. Making Money, Working Paper No. 29710, Cambridge MA: NBER.

Hayek F.A., 1976/1990. Denationalisation of Money: The Argument Refined. An Analysis of the Theory and Practice of Concurrent Currencies (3rd edition), London: Institute of Economic Affairs.

Keynes J.M., 1923. A Tract on Monetary Reform, London: Macmillan.

Klein A., 2020. China’s Digital Payments Revolution, Washington: Brookings Institution.

Knapp GF., 1905/1924. The State Theory of Money, London: Macmillan.

Kocherlakota N. R., 1998a. Money is Memory, Journal of Economic Theory 81 (2), 232 – 51.

Kocherlakota N. R., 1998b. The Technological Role of Fiat Money, Federal Reserve Bank of Minneapolis Quarterly Review 22 (3), 2-10.

Kumhof M., Noone C., 2018. Central Bank Digital Currencies – Design Principles and Balance Sheet Implications, Staff Working Paper No. 725, London: Bank of England.

Lipkin A., 2021. Cryptobanknotes: Hybrid Banknote Technology for Today, Washington: Noll Historical Consulting.

Nakamoto S., 2008. Bitcoin: A Peer-to-Peer Electronic Cash System, https://bitcoin.org/bitcoin.pdf.

Menger C., 1892. On the Origin of Money, The Economic Journal 2 (6), 239-255.

Mises L., 1912/1953. Theorie des Geldes und der Umlaufsmittel, Berlin: Duncker & Humblot [quoted from the English translation (with part IV added), The Theory of Money and Credit, New Haven: Yale University Press].

Panetta F, 2018. 21st Century Cash: Central Banking, Technological Innovation and Digital Currencies, in: Gnan E., Masciandaro D. (eds.), Do We Need Central Bank Digital Currency? Conference Proceedings 2018/2, Vienna: SUERF – the European Money and Finance Forum, 23-32.

Panetta F., 2021. Preparing for the Euro’s Digital Future, Frankfurt am Main, 14 July 2021: The ECB Blog: https://www.ecb.europa.eu/press/blog/date/2021/html/ecb.blog210714~6bfc156386.en.html

Peneder M., 2021. Digitization and the Evolution of Money as a Social Technology of Account, Journal of Evolutionary Economics, DOI 10.1007/s00191-021-00729-4

Peneder M., 2022. Systemdynamik und Evolutionärer Wandel, in: Lehmann-Waffenschmidt M., Peneder M. (Eds.), Evolutorische Ökonomik. Konzepte, Wegbereiter und Anwendungsfelder, Berlin, Springer (forthcoming).

Peneder M., Resch A., 2021. Schumpeter’s Venture Money, Oxford: Oxford University Press.

Pichler P., Summer M., Weber B., 2019. Does Digitalization Require Central Bank Digital Currencies for the General Public? OeNB Monetary Policy & The Economy Q4/19, 40-56.

Prasad E.S., 2021. The Future of Money. How the Digital Revolution is Transforming Currencies and Finance, Cambridge MA: Harvard University Press.

Rochet J.C., Tirole J., 2003. Platform Competition in Two-Sided Markets, Journal of the European Economic Association 1 (4), 990-1029.

Schumpeter J.A., 1917-18/1956. Das Sozialprodukt und die Rechenpfennige. Glossen und Beiträge zur Geldtheorie von Heute, in Archiv für Sozialwissenschaft und Sozialpolitik 44, 627-715 (quoted from the English translation by A.W. Marget “Money and the Social Product“, International Economic Papers 6: 148-211).

Schumpeter J.A., 1942/50. Capitalism, Socialism and Democracy, 3rd edition, New York: Harper & Row.

Schumpeter J.A., 1954. History of Economic Analysis, Oxford: Oxford University Press.

Schumpeter J.A., 1970. Das Wesen des Geldes, Göttingen: Vandenhoeck & Ruprecht.

Tobin J., 1985. Financial Innovation and Deregulation in Perspective, Bank of Japan Monetary and Economic Studies 3 (2), 19-29.

Tobin J., 1987. The Case for Preserving Regulatory Distinctions, Proceedings of the Economic Policy Symposium, Jackson Hole, Federal Reserve Bank of Kansas City, 167-183.

Waller C.J., 2021. CBDC – A Solution in Search of a Problem, Speech at the American Enterprise Institute, Washington, D.C., 5 August 2021,

https://fraser.stlouisfed.org/files/docs/historical/federal/20reserve/20history/bog_members_statements/waller20210805a.pdf

Wieser F., 1904. Der Geldwert und seine geschichtlichen Veränderungen, Zeitschrift für Volkswirtschaft, Sozialpolitik und Verwaltung, XIII, Wien.

Wieser F., 1914/1927. Theorie der gesellschaftlichen Wirtschaft, J.C.B. Tübingen: Mohr (2nd ed. 1924; English translation as Social Economics, New York: Adelphi).

Wieser F., 1927. Geld, in Handwörterbuch der Staatswissenschaften, 4th ed., Vol. IV, Jena.

Yao Q., 2018. A Systematic Framework to Understand Central Bank Digital Currency, Science China: Information Science 61 (3): 033101.

Michael Peneder, Austrian Institute of Economic Research, Arsenal Obj. 20, 1030 Vienna, Austria, Tel: +43-1-7982601-480, E-mail: Michael.Peneder@wifo.ac.at

Peneder (2021).

https://plato.stanford.edu/entries/phenomenology/. Note that the founder of social phenomenology, Alfred Schütz (1899-1959), was also a student of Friedrich Wieser and Ludwig Mises and later a teacher of Peter L. Berger and Thomas Luckman, best known for their contributions to the sociology of knowledge and communication.

Peneder (2022).

Bindseil et al (2022), Catalini and de Gortari (2021).

Brooks (2021).

Menger (1892, p. 252).

Knapp (1905/1924).

Schumpeter (1954, p. 1090).

Schumpeter (1917-18/1956, p. 160).

Hence, “money represents something more and stronger than the will of participating individuals” (Wieser, 1914/1927, p. 162, 165).

Wieser (1927, p. 693).

Mises (1953, p. 415, 451).

“Money is not a commodity – not even when it happens to consist of a valuable material.” Also, “it is not essential for money to consist in something, or to be covered by something, that has an economic value of its own” (Schumpeter, 1917-18/1956, p. 161).

Mimicking the limited supply of gold while also capitalising on the (in)famous “prestige of its smell and colour” (Keynes, 1923, p. 172).

Peneder and Resch (2021).

Brunnermeier et al (2019, p. 5).

Ibid. p. 7.

Berg et al. (2019, p. 59).

Kocherlakota (1998a, b).

Auer et al. (2021, p.2).

See also Gorton et al (2022).

That is, Meta, Apple, Microsoft, Amazon and Alphabet (https://fortune.com/2021/10/29/faang-mamaa-jim-cramer-tech-facebook-meta/).

Schumpeter (1942/50).

Rochet and Tirole (2003), Evans and Schmalensee (2016), Belleflamme and Peitz (2021).

The private Chinese digital payment services Alipay and WeChat Pay have already demonstrated the powerful leverage of network effects in the multi-sided ecosystem of commercial and social media platforms. See, e.g., Klein (2020).

Brunnermeier et al (2019, p. 28).

The idea goes back to James Tobin (1985, 1987), who is best known as a Keynesian economist but was also a student of Schumpeter at Harvard.

Waller (2021), Economic Affairs Committee (2022), Eichengreen (2022).

Bofinger and Haas (2021).

Ahya et al (2021), Prasad (2021).

Yao (2018), CSIS (2020).

See also European Central Bank (2020).

“The dollar’s international role benefits the United States by, among other things, lowering transaction and borrowing costs for U.S. households, businesses, and government. The dollar’s international role also allows the United States to influence standards for the global monetary system” (Board of Governors of the Federal Reserve System, 2022, p. 15).

Barrdear and Kumhof (2016), Bordo and Levin (2018), Engert and Fung (2018).

Pichler et al (2019, p. 42f).

Lipkin (2021).

For instance, Agur et al (2022), Allen et al (2020), Auer et al (2020), Bindseil (2019), Brunnermeier and Niepelt (2019), Gnan and Masciandaro (2018) or Kumhof and Noone (2018).

Cukierman (2019, p. 18).