By endorsing the Paris Agreement on climate change, the European Union (EU) has committed itself to a path of sustainable economic growth. Innovation in the field of environmental technology (Greentech) has the potential to significantly reduce the costs associated with the EU’s green transition. The European Greentech sector has experienced exponential growth in recent years and a well-developed Private Equity (PE) and Venture Capital (VC) ecosystem is an important prerequisite for its continued development. In light of its importance to the European green transition, this research note discusses the current state of the European PE/VC market and its relevance for the financing of Greentech companies.

By endorsing the Paris Agreement on climate change, the European Union (EU) has committed itself to a path of sustainable economic growth. In the EU Green Deal communication, the European Commission presented its vision on how to transform the European Union to reach climate neutrality by 2050, protect bio-diversity and promote a circular economy. The Green Deal will prove to be vastly consequential for all segments of the EU economy and will have significant repercussions on European SMEs’ investment behaviour and finance needs. At the same time, the pending green transition also brings about a wave of opportunity, in particular for innovative start-ups and other SMEs, as rising demand for green products and services presents unprecedented growth potential for the EU economy.

The European Greentech sector is a key player in Europe’s net-zero strategy. Greentech innovations provide technological solutions for environmental issues and thereby lower the cost of greenhouse gas abatement or pollution reduction for other societal actors.2 They can also help EU firms to adapt to the reality of an altered climate, for example, through innovations in the field of crop management or irrigation techniques in agriculture, better weather forecasting technologies, or advances in the field of disease control. By supporting the Greentech sector, policy makers can ensure the EU transitions to climate-neutrality and addresses other important environmental issues in a cost-efficient manner. Moreover, it can position the EU as a global market leader in the field of Greentech technology.

A healthy Greentech ecosystem can only thrive in a well-developed private equity (PE)/venture capital (VC) environment. In recent years, the European ecosystem for risk capital has experienced healthy growth, reaching pre-financial crisis levels at the onset of the COVID-19 pandemic. These markets are vital in ensuring sufficient availability of innovation finance and constitute an essential source of funding for start-ups and high-growth companies.

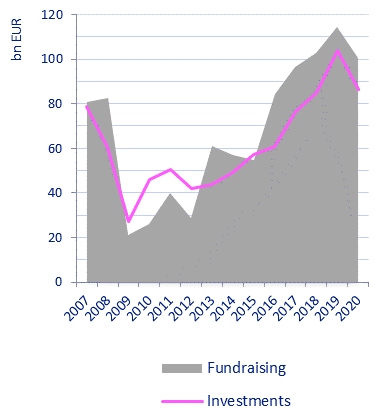

Overall, the European PE/VC ecosystem weathered the crisis reasonably well, despite some measurable harm inflicted by the physical restrictions imposed during the initial 2020 lockdowns. Over the entire year 2020 considered, COVID-19 had a negative, yet small impact on European PE markets (Figure 1). PE funds located in Europe raised over EUR 100bn in 2020, a slight decline compared to the record year 2019. PE funds’ investment activity also declined slightly to EUR 86bn (-17%). Consequently, PE investment into European companies decreased as well, dropping by 12.4%.

Figure 1: Recent trends in the European PE sector

| a) Fundraising and invested amounts by European PE firms | b) Investments into European companies |

|

|

Source: Kraemer-Eis et al. (2021) based on Invest Europe.

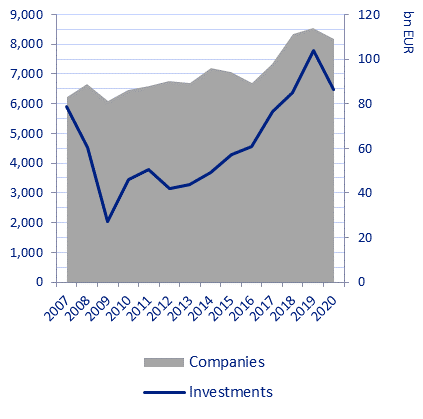

The VC market, the PE segment most relevant for risk finance for young, innovative start-ups, even exhibited growth during the 2020 crisis year. By the end of the year, VC firms that were forced to operate under strict lockdown measures had already caught up in terms of activity rate, in terms of deals, as well as volumes (Crisanti et al, 2021). VC investments into European companies rose by 7%, contrary to the declining trend in the aggregate PE market, reaching a record volume of EUR 12bn, primarily driven by significant growth in the late-stage investment market (Figure 2). Investment volumes in the market for seed financing, however, lagged, hovering just below EUR 1bn, a threshold that has proven a barrier of resistance.

Figure 2: VC investments into European companies

Source: Kraemer-Eis et al. (2021), Invest Europe.

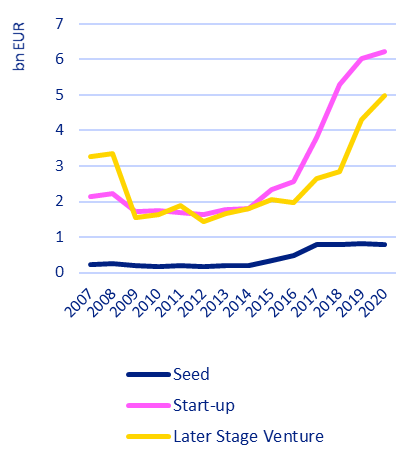

VC and PE fund managers’ expectations for the forthcoming period have improved. The results of the most recent EIF VC Survey3 show that, despite the ongoing challenges posed by the pandemic, optimism among VC fund managers has reached pre-crisis levels (Botsari et al., 2021). However, the market remains plagued by significant challenges. The strong post-pandemic recovery has led to a surge in competition among investors, which boosted start-up valuations and has made fundraising more challenging (Figure 3).

Figure 3: VC investments into EU companies

Diagram shows the results for the EIF VC Survey 2021 question “Please select the biggest challenges you currently see in the VC business.” The graph shows the total percentage of responses with respect to the items selected by each respondent as their three most important challenges (as far as applicable). The number in brackets [ ] corresponds to the ranking of the respective challenge in the EIF VC Survey Autumn 2020.

Source: Botsari, Kiefer, Lang, and Legnani (2021), based on EIF VC Survey 2021.

Overall, the entire Venture Capital ecosystem in Europe has continued to mature over the past years. It showed strong resilience during the Pandemic and performed well ahead of expectations in terms of investment activity (also in 2021). However, this is not to say that this ecosystem is set to face a smooth road ahead. For example, structural issues surrounding scale-up financing have even worsened during the COVID-recession. In this context there are also issues related to the exit environment as well as a lack of European institutional money in the VC market.

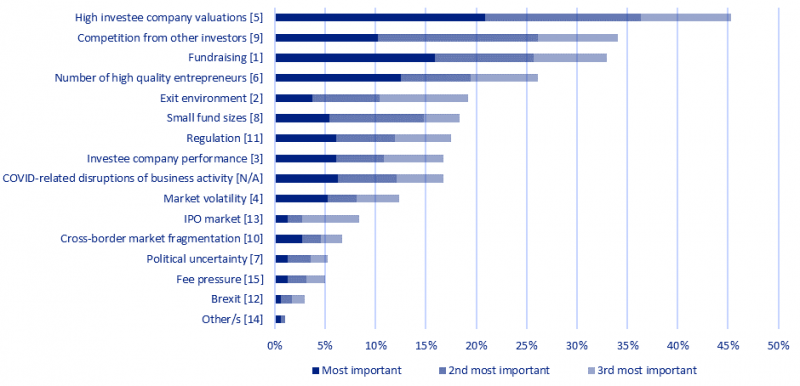

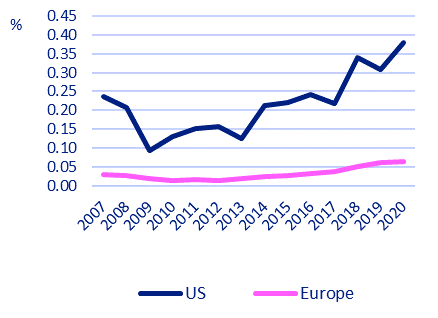

Moreover, European VC markets continue to lag their global peers. Concerns about the European fundraising environment are corroborated by the widening gap between the European and US markets that occurred in the wake of the COVID-19 pandemic (Figure 4). Therefore, given the crucial role of PE and VC markets in Europe’s green transition, it remains vital for EU policy makers to provide continued support to this European ecosystem in order to guarantee progress in the sectors’ development and to ensure a consistent supply of innovation finance to Europe’s Greentech companies.

Figure 4: VC Fundraising, Europe vs US

Source: Kraemer-Eis et al. (2021), Invest Europe.

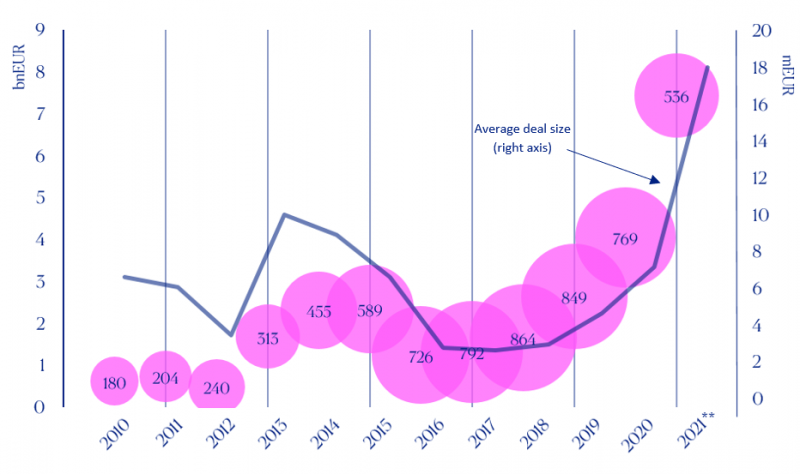

Greentech innovation financing has been on the rise in recent years (Figure 5). After a minor set-back during the period 2013-2016, VC and PE growth investments4 in European Greentech companies rose sharply from 2017 onwards, reflecting the growing societal concerns about environment and sustainability and the increased focus of EU policy makers on private financing as a catalyst for the green revolution.

Figure 5: Innovation finance for European Greentech companies (VC + PE scale-up, EU-27)*

* The bubble surface area indicates annual number of deals.

** Incomplete yearly total at the time of data extraction (18/10/2021).

Source: Kraemer-Eis et al. (2021), PitchBook.

The European Greentech sector continued to expand steadily during the COVID-19 pandemic. Over 2020, investments in EU Greentech companies increased by 53%, outpacing the general market significantly. The growth rate of Greentech finance accelerated further during the first three quarters of 2021 and the data available at the time of writing indicates that upon continuation of the current growth trend, the EU Greentech VC + scale-up market will have doubled by the end of the year.

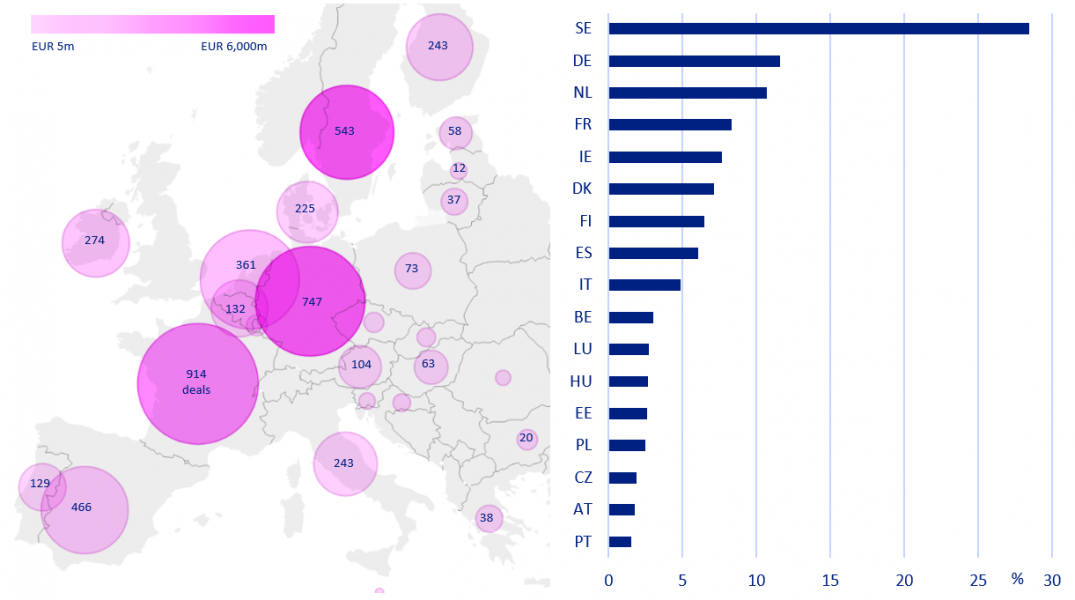

In recent years, Sweden has been the key hub in the EU-27 Greentech ecosystem (Figure 6). With a total investment volume of nearly EUR 6bn since 2015, it is the largest beneficiary of Greentech financing in Europe. Punching well above its weight, it even exceeds the German market, where the total deal volume amounted to EUR 4.3bn. Swedish Greentech companies attracted no less than 28% of total Swedish VC and scale-up financing during that period.

Figure 6: Geographical distribution of the EU-27 Greentech ecosystem (2015-Q3/2021)

| a) Number of deals by country | b) Share Greentech in VC+scale up ecosystem, selected countries |

Source: Kraemer-Eis et al. (2021), PitchBook.

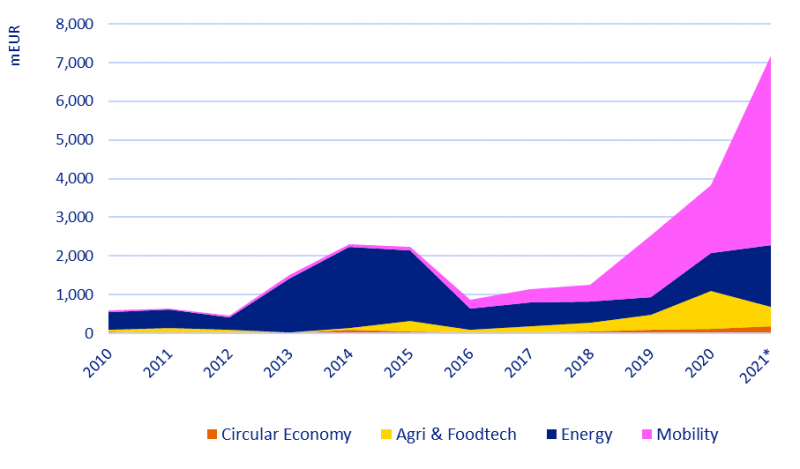

Considered over the combined period 2015-Q3/2021, the vast majority of total investments (VC+scale-up) in the European Greentech sphere were accounted for by the energy and mobility sectors (Figure 7). While businesses in the energy sector have been popular investment targets during the previous decade, the mobility segment has grown exponentially in recent years. Since 2015, business focussing on transport and energy solutions, such as electric vehicles (EVs), EV batteries, e-scooters, IT-platforms for shared micro-mobility solutions, hydrogen power technologies with applications in transport, EV technology in the aviation industry, etc., have received nearly half of total Greentech financing. In particular, post-COVID, the dominance of the sector grew markedly. Over the first three quarters of 2021, mobility financing accounted for nearly 70% of investment volumes in the Greentech market. Also investments into Agritech5 have grown significantly over the past decade. The circular economy sector (dominated by recycling and waste management technology) has been slow to catch up and makes up only a negligible part of the total market. The relative underdevelopment of this important subsegment of the EU Greentech market signals ample scope for policy makers to support innovation financing and further advance the sectors’ growth potential.

Figure 7: Sectoral focus of EU-27 Greentech companies

*Incomplete year total at the time of data extraction (19/10/2021).

Source: Kraemer-Eis et al. (2021), PitchBook.

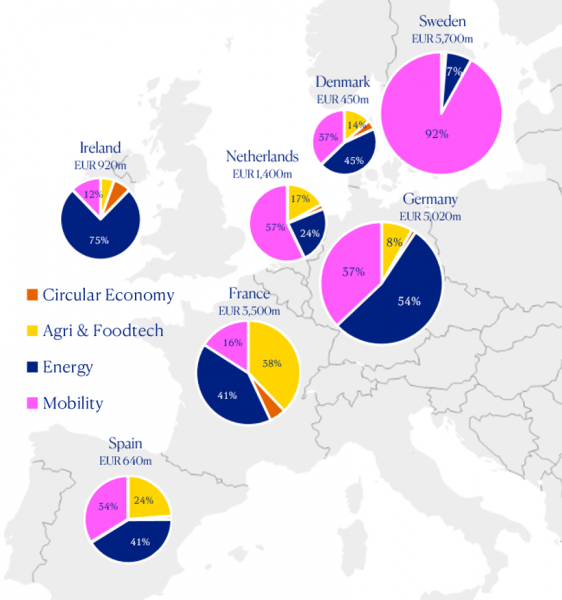

There is pronounced heterogeneity in the environmental focus of national Greentech ecosystems (Figure 8). Considered over the period 2015-2021, the Swedish and Dutch markets were predominantly focused on mobility, whereas the German and Irish Greentech ecosystems have been more energy-orientated. The centre point of the European Agri- and Foodtech ecosystem is located in France, where this segment accounted for 38% of total French Greentech investment volume, substantially exceeding the share of other countries considered.

National differences in environmental focus of Greentech investments could be reflective of differences in national policy priorities, which in turn partially depend on economic sectoral structures and associated differences in national sectoral emission distributions. France, for example, has a large agricultural sector compared to other EU Member States, potentially explaining why their Greentech financing ecosystem disproportionally focusses on agricultural innovations. Germany’s emissions, on the other hand, are driven disproportionally by electricity generation. This correlates indeed with its Greentech investment focus in the field of energy solutions. Sweden has always been a front-runner when it comes to sustainable mobility, which also in this case correlates with the environmental focus of their Greentech ecosystem.

Figure 8: Environmental focus* of the largest European local Greentech ecosystems (2015-Q3/2021)

* As measured by the distribution of total investment volume (VC + scale-up) in a country’s Greentech ecosystem across different subsegments considered.

Source: Kraemer-Eis et al. (2021), PitchBook.

Public support for Europe’s Greentech risk finance ecosystem is vital, as PE and VC markets are typically plagued by market failures. By nature, these markets are characterised by information asymmetries, leading to an inefficiently low supply of risk-finance. Therefore, public involvement in the VC investment market is associated with several key benefits. Public investors’ participation in PE/VC funds targeting innovative Greentech companies has a positive signalling effect on private investors, e.g. due to perceived strong due diligence requirements and an assumed higher stability of public LPs’ commitment to a fund. Moreover, public finance contribution can unlock private financing and exert an important leverage effect on the market. The success of public intervention in the VC investment market depends on the relationship between private VC activities and government policy programs. Governmental VC schemes are found to be most successful when acting alongside private investors, which favours a governmental fund-of-funds set-up over direct public investments (Colombo, Cumming and Vismara, 2014; see also Kraemer-Eis et al., 2021, for an overview of related studies).

The very nature of Greentech innovation implies that finance support should follow-up all the way through the innovation development life cycle, from the start-up to the scale-up phase. Start-ups working on cutting-edge technology (deep-techs) are typically characterised by a long R&D phase (deep-tech), involving large capex needs to finance production lines or computing power, requiring access to long-term funding sources for scale-up financing. To address the Greentech funding gap, the Word Economic Forum proposes the use of blended finance approaches, through a sophisticated mix of public and private investment (WEF, 2020).

Botsari, A., Kiefer, K., Lang, F. and Legnani, D. (2021). EIF VC Survey 2021: Market sentiment. EIF Working Paper 2021/74. EIF Research & Market Analysis. October 2021.

Colombo, M. G., Cumming, D. J., & Vismara, S. (2016). Governmental venture capital for innovative young firms. The Journal of Technology Transfer, 41(1), 10-24.

Crisanti, A., Krantz, J., Pavlova, E. and Signore, S. (2021). The VC factor. Pandemic edition. Data driven insights into European VC and its resilience to the COVID-19 crisis. Joint EIF – Invest Europe study. First online 23 September 2021.

Kraemer-Eis, H., Botsari, A., Gvetadze, S., Lang, F., & Torfs, W. (2021). European Small Business Finance Outlook 2021. (No. 2021/75). EIF Working Paper.

WEF (2020) Bridging the gap in European scale-up funding: the green imperative in an unprecedented time. World Economic Forum Community Paper. June 2020.

This note is based on the 2021 European Small Business Finance Outlook (ESBFO), the European Investment Fund’s annual publication on SME investment financing in Europe (Kraemer-Eis et al., 2021). The ESBFO provides an overview of the main SME financing markets (Equity, Guarantees, Securitisation), as well as a number of thematic areas (Inclusive finance, Fintechs, Green finance & investment) that are central to the EIF’s mission as Europe’s main public provider of financing solutions for SMEs and mid-caps.

For an elaborate list of what constitutes Greentech innovation in the context of the descriptive analysis further on in this note, see Kraemer-Eis et al. (2021).

The EIF Venture Capital and Private Equity Mid-Market surveys are conducted among VC and PE general partner (GP)/management companies targeting VC and private equity mid-market investments in European enterprises. The latest survey wave dates from July 2021.

Greentech VC and PE Growth investments derive from the PitchBook data platform and therefore differ in terms of coverage compared to the general market’s investment statistics presented in figures 1 and 2.

Defined as technology aimed at improving the sustainability of the agricultural sector.