Ten years on after the Great Financial Crisis (GFC), and with a recovery that is quite mature, what are the main global financial vulnerabilities that risk derailing the expansion or amplifying any slowdown? As depicted by consensus forecasts, the near-term outlook – for the 12 months or so – looks still favourable. Despite recent stress in EMEs, the forecasts have changed little between May and August. But financial risks continue to build up, in their usual, gradual and cumulative way, and fault lines now appear more evident. As a result, financial factors are likely to play a key role in the materialisation of risks to the outlook, as either catalysts or amplifiers. And relative to pre-crisis, non-banks are likely to play a bigger role. Looking further ahead, there is an issue that casts a long shadow on economic prospects –globally rising debt levels relative to GDP and the possibility of a “debt trap”.

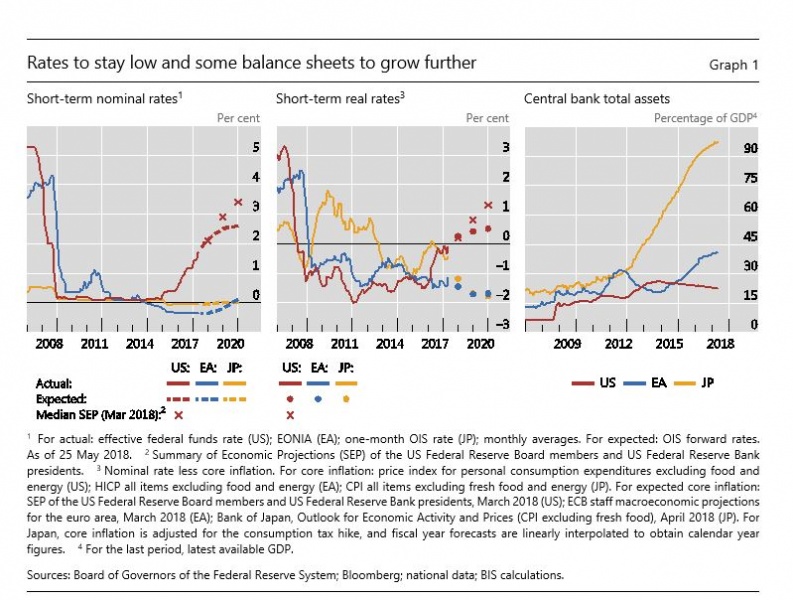

Ten years on after the Great Financial Crisis (GFC), and with a recovery that is quite mature, it is worth asking: what are the main global financial vulnerabilities that risk derailing the expansion or amplifying any slowdown? The question is far from an idle one because the policy response to the GFC has been unbalanced, overburdening central banks – they have been “the only game in town” for far too long. Their unprecedented actions no doubt avoided a repeat of the Great Depression and helped lay the basis for the recovery. But the extraordinarily and persistently low interest rates, combined with bulging balance sheets, have also contributed to the financial vulnerabilities that we now see (Graph 1).

The near-term outlook looks favourable…

The near-term outlook – say, over the next 12 months or so – looks favourable. This is the message of the forecasts of the main international organisations and of the economists’ consensus. The year 2017 was a truly vintage one: growth was back in line with long-term pre-crisis averages, unemployment at multi-year lows in many economies, including the largest, and inflation generally subdued. After a soft patch in the first quarter of 2018, notably in the euro area, global growth is projected to edge up this year, staying above potential, and to fall back slightly towards potential in 2019. Inflation is not seen as a threat. Despite recent stress in EMEs, the forecasts have changed little between May and August.

….but not all is well on the real side….

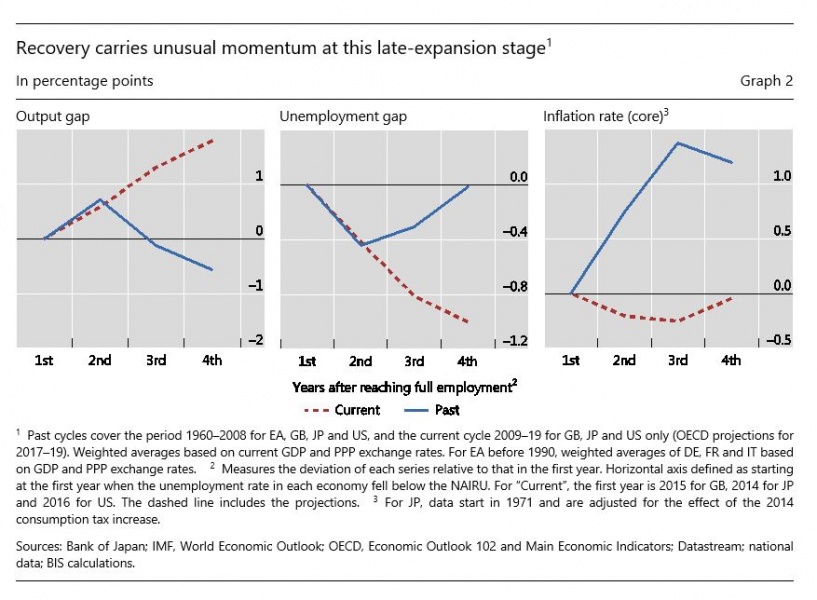

At the same time, this picture is quite unusual. Strong, above-potential growth so late in the expansion is quite rare, especially with economies close to, if not beyond, full employment estimates (Graph 2). To be sure, standard practice is to increase measures of potential if inflation fails to rise. But this can be misleading. It clearly proved to be so pre-crisis. In fact, inflation has been a rather unreliable measure of sustainable output. And we know that, for purely technical reasons, should a recession occur at some point, all the current measures of economic slack (“output gaps”) will be revised upwards, because of the way trends are calculated.

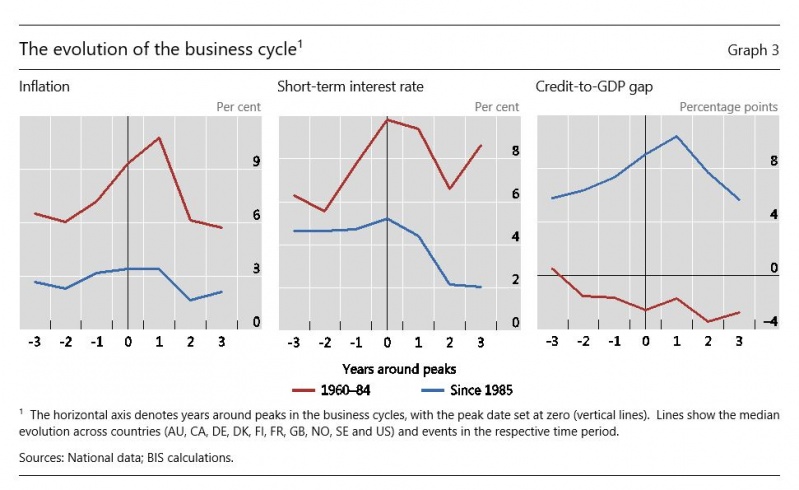

Indeed, as we document in the latest BIS Annual Economic Report, the behaviour of inflation has become an increasingly unreliable leading indicator of output turning points since the early 1980s (Graph 3). A typical postwar pattern until then was that recessions followed a rise in inflation and consequent monetary policy tightening, with credit showing no particular acceleration. Since then, inflation has done little around turning points, so that monetary policy has not had to tighten significantly, but recessions have been preceded by strong and protracted credit growth. Hence the greater relevance of financial vulnerabilities.

…and financial vulnerabilities have been building up

And financial vulnerabilities have been building up, in their usual, gradual and cumulative way.

First observation. There are signs that financial markets are overstretched. Despite the equity market wobble in February and the recent tightening in emerging market economies (EMEs), financial conditions remain quite easy from a long-term perspective. G3 term premia are very compressed, equity markets elevated (except in relation to the unusually low bond yields themselves), volatilities rather low and, above all, credit spreads are hovering around pre-crisis levels.

Importantly, and rather puzzlingly, at least until recently, US financial conditions, and on balance global ones, actually eased during the Fed’s tightening. This was so despite bond yields edging up. EMEs were the main beneficiaries during this phase, as the US dollar depreciated. Given their large stock of US dollar debt, a dollar depreciation tends to strengthen borrowers’ balance sheets there. That is why the more recent appreciation has coincided with wobbles and tensions, greatly exacerbated by idiosyncratic vulnerabilities in some countries, most notably Argentina and Turkey. That said, so far tensions elsewhere have, for the most part, been contained. They have affected mainly countries with large current account deficits and relatively high inflation. We have not yet seen investors stampede out of markets indiscriminately.

The very easy financial conditions in advanced economies, notably in the United States, are one reason for being cautious about the optimistic outlook beyond the near term. Research at the IMF, consistent with our own analysis at the BIS, finds that easy financial conditions boost economic activity in the short run but increase downside risks further down the road.

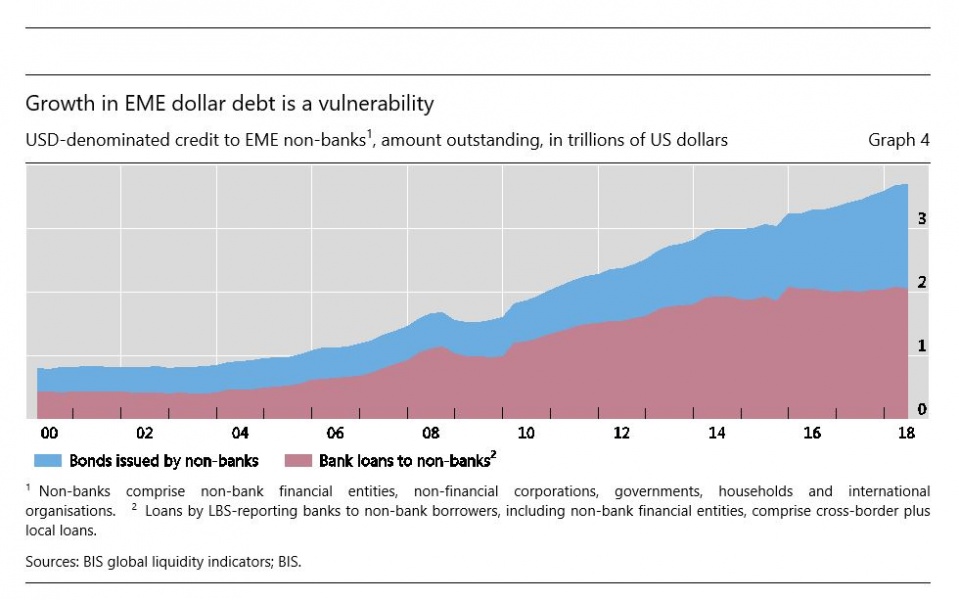

Second observation. Leading indicators of banking distress are flashing amber or red in several countries less affected by the GFC. These are countries that have seen a further build-up of financial imbalances – essentially, prolonged strong private sector credit expansion and strong property price increases. This has been the case in advanced economies, such as Australia, Canada, some Nordic countries and Switzerland, but also in several EMEs, not least China, some others in Asia and also in Latin America. Moreover, a number of EMEs have seen rapid foreign currency credit growth post-crisis. The aggregate stock of such credit to non-bank EME borrowers has actually more than doubled since the turmoil (Graph 4). In contrast to pre-crisis, the funding has come mainly from capital markets.

There is some good news in all this. The list of countries does not include any of the large economies hit hard by the GFC. The post-crisis financial reforms have greatly strengthened the financial system’s resilience. And EMEs have built up their defences since the serious strains in the mid-1990s – better macroeconomic policy frameworks, greater exchange rate flexibility and larger foreign currency reserve buffers. Thus, one should read the indicators not so much as pointing to banking distress ahead, but to the risk of strong financial headwinds at some point. Signs that financial cycles have actually turned in a number of countries underline this possibility.

On tinder, sparks and fire

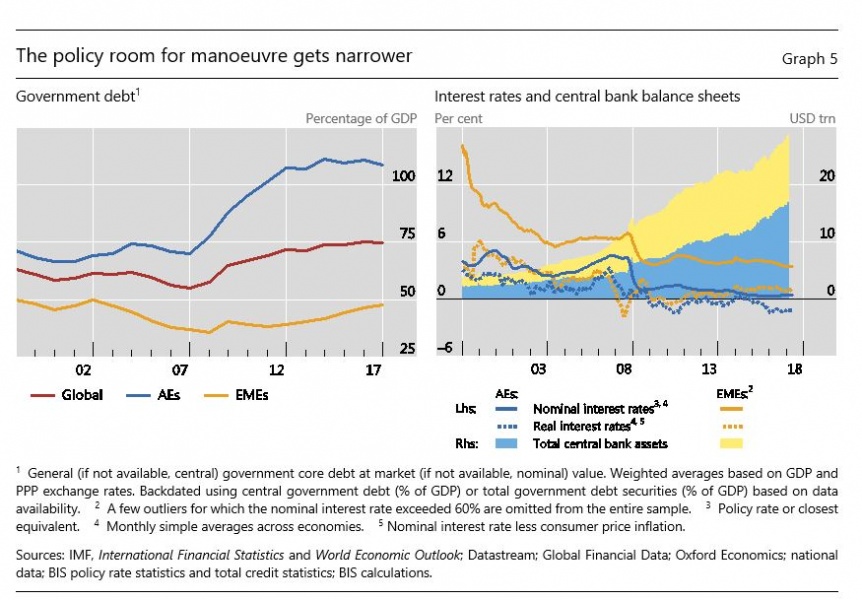

All of this suggests that there is plenty of tinder to fuel a fire. And, above all, the limited room for policy manoeuvre on the monetary and fiscal sides should give us cause for reflection. Post-crisis, not only have interest rates declined substantially to new depths and central bank balance sheets ballooned to unprecedented sizes, but public sector debt has reached peacetime highs (Graph 5).

There is no dearth of candidates to spark the fire. One possibility could be inflation rising unexpectedly and financial markets perceiving that central banks are behind the curve. This would be the worst scenario. It would trigger the sharpest snapback in the yield curve, with greater global implications, not least for EMEs. Personally, I don’t think this is very likely. As Japan highlights most clearly, there are still significant disinflationary tailwinds in the global economy, probably linked to globalisation and technological advances. Still, such a scenario cannot be ruled out. Moreover, given the way markets are positioned, it would not take much for them to overreact. We saw this, briefly, in February, when a slight upward surprise in US wage growth appeared to trigger a rise in yields and drop in the equity market.

A second possibility could be a general reversal in financial markets’ risk appetite in response to self-reinforcing cyclical developments. Regardless of inflation, growth could disappoint as the mature expansion flags or financial cycles turn. This may well be what we started to see in EMEs as the US dollar appreciated and external conditions tightened. It might also occur as the Chinese authorities struggle to maintain growth while inducing the necessary deleveraging.

A third possibility could be a more exogenous trigger reflecting political developments. An escalation of protectionist pressures is especially worrisome: its global impact would be very significant. But the trigger could also be more country-specific: what we saw in Italy earlier in the year is an ominous sign. And, in the background, the backlash against globalisation is continuing, alongside signs of the rise of nationalistic tendencies. Think, for instance, of what has been happening in Europe.

In all of these cases, financial markets would play a prominent role, as either triggers or amplifiers. And new players in the asset management industry would in all likelihood take centre stage. Liquidity may now appear plentiful. But it is bound to evaporate under stress. Corporate and emerging markets appear especially vulnerable, but even sovereign bond and equity markets would not remain unscathed.

These various just outlined are hardly independent; in fact, they interact closely. Consider just one example. A leading country imposes trade barriers. The currency of the country at the receiving end depreciates under market pressure. The depreciation is interpreted as a sign of currency manipulation. As a result, the country that imposed the barriers in the first place raises them further. A vicious circle develops. More generally, stress in EMEs can boomerang on the advances economies that were at the source of the spillover and on others, through financial markets, banking exposures or simply a slowdown in economic activity. EMEs now play a much bigger role in the global economy than they did twenty or even ten years ago.

What end game?

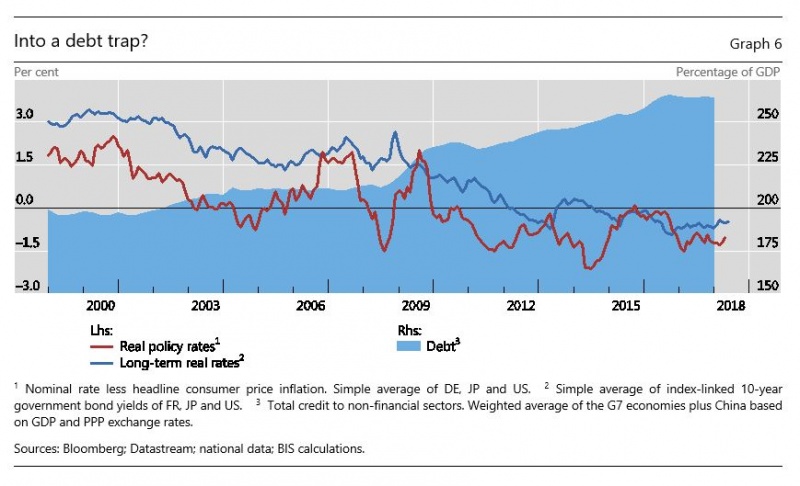

And guess what: there is an elephant in the room. Debt (private plus public) has continued to rise globally in relation to GDP as interest rates have declined and remained unusually low, in both nominal and real (inflation-adjusted) terms (Graph 6). Indeed, real rates are negative even as countries look like they are approaching, or even exceeding, estimates of potential. Moreover, rates are expected to remain low for quite some time, which could encourage a further debt build-up. If this continued, how far would central banks manage to raise rates without triggering the very problems they are trying to avoid? Empirical evidence that debt service burdens matter greatly for expenditures is clearly relevant here. The possibility of such a “debt trap” should not be dismissed out of hand.

What policies?

To conclude. The near-term prospects are favourable, but the risks ahead should not be underestimated. The path is narrow. Policymakers and market participants should brace themselves for a bumpy ride.

The main policy implication is the need to seize the moment to rebalance the policy mix and regain room for manoeuvre. This means reinvigorating the flagging structural policies, finalising the implementation of the financial reforms, activating macroprudential tools where vulnerabilities are building up, consolidating fiscal positions, and normalising monetary policy with a steady hand. All this should be seen as part of the establishment of more holistic macro-financial stability frameworks designed to ensure lasting macroeconomic and financial stability.

Such frameworks would be firmly anchored to a long-term focus. Financial vulnerabilities build up slowly. And the costs of high debt may emerge only after a long time. The incentive to kick the can down the road can prove irresistible. But, however distant it may appear, the future will eventually become today.

At which point, it is too late.