1. Why climate change matters for finance

Planetary Boundaries identify global priorities relating to human-induced changes to the environment. Natural scientists found that nine processes and systems regulate the stability and resilience of the Earth System that together provide conditions upon which our societies and economies depend. Four of nine planetary boundaries have now been crossed because of human activity. Two of these, climate change and biosphere integrity, are what scientists call “core boundaries”. Significantly altering either of these core boundaries would drive the Earth System into a new state (Steffen, Richardson et al., 2015). Staying within the ‘safe operating space’ and thereby avoiding dangerous climate change requires substantial restructuring of economies and a paradigm shift in economics and financial decision-making.

So far climate change with temperatures rising by 3-4°C by the end of this century was considered a global emergency. It turns out however that already a moderate temperature increase would lead to massive, sometimes abrupt and disruptive impacts on economies and societies. Already beyond 2°C there is a significant risk of turning natural systems – that presently help keep temperatures down – into massive sources of carbon that would put us on an “irreversible pathway” to a world that is 4-5°C warmer than before the industrial revolution. The authors state that a total re-orientation of human values, equity, behaviour and technologies is required. All humans should become stewards of the Earth (Steffen, Rockström et al., 2018).

The UN’s Paris Agreement on Climate Change is an important milestone and guidepost for the transformation to sustainable development. Its overall goal is to limit the temperature increase to well below 2°C compared to the preindustrial level. The scale of the change required is substantial which among others calculations by Rockström et al. (Rockström, Gaffney et al., 2017) indicate. Fossil-fuel emissions should peak by 2020 at the latest and fall to net zero by 2050 to meet the climate goal of the UN’s Paris Agreement. According to the “carbon law” approach halving emissions every decade would result in a Paris-compatible development pathway. This ensures that the greatest efforts to reduce emissions happens sooner not later and reduces the risk of exceeding the remaining global carbon budget to stay below 2°C. The effort of reducing emissions should be complemented by an ambitious, exponential roll-out of renewables. For example, doubling renewables in the energy sector every 5-7 years, ramping up technologies to remove carbon from the atmosphere, and rapidly reducing emissions from agriculture and deforestation.

More broadly business practices that focus on the short and the very short term, lead to economic decisions that ignore relevant scientific insight and public concern. Furthermore, the perception of manageable risks of conventional technologies in contrast to the uncertainty concerning technology development in an era of disruptive change are inhibiting investment flows in low-carbon technologies. Together with the lack of company-level information, the need for diversification, and the search for an appropriate level of portfolio risk and return it is a challenge for investors to consider climate change in the context of an investment.

Risks emerging from climate change are currently not adequately accounted for in risk premia of investments in infrastructure for transport, buildings and energy supply. Under current market conditions, which largely neglect external costs and climate risks, the returns on investments in conventional technologies is still perceived to be higher than the returns on investments in sustainable technologies. At present financial markets largely ignore the liabilities that current greenhouse gas emissions generate. Climate change results from the accumulated climate gases in the atmosphere. This means today’s activities have an irreversible impact in the long term even if climate change impacts can for the most part not be felt yet.

Institutional arrangements matter when switching technologies. For renewable energy projects the cost of finance has a relatively high impact on the returns and viability, because the operating costs are very low compared to fossil-fuel energy projects. Dhruba (2018) recently highlighted that credit risk assessment and ratings usually have been an inappropriate measure of credit risk for renewable energy finance, yet they have a significant influence on the cost of finance. Dhruba (2018) lists factors like inadequate credit information, a lack of historical data at the project level, and the higher risk of technological obsolescence that result in credit market failure in clean energy finance, leading to mispricing of risk and poor capital allocation to clean energy infrastructure in the economy.

The important role of finance for overcoming this inertia is also acknowledged in the Paris Agreement. On the need for redirecting finance flows the Paris Agreement states explicitly in Art. 2.1c: “Making finance flows consistent with a pathway towards low greenhouse gas emissions and climate resilient development”. This signals to investors the expectation that the Paris Agreement will have a substantial impact on the finance sector and highlights the danger of stranded assets on the one hand and opportunities for early movers at a time of deep transformation on the other hand. Climate change is therefore not only an environmental challenge, but also requires a shift in the business agenda.

Technology roadmaps can serve as elements in scenario considerations and thus enhance guidance of investment decisions towards sustainability. Technology roadmaps cannot foresee price developments with certainty, but illustrate plausible alternative options compared to the current technology pathway and help explore the impact of different institutional designs. Investment expectations may face rapid change if various trends occur simultaneously, such as technological innovation, policy impacts, and changed behaviours. This can lead to snowball effects with more dramatic effects when combined compared to adding up isolated processes (De Lorenzo, L., Enkvist, P.-A., 2018).

2. Climate-related financial risks & opportunities

Greening finance, unlocking and redirecting private investment flows towards low-carbon structures are necessities for accomplishing the 2°C temperature target of the Paris Agreement.

The scenarios of IEA, IPCC and other independent research organisations indicate major impacts of climate change for different financial investor groups.

Such a reframing of the finance sector calls for climate information for the business sector on climate-related risk on the one hand and climate related financial opportunities on the other.

Insurers are concerned that total insured losses from natural catastrophes and large human-made disasters amounted to US$ 144 billion in 2017, the highest level of global catastrophe claims ever recorded in a single year. More than 11,000 people lost their lives or went missing in disasters in 2017 and the disasters are associated with a total economic loss of US$ 337 billion (Swiss Re, 2018). Climate risks are not limited to natural disasters. They include health risks, which could increase mortality rates and force insurers to retool life insurance coverage. The risks also involve lawsuits that seek damage from businesses and government agencies for contributing to climate change or failing to minimizing the resulting impact. Litigation is already growing in cases against fossil fuel companies (Franta, 2017).

Public pension funds and sovereign wealth funds manage large volumes that matter greatly for the transition to sustainability. Climate change impacts such as the physical risks that have a material effect on the pension fund assets, constrained demand for carbon-intense products and finally evolving interpretations of fiduciary and tortious duties of care with possible related financial liabilities. Applying due care, skill and diligence may require pro-active governance of climate change portfolio risks (Barker, Baker-Jones et al., 2016). While the fiduciary duty of pension funds’ trustees is often perceived as a barrier to change in investment practices, it could also mandate climate risk disclosure or, even more stringently, fossil fuel divestment when interpreting fiduciary duty as it evolves with social expectations (Richardson, 2007, Woods, 2009, Ayling and Gunningham, 2017).

Banks can steer investments of their customers in low-emission technologies and adjust the conditions of loans that they provide to carbon-intense projects or sectors. However, not all banks take such substantive action when they implement their climate strategy (Furrer, Hamprecht et al., 2012). Banks face risks from physical impacts of the related assets, regulatory risks and the risk of credit defaults as a result of economic losses caused by climate change (UNEP, 2018).

Climate-related risks are usually clustered as follows (e.g. TCFD, 2017).

Economic and financial risks from environmental imbalances:

Risks from policy regime changes towards low-carbon structures:

A recently developed climate stress test finds that direct and indirect exposures to climate-policy-relevant sectors represent a large portion of investors’ equity portfolios. Hence the exposure of EU financial institutions to fossil assets is considerable, both in terms of equity and debt finance (Battiston, Mandel et al., 2017). Weyzig et al. (2014) estimate the exposure of large financial institutions (twenty-three large EU pension funds and twenty of the largest EU banks) to oil, gas and coalmining firms and scale these estimates up to the entire EU pension funds and banking sector. This again indicates that early climate action is preferable, as it would allow for smooth asset value adjustments. IEA estimates that the premature shut-down of assets in a 2°C-scenario would amount to $320bn by 2050. Delaying the transition by a decade would more than triple the amount of investment at risk of being stranded to more than $1.3tn, assuming the same carbon budget is kept (IEA 2017).

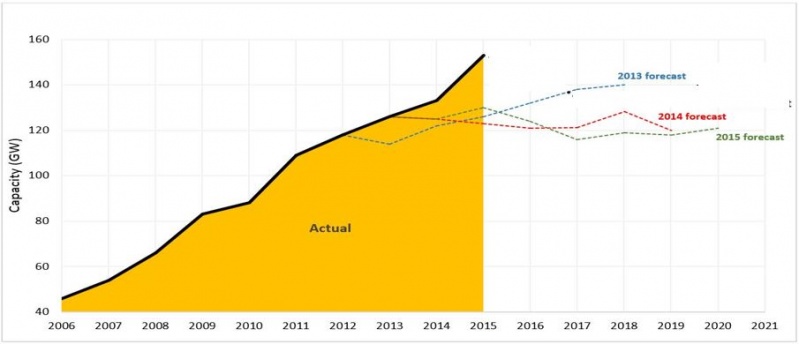

In the financial sector short-termism is still the prevailing motive for decision-making, which is cemented by the still increasing pressure for short-term results (Cremers, Pareek et al. 2018). Decisions are based on models that extrapolate future development from the past without any consideration for structural shifts and the resulting financial risks (Silver, 2017). The difficulty of accounting for structural shifts in economic models and financial decision-making is illustrated by the fact that IEA’s forecasts for the global addition of renewable electricity capacity lay for years below the realized capacity.

Graph 1: International Energy Agency’s forecasts of global renewable capacity addition

Source: IEA, Energy Council’s Analysis, 2016

While accounting for uncertainties related to technological development and disruptive technologies in financial decision-making is difficult it is essential. Not all indeterminacies, complexities and variabilities of the real world can be artificially aggregated to ‘risk’ (Stirling, 2017).

Acknowledging structural shifts, the potential of disruptive technologies and uncertainties would not only reflect the costs and strategies for avoiding them, but also focuses the perspective on related opportunities for investments.

Climate-related financial opportunities for investors in the finance sector include:

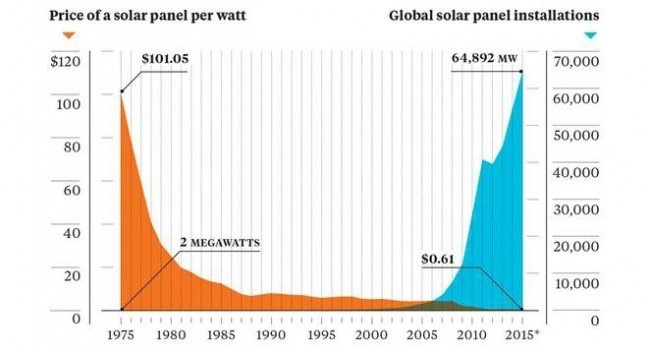

Examples for observable trends that promise opportunities are investments in radical energy efficiency, diffusion of renewable energy technologies, energy storage or low-carbon products and services. How far-reaching such technological changes are, is illustrated in Graph 2 showing the decline in prices and the increase in the diffusion rate of solar panels over a relatively short time period.

Graph 2: Price and volume trends of solar panels

Source: https://cleantechnica.com/files/2016/02/solar-price-installation-chart.jpg

3. Paradigm shift in financial decision making

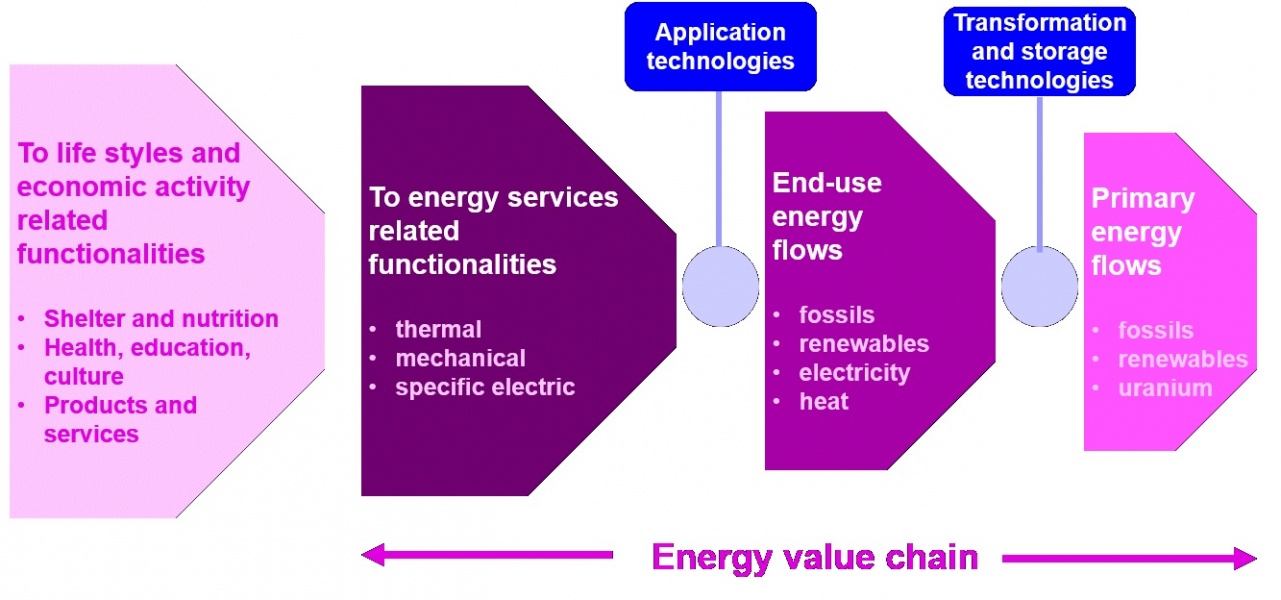

To account for the challenges listed above a new perspective on the energy system can serve as a compass for the finance sector towards greening investment. Focusing on energy services or energy related functionalities, i.e. ‘which benefit do we expect from energy’ instead of ‘where do we get energy from and how much energy flows do we need’ redirects the attention to welfare-relevant energy services. Applying such a framing delivers a broader system perspective and can guide a paradigm shift in financial decision making.

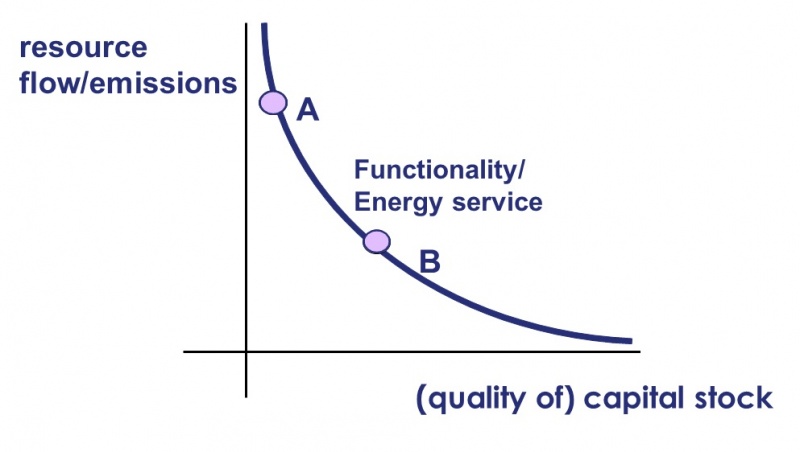

Today’s investment in long lived infrastructure determines emissions and thus global warming for many decades while current decision rules poorly reflect the interconnectedness of the investment and the operating phase over the whole lifetime of a technology. To capture this long-term aspect, the energy services (functionalities) approach offers a systematic consideration of stock-flow interactions. This is relevant for financial investment decisions as a constant level of an energy service or functionality can be produced by a range of combinations of capital stocks and resulting energy and emission flows that accumulate over the whole lifetime of an investment (see Graph 3).

Graph 3: Relevance of Stocks and Flows

Source: Köppl et al. (2016).

An example for the use of this approach in the building sector is the comparison of passive solar houses with houses with low energy efficiency standards. For delivering the same level of energy services in both houses much higher energy flows are required in the latter (accumulating over decades) than in the former due to the different housing stock. Thus, the same energy services can be produced with different stock-flow combinations, where a better quality of stock prevents energy and emission flows over the whole lifecycle.

For buildings and other investments in a capital stock with a lifetime of several decades a conflict of interest becomes obvious: investors are interested in short-term revenues which leads to insufficient consideration of long-term climate issues (investment determines more or less GHG emissions over the whole lifetime of the building) within investment analysis.

Moving onto sustainable pathways requires long-term orientation and accounting for stock-flow interactions in any investment decision. This could be facilitated by a new perspective on the energy system with energy related functionalities as starting point and performance indicator (see Graph 4). For becoming an active player in redirecting the financial flows towards sustainable pathways the finance sector needs such a fundamental rethinking in financial-decision making. The functionality approach offers one possibility for such a rethinking.

Graph 4: The energy value chain

Source: Köppl, Schleicher (2018).

Three I’s could serve as guiding principles for the reorientation of the finance sector, notably Innovation, integration and inversion. Innovation directs the focus on emerging disruptive change processes observable in various economic sectors. These are for example, technologies for decentralized energy supply, new technologies like self-driving cars or 3D-printers in industrial production. Buildings with an active role in the energy system as energy prosumers or providers of storage capacity or bi-directional energy grids illustrate the guiding principle of integration. Inversion highlights the starting point of the analysis of energy systems being refocused on welfare-relevant energy services, e.g. mobility instead of fuel use.

The increasing awareness of the financial sector to address the described complex and long-term implications of current investment decisions on energy use and emissions shows in the steadily growing market for green bonds. Although green bonds currently only account for approximately one percent in the global bonds market (Clapp, 2018) the recent past shows encouraging growth. According to the Climate Bonds Initiative (https://www.climatebonds.net/) green bonds issued in 2017 totaled 161 billion US $ and are estimated to reach 250 billion US $ in 2018. Green bonds are issued by various institutions like multilateral development banks, commercial banks, corporations, municipalities and public utilities. The IEA reports that the largest share of the issued green bonds finance and refinance apply to energy efficiency projects (IEA, 2018). Legal requirements for investors to report on their climate change risk like in France, the report of the Task Force on Climate Related Financial Disclosure (TCFD, 2017) or the EU High Level Group on Sustainable Finance (HLEG, 2018) and the accompanying intended regulations to promote sustainable finance could very likely prove as favorable environment for the recently observable trend in the green bond market.

4. Conclusions for driving the change in the financial sector

The scale of change necessary to limit temperature increase by well below 2°C is huge and must be understood as deep structural change of our prevailing energy systems with implications for the financial sector. To support the structural shift towards low-carbon structures for the real and finance sector a regulatory framework to mainstream climate is essential. Such regulation would foster the integration of climate science and climate economics into financial institutions and financial-decision making redirecting the perspective towards the interlinkages between climate change, emerging disruptive technologies and business models. Such a broader perspective helps to redirect financial flows from carbon intensive incumbents to new (sometimes more risky) low carbon industries and services. An orientation along the outlined paradigm shift for the energy sector can serve as a new compass to adequately identify risks, uncertainties and opportunities of a deep structural change for investors which is characterized by system thinking and a focus on functionalities. Implementing a forward-looking analysis in line with the 2°C scenario also comprises longer time horizons for investment decisions.

Numerous studies and estimates are already available that on the one hand point at the risks from potential stranded assets and on the other offer estimates on financial needs for decarbonizing our economies. Investors already can take advantage of this knowledge to adjust their investment behavior towards climate resilient structures.

Ayling, J. and N. Gunningham, 2017. “Non-state governance and climate policy: the fossil fuel divestment movement.” Climate Policy 17(2): 131-149.

Barker, S., et al., 2016. “Climate change and the fiduciary duties of pension fund trustees – lessons from the Australian law.” Journal of Sustainable Finance & Investment 6(3): 211-244.

Battiston, S., Mandel, A., Monasterolo, I., Schütze, F., Visentin, G., 2017. A climate stress-test of the financial system. Nature Climate Change 7, 283.

CBI, 2018. Green Bonds Market 2018. https://www.climatebonds.net/

Clapp, C., 2018. Investing in a green future. Nature Climate Change 8.

Cremers, M., Pareek, A., Sautner, Z., 2018. Short-Term Investors, Long-Term Investments, and Firm Value.

De Lorenzo, L., Enkvist, P.-A., 2018. Framing stranded assets in an age of disruption. Stockholm Environment Institute and Material Economics.

Dhruba, P., 2018. Managing Credit Risk and Improving Access to Finance in Green Energy Projects. ADBI Working Paper 855. Tokyo: Asian Development Bank Institute. Available: https://www.adb.org/publications/managing-credit-risk-improving-access-financegreen-energy-projects

HLEG, 2018. Financing a Sustainable European Economy. Final Report by the High-Level Expert Group on Sustainable Finance.

Franta, B., 2017. “Litigation in the fossil fuel divestment movement.” Law & Policy 39(4): 393-411.

Furrer, B., et al., 2012. “Much Ado About Nothing? How Banks Respond to Climate Change.” Business & Society 51(1): 62-88.

IEA, 2016. Energy Council’s Analysis.

IEA, 2017. Perspectives for the energy transition: Investment needs for a low-carbon energy system. Paris, IEA Publications, International Energy Agency.

IEA, 2018. World Energy Investment.

Köppl, A.; Kettner, C.; Kletzan-Slamanig, D.; Schleicher, S. P.; Damm, A.; Titz, M.; Damm, A.; Steininger, K. W.; Wolkinger, B.; Schnitzer, H.; Titz, M.; Artner, H.; Karner, A., 2014. “Energy Transition in Austria: Designing Mitigation Wedges.” Energy & Environment 25, 281–304.

Köppl, A.; Kettner, C.; Schleicher, S. P.; Hofer, C.; Köberl, K.; Schneider, J.; Schindler, I.; Krutzler, T.; Gallauner, T.; Bachner, G.; Schinko, T.; Steininger, K. W.; Jonas, M.; Zebroowski, P., 2016. “ClimTrans2050 – Modelling Low Energy and Low Carbon Transformations. The ClimTrans2050 Research Plan.” Austrian Institute of Economic Research (WIFO): Vienna.

Köppl, A., Schleicher, S., 2018. “What will Make Energy Systems Sustainable?”. Sustainability 10, 2537.

Richardson, B. J., 2007. “Do the fiduciary duties of pension funds hinder socially responsible investment?”. Banking & Finance Law Review. Available at SSRN: https://ssrn.com/abstract=970236

Rockström, J., Gaffney, O., Rogelj, J., Meinshausen, M., Nakicenovic, N., Schellnhuber, H.J., 2017. A roadmap for rapid decarbonization. Science 355, 1269-1271.

Schleicher, S. P.; Köppl, A.; Sommer, M.; Lienin, S.; Treberspurg, M.; Österreicher, D.; Grünner, R.; Lang, R.; Mühlberger, M.; Steininger, K. W.; Hofer, C., 2018. “What Future for Energy and Climate? Impact Assessments for Energy and Climate Strategies.” Austrian Institute of Economic Research (WIFO): Vienna. (German)

Silver, N., 2017. “Blindness to risk: why institutional investors ignore the risk of stranded assets.” Journal of Sustainable Finance and Investment 7:1; 99-113.

Steffen, W., Richardson, K., Rockström, J., Cornell, S.E., Fetzer, I., Bennett, E.M., Biggs, R., Carpenter, S.R., de Vries, W., de Wit, C.A., Folke, C., Gerten, D., Heinke, J., Mace, G.M., Persson, L.M., Ramanathan, V., Reyers, B., Sörlin, S., 2015. Planetary boundaries: Guiding human development on a changing planet. Science 347.

Steffen, W., et al., 2018. “Trajectories of the Earth System in the Anthropocene.” Proceedings of the National Academy of Sciences.

Stirling, A., 2017. Precaution in the Governance of Technology, in: Brownsword, R., Scotford, E., Yeung, K. (Eds.), The Oxford Handbook of Law, Regulation and Technology Oxford University Press, Oxford.

Swiss Re, 2018. Natural catastrophes and man-made disasters in 2017: a year of record-breaking losses: 59.

TCFD, 2017. Recommendations of the Task Force on Climate-related Financial Disclosures. Final Report to the Financial Stability Board.

UNEP, 2018. “Navigating a new climate: Assessing credit risk and opportunity in a changing climate: Outputs of a working group of 16 banks piloting the TCFD Recommendations, PART 2: Physical risks and opportunities.”

Weyzig,F., et al., 2014. The Price of Doing Too Little Too Late. Green New Deal Series, Volume 11.

Woods, C., 2009. Funding Climate Change: how pension fund fiduciary duty masks trustee inertia and short-termism.