Bitcoin’s value has on balance risen substantially in recent months, despite large fluctuations. These fluctuations have attracted much attention from various sides. It appears that opinions on the future of this cryptocurrency are strongly divided. Most economists often take a different view on Bitcoin than people in the crypto world. The latter group emphasize the innovation that Bitcoin (more specifically the blockchain) brings, while economists often see Bitcoin as a bubble, with characteristics of a Ponzi scheme and underpinned by spectacular, but poorly founded economic claims. Most people have above all many questions. In this Policy Note, which has the structure of a Q&A-session, I will discuss the various arguments as objectively as I possibly can.

My conclusion: Bitcoin is not the money of the future and certainly not a future ‘world money’. If it survives, which it may, it will probably be as a high risk asset class. As such, it may strongly increase in value in the future, but it could just as easily go the other way and end up valueless. The buyer beware.

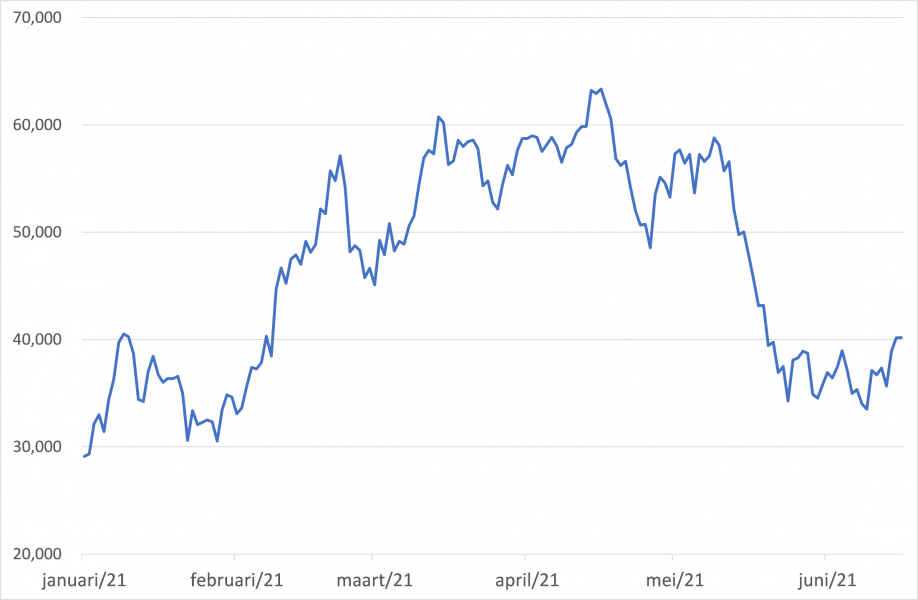

Between September 2020 and mid-April 2021 the price of Bitcoin has risen sharply from $10,000 to more than $ 60,000, only to fall back in a couple of week to less than $40,000 (figure 1). The largest cryptocurrency’s price fluctuations is prompting talk about Bitcoin’s future. Some central banks want to clamp down on Bitcoin, but in El Salvador the President made it legal tender. Elon Musk kicks around the price of Bitcoin by Twitter. Pressing questions are coming up. Is Bitcoin money or not? Why is Bitcoin valuable? And what does the future hold?

Skeptics anticipate a collapse at some point, while true crypto believers see Bitcoin as the currency of the future. The discussions about Bitcoin are very broad and opinion is divided on even its most basic aspects. For example, Bitcoin was designed to be a payment method, but more and more people have come to view it mainly as a new investment category. The likely future of Bitcoin is also the subject of debate; will it replace the existing system, or will it eventually become “just” another new financial product that exists alongside the ones we already know?

In this Policy Note, I will attempt to answer some of the pressing questions about Bitcoin, without the least intention of even trying to settle them definitively. The main perspective I take here is that of an economist. Because regardless of all the innovation unleashed by the arrival of Bitcoin which may cause permanent changes to the financial system, some of the economic claims being thrown about deserve, at the very least, closer consideration. Some of them are just plain wrong. And it is not easy to verify claims and news. I will subject a few such news facts to further scrutiny in this Policy Note.1

A Common Definition of Money

Money is frequently defined as follows: something is money if it is generally accepted within a specific society as a unit of account, a medium of exchange (payment instrument), or a store of wealth. This definition is not entirely adequate, since in a developed economy, money can be used not only as a unit of account, as a means to pay for goods and services and to accrue savings, but one should also be able to use it at the same time for borrowing money or issuing a bond.

If we take this definition of money as our starting point, we can review the various elements. Bitcoin can be used as a payment instrument, but its overall acceptance is limited to Bitcoin believers. This group can be likened to a sort of society that is spread across the world and has become pretty big. But it does not overlap with a real Bitcoin economy. In fact, there hardly is one. In this light, Bitcoin is not unlike a foreign currency, but one without an underlying economy to support it. This feature makes Bitcoin and other cryptocurrencies fairly unique.

There are relatively few companies that accept payments in Bitcoin. In early February 2021, Elon Musk announced that soon, you would be able to buy a Tesla with Bitcoin, but the next person that the same news item interviewed was a Dutch Tesla dealer who strongly denied that his business would accept such payments. On March 23, however, Musk put his Bitcoin where his mouth is. For the meantime only in the U.S., Tesla would indeed be allowing payments in Bitcoin. To begin with Tesla will not accept other cryptos, but that could very well change. However, on May 13, however, Musk announced that Tesla would stop accepting Bitcoin because of its energy-intensity. One can hardly believe that this was the real reason, as the energy-intensity of Bitcoin mining is not exactly recent news. Musk’s moves raise several interesting questions that I will address in Box 3.

On March 20, 2021, the Dutch newspaper NRC reported that approximately 200 companies in the Netherlands accept Bitcoin as a means of payment, noting that, for many, this above all is related to marketing campaigns. In practice, they at most execute a few transactions a year. Public acceptance of Bitcoin still has a long way to go, even if several million people across the globe have their own so-called wallet. Therefore, Bitcoin definitely has value (see below, too) but to turn that value into cash, which is undifferentiated purchasing power, it first has to be converted into regular money, like dollars or euros. As a unit of account, Bitcoin only works if valued in a regular currency. Whether or not inflation occurs in the Bitcoin world is an open question. No information exists on the subject. Bitcoin prices do not exist within a Bitcoin economy as an allocation mechanism, or at least not perceptibly, on which more later.

|

Box 1: El Salvador: the first country to introduce the Bitcoin as legal tender? On June 9, 2021, the President of El Salvador announced that the government had decided to introduce the Bitcoin as legal tender. However, the existing currency (the USD dollar) will retain its position of legal tender as well. So we are witnessing a country using two kinds of money as legal tender at the same time. To be sure: we are talking about two types of money that may fluctuate with 10% on a daily basis against each other. This simply does not make sense. In an overwhelmingly cash-based economy like El Salvador, one may expect that the position of the dollar will remain unshaken by this decision. And prices will remain in dollars. And it is unclear how the government thinks to enforce the legal tender status of Bitcoin in a country where a substantial size of the population have no internet-access. Three important arguments for this step were mentioned. Bitcoin should help to increase financial inclusion. Many Salvadorians don’t have a bank account, but a large proportion of them have a smartphone. Which makes it possible to use internet-based application. Secondly, El Salvador is very much dependent on remittances from Salvadorians working abroad. In the current banking systems, such payments are cumbersome, slow and expensive. Third, the government hopes to attract rich Bitcoin-owners to move to El Salvador, offering tax advantages. These arguments are not very convincing. The first two problems, which are real, are probably better solved by a dollar-based CBDC than by Bitcoin. Many banks in emerging economies are already working on CBDC and the most important motive here is to increase financial inclusion. And such a system could also help to improve cross-border payments. The third argument is more difficult to understand. Why would a rich Bitcoin-owner want to move to El Salvador, other than the motive to move to a less-regulated environment? What kind of companies does El Salvador want to attract? El Salvador is apparently not able to implement its decision and had approached the World Bank for support. Which was immediately refused, because “this is not something the World Bank can support given the environmental and transparency shortcomings (of Bitcoin).” Maybe El Salvador better rephrases its request and asks for support in developing a dollar-based CBDC. The World Bank would gladly support such a project, I would think. |

Bitcoin as an asset class (store of wealth)

It takes some effort to see Bitcoin as a regular investment asset too. With “regular” currencies like the euro, people can make money by investing it in a profitable business. The profit generates a return, and if the amount of money grows in line with real economic activity, investors can cash in on it. The most important point here is that one party’s gain is not necessarily another’s loss. Simultaneously, it’s also possible to borrow money to invest at a predictable interest rate and to, over time, pay the interest and loan repayments from the generated income.

Bitcoin works differently. We have seen that Bitcoin can increase or decrease strongly in value, but it is a closed system. There is no underlying economy. Moreover, Bitcoin has strong deflationary characteristics. How much Bitcoin is available is predetermined and ultimately limited. Therefore, the ROI of Bitcoin is only related to the price of the Bitcoin itself, expressed in regular currency.

Figure 1: The price of Bitcoin (in US dollars)

Source: coindesk

Because there are only a very few places where they can make a payment in Bitcoin, Bitcoin investors can only claim their return if another user is prepared to invest in Bitcoin against a higher price, in exchange for regular currency, of course. This is perhaps one important reason why speculation about Bitcoin’s further upward potential is rife at the exact time that the price of Bitcoin has soared. Without the inflow of new money, investors in Bitcoin cannot reap their return in regular currency. In this, Bitcoin shares strong resemblance to a pyramid scheme. At the same time, commentators regularly point out that price manipulation can occur in the Bitcoin system, when a few big parties manipulate the price for their own gain. The market for Bitcoin is relatively illiquid compared to the traditional financial markets, which means, unfortunately, that it lends itself well to such manipulation.

Of course, the same can be said of an asset class like precious metals, too. They often have only limited value in regular economic activity, even though they have industrial applications and can be used to make jewelry. Cowrie shells and Rai stones cannot even make this claim and just like Bitcoin, their value can plummet to zero. Nonetheless, it’s a cold hard fact that these two means of payment have been in use for thousands of years, even if their significance has declined considerably. Even gold was pushed from its pedestal temporarily in the 19th century by the advent of aluminum. Early perspectives on aluminum considered it an exceptionally remarkable new metal. Napoleon III even replaced the golden tableware he used at state banquets temporarily with the new-fangled aluminum. The hype was short-lived; aluminum cutlery soon became part of soldiers’ standard equipment and disappeared even sooner from the royal court. Gold and silver have traditionally played an important role as safe investments that are relatively easy to exchange for currency. They still do.

|

Box 2: Paying Taxes in Bitcoin If the government backs a currency as a means of payment, in a normal economy, it greatly helps to increase general acceptance. So the news that taxes could be paid in Bitcoin and Ethereum in Switzerland was welcomed in crypto circles. Closer examination, however, reveals that this news is less spectacular than it first appears. It was the canton of Zug that opened the possibility of paying taxes in Bitcoin, something that was already possible in a few Swiss cities. But the tax assessment simply reads in Swiss francs. And the tax authorities just want to be paid in francs. However, people can convert their cryptos into francs through a designated crypto company with which the tax assessment can be paid. After all, local governments keep their books in the national currency. Not so spectacular, then. At any time people can decide to convert illiquid assets, such as gold, stocks, real estate, or cryptos, into regular money to pay a bill. That has now been made a little easier for Bitcoin users. |

Can You Get a Loan in Bitcoin?

The fact that Bitcoin also has some characteristics of a zero-sum game, limits its use in day-to-day-transactions. Regular money can be used for more than just payments, it can at the same time be borrowed or invested. With Bitcoin, it is the price that ultimately determines the return, positive and negative.

By definition, then, the fate of the person who takes out a loan in Bitcoin is the opposite of the investor’s. A great deal of attention is going to those people who got into Bitcoin in early 2020; they can now collect a profit thanks to the current, much higher price. But someone who, say, took out a mortgage loan in Bitcoin would have seen their debt explode in terms of regular money and would likely now be bankrupt. Incidentally, I am unaware whether many people have taken out Bitcoin loans.

The underlying problem, of course, is that there is no underlying Bitcoin economy in all costs and revenues are in Bitcoin. As long as people’s daily incomes and expenditures take place in regular money, Bitcoin (or any other random crypto) will, at best, be ill-prepared to serve the same function as money.

That said, Bitcoin fulfills the function as a store of wealth rather well, but its high volatility also makes it high risk. Therefore the most important possible role that Bitcoin could have in the future financial system is as an asset class.

Things are as valuable as the worth we attach to them. This may seem like a lazy definition, but it is not. Clearly, some goods exist that are considered valuable because they are useful. Early money standards, for example in Egypt, were based on grain. In Virginia, the money system was based on tobacco for centuries (Davies, 2018). The intrinsic value of metal coins depends on which metal is used to mint it, like copper, iron, silver, and gold. But most money has no practical application other than fulfilling the role of money.

One very old money standard was based on massive stones (Rai), while the longest functioning money standard throughout a large geographical area was based on Cowry shells. Besides dental crowns and jewels, gold has few practical applications and paper money is completely worthless the minute that no-one will accept it.

Traditional fiat money has no physical form. The same is true for Bitcoin. As long as enough people believe in Bitcoin and are prepared to pay regular money for it, Bitcoin has value. If people stop believing in it, Bitcoin becomes worthless. As noted, Bitcoin shares this characteristic with other types of fiduciary money, like the aforementioned Rai, shells, or currency and fiat money. It is important, however, that deposit money, which is a liability of the banking system, is fully back by a bank’s assets, such as loans, investments and liquidity reserves. Bitcoin has no backing at all.

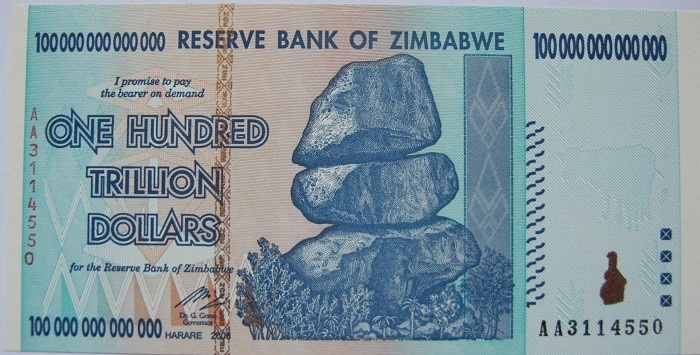

It is also true that as long as people trust in the government, regular money’s status as legal tender enjoys some protection. However, that trust in money can be revoked if, during times of hyperinflation, trust in the government is utterly destroyed, as in Zimbabwe in 2008 (see Figure 2) or, more recently, in Venezuela. However, hyperinflation is a relatively rare phenomenon.

Figure 2: Hyperinflation Money in Zimbabwe

Source: Reserve Bank of Zimbabwe

Seigniorage is the ‘profit’ that comes along with the creation of money. It originates from the fact that the production costs of money are lower than its economic value. For example: it takes only a few eurocents to produce a 100 euro bank note. If the producer of new money is also the one that brings into circulation by spending it, the difference is the profit. Monetary financing, viz. financing government spending with newly created money, is also a good example. Seigniorage is not ‘free money’ for society. Actually, it is a different form of taxation (Keynes, 1924).

Deposit money is created by commercial banks, but it brings no seigniorage. The money created by commercial banks, often via mutual debt acceptance, is a liability of the bank as it is owned by its clients. The advantage for the bank here is not seigniorage, but the return on the asset that is financed by it.2

Bitcoins are produced in a so-called mining process and the income is the reward for the miner that succeeds in solving the algorithm by hard work. This may be profitable, depending on the price of Bitcoin, but it is not by definition a constant group that receives this reward. So there probably is not an entity or group of entities that structurally generates something that looks like seigniorage. Although one cannot exclude that the inventor(s) of Bitcoin, Satoshi Nakamoto, silently had mined a first string of Bitcoins before going public. We probably will never know.

Some people anticipate that the value of Bitcoin can rise much, much higher, to a million dollars even. If asked whether this is possible, I can only say: yes, it could. The value of Bitcoin could even rise to as much as two million dollars, or more. But it might not, because the chance that the value of Bitcoin could suddenly crash, even to zero, is arguably just as likely. As I have explained, the value of Bitcoin is completely determined by the value its enthusiasts attach to it. Hypes can go very far, though. Back in the 17th century when Tulip Mania was sweeping the Netherlands, there was one type of tulip bulb that was worth so much you could trade it for a fine canal house in Amsterdam. Relatively speaking, the hype surrounding Bitcoin is not so bad, although with a much larger international reach.

Bitcoin advocates regularly point out that Bitcoin is not affected by inflation. They draw attention to the fact that there is a limited amount of Bitcoin, a situation they compare to the regular money circuit, where in principle central banks can introduce an infinite amount of money to the market. While it is true that this tells us something about the amount of Bitcoin available, it tells us nothing about the rate of inflation, which is measured in terms of price development rather than the development of the amount of money. So the example tells us nothing about actual inflation in the ‘Bitcoin-world’. In order to make any claims about inflation in the world of Bitcoin, you would need to identify exactly which goods and services were being traded in Bitcoin globally, how large a share each individual product has in the total purchases in Bitcoin, and what the price development of every individual product (in Bitcoin) is over time. Only then can a price index be constructed for Bitcoin to measure its progression over time. But that information does not exist and will not be made available. Because that would require far-reaching transparency throughout the Bitcoin world, to an extent that would undermine the core philosophy of Bitcoin, which privileges privacy and pseudonymity over transparency. The claim that Bitcoin is not affected by inflation, therefore, is unfounded.

A related factor is that Bitcoin is not suited to functioning like money in a normal economy. In this respect, the predetermined, fixed amount of Bitcoin is a great handicap. To maintain a stable price level, it is important for the amount of money to be able to grow more or less in line with economic activity. This is not entirely a one-to-one relationship, because the rate at which money is exchanged between owners (the so-called velocity of money) also plays a role, as explained by Irving Fisher’s Equation of Exchange. If the amount of money cannot grow in relation to economic activity, it can only be accommodated by either an ever-increasing velocity of money or a structural decline in prices. A problem arises when people begin to expect structural price decline and start to delay spending, which means that the velocity of money is more likely to decrease instead of go up. This could land the economy in a serious depression. The same problem, among others, affected the gold standard, eventually leading to its being given up. As a result, fiduciary money became far more common during the last few decades of the gold standard, for example, debased currency, bank notes, and fiat money.

When Bitcoin was launched, commentators (for example, The Economist in 2011) quickly noted the coin’s structurally deflationary nature. The artificial scarcity of Bitcoin is an advantage for Bitcoin investors as long as enthusiasm for Bitcoin continues to grow: rising demand with inelastic supply by definition leads to a higher price. In this sense, Bitcoin resembles gold. But from a monetary perspective, it severely handicaps Bitcoin’s potential to become a serious currency. Price stability requires the amount of money to retain some elasticity so that it can grow in line with the economy. The gold standard proved untenable for a reason. Once the economy “outgrew” the gold supply, fiduciary money became increasingly important.

The same thing could happen to cryptocurrency, too. Since the introduction of Bitcoin, a great many new cryptocurrencies have been created. As the deflationary character of Bitcoin becomes a bigger handicap to its successfully fulfilling the payment function of money, other cryptos may well step in to play that role. It’s what happened when paper money and later, fiat money, gradually replaced precious metals as a means of payment. In this scenario, it is imaginable that Bitcoin would increasingly become an investment category. History provides an analogy with precious metals here, as well. Considering the fact that the amount of some newer cryptocurrencies is not limited in advance, unlike Bitcoin, the crypto world is neither more nor less inflationary than regular money.

It is well known that the “mining” of Bitcoins is a very energy-intensive process. It is the mining of Bitcoin which causes its huge energy consumption. A recent publication by PWC calculated that one transaction in the Bitcoin network consumes 750 kilowatts of energy. By comparison, 450,000 Visa transactions can be carried out for the same amount of energy.3 It is equivalent to approximately the electricity consumption of a Dutch family in about 75 days. Not exactly what you call an attractive sustainability track record. The total energy usage, according to another article, is around 121 terawatt hours per year. That is more than the energy consumption of the whole of the Netherlands and is about thirty times the annual energy production of the Dutch nuclear power plant in Borssele. The authors of the latter article point out that the annual costs of gold mining are even higher. But whether that is true depends entirely on the Bitcoin price. The comparison used in that study is based on the amount of energy per value unit. At its current price, Bitcoin’s energy consumption may be not too unfavorable, but a year ago it was a different story. Relative to other payment methods, like cash or fiat money, Bitcoin is extremely energy intensive. There are also newer cryptos that consume far less energy.

Some Bitcoin adepts argue that Bitcoin’s high energy consumption should be accepted without complaint simply because Bitcoin is such an innovative application. Here the crypto devotees seem to be confusing the Bitcoin blockchain with the “currency.” Because as a means of payment, Bitcoin adds no real functionality compared to regular fiat money. On the other hand, the distributed ledger technology it uses is a distinct innovation compared to the regular system.

According to the PWC report mentioned above, the blockchain, the distributed ledger technology (DLT) behind Bitcoin, can handle approximately 180,000 transactions per day. That seems like a lot, but the Dutch giro-based payment system can handle that volume in a few minutes. The existing Chinese giro payment system can handle it in two seconds; the new Chinese Digital Currency Electronic Payment (DCEP) system is even designed for 300,000 transactions per second. Compared to regular currencies, then, Bitcoin is clearly lagging behind as a means of payment. To put it bluntly, for the time being, the speed of the blockchain is to regular payments what a handcar is to an F16 at top speed.

That could all change, of course. A so-called lightning network has been under construction since 2016, but as far as I know it is still not widely used. But in fact, this “second-layer” solution is actually nothing more or less than temporarily bypassing the blockchain. It can even make the Bitcoin market more opaque. The tragedy of Bitcoin can be boiled down to the fact that it came with a completely new, revolutionary technology, the DLT. Now there are other cryptocurrencies that have their own networks; some are much faster than the blockchain, with a number of them almost capable of matching the processing speed of the regular payment system, as described here.

DLT is a technology that is rapidly gaining a foothold in the mainstream financial system. But the same is not automatically true for Bitcoin. It can be compared to the impact of the internet on banking. Twenty years ago, many trend watchers predicted that new internet banks, i.e. banks without branches only accessible via the web, would rapidly replace the existing ‘dinosaur’ banking system. In 2021 almost every bank (also) offers its services via internet banking. Many a pure internet bank, however, has ingloriously been absorbed into an old-fashioned bank. Egg Bank, one of the first pure internet banks, is now part of the Yorkshire Building Society. Anyone searching the internet for “Egg Bank” today has a good chance of ending up on the websites of companies offering women the opportunity to have their eggs frozen.

People who are deeply enthusiastic about Bitcoin like to draw attention to the network’s transparency. After all, every individual transaction is visible on the blockchain. But this is not the whole story. It is true that every web address is visible, but it is often not known who is behind it. This is because of pseudonymity. The creators of Bitcoin and similar crypto currencies and their supporters are mostly strongly committed to privacy. There is nothing wrong with that in itself, but it also makes cryptos very attractive for the financial settlement of criminal transactions. Even in the case of computer hacks, as was the case recently at the Dutch Maastricht University, the hackers often have to be paid off in Bitcoins. If such a transaction were concluded through an ordinary bank account, the police would probably be on the criminals’ doorstep within minutes. But when criminal transactions are conducted via the blockchain, tracking down the criminals requires much more law enforcement effort, although gradually the police are becoming more effective in tracing Bitcoin transactions. Incidentally, the number of criminal transactions completed in Bitcoin accounts for less than 1 percent of the total number of Bitcoin transactions, I was told by my colleagues. Nevertheless, that says nothing about the amounts of money that could supposedly be involved.

In a well-regulated banking system, crypto exchanges that need a traditional bank-account are supervised, in the sense that their bank has to fulfill all obligations that comes from i.e. Due Diligence and Anti-Money Laundering legislations. Banks have to know their customers. However, crypto exchanges that hold their bank account in a poorly regulated environment or even a more or less failed state will probably escape supervision. And another problem comes from so-called ‘tumblers’, in which transactions from different users and/or in different cryptos are being mixed in order to destroy their traceability.

| Box 3: Tesla Now Accepts Payments in Bitcoin

In early February 2021, Elon Musk announced that Tesla would be accepting payments in Bitcoin. It was also announced at the same time that Tesla had purchased USD 1.5 billion of Bitcoin, the equivalent of 3 percent of Tesla’s balance sheet total and about 8 percent of its liquid assets. On March 23, Musk reiterated his commitment and made it more concrete. It will not be long before a Tesla in the U.S. can be paid for with Bitcoin, with the rest of the world to follow later, according to the plan. Unlike the Swiss canton of Zug, Tesla does not use a crypto company as an intermediary. You can pay your new Tesla car directly in Bitcoin. At first glance, this is a big step forward in the general acceptance of Bitcoin. However, after a few of weeks, on May 13, Musk announced that Tesla will stop accepting Tesla, only to state a couple of weeks later that Tesla would be prepared to accept Bitcoin after all, once it has reduced its energy consumption. The statements of Elon Musk has resulted in strong fluctuations in the price of Bitcoin. Above all, they illustrate the illiquidity of the Bitcoin market, which for a big investor is easy to manipulate. Although for the time being Tesla has stopped accepting Bitcoin, it is interesting to have a closer look at what it actually did. The key question is which currency will be used to set the price of a Tesla. Currently, in the U.S., this is still done in dollars. If customers can then pay in Bitcoin, the daily price of a Tesla expressed in Bitcoin will constantly fluctuate with the USD-Bitcoin exchange rate. Then, as with the Swiss canton of Zug, it’s a nice publicity stunt, but it’s not really material. However, a big difference is, that Zug in the end does not accept Bitcoin, while Tesla actually did. On its own, setting the price of a Tesla in dollars is a logical choice for Tesla, especially since the cost side of the business is in regular currency. If Tesla were to lock in the Bitcoin price of a car for an extended period of time, the company would run the risk of making its dollar-denominated operating income increasingly dependent on fluctuations in the price of Bitcoin. That would be a risky gamble. Only if Tesla started paying its suppliers and employees in Bitcoin could it afford to receive (a large portion of) its revenues in Bitcoin, because that would shift the risks to employees and suppliers. In practice, it is likely that Tesla invoiced a portion of its automobiles in Bitcoin and a portion in regular money. This is like treating Bitcoin as a foreign currency, although one which is difficult to hedge against. The impact on the operating result was probably limited, but would still depend mainly on whether the car was paid in Bitcoin or in dollars. The former, however, held a nasty surprise for buyers, according to a recent article on CoinDesk. In the United States, when people buy a car, if the product is defective they are entitled to return the car to the factory and get in certain circumstances a refund of the purchase price. The legislation on this is known as lemon law. If someone buys a Tesla worth USD 50,000 and pays in Bitcoin and is entitled to a refund, Tesla will refund the purchase price. But it will only do this in Bitcoin if it has fallen in value. If Bitcoin has continued to rise since the vehicle was purchased, however, Tesla will refund the amount owed in dollars. The terms and conditions show this. Thus considered, it is in any case better to pay for a Tesla in dollars or, should people want to monetize their holdings of Bitcoins to buy a Tesla, they should simply do so through a crypto exchange and pay for the new car with the dollar amount released in the process. A second important question is what Tesla will do with the Bitcoin it obtains. The company could add it to the Bitcoins it already holds, or it could choose to dispose of them directly. Some analysts point out that if Tesla keeps a large amount of Bitcoin in its portfolio, there is a chance that its share price could become increasingly correlated with the price of Bitcoin. Considering the small share of the balance sheet that Tesla currently holds in Bitcoin (around 3 percent), this seems to be a non-issue for the time being. Remarkably, since Musk’s first announcement, the price of Bitcoin has risen by about 50 percent, but Tesla’s share price had fallen by about 20 percent. This has evaporated about USD 200 billion worth of stock market value. But it is still too early to conclude whether the drop in Tesla’s share price has anything to do with Musk’s announcement. Some skeptics say that not only Bitcoin, but also Tesla shares (still with a price-to-earnings ratio of around 990) are a bubble. Time will tell. After the announcement that Tesla would stop accepting Bitcoins, the Bitcoin price nose-dived, only to recover somewhat once Musk announced that Tesla may accept Bitcoin as yet in the future. One may conclude that this smells like price manipulation. In a regulated market, Musk’s behavior would certainly have been investigated by the supervisors. |

The absence of a central regulator for the blockchain is good for privacy, as explained above, but it also means that if anything goes wrong, no central authority can be called upon to fix it. Human error is responsible for almost all payment transactions gone wrong. People occasionally mistakenly transfer money to the wrong account. They can be tricked into transferring money to a fake account (spoofing). A third example: people sometimes pay the incorrect amount. In many if not most cases like these, banks can resolve payment errors. Even when, through no fault of the account holder, an account is hacked by an outside party, banks often (partly) compensate the account holder’s damages. Not so in the blockchain. If a payment goes wrong or a wallet is hacked and emptied, users can’t do anything to fix it. Another vulnerability is that losing the password for a Bitcoin wallet is just as bad as losing an actual wallet (see below).

Given the current price spike, losing your Bitcoin wallet password is very similar to losing a winning lottery ticket. The solution? Cry your eyes out and try again. Some (difficult to verify) accounts maintain that roughly 20 percent of all wallets can no longer be accessed by their owners. The contents of these wallets can be huge sums, especially those belonging to people who bought a few hundred dollars in Bitcoin for just a few cents per Bitcoin. The internet has stories to tell about lost passwords, people who deleted passwords while reformatting their hard drives, and people who discarded old computers only to realize their wallet had literally ended up on the garbage belt with it. The lesson is simple: pay better attention. Because there is no central regulator protecting Bitcoin users.

But, of course, you could also argue that the people who choose to hold (part of) their assets in Bitcoin are aware of this. It is the risk you inevitably run in exchange for far-reaching privacy and the absence of central supervision. Whether every enthusiastic Bitcoin follower who has recently jumped in realizes this is an open question.

By now, the reader can surely recognize some convergence between existing financial institutions and the world of cryptos. Among other things, banks provide custodian services to Bitcoin investors, which may actually help to solve some of the problems mentioned above. There are now also numerous other financial service providers offering investment products in Bitcoin and other cryptocurrencies. In many cases, these parties do not include Bitcoins on their own balance sheets. Unfortunately, it is generally difficult to obtain precise insight into which services they are actually offering. Often, they do not have an annual report with core data, balance sheet data, and a profit and loss statement. In many jurisdictions, if crypto companies want to have a banking relationship with a regular bank, they must provide comprehensive disclosure to their bank. Banks must require this under supervisory legislation, which demands that they know their customers. Some crypto companies believe that the regulator is too strict and in the Netherlands they have even filed a lawsuit on this issue. It illustrates the inherent tension between, on the one hand, the high degree of privacy that many Bitcoin users see as a huge advantage and, on the other hand, the fear on the part of the regulator that this degree of privacy makes it all too easy for criminals to conduct illegal transactions through Bitcoin.

Distributed ledger technology is finding more and more applications away from Bitcoin in existing institutions, for example in transnational payments or expediting international letters of credit. In these places, DLT is adding significant value. Some central banks are considering introducing a central bank digital currency (CBDC) which may be based on DLT, although DLT appears to be more feasible for (wholesale) central bank applications rather than retail. (Terpstra et al., 2021). The Chinese central bank is also considering using DLT for the central settlement of DCEP, the Chinese CBDC, but as far as we know there is not yet a definitive decision.

Paying with Bitcoin is in many ways similar to paying with cash. Law-abiding citizens use cash without any bad intentions, but it too, unfortunately, is also highly attractive to people with more questionable intentions. There is strong evidence that cash payments, especially banknotes in large denominations, play a significant role in the criminal world. For that reason, some economists advocate a reduction in the use of cash money (Rogoff, 2016). Over the past few decades, the central bank in Sweden conducted a large-scale cash purge, which has lessened the importance of large banknotes considerably. This article describes the process. The ECB has also taken some cautious, early steps to this end, but it’s a sensitive matter. In some countries, like Germany and Austria, people place a lot of value on cash. These countries have always considered privacy important where money is concerned, which to be sure is not to say that German and Austrian citizens are involved in large-scale tax evasion. It is more a question of culture, as illustrated by the saying Nur Bares ist Wahres, which basically means that many people only consider a payment complete if it’s done in cash. Modern methods of payment are widely available there, as shown in the advertisement in the following photo, taken in Vienna in 2018 (Figure 3). Contactless payments are also possible in Germany and Austria, but it is not as popular there as it is in the Netherlands.

Figure 3: Recent Advertisement Promoting Card Payments in Vienna

Source: Author’s Archive

For the prospects of Bitcoin, it is important that central (and private) banks want to have oversight of payment behavior in order to detect criminal transactions. Indeed, this is legally required. As said, customers like the idea of being able to turn to their bank to rectify a transaction that they can prove is wrong. In addition, some governments are slowly but surely working to further reduce the attractiveness of cash for payment transactions. Against this backdrop, it is highly unlikely that regulators would tolerate opaque crypto networks undoing their efforts. To the extent that large-scale use of DLT is permitted, at some point central banks will likely demand that they be given access to the transactions and the parties behind them. Incidentally, this discussion is also currently playing out in the design of digital central bank money). In China, for example, the PBoC will soon be able to see exactly what is happening in the DCEP network (the Chinese version of CBDC).

No, Bitcoin cannot do that. Nor can any crypto or regular currency. The whole concept of a global currency is flawed. The theory of optimal currency areas teaches that currency areas have an optimal size. Whether a currency area may be called an optimum currency area (OCA) depends on the economic and political cohesion in that area and, in the words of Nobel laureate Robert Mundell, “the optimum currency area is not the world” (Mundell, 1961). Monetary autonomy is also important. Policymakers of particular currency areas want to be able to influence the money supply within their economy so that there is not excessive inflation or deflation. In Europe, we have the EMU, a currency area in which political integration is not yet complete. Given how hard it is to achieve political cohesion in a group of about twenty countries that are similar in many ways, the chances that it could be achieved on a global scale are zero.

No. The system is neither fast enough nor transparent enough. Moreover, creating a global currency anchor is a highly political process. It would enormously influence the way the international financial system is organized and could place restrictions on national monetary sovereignty. The stakes are extremely high. Policy makers would never allow an opaque system like Bitcoin to fulfill that role.

That doesn’t diminish the fact that intelligently designed crypto currencies may well play a role here. In 2019, for example, a consortium led by Facebook announced plans for a new digital currency, the Libra (later renamed Diem). There are many differences between Libra/Diem and Bitcoin, and of course the most important is that the Diem does not exist yet. But the design of the Diem is economically very sound. It is flexible, the consortium behind the Diem wants to cooperate with supervisors to prevent use of the Diem for illegal transactions and the Diem is a so-called stablecoin. This means that all Diem are in principle backed by high-quality, highly liquid assets. It all remains to be seen, but the authorities immediately recognized that the Diem has the potential to become much bigger than Bitcoin, thus affecting the monetary autonomy of central banks. It is probably the main reason why central banks have greatly increased their efforts to introduce CBDC in recent years.

Earlier, I stated that the Libra/Diem could serve as a global currency anchor with a few adjustments. The composition of the Diem would need to be like the SDR, the International Monetary Fund’s basket of currencies which is comprised of the most important currencies in the world. The IMF would have to supervise this basket, but the Bank for International Settlements (BIS) would manage the currency on a day-to-day basis. That would vastly improve the global financial infrastructure and simultaneously make the global economy more stable.

The Diem does not exist yet, but if one day it does, in its original version, possibly supplemented with various national stable coins (and if it is successful), then it is not at all clear what the added value of Bitcoin will be as an international means of payment. But maybe it could still play a role as an asset class.

Some people think that the blockchain may replace banks as the major source of financing of the economy. I don’t agree. Banks do much more than channeling funds between creditors and debtors (or so-called direct finance). In direct finance, all risks involved in a transaction, such as the credit risk, interest rate risk, concentration risk and liquidity risk, remain with the lender or borrower. When banks are involved as intermediary (indirect financing), they take over most of those risks from both creditors and borrowers. Depositors run only credit risk on the bank, and this risk is limited to the amount that is not covered by deposit insurance. The banks guarantee liquidity to its depositors, while at the same time allow debtor a long and predictable pay-back period. And so on. Indirect finance necessitates the presence of a trusted third party, in this example a bank. Blockchain can’t fulfill this role. Banks can.

Of course blockchain technology can play a major role in making direct financing more professional, which may improve its competitive position vis-à-vis indirect financing. But I don’t expect banking to disappear.

As explained above, this is already happening to some degree. For example, some banks are already acting as custodians for Bitcoin companies. However, this does not necessarily mean that they take Bitcoins on their balance sheet themselves; trading at their own risk is now largely prohibited for most banks. They would also have to hold a lot of equity against it, given Bitcoin’s volatility. But when banks offer services to Bitcoin companies, they immediately provide a means for the regulator to get a better handle on them. After all, banks need to know their customers well, which means they need to have a good understanding of what their customers are doing. The customers behind the wallets may very well have to reveal their real identity to the custodian. Many parties are entering this market with additional financial services in cryptocurrency. Although some of these companies are starting to look like banks in many ways, they rarely are, which makes sense, as they would be directly subject to banking supervision. For Bitcoin to be fully integrated into the system, its pseudonymity will have to be largely abandoned.

No, we cannot. As it is, there is no real Bitcoin economy. So if a Bitcoin investor has made a nice profit in Bitcoins then, in order to collect this profit, they must find someone else to take the Bitcoins from them. As long as money flows into Bitcoin from the dollar or euro sphere, the Bitcoin price can remain high or even continue to rise. If that flow dries up, sentiment can also shift very quickly. Of course, there are people who can make a lot of money investing in Bitcoin, but there are also many who cannot. In that respect, it’s a bit like a lottery or going to a casino. You have a chance to make a nice return on your investment, but you also know that most people just lose their money. So getting rich in our sleep while Bitcoin does its “work” is unfortunately not possible. No matter how much many of us would like that. In the end, goods and services have to be produced somewhere.

The fact that Bitcoin is rather attractive for the settling of illegal activities also gives Bitcoin investing a bit of a sour aftertaste. It is, of course, conceivable that the blockchain will be modified in such a way that a certain degree of transparency for a central regulator will replace pseudonymity. And that a market regulator will henceforth oversee whether price manipulation is taking place and whether Bitcoin investors are being provided with good, objectively accurate information. Who could object to that?

Nevertheless, the possibility remains that such measures, which regulators are bound to lean toward sooner or later, will subsequently cause Bitcoin’s light to burn out quickly. Criminals are then likely to retreat from Bitcoin in a hurry. If it were to emerge that, despite the small number of false transactions mentioned above, a great deal of money is involved, the price could fall rapidly.

Bitcoin faces a slightly contradictory threat, namely, that it could become too successful. So far, despite its success, the fluctuations of the Bitcoin price has no economic effect at all. Neither its increase by a staggering 500% in less than a half year nor its following fall by 30% has left any traces in the real economy. So-called wealth-effects were not visible. From a stability point of view, Bitcoin is not very relevant. But this may change if more and more people would invest substantial parts of their wealth in an ever more expensive Bitcoin.

Central banks will certainly not allow an uncontrollable type of alternative money to take away their control of domestic monetary developments. The same is true with stablecoins: central banks are now working hard on CBDC themselves, with the preservation of monetary sovereignty as the main reason. Bitcoin or any crypto should not become systemically important. Regulators have worked hard in recent years to strengthen the stability of the banking system and won’t be happy to see it now eroded by an unregulated and opaque shadow system.

Overall, I get the sense that the DLT, the real innovation behind crypto currencies, is likely to become a permanent fixture in the financial system. However, the prospects of Bitcoin as a currency, like those of other crypto currencies, are a lot less certain.

Caveat Emptor!

Boonstra, W.W. & L. van Goor (2020), The Basics of Money and Banking. From ancient coins to credit and cryptos, VU University Press, Amsterdam.

Davies, G. (1016), A History of Money, fourth edition (by D. Connors), University of Wales Press, Cardiff.

Keynes, J.M. (1924), A Tract on Monetary Reform, Prometheus Books, New York.

Mundell, R.A. (1961), A Theory of Optimum Currency Areas, American Economic Review, Vol. 51 (4), Sep. 1961, pp. 657–665.

Rogoff, K.S. (2016), The Curse of Cash, Princeton Press.

I am grateful to my colleagues Djuri Baars, Jarl Nieuwenhuizen, Claudia Terpstra, Wouter van Eijkelenburg, and Maartje Wijffelaars for their comments on this article. Djuri, Jarl and Claudia’s innovation insight in particular helped me find my way in the world of cryptocurrency and blockchain. I learned a lot from that journey, but whether it was enough is up to the reader to decide. I take full responsibility for any inaccuracies. I must also point out that I am not an investment adviser, and that this article offers neither purchase nor investment recommendations.

Note, that in this process the bank creates ‘free funding’ to finance a newly acquired asset, such as a loan. This is an advantage on system level, although an uncertain one for an individual bank. Moreover, in times with zero interest rates on savings deposits, this funding advantage evaporates. See Boonstra & Van Goor (2020) for a thorough discussion of the money creation process.

See also https://www.statista.com/statistics/881541/bitcoin-energy-consumption-transaction-comparison-visa/