Research on central bank digital currency (CBDC) has gained impressive momentum recently. While the motivations for issuing retail CBDC are different for advanced and developing/emerging economies, in both cases CBDC would become part of the respective existing payment ecosystem. We identify a lack of systemic analysis that would be necessary to discuss the role of CBDC within the existing payments ecosystem and the inefficiencies central banks intend to specifically address. At the same time, it is not yet clear from the CBDC prototypes outlined so far what their unique selling proposition over existing systems might be. This suggests that the perspective of potential users is largely ignored and CBDC projects risk the failure to assert themselves in the existing payment ecosystem. This paper provides a systemic analysis of the existing payment ecosystems in advanced and developing/emerging economies and discusses CBDC proposals from the perspective of potential unique selling propositions vis-à-vis existing subsystems.

As a recently updated BIS survey (Boar and Wehrli 2021) shows, more and more central banks around the world are engaged in Central Bank Digital Currency (CBDC). According to the survey, the main motivations of central banks are

With this focus on the payment system, it is surprising that central banks have so far not clearly elaborated which inefficiencies they intend to specifically address with CBDC. At the same time, it is not yet clear from the CBDC prototypes outlined so far, what their unique selling proposition over existing systems might be.

This shortcoming reflects two fundamental problems with the CBDC discussion to date. First, there is a lack of systemic analysis needed to discuss the role of CBDC within the existing payments ecosystem. Second, the perspective of potential users is largely ignored. In Bofinger and Haas (2020) we address these issues by providing a systemic taxonomy of the payment system and an extensive discussion of different CBDC design options and proposals.

The focus of the following analysis is on the use of CBDC in developed economies. Nonetheless, the specific aspects arising for developing and emerging economies are also addressed.

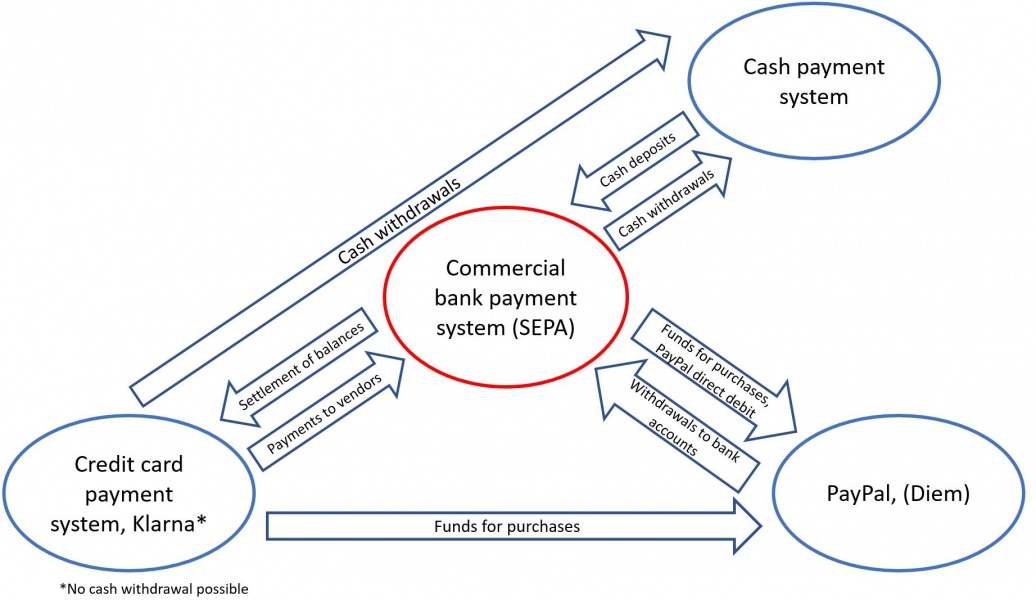

For a systemic analysis of the role of CBDC in advanced economies, it is useful to first look at the existing retail payment ecosystem (Figure 1). It consists of several coexisting subsystems with the commercial bank payment system at its center. The central role of commercial banks derives from the fact that bank deposits are the dominant means of settlement for the other subsystems and that cash can only be generated by withdrawals from a bank deposit.

In principle, almost all financial services can be provided by the commercial bank payment system. The stable coexistence with the other systems shows that these must have unique selling propositions.

Figure 1: The existing retail payment ecosystem

Cash payment system: As a means of regular payment, the unique selling position of cash is dwindling. However, for the US-Dollar, the Yen and the Euro, the circulation of currency relative to GDP has increased over the past two decades. The growing demand for cash reflects above all its advantages as means of payment in the shadow economy. In addition, cash also has its attractiveness as absolutely safe store of value, especially for amounts that go beyond the 100,000 euro threshold until which deposits are protected by the deposit insurance. But even in the case of regular retail payments there are private households who prefer the anonymity of cash over digital payments.

Credit card payment system (VISA/Mastercard/Klarna): This system has the specific advantage that credit cards of the big providers can be used globally and with multiple currencies. This is also the case with bank cards issued directly by banks (Maestro), but their global acceptance is significantly lower. In addition, providers of credit cards also allow for short-term overdraft facilities and consumer loans and offer bonus programs (e.g. “Miles and More“) or insurance services. Credit card payment systems do not require system specific deposits as they access bank deposits for settlement. Klarna’s attractiveness derives from its relatively generous credit facilities.

PayPal: While central banks often explain their CBDC engagement with the risks associated with Facebooks Libra/Diem project, they almost never refer to PayPal. This is surprising, as the PayPal payment system has experienced an impressive growth in the past years which can be explained by its attractive features:

This coexistence of the subsystems with the commercial bank systems provides a certain degree of competition. If one subsystem charges too high fees, customers can switch to the commercial bank payment system or another subsystem. The strong growth of Klarna shows that it is still possible for new competitors to enter the market successfully.

A systemic view would now suggest that central banks identify concrete inefficiencies of this ecosystem that require their intervention. At the same time, they would then have to make clear what unique selling proposition a specific CBDC project has to offer in order to assert itself in this ecosystem.

The lack of a systemic perspective is further demonstrated by the fact that no clear distinction is made between two fundamentally different forms of CBDC design.

The inadequate differentiation between the two design options becomes evident in the ECB’s report on a digital euro (ECB 2020). In line with the first option, the ECB argues:

“(…) the digital euro could make use of – and thereby strengthen – existing pan-European payment solutions for consumers and merchants across Europe.” (ECB 2020, p. 20).

At the same time, the ECB emphasizes: “A parallel infrastructure would also run counter to the aim of issuing a digital euro in order to improve the cost and environmental footprint of payments.” (ECB 2020, p. 34).1

The insufficient consideration of the user perspective and the need to offer a unique selling proposition vis-à-vis the other subsystems means that the chances of success of the CBDC prototypes developed to date cannot be rated very highly. We are going to illustrate this with some prominent examples.

CBDC as commercial banks light

A widely discussed proposal was developed by Bindseil (2020) who is Director General Market Infrastructure and Payments at the European Central Bank. The proposal can therefore be regarded as a variant of the digital euro. It can be interpreted as an option where non-banks can open bank accounts with the ECB that will be used within the existing payments ecosystem. In other words, it does not imply a new parallel payment system.

A key feature of the proposal is a tiered remuneration system. It aims to discourage the usage of CBDC accounts as a store of value as this could lead to an uncontrolled disintermediation of the banking system. Bindseil (2020, p.24) describes the system as follows:

Another decisive feature of a central bank account is the limited spectrum of services it offers compared to a bank account held with a private bank. Bindseil (2020, p. 26) makes this point very clear:

“The attractiveness of CBDC for payment purposes does not only depend on the amount of CBDC that would be remunerated at a fairly attractive level, but also on other features of the use of CBDC as means of payment. It will matter in particular whether account services of CBDC include the services that deposit accounts with commercial banks typically offer, like remote internet access, mobile phones and cards, periodic payments to other accounts, debit orders, user-defined maximums for different types of transfers, etc.”

Theoretically, central banks could try to offer the whole spectrum of banking services, but without an obvious market failure, such intervention with the market could not be justified. In fact, Bindseil (2020, p. 26) argues:

“There would therefore still be a difference relative to the breadth of services by commercial banks”.

From the user perspective, such a CBDC option seems hardly attractive. The most important advantage of a central bank account over a commercial bank account is its absolute safety. However, this feature is only relevant for accounts above the 100,000€ threshold, as deposits below this threshold are protected by deposit insurance schemes.

Thus, for the typical household, there is no obvious advantage to a CBDC account over an account at a commercial bank. Rather, a CBDC account has serious disadvantages:

Of course, central banks could in principle decide to offer the full range of services at sufficiently lower prices than commercial banks. But Fabio Panetta, the member of the ECB Executive Board in charge of the digital euro, stated in an interview with DER SPIEGEL, that the ECB wants banks as partner, not as competitors. And he added that the ECB does not plan to offer financial services.2

CBDC as a substitute for the cash payment system: the offline digital euro

In its report on the digital euro, the ECB (2020) also envisages an offline solution for the digital euro. This should be seen as a digital substitute or complement for cash:

“A digital euro based on infrastructures existing in parallel to those of other payment solutions could help to withstand extreme events such as cyber incidents and attacks, natural disasters and pandemics.” (ECB, 2020, p.33).

Payment should be settled between the devices of payer and payee by a transfer of pre-funded units. The ECB argues that the offline functionality should ensure a high level of privacy and anonymity as it “avoids the sharing of transaction details with parties other than the payer and payee, enabling the digital euro to become a complement to cash” (ECB, 2020, p.31).

What could be the unique selling propositions of an offline digital euro vis-à-vis the cash payment system? With respect to the usage for regular payments, several effective digital solutions for payments are available already. And it is not very likely that people who still prefer cash for regular payments would adopt a digital euro.

With respect to anonymity and the function as a safe asset, the anonymity of a digital euro can never be as perfect as it is with cash. Rigid limitations due to Anti-Money-Laundering or CFT rules limit the use as a store of value and for payments in the informal sector. Finally, with respect to the offline usage in extreme events, cash payments have the advantage that they do not require a functioning electricity net.

As long as central banks do not intend to abolish cash, it is difficult to identify a unique selling propositions of a digital euro vis-à-vis cash. And if central banks want to maintain the access of citizens to central bank money, the easier solution is to maintain a nation-wide cash supply system.3

CBDC as substitute for the cash payment and the commercial payment system: the e-krona

The most far-reaching CBDC approach is an option where central banks establish a new parallel retail payment system that competes with the commercial bank payment system and all other subsystems of the existing payment ecosystem.

An example for such an ambitious proposal is the e-krona project by the Sveriges Riksbank. The Riksbank (2020) describes its system as follows:

“All transactions in the e-krona network occur separately from existing payment networks, which, as stand-alone systems provide added robustness in the event of problems with the existing payment infrastructure”.

But the “added robustness” implies low interoperability with other payment systems, which becomes apparent in these statements:

“[W]hen a holder of e-kronor want to pay to a recipient who does not have e-krona accounts or who does not wish to increase their e-krona holdings, there is a need to exchange e-kronor for commercial bank money, i.e. to go outside the e-krona accounts” (Armelius et al. 2020, p. 85)

Similarly, “[t]he merchant that desires to accept e-krona payments also needs to open an account at the Riksbank” (Armelius et al. 2020, p. 83). Thus, payments are only possible within the system and not outside the system. In order to participate in the network, a digital wallet must first be activated, and money has to be transferred into the system.

In comparison to the existing payment systems, it is hard to identify a unique selling proposition of the e-krona. Again, the absolute safety of a central bank account is irrelevant for typical households.

For a small country like Sweden, the focus on its own country and its own currency is likely to prove a particular disadvantage. But also the ECB should ask itself what particular advantages a parallel digital euro payment system could offer over the existing systems. If, as Panetta emphasized, the ECB does not plan to offer any financial services of its own, it will be very difficult for a digital euro payment system to compete with private systems, whose attractiveness is determined to a large extent by the financial services they offer.

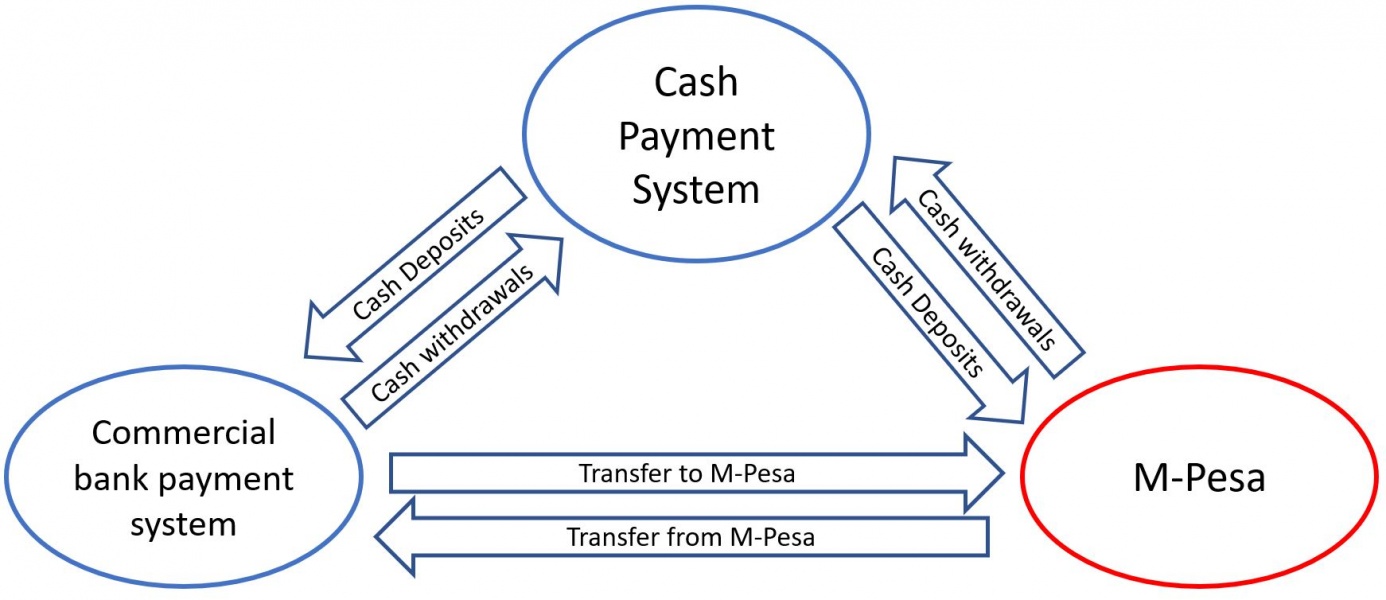

As the BIS survey shows, for central banks in emerging and developing economies with often high shares of unbanked adults (Demirguc-Kunt et al. 2018), financial inclusion is the most important motivation to issue CBDC. However, in many countries, the market has already found a very effective substitute for the commercial bank payment system.

While the access to the banking system is limited, almost all people use mobile phones. This provides the basis for payment networks operated by mobile phone providers. The very successful M-Pesa system was launched already in 2007 by Vodafone Group plc and Safaricom in Kenya. With local merchants and retailers as agents, it is not only possible to make transfers but also deposit and withdraw cash. In addition, such mobile payment services offer an increasingly broader range of services including the provision of loans. These mobile payment systems are also connected and interoperable with the commercial banking system (Figure 2).

Figure 2: The payment ecosystem for emerging and developing economies

Given the growing role of such mobile phone-based systems in more and more countries (GSMA 2020), the need for CBDC as an instrument for financial inclusion is not obvious. In addition, it would be impossible for central banks to establish a payments infrastructure that parallels the mobile phone infrastructure. Central banks could only distribute SIM cards in order to reach out to citizens.

The intense CBDC discussion of central banks threatens to go in the wrong direction. The insufficient systemic perspective has led to the development of CBDC prototypes for which it is questionable whether they have a unique selling proposition from the user’s perspective compared with existing payment systems. If central banks really want to develop a successful alternative to the large global payment platforms, it must not be national, but international and not limited to one currency, but applicable to as many currencies as possible. And even then, it will be difficult to establish a pure payment system on the market if the competing providers also offer a wide range of financial services. This raises the fundamental question of whether the central banks are the right actors when it comes to finding a European response to the players operating from the U.S. and China. Wouldn’t it be better if they sought to initiate and orchestrate a comprehensive private solution? The European Payments Initiative could be a possible starting point.

Armelius, Hanna, Gabriela Guibourg, Stig Johansson, and Johan Schmalholz. 2020. “E-krona design models: pros, cons and trade-offs.” In Sveriges Riksbank Economic Review – Second special issue on the e-krona. Vol. 2020:2. Sveriges Riksbank.

Bindseil, Ulrich. 2020. “Tiered CBDC and the financial system.” ECB Working Paper Series, January, No. 2351.

Boar, Codruta, and Andreas Wehrli. 2021. “Ready, steady, go? – Results of the third BIS survey on central bank digital currency.” BIS Papers, January, No. 114.

Bofinger, Peter, and Thomas Haas. 2020. “CBDC: Can central banks succeed in the marketplace for digital monies?”, CEPR Discussion Paper No 15489.

Demirguc-Kunt, Asli, Leora Klapper, Dorothe Singer, Saniya Ansar, and Jake Hess. 2018. “Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution.” Washington, DC: World Bank. © World Bank. https://openknowledge.worldbank.org/handle/10986/29510 License: CC BY 3.0 IGO.

ECB. 2019. “Opinion of the European Central Bank of 26 November 2019 on the requirement for certain credit institutions and branches to provide cash services.” Opinion by the ECB (CON/2019/41), November 26, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52019AB0041.

ECB. 2020. “Report on a digital euro.” October 2,

https://www.ecb.europa.eu/pub/pdf/other/Report_on_a_digital_euro~4d7268b458.en.pdf.

GSMA. 2020. “Partnering during crisis: The shared value of Partnerships between Mobile Networks Operators and Humanitarian Organisations.” April.

Panetta, Fabio. 2021. “Interview with Der Spiegel.” February 9,

https://www.ecb.europa.eu/press/inter/date/2021/html/ecb.in210209~af9c628e30.en.html.

Sveriges Riksbank. 2020. “Technical solution for the e-krona pilot.” February 20, https://www.riksbank.se/en-gb/payments–cash/e-krona/technical-solution-for-the-e-krona-pilot/.

A similar statement is the following: “In order to improve the overall resilience of the payment system, the digital euro should be widely available and transacted via resilient channels that are separate from those of other payment services and can withstand extreme events.” (ECB 2020, p. 14).

„No, we have explicitly and repeatedly stated that we want the banks to be our partners, not our competitors. We will offer safe money, not financial services.“ Panetta (2021).

A similar solution has been implemented in Sweden, where a draft law requires credit institutions and branches that provide payment accounts with basic functions to consumers to provide adequate cash withdrawal services to all consumers throughout Sweden (Government Offices for Sweden, Govt Bill 2019/20:23). The ECB (2019) explicitly welcomed the objectives of this draft law.