In a good year, the savings glut allows many countries to run a current account deficit. Consequently, their level of investment is not constrained by domestic savings; cf. the Feldstein-Horioka puzzle (Feldstein and Horioka (1980)). However, in a bad year – when capital flows stop – the countries that have come to rely on capital inflows will experience a setback. Bussière et al. (2017) are cautiously optimistic on the post-crisis development of capital flows, including the resilience of equity-like flows, but they acknowledge the meltdown of international bank and debt financing in particular in the euro area.

The importance of a current account deficit depends on several factors2. In addition to the state of global capital markets, the confidence in the country in question matters, as do the exchange rate regime, and price and wage flexibility.

Current account deficits thus tend to be persistent and, in the euro area, the countries that fared particu-larly poorly after the financial crisis all had significant deficits in the years prior to the 2008-crisis. The fu-ture stability of the euro area will depend on whether these countries can maintain their newly won posi-tion as surplus or close to surplus countries, or they slip back into running current account deficits.

Denmark ran persistent current account deficits for many years. The focus of demand management policy was on containing the current account deficit. However, after almost being at the edge of the economic abyss in the early 1980s, there was a regime shift in economic policy. Denmark has tried for 200 years to peg its currency, initially to the Hamburg Thaler, in the post-Bretton-Woods era to the German Mark, and since the beginning of Economic and Monetary Union in 1990 to the euro. The decades since 1982 are among the few successful ones.

Denmark’s lesson is that you need to become as German as the Germans to peg to their currency, whether inside or outside a currency union. If you run a less competitive economy, adjustment one way or the other will happen. However, at the end of the day, we cannot all be Germans.

Current account arithmetic

The current account has many economic interpretations, including

(1) Current account = Exports – Imports + Net income and transfers

(2) Current account = Savings – Investment

(3) Current account = Net Capital Outflow + Reserve Accumulation

(4) Current account (country x) = – Current account (Rest of World)

Current account surpluses depend on economic circumstances. When global savings are ample and foreign lenders and investors have confidence in a deficit country, its rule of law and democratic institutions, it will not be difficult to import capital needed to finance the deficit. However, history has shown that the environment can change quickly and capital flows can stop suddenly. Under such circumstances, the current account is constrained, and savings and investments have to adjust unless you run a current account surplus.

The consequences of this adjustment depend on the macroeconomic policy regime and the wage and price flexibility of the economy. If either exchange rates or wages and prices do not adjust, then quantities have to adjust. This results in unemployment.

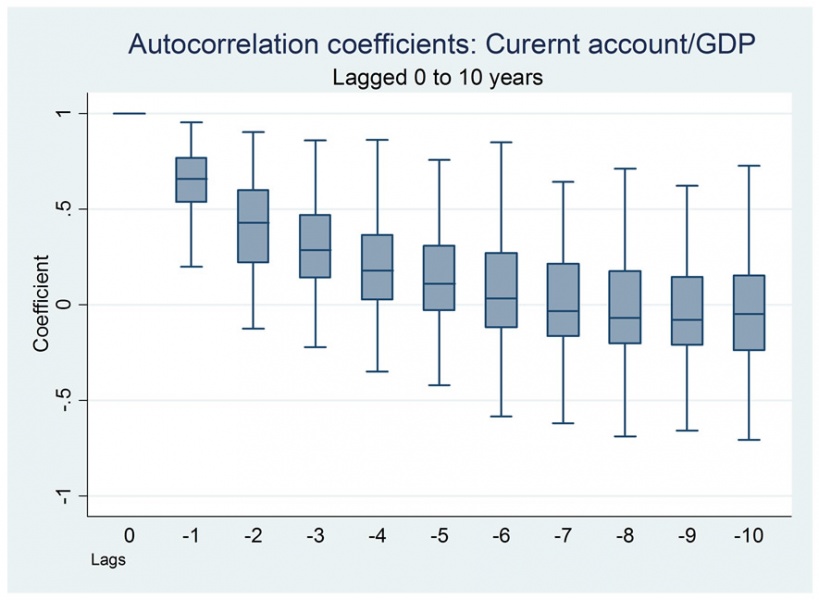

History suggests that there is a lot of persistence in whether a country has a current account surplus or a current account deficit. Chart 1 exemplifies this by showing that most countries have positive autocorrela-tion in their current accounts over a five-year period.

Chart 1: The Deficit Trap

Notes: The chart displays the distribution of autocorrelation coefficients for the 147 countries for which data is available. The solid bars represents the 25 and 75 percentiles, and the lines show the 10 and 90 percentiles. The lags are 1-year intervals.

Source: The World Bank’s online DataBank: IMF Balance of Payments Statistics Yearbook and Danish FSA calculations.

There might be very good reasons for the persistence. Deficit countries may be emerging market countries that are in the process of catching up and as such offer good investment opportunities. Developed surplus countries that have fewer of these opportunities should see capital flow to these countries. However, the world can be a cruel place for the deficit countries. At times when capital flows stop, their degrees of freedom will be constrained by how far they can reduce their foreign exchange reserves. Surplus countries are not similarly constrained, as there is no ceiling on their accumulation of foreign exchange reserves. There is an often-observed asymmetric pressure to adjust. This is even more the case if deficit and surplus countries are part of the same currency union, as there is not even an impact on the domestic money supply of the surplus country.

Current account deficits in the euro area

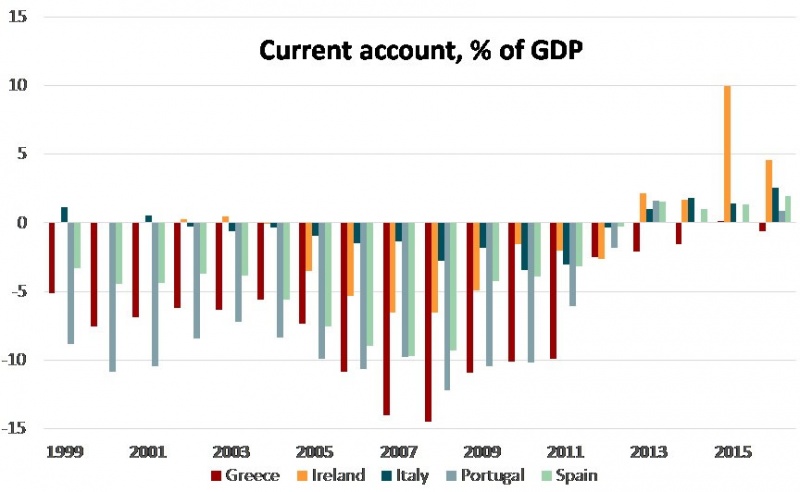

Looking at the countries in the euro area that suffered most during the financial crisis and the subsequent euro crisis, Portugal, Ireland, Italy, Greece and Spain, their economies appear to have been subject to a sudden stop experience, and their current accounts improved rapidly, cf. Chart 2.

Chart 2: The persistent deficit countries in the euro area

Source: The World Bank’s online DataBank: IMF Balance of Payments Statistics Yearbook. Data for Ireland is from the OECD.

Capital had been flowing freely from Germany and other surplus countries to the deficit countries until the crisis struck. When capital stopped flowing, savings and investments had to adjust. In the short to medium-term, the only possibility was a massive contraction in demand, resulting in a dramatic increase in unemployment.

Prior to the crisis, Olivier Blanchard, the former chief economist of the IMF, was initially of the opinion that current account deficits within the euro area had become a non-issue; cf. Blanchard and Giavazzi (2002). However, four years later he recognized that he was wrong, cf. Blanchard (2006), and made more accurate predictions of subsequent events.

The development was partly the result of a failure to follow the rules of the Economic and Monetary Union, and partly the result of a design flaw in the construction of the EMU. Following Germany’s and France’s blatant disregard for the rules on fiscal balances in the early days of EMU, less disciplined countries like Greece and Italy could easily disregard the fiscal rule set. However, countries that showed fiscal discipline, such as Ireland and Spain, also suffered. They had been running fiscal surpluses, but large current account deficits. Thus, the private sector had large savings deficits with exposure to sudden interruptions to capital flows. The EMU-rules ignored private sector deficits. This was a design flaw. To some extent, private sector deficits reflected a boom in real estate investments financed by exuberant bank loans. As capital flows stopped, the private sector had to retrench and cut its savings deficit. The combination of bad loans and an economic setback resulted in huge losses in the banking sector, some of which the public sector chose to cover.

Romer and Romer (2017) document how the degree of monetary and fiscal space prior to financial distress greatly affects the aftermath of financial crises. Countries that have little policy space suffer more than countries with more policy space. As opposed to their analysis, we have here used the current account deficit as a proxy for policy space.

The Danish experience

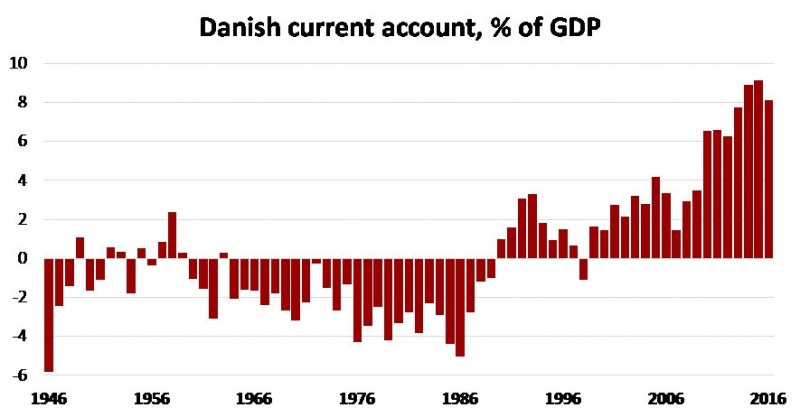

Denmark resembled the deficit countries in the euro area for a large part of the post-war period, cf. Chart 3.

Chart 3: Denmark from persistent current account deficit to Surplus

Source: Abildgren (2017).

Denmark was a country with persistent current account deficits. Demand management policies were stop-go policies depending on the availability of external finance. However, over the last few decades, Denmark has become a surplus country. Lately, Denmark has been running substantial surpluses.

What caused that change? The generally accepted story is that Denmark’s economic situation in the early 1980s created a burning platform. Denmark was on the way towards the economic abyss, as the then Minister of Finance stated. A subsequent change of government led to a drastic change in economic strategy, and different governments since then have supported this change.

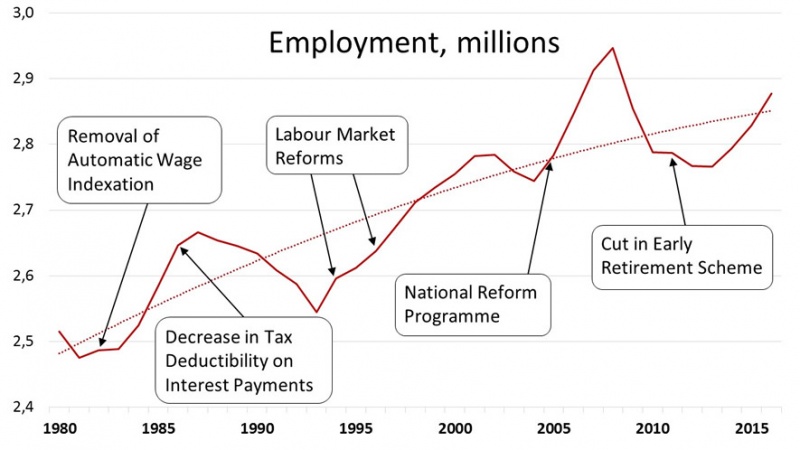

Many of the problems that Denmark addressed are the same issues that many of the crisis countries in the euro area face. Denmark removed wage indexation, balanced public budgets, cut tax deductibility of interest, thus increasing incentives to save, introduced labour market pension schemes, created an extremely flexible labour market, and linked retirement age to life expectancy, cf. Chart 4. Since the 1990s, reforms have targeted labour supply to improve public finances, and this has benefitted the overall economy.

Chart 4: Employment and major policy reforms in Denmark

In short, the Danes became as German as the Germans, or maybe even more so. The DKK/EUR (DKK/DM) exchange rate has been the ‘canary in the coal mine’ that has helped Denmark stay the course by keeping policymakers permanently alert. The interest rate on government bonds has been a less reliable ’canary’; staying too quiet for too long and being too noisy on other occasions.

Conclusion

Different national economic growth rates and varying trends in competitiveness, international trade and investment flows imply that some countries run deficits, while other countries run surpluses on their cur-rent accounts. Capital flows from surplus countries to deficit countries are in normal times in the interest of both parties. From time to time, however, crisis occur which disrupt the smooth working of international financial markets. In crisis times, it can become difficult to finance current account deficits on acceptable terms. Luckily, It happens only occasionally.

The adjustment burden continues to fall on deficit countries. If they want to avoid that, they need to be-come as German as the Germans. Denmark’s experience suggests that it is doable. However, it took Den-mark many years to learn how. The question is whether the recent experience of the most exposed countries has created the burning platform that is an essential prerequisite for reform. In any case, as one of the relations of the current account (4) showed, we cannot all run a current account surplus. Therefore, we will also have to think of other options.

International Monetary Fund, Balance of Payments Manual, www.imf.org/external/np/sta/bop/BOPman.pdf

K. Abildgren, A Chart & Data Book on the Monetary and Financial History of Denmark, Working Paper, 2017.

O. Blanchard and F. Giavazzi, Current Account Deficits in the Euro Area: the End of the Feldstein-Horioka Puzzle?, Brookings Paper on Economic Activity, 2002.

O. Blanchard, Adjustment Within the Euro: The Difficult Case of Portugal, Portuguese Economic

Journal, 2006.

M. Bussière, J. Schmidt and N. Valla, (No) worries about the new shape of international capital flows, SUERF Policy Note, 2017.

M. Feldstein and C. Horioka, Domestic Saving and International Capital Flows, The Economic Journal, 1980.

C. Romer and D. Romer, Why some times are different: Macroeconomic Policy and the aftermath of financial crisis, Working Paper, 2017.

Thanks to Morten Balling and colleagues at the Danish FSA for useful comments.

In the balance of payments statistics, transactions are organized in respectively the current account and the capital and financial account. The major classifications in the current account are: goods and services, income and current transfers. Conceptually, a deficit in one subset of items must always be balanced by a surplus in other items. Thus, a country can run a current account deficit for many years, if the deficit can be financed by inward capital movements in the form of foreign bank loans, direct investments from abroad or other inward transactions, which belong to the financial and capital account. As long as foreign lenders, investors and governments have confidence in the country in question and the domestic government is willing to increase its foreign debt, a current account deficit is less of a political concern.