Economists have argued that when nominal interest rates are constrained, higher inflation expectations can help stabilize the macroeconomy by lowering real interest rates and stimulating consumption. Yet, to date, the empirical evidence for this channel has been very mixed. In this policy note we review evidence from our recent study (Duca-Radu, Kenny and Reuter, 2020) of this important policy question for central banks. The study exploits a very large survey dataset with over two million observations drawn from 17 euro area economies. We find clear scope for higher inflation expectations to help stabilise the economy. The stabilising effect, while significant and very generalised in the population, is relatively modest in quantitative terms. It also tends to be stronger when interest rates are close to their lower bound.

In most advanced economies, the nominal rates of interest set by policy makers are at unprecedented low levels that are close to their effective lower bound. By lowering nominal rates, central banks have sought to help stimulate economic activity by reducing also the real rate of interest which determines investment, consumption and savings behaviour. However, due to the lower bound on nominal rates, further reductions in the real rate of interest can mainly be achieved through higher rates of expected inflation. In line with this, policy makers have stressed the role of inflation expectations as a key component in the effective transmission of non-conventional policies including asset purchases.2 The current context of the COVID-19 pandemic has also engendered a risk of too low inflation and highlighted the need to avoid a sharp drop in inflation expectations as part of the process of macroeconomic stabilisation.

The scope for central banks to help stabilise the economy through the management of inflation expectations hinges on two crucial elements. In the first instance, central banks must be able to influence – either through their policy actions or their communication – the actual inflation expectations of households and firms. Second, households and firms must themselves adjust their own behaviour in response to changes in their inflation expectations. In this policy note, for the specific case of household inflation expectations, we explore new research on this second aspect. Thus far, as recently reviewed in a survey paper by Candia, Coibion and Gorodnichenko (2020) at the recent Jackson Hole Economic Symposium in August 2020, it is fair to say that the evidence on whether or not households would increase consumption and reduce savings in response to higher inflation expectations is very mixed. Research by Ichiue and Nishiguchi (2015) for Japan, Crump et al. (2020) for the US and D’Acunto et al. (2018), Dräger and Nghiem (2018) and Goldfayn-Frank and Wohlfart (2019) for Germany find, respectively, an increase in spending in response to higher expected inflation.3 However, for US consumers, Bachmann et al. (2015) and Burke and Ozdagli (2013) find that there is no significant positive impact of inflation expectations on durable goods consumption. Indeed, at the lower bound, the findings of Bachmann et al. (2015) imply that higher consumers’ inflation expectations may lower current consumption. Similarly, Coibion et al. (2019) report experimental evidence for Dutch households where they move the inflation expectations of survey participants by providing random subsets of the sample with information about actual inflation. They find that consumers who revise their inflation expectations upwards tend to reduce their spending on durables, at least in the short term. They attribute this to households’ interpretation that higher expected inflation temporarily reduces their future real income, which leads to little adjustment of non-durable spending but sharp delays and reductions in durable goods purchases to offset this transitory shock.4 In this policy note we review new micro evidence for the euro area countries on this crucial relationship. The work we review, described in detail in Duca-Radu, Kenny and Reuter (2020), exploits a very large micro data set on consumers’ quantitativ perceptions and expectations for inflation. A key insight we develop is how perceptions of current inflation appear central to pinning down also the link between a consumer’s readiness to spend and their inflation expectations. We then document a very generalized result that an increase in inflation expectations relative to a consumer‘s own perceptions of inflation is indeed associated with a positive response of a consumer’s readiness to spend. This finding – which is observed with striking consistency in the cross section of demographic groups and euro area countries – supports the faith that central bankers have developed in inflation expectations as a tool for macroeconomic stabilization. However, the analysis also shows that the macroeconomic and quantitative magnitude of this effect is relatively modest, implying that policy may need to rely on other indirect channels of monetary transmission beyond any direct impact of real interest rates and inflation expectations on households willingness to consumer.

The European Commission’s Consumer Survey provides an excellent source of information on euro area household inflation expectations. Starting in May 2003 the survey collects quantitative data on inflation expectations and perceptions expressed as percentages over the next 12 months and over the past 12 months respectively. In addition, the survey gathers qualitative information on other relevant aspects such as consumers’ expectations about their own financial situation, whether they are running into debt or rather saving, their spending intentions but also about the general economic and unemployment situation. Moreover, the survey also records information regarding the respondents’ demographics such as gender, age, education, employment status and income levels. In other words, it provides a rich information set with the only downside that each new month a new set of consumers is interviewed, meaning that the data provides a repeated cross-section and not a panel of the same consumers through time. For empirical analysis, such a panel would be highly valuable in tracking how fluctuations in inflation expectations of a given consumer might influence their attitude to spending and consumption.

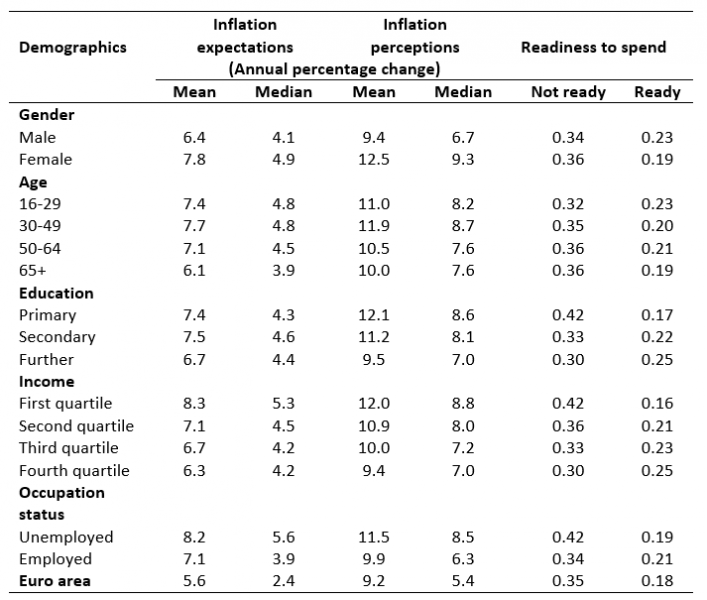

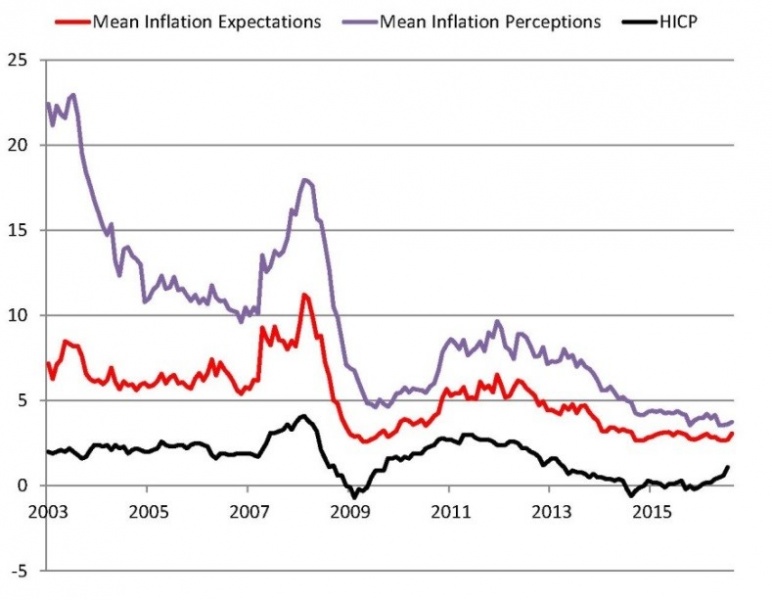

Table 1 summarises some of the most relevant data to the question at hand. It is immediately visible that consumers hold very heterogeneous opinions about inflation expectations and perceptions. Inflation expectations and perceptions are typically lower for men, individuals above 50, those with higher educational attainments, with higher income and having a job. Lower can be actually interpreted as more accurate relative to the official measures of inflation such as the EU Harmonised Index of Consumer Prices (HICP). For instance Chart 1 shows that consumers’ mean expectations and mean perceptions of price changes are persistently higher than actual inflation developments as measured by the HICP. Mean inflation expectations also tend to be systematically lower than mean perceptions. Still, consumer perceptions and expectations co-move strongly with inflation. Important to note here is that survey respondents are not supplied with information about official price indices nor are they given a range of possible inflation rates from which they could choose. This may partly explain why inflation expectations and perceptions diverge so strongly from official inflation measures. In particular, the survey responses may capture a respondent’s subjective experience of inflation which may weight differently price fluctuations of particular goods and services. Also, as shown in Arioli et al (2017), the divergence is driven in particular by the fraction of consumers with very high inflation expectations and perceptions. The median values, tend to be much lower.

Table 1 also reports on the spending intentions of the consumers interviewed in the survey summarised as the share of consumers indicating that they are ready (it is a good time) and not ready (it is not a good time) to spend. In fact, most consumers typically respond that they do not know whether or not it is a good moment to spend. This is visible when subtracting the sum of the reported shares from a value of 1. The second largest category is represented by consumers that indicate that it is not the right moment to spend (“Not ready”), while consumers that indicate that they consider it is the right moment to spend (“Ready”) represent the smallest group on average. Across consumer demographic characteristics, both employed and male respondents tend to have a higher readiness to spend compared with the unemployed and females respectively. At the same time, the share of respondents considering it is the right moment to spend is decreasing with age but increasing with income and the level of educational attainment.

Table 1: Descriptive statistics: inflation expectations, inflation perceptions and readiness to spend

Source: European Commission EU Business and Consumer Survey, Sample period: May 2003 -December 2016.

Chart 1: Mean inflation expectations and perceptions vs HICP

Data source: European Commission EU Business and Consumer Survey, Eurostat.

When estimating the spending-inflation expectations relationship we start from a very simple observation, which is that the spending given current expectations of inflation is equally conditioned on the consumer’s most recent experience of inflation or better said what he or she perceived inflation to be. In line with this observation, we place the difference between the expectation of future inflation relative to a consumer’s own perception of inflation at the centre of our analysis. Theoretically, this conditioning on the deviation of expected inflation from current perceptions can be motivated by taking a local linear approximation of the familiar consumption Euler equation that is central in conventional macroeconomic models. According to the typical Euler equation, current consumption will tend to respond positively to an increase in inflation expectations because of a fall in the relative attractiveness of setting aside income for future consumption. Under this local consumer-specific approximation of the conventional Euler equation, consumption is driven by two terms: the first measures the consumption plan as if inflation was expected to remain unchanged and the second represents an adjustment to the consumption plan according to the expected change in inflation measured as the difference between the expected rate of inflation and the perception about current inflation.5

Thus, while previous empirical literature takes the approach to analyse the relationship between spending and inflation expectations directly, we analyse instead the relationship between spending and the expected change in inflation. The approach is not only conceptually appealing, but also attractive from an econometric point of view. By employing the differencing strategy one can control for otherwise unobserved heterogeneity, such as emotions, sentiment or idiosyncratic measurement error, that can affect to the same extent both inflation expectations and perceptions. For example, to the extent that both perceptions and expectations are jointly influenced upwards by negative sentiment about the real economy, this effect will be netted out using the proposed differencing strategy. Not controlling for this unobserved heterogeneity can give rise to inconsistent and biased parameter estimates of the sensitivity of consumption to expected inflation. Taking this difference was possible as the data includes both inflation expectations and perceptions of the same individual, which is not always the case for other surveys. Some studies have separately controlled for official measures of inflation and also even individual perceptions. However, such approaches will not be able to fully net out the effects of unobserved heterogeneity on the survey measures of inflation expectations.

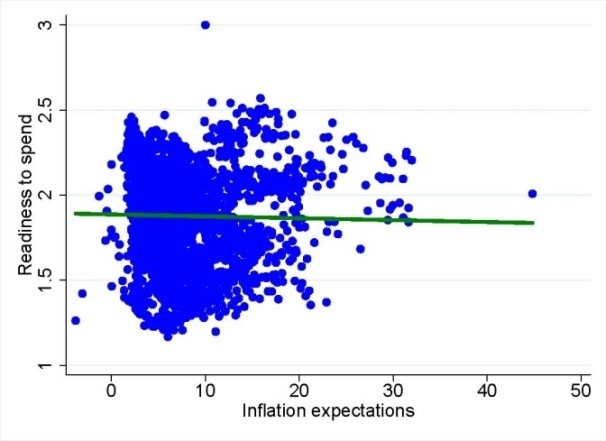

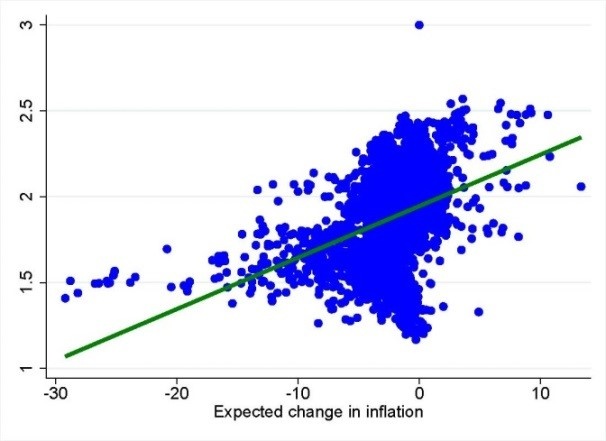

Chart 2: Scatterplots of readiness to spend vs inflation expectations and expected change in inflation

| (a) Readiness to spend vs inflation expectations | (b) Readiness to spend vs expected change in inflation |

|

|

Note: One dot represents a monthly country aggregate of (a) inflation expectations and (b) expected changes in inflation.

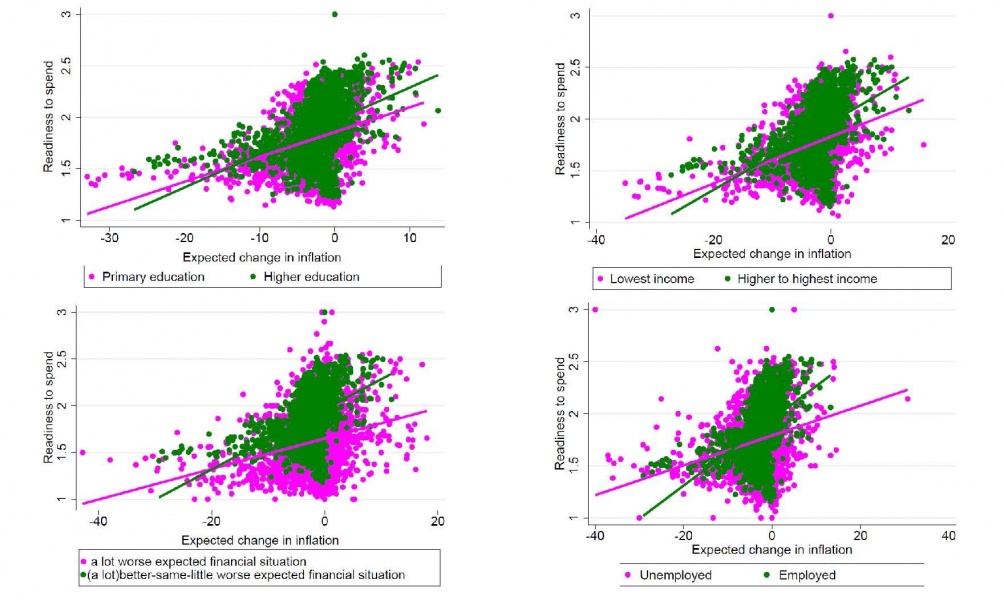

A first look at the data strongly supports the proposed approach. Chart 2 shows two scatter plots: the one on the left plots the link between inflation expectations (on the x-axis) and the consumers’ readiness to spend (on the y-axis), whereas the one on the right plots the expected change in inflation (on the x-axis) versus the consumers’ readiness to spend (on the y-axis). The consumers’ readiness to spend takes values from 1 to 3, 1 indicates that they are not ready to spend, while values close to 3 indicate that they are ready to spend. Clearly when conditioning simultaneously both on inflation expectations and perceptions in the way we propose, the relationship with spending is much stronger and plainly positive. In contrast, the simple bi-variate correlation with the level of expected inflation shows no clear relationship. Additional scatterplots in Chart 3 show how this relationship can differ depending on consumer characteristics. In particular, the relationship is stronger for consumers with higher educational attainment, higher income and for consumers who have a job or expect that their finances will improve. Very important to notice though is that the positive relationship holds across all these consumer groups.

To draw more robust conclusions on this relationship we employ an econometric model in which we include a rich set of controls. The model is in fact similar to that used in Bachman et al. (2015) and helps to measure the impact that a given increase in the expected change in inflation will have on the probability that consumers will be willing to make major consumer purchases. Table 2 shows two of the specifications that we have used. Specification 1 includes a rich set of other controls for consumers’ expectations about their own financial situation and the general economic situation, demographic characteristics (age, gender, educational attainment, income quartile) as well as country-specific fixed effects and quarterly time-series dummies to capture common sources of variation in spending. Specification 2 is even richer and adds additional variables such as consumers’ expectations about the labour market situation and an indicator of financial distress, i.e. whether a consumer is ”running” into debt. It also adds interactions between the expected change in inflation and various control variables to capture potentially important sources of heterogeneity in the spending response, as well as information sources outside the survey such as lending rates to households at the country level and oil prices. Both specifications include a dummy variable (ELB) for the lower bound period and an interaction term with the expected change in inflation which allows for both a level shift in spending attitudes and a possible change in the response to inflation expectations when the lower bound is binding.

Chart 3: Scatterplots of expected change in inflation vs readiness to spend differentiating by consumer characteristics

Source: Duca-Radu, Kenny and Reuter (2020).

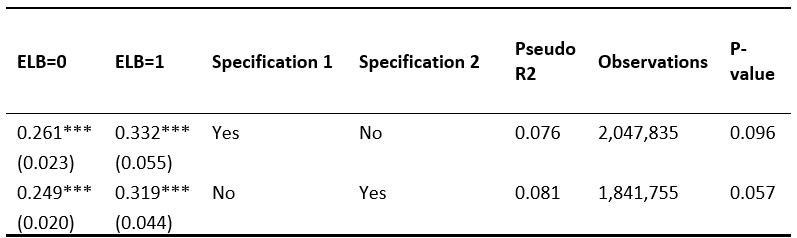

Table 2 reports the average effect of a one unit increase in the expected change in inflation. We find strong statistical evidence for the positive relationship highlighted in Chart 2. The parsimonious specification reveals a 0.26 percentage points (pp) increase in the probability of being ready to spend in response to a 1.0 pp increase in the expected change in inflation when the ELB is not binding. This result implies that a one standard error change in the expected change in inflation (approx. 10.0 pp in our sample) would be equivalent to an upward shift in the probability to spend from 21.2% to 23.8%. This result suggests that indeed higher inflation expectations relative to the current inflation perceptions have the potential to trigger an economically relevant positive stimulus to spending. When the ELB is binding the increase in the probability to spend is even higher estimated at 0.33 pp – a difference which we also show to be significant given the precision of the estimated effects. This points to an even stronger potential stabilisation role of an increase in inflation expectations relative to current perceptions about inflation when the lower bound is binding.

Table 2: Spending response to the expected change in inflation

Note: The table shows the average marginal effect of a unit increase in the expected change in inflation on the probability that consumers are ready to spend. *** indicates that the estimated effect is highly significant at the 1% level. Source: Duca-Radu, Kenny and Reuter (2020).

The significant positive relationship that we estimate is qualitatively consistent with results reported by D’Acunto et al. (2018) for Germany and with Ichiue and Nishiguchi (2015) for Japan. Ichiue and Nishiguchi (2015) argue that consumers in Japan are less likely to expect a simultaneous movement in nominal interest rates in response to higher inflation expectations on the back of their prolonged experience with a period of interest rates near zero. This is also relevant for the euro area lower bound episode because forward guidance on future interest rates has been used to signal the intention to keep interest rates low. Our results contrast with the main findings of Bachmann et al. (2015) for the US economy who finds that the effect of higher inflation expectations is very close to zero and statistically not significant during normal times, while at the zero lower bound the spending probability is even reduced. Interestingly, our results also point to a weaker and at times not statistically significant relationship between the inflation expectations and the spending probability when not controlling for unobserved heterogeneity by using our proposed differencing strategy. This might point to the fact that when the economy is weak the unobserved heterogeneity linked to consumer’s pessimism plays an even more important role.

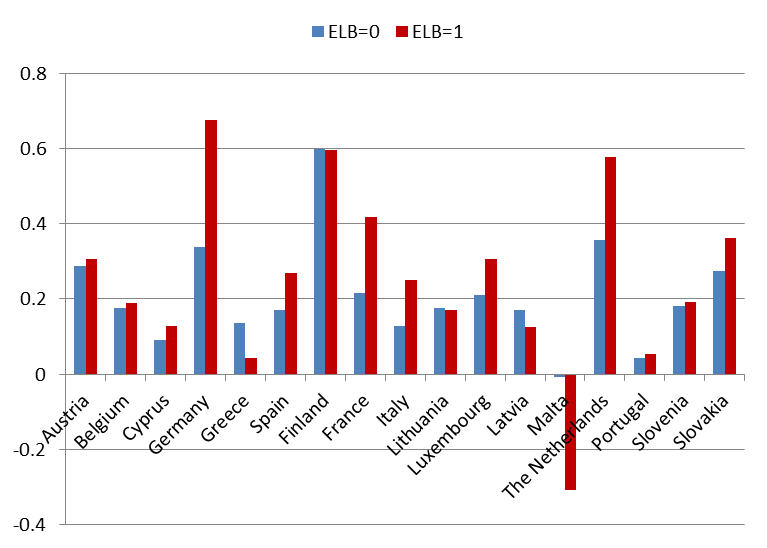

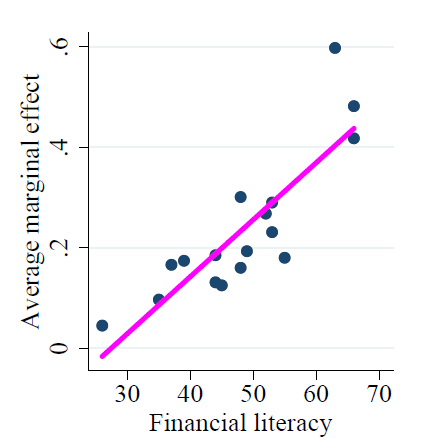

Chart 4: Country average effects

Note: All average marginal effects are statistically significant at 1% level, except the average marginal effect outside the ELB for Malta.

So far we have discussed results estimated for the euro area as a whole. Nevertheless, when going more granular at country level the positive relationship between spending and our measure of the expected change in inflation still holds. Chart 4 shows the average marginal effects resulting from re-estimating our model individually for each euro area country included in our sample using the most comprehensive specification. Country results confirm euro area aggregate results. All countries included in the sample, except Malta, exhibit a positive spending response. There is significant heterogeneity though, with effects ranging from 0.04 to 0.60 outside the ELB and from 0.04 to 0.68 at the ELB. The spending response in each country is generally higher during the period when the lower bound is binding. France, Germany and the Netherlands display particularly high differences between the two periods. Relatively large effects are found in northern countries such as Finland, the Netherlands, Germany while smaller effects are found in southern countries like Cyprus, Spain, Italy, Portugal and Greece.

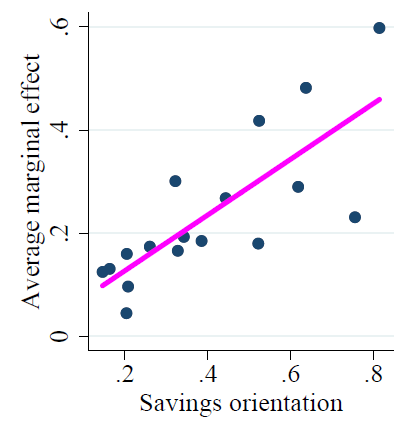

Another important question that we can address with our model is the extent to which country heterogeneity in the spending response to inflation expectations may link with country characteristics. Chart 5 shows how country average effects vary depending on the strength of the savings orientation and the degree of financial literacy when measured at a country level. The savings orientation is measured as the average share of consumers who indicate that they are able to save. To define financial literacy we draw from Lusardi and Mitchell (2014) who calculate an index using questions assessing basic knowledge of four fundamental concepts in financial decision-making: knowledge of interest rates, interest compounding, inflation, and risk diversification from the Gallup World Poll survey. The spending response at country level is shown to have a strong positive relationship both with the country’s savings orientation and the country’s financial literacy score. The strong positive relationship with the country’s savings orientation points to the possible relevance of accumulated asset holdings in adjusting consumption in response to expected changes in intertemporal prices. For example, Ichiue and Nishiguchi (2015) find that consumers with a large stock of accumulated assets can respond more positively to intertemporal prices. At the same time, a low average savings orientation may weaken intertemporal substitution due to binding liquidity constraints. The positive relationship with a country’s financial literacy score supports the idea that policies aimed at improving financial literacy could potentially boost the spending response. In line with these findings, Dräger and Nghiem (2018) show that in Germany the perceived real interest rate matters only for financially literate households and for consumers who are able to save.

Chart 5: Country effects vs country characteristics

|

|

From a policy perspective, an even more interesting question is whether or not the positive spending response that we found translates into an impact on actual consumption. For this purpose, we use a simple dynamic model to capture the relationship between aggregate real consumption and the average estimated probability to spend derived from our microeconomic analysis. Such an approach provides a bridge which can link the micro evidence with macroeconomic aggregates.

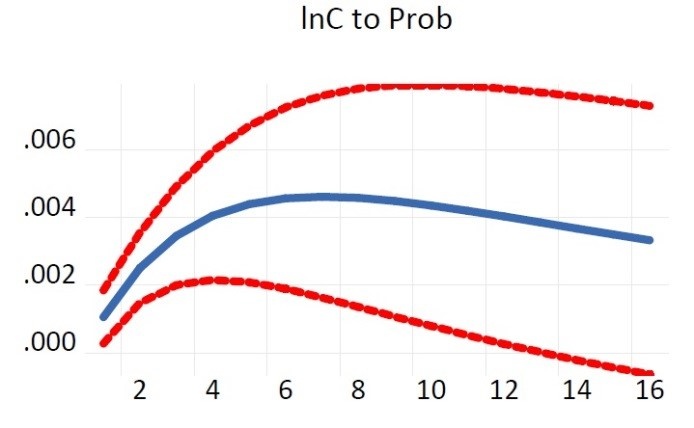

We estimate the average probability to spend of the ”representative consumer” in the euro area as a weighted average of the individual fitted probabilities obtained from our micro-econometric model. The individual probabilities are weighted using individual consumer weights based on the representativeness of a consumer in total population. This representative probability summarizes all the micro and macro level information that we have included in our probabilistic model specification. We find that our aggregate measure of the probability to spend co-moves quite strongly with real consumption and we show that aggregate euro area consumption (lnC) responds positively to a shock in the spending probability (Chart 6). In particular, an initial positive shock in the spending probability leads to a slow increase in consumption and the positive effect lasts for eight to ten quarters.

Chart 6: Impulse response function of consumption to the probability to spend

Note: Prob refers to the fitted aggregated probability and lnC refers to log real total consumption. Confidence bands represent +−2 standard errors. X-axis denotes time periods measured in quarters.

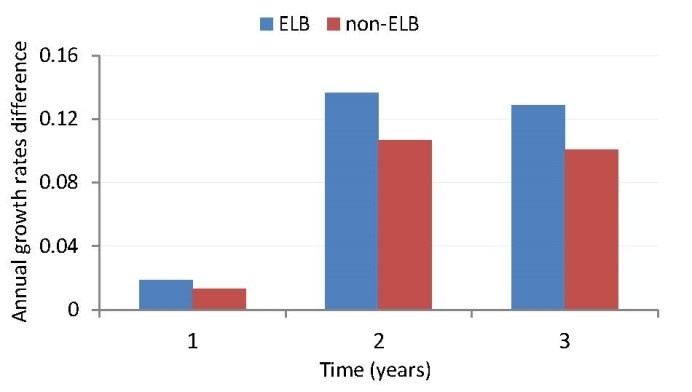

Based on this simple dynamic model, two scenarios are implemented to capture the effects of a 2.0 pp change in inflation expectations. These scenarios illustrate the impact of moving from a situation of undesirably low inflation (e.g. at 0%) to a rate of inflation more in line with price stability (e.g. of 2%) whilst holding perceptions about past inflation constant. A first scenario depicts the effects of such a change when the lower bound is binding while a second captures the impacts when the economy is away from the lower bound. The 2.0 pp expected increase in inflation is implemented gradually as a 0.5 pp increase that takes place over four consecutive quarters. Chart 7 shows the difference in the annual real consumption growth rates relative to a baseline scenario in which inflation expectations and consumers’ spending probabilities are kept constant throughout the 12-quarter simulation period. In cumulative terms, real consumption rises by 0.28% over the three year horizon when the ELB is binding and by just 0.22% when it is not. Although this response appears relatively modest, it should be recalled that the standard deviation of expected change in inflation is considerably higher (10.0 pp). Hence, the relevance of consumer inflation expectations is likely to be even more economically relevant in practice.

Chart 7: Impact on real consumption of a gradual increase in consumer inflation expectations

Overall, our micro and macro evidence on the importance of inflation expectations at the level of the individual consumer offers support for central bank policies aimed at raising inflation expectations during lower bound episodes because such developments have the potential to stabilise aggregate demand. However, a word of caution is also warranted. Our analysis needs to be complemented by further investigations of how in practice central banks might influence household expectations either through their policy decisions or through related policy communication. To date, most of the evidence on the effective management of inflation expectations links to expectations of financial market participants or professional forecasters and other economic experts. In the case of consumers and the general public, some first insights on this are starting to emerge (see recent work by Haldane and McMahon (2018), Coibion et al. (2020) and Candia et al. (2020)). This evidence generally points to the potential benefits of simple and possibly targeted communication strategies, though it also points to the risk of unintended signalling effects and, hence, miscommunication. Overall, economists still lack clear evidence about the best way in which monetary policy makers could influence the public’s very diverse inflation expectations. Further insights on this communication challenge will be particularly important. Based on the evidence reported here, a particular aspect that warrants attention is the possibility of divergent effects of communication on perceptions of current inflation and expectations for inflation. As we have shown, the desired stabilisation effect from inflation expectations tends only to be achieved if policy and communications help to change expected inflation relative to the public’s perceptions of current inflation. This may be no small task.

Andrade, P., Gautier E., Mengus E. (2020). What Matters in Households’ Inflation Expectations?, CEPR Discussion Paper Series 14905.

Arioli, R., Bates, C., Dieden, H., Duca, I., Friz, R., Gayer, C., Kenny, G., Meyler, A. and Pavlova, I. (2017). EU consumers quantitative inflation perceptions and expectations: An evaluation, ECB Occasional Paper No. 186. https://www.ecb.europa.eu/pub/pdf/scpops/ecb.op186.en.pdf

Bachmann, R., Berg, T. O. and Sims, E. R. (2015). Inflation expectations and readiness to spend: Cross-sectional evidence, American Economic Journal: Economic Policy 7(1): 1–35.

Burke, M. A. and Ozdagli, A. (2013). Household inflation expectations and consumer spending: Evidence from panel data, Federal Reserve Bank of Boston Working Paper Series No 13-25, December.

Candia,B., Coibion, O. and Y. Gorodnichenko (2020). Communication and the beliefs of economic agents, paper presented at the Jackson Hole Economic Symposium, August 2020, available here: CandiaCoibionGorodnickenkoJacksonHole2020

Coibion, Olivier, Yuriy Gorodnichenko, Saten Kumar and Mathieu Pedemonte (2020). Inflation Expectations as a Policy Tool?, Journal of International Economics 124: 103297.

Coibion, O., Georgarakos, D., Gorodnichenko, Y. and van Rooij, M. (2019). How does consumption respond to news about inflation? Field evidence from a randomized control trial, NBER Working Paper No 26106. https://www.nber.org/papers/w26106.pdf

Crump, R. K., Eusepi, S., Tambalotti, A. and Topa, G. (2020). Subjective intertemporal substitution Federal Reserve Bank of New York Staff Report 734, Revised July 2020, available here: https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr734.pdf

D’Acunto, F., Hoang, D. and Weber, M. (2018). Unconventional fiscal policy, AEA Papers and Proceedings 108: 519–23.

Duca-Radu, I., G. Kenny and A. Reuter (2020). Inflation expectations, consumption and the lower bound: Micro evidence from a large multi-country survey, forthcoming, Journal of Monetary Economics.

Dräger, L. and Nghiem, G. (2018). Are consumers’ spending decisions in line with an Euler equation?, Discussion Paper No 1802, Gutenberg School of Management and Economics, January.

Draghi, Mario (2015). Press conference, October 22, 2015. Available at: https://www.ecb.europa.eu/press/pressconf/2015/html/is151022.en.html.

Goldfayn-Frank, O., & Wohlfart, J. (2019). Expectation formation in a new environment: Evidence from the German reunification, forthcoming, Journal of Monetary Economics, https://doi.org/10.1016/j.jmoneco.2019.08.001

Haldane, Andrew, and Michael McMahon (2018). “Central Bank Communications and the General Public,” American Economic Association Papers and Proceedings 108: 578-583.

Ichiue, H. and Nishiguchi, S. (2015). Inflation expectations and consumer spending at the zero bound: Micro evidence, Economic Inquiry 53(2): 1086–1107.

Lusardi, A. and Mitchell, O. S. (2014). The economic importance of financial literacy: Theory and evidence, Journal of Economic Literature 52(1): 5–44.

Rondinelli, C. and Zizza, R. (2020). Spend today or spend tomorrow? The role of inflation expectations in consumer behaviour, Temi di discussion (Bank of Italy Working Paper Series), n.1276

Wiederholt, M. and N. Vellekoop (2019). Inflation expectations and choices of households, SAFE Working Paper N. 250.

The views expressed in the note belong to the authors and are not necessarily the views of either the European Central Bank or the European Commission. Any errors are the sole responsibility of the authors.

In commenting on the prevailing environment of relatively low inflation, at the ECB press conference in 2015, Draghi (2015) noted “When we are at practically zero nominal rates, the real rates are being driven by the expectation of inflation. So lower expectations of inflation imply higher real rates … that’s why we fight negative expectations of inflation.”

Wiederholt and Vellekoop (2019) find that in the Netherlands, individuals with higher inflation expectations tend to save less and are more likely to acquire large items (cars).

Using Italian data based on the Survey of Household Income and Wealth (SHIW), Rondinelli and Zizza (2020) argue that the effects of higher inflation expectations on consumer spending decisions depend on the inflation regime. In a high-inflation regime, as in the early 1990s, consumers with higher inflation expectations tend to have higher current than future expenditure. By contrast, in a low-inflation environment, such as the one after the global financial crisis, higher expected inflation lowers households’ purchasing power and, thereby, spending. Using French data Andrade et al. (2020) find that households expecting stable prices consume relatively less than the ones expecting positive inflation; variations of expectations across households expecting a positive inflation rate are associated with much smaller differences in individual durable consumption choices.

In particular we take a local approximation of the Euler equation at the point where inflation expectations take the value of current inflation perceptions.