The rise of China to the status of economic superpower has been the dominant feature of the last three decades. China’s rise, the main characteristic of globalisation, in conjunction with a beneficial sweet spot in demography, drove output up and inflation down in the advanced economies. But these trends are now reversing, and China’s greatest contribution to global growth is now past. Its working age population is now shrinking, while the ranks of the old expands, there and worldwide. This great demographic reversal will lead to a return of inflation, higher nominal interest rates, lessening inequality and higher productivity, but worsening fiscal problems, as medical, care and pension expenditures all increase in our ageing societies. Meanwhile debt has been massively accumulated, especially as a consequence of the Covid pandemic. This will make control of inflation much harder in future decades. Be warned, the future will not be at all like the past, and in many ways even more difficult to manage.

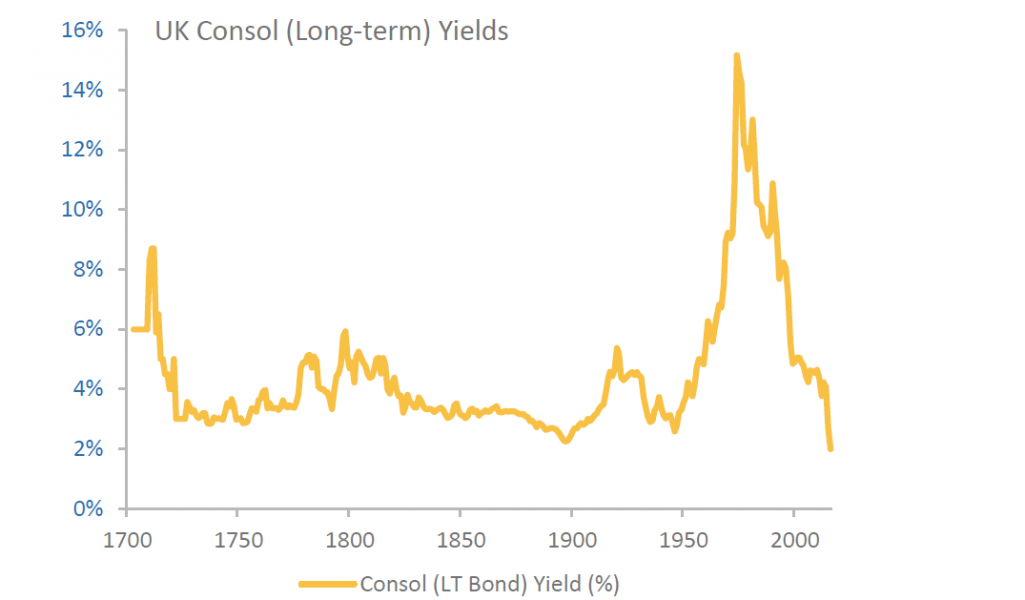

During the seven decades, 70 years, since about 1950, trends in nominal variables, e.g. inflation, inflation expectations and interest rates, have been remarkably different from those of previous centuries. This is illustrated in Figure 1, showing the path of consol, (long-term bond), yields in the UK from 1694, the date of the foundation of the Bank of England, until 2020. Longer-term inflation, inflation expectations and nominal (and real) interest rates remained relatively constant over the earlier centuries, but then these nominal variables all rose dramatically from 1950 to a peak at the end of the 1970s. After that they fell equivalently precipitously until the present extraordinarily low levels.

Figure 1: Interest rates have been falling for decades

Source: FRED, Bank of England

These divergent trends have owed a lot to the changing monetary regimes, with the abandonment of the Gold Standard in, and following, WWII, and the attempt to maintain employment at a higher level than consistent with price stability. In our book1, however, we are focussing on the continuing decline in nominal variables since the 1980s, and what the future in this respect may hold for us. Much of the disinflation of the last three or four decades has, indeed, been due to an improved monetary regime, i.e. the combination of Central Bank Independence, together with the adoption of inflation targets, largely successfully achieved. But, in practice, it has not been too difficult, once the original break in inflation was achieved in the early 1980s, to maintain inflation at its target level, and, indeed, over the years since the Great Financial Crisis, central banks have struggled to keep inflation from falling significantly below their (common) inflation target, usually at 2% p.a. So, something else, besides an improved monetary regime, has been responsible for the disinflationary trends in recent years.

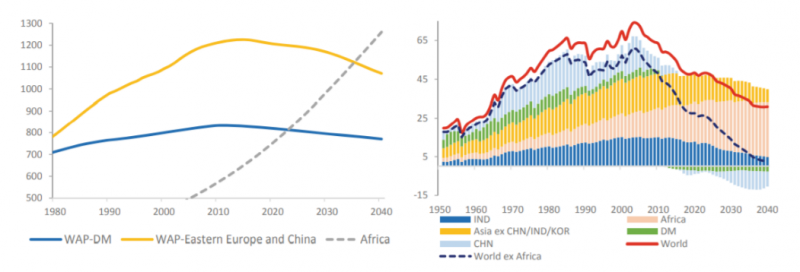

What we argue is that the main driving force behind such disinflationary trends in recent decades has been a mixture of demography and globalisation. In particular China is huge, and its working population has become increasingly incorporated into the world’s trading system during these decades. Together with the incorporation of Eastern Europe into the available world working force, and improved demography, the effective world’s working age population more than doubled over the 30 years from 1980 to 2010, as shown in Figure 2. The effective working age population on which a footloose manufacturer in the West could call, was just over 700 million in 1980, but had reached over 2000 million by 2010, the largest positive labour supply shock that the world has ever seen. The working age population grew by leaps and bounds from year to year, until about 2010, see Figure 2. This upwards trend is now in the process of massive reversal, with one major exception. This is that the working age population in Africa is currently exploding upwards, a point that we shall come to later.

Figure 2: Working age populations falling globally – Africa is the key exception, and India to a lesser extent

Source: UN Population Statistics

The increase in the available working supply in China was not only due to its inclusion in the world trading system, but also to a couple of major additional factors, the first being massive, internal migration from the western, inland, agricultural provinces to the industrial, urban centres in the coastal regions of China, and the second being a huge change in dependency ratios, with sharply falling birth rates, partly due to the ‘one-child policy’, bringing about a relative fall in young dependents, outdistancing during these decades a rise in the aged.

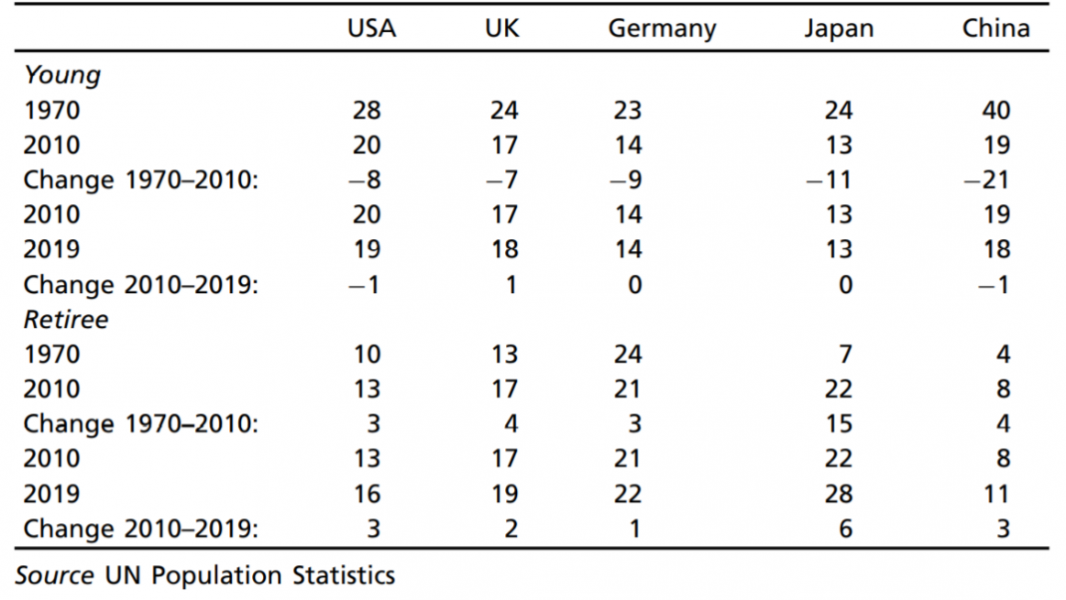

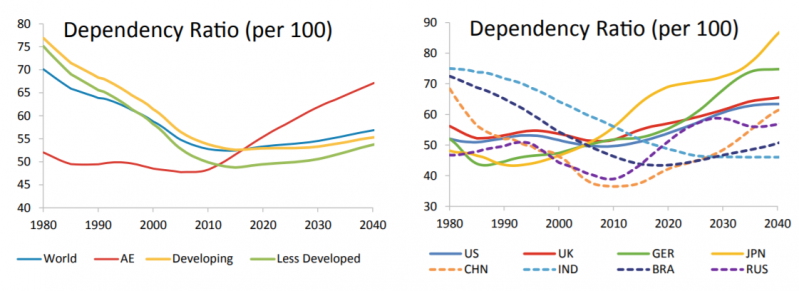

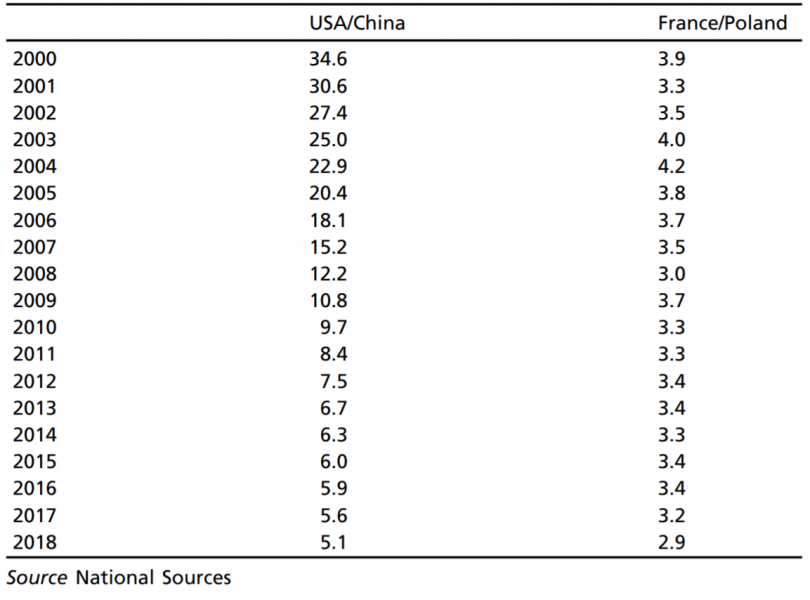

Exactly the same demographic changes have occurred in almost every other developed economy with the proportion of young in the population declining sharply over the years 1970-2010, outdistancing the rise in retirees over the same period, in virtually every country, except Japan, which has led the way in this common demographic adjustment. This is shown in Table 1 and Figure 3.

Table 1: Dependency ratios rising because of the elderly, not the young

Figure 3: The ‘dependency ratio’ is rising in the AEs and EME giants – except India

Source: UN Population Statistics

The falling ratio of dependents to workers is of, and by, itself disinflationary. In extremely simple terms, workers must produce goods and services of more value than their wages; otherwise it would not be economical to hire them. By the same token, the young and old, who are not working, consume, but do not produce. Therefore, they increase demand relative to supply. The dependency ratios have been improving considerably until around 2010, and are now reversing sharply in most countries, see Figure 3.

Table 2: Inequality has narrowed across countries, particularly the EMEs

Ratio of the wages of the workers

So, the combination of globalisation and demography has led to a huge increase in the world’s effective supply of labour, with that increase largely concentrated in Asia and Eastern Europe, where the wages of workers were initially at a far lower level than in the West. Moreover, these workers were relatively well educated, and the governments and administration in these countries were, in general, competent, efficient and focussed on growth. What would you expect the outcome to be? In a sense it is a triumph for macroeconomics that what happened is what you might have expected; this resulted in a shift of production of tradeable goods and services from the high-labour cost areas in the West to the low labour-cost areas in the East. The result was a sharp rise in the wages in the East and relative stagnation in the wages in the West. This is shown in Table 2. Largely because China, and the rising nations of Asia, have such a large population, the absolute and relative rise in Asian (and Eastern European) incomes led to a significant fall in world inequality, at the same time as inequality within countries began to rise.

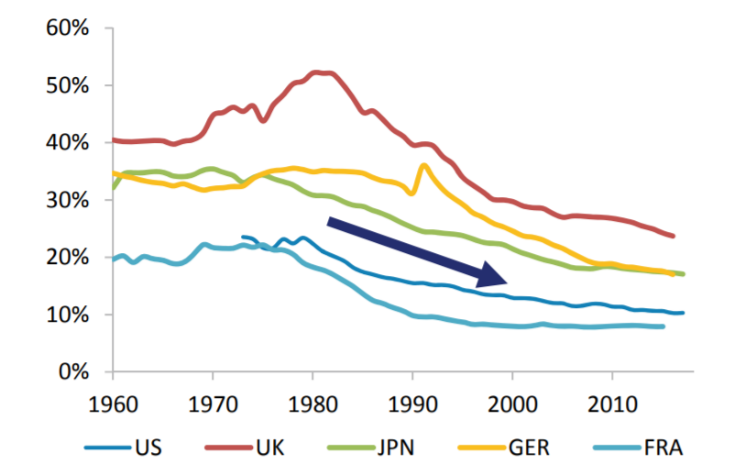

The greater world-wide availability of labour, the shift of manufacturer jobs to the East, especially to China, and the shift of production in the West from manufacturing to services, sometimes described as the ‘gig economy’, led to a major weakening in the bargaining power of labour. A steep decline in trade union density was both a symptom and a further cause of this decline in labour-bargaining power, see Figure 4.

Figure 4: The bargaining power of labour in the AEs has fallen due to the global shock to labour supply

Source: OECD

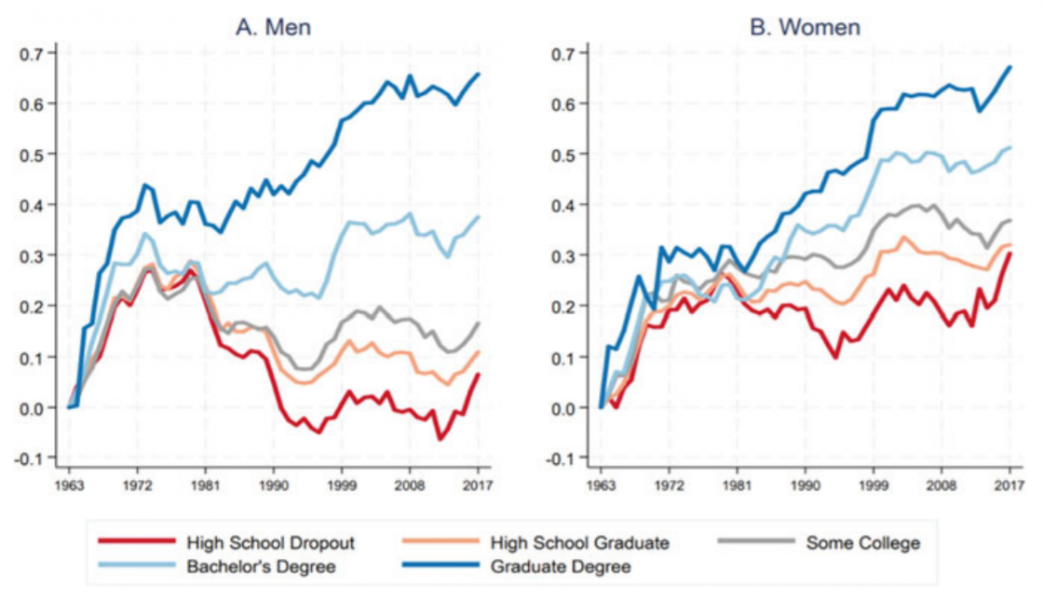

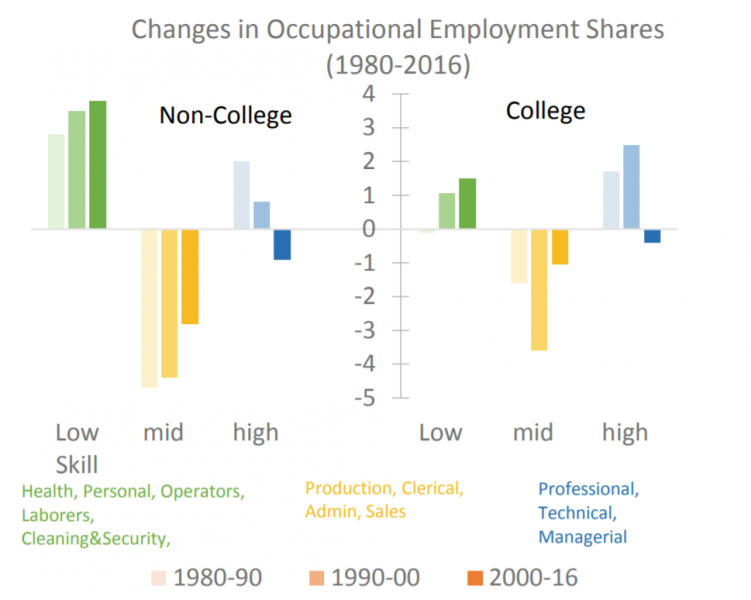

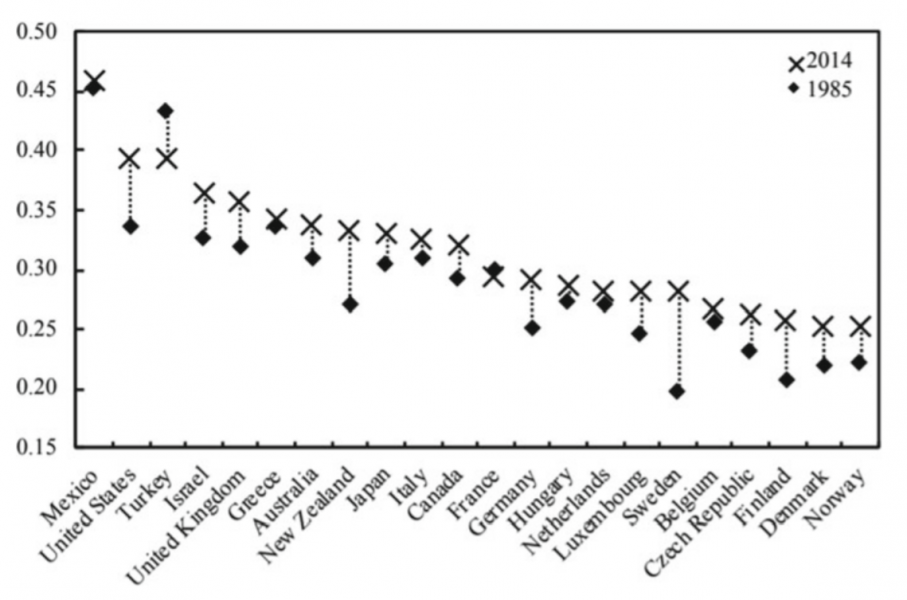

In this process, the East provided masses of relatively low-skilled, but amenable labour, while the West provided skills, management and capital. As a consequence, the relative returns to the unskilled in the West stagnated, while the relative returns to skilled labour and management continued to increase very sharply, see Figures 5 and 6. The result was that the majority of working forces in Western economies, with relatively low human skills and no capital, saw their real incomes stagnating, and were forced into less technical sectors, the gig economy. The outcome was a rise of within country inequality over the last thirty years, particularly in the USA and the Nordic countries, but more generally, with only a few exceptions such as Turkey, see Figure 7.

Figure 5: Those with lower educational attainment have been most exposed to the global shock to labour

Cumulative change in real weekly earnings at working age adults aged 18-64, 1963-2017

Source: American Economic Association

Figure 6: Those with lower educational attainment have been squeezed out of more technical occupations, and into less technical sectors

Source: OECD

Figure 7: Within-country inequality has risen over the last 30 years

The Gini coefficient has risen across the OECD countries

Source: Rachel and Summers (2019)

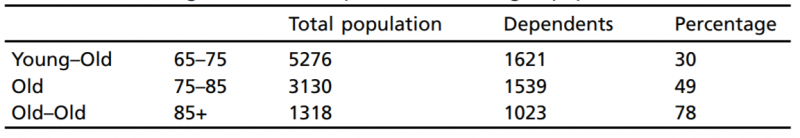

An unhappy aspect of the rise in life expectancy has been the increasing proportion of those with the infirmities of ageing, notably dementia, especially Alzheimer’s, but also other forms of morbidity, such as Parkinson’s and arthritis. Such ailments do not kill quickly, as cancer and heart disease have often done, but leave their sufferers incapacitated, in medical terms dependent on others for some, or most, of the activities of daily living (ADL). Note that in medical terminology, dependency depends on one’s needs for help with ADL, while in economics terminology, dependency relates to age brackets. In Table 3, we show how the percentage of those who are medically dependent rises sharply as the age bracket increases from young/old (65-75) to old/old (85 plus). By the time someone reaches the age of 95 they are almost certain to be medically dependent and reliant on the support and care of others. Since life expectancy has been rising so sharply, at any rate until recently, the percentage increase in the total population of the really old, 75 plus, will be growing far faster than that of the rest of the population, and their expected dependency will be an increasing burden on pensions, the need for carers and medical support, see Table 4.

Table 3: The oldest-old form the dominant cohort among ‘medical dependents’

UK, 2017

Table 4: The Cohort of the oldest-old will grow the most across all types of ‘medical dependents’

Change 2015-35

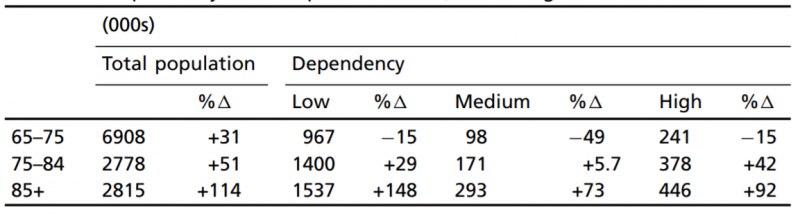

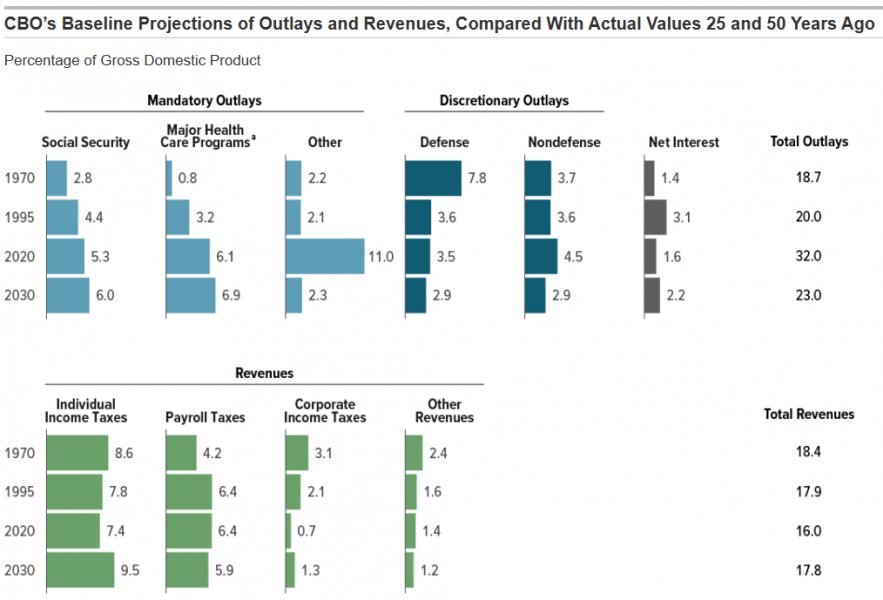

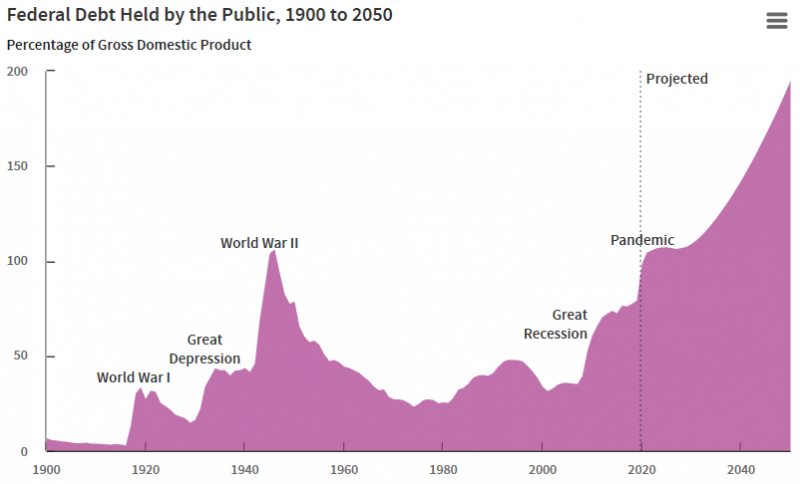

Largely because of such reasons, ageing will lead to a massive rise, given the expected future profile of public sector expenditures and tax receipts, in public sector deficits and borrowing. This was so even before the Coronavirus pandemic struck, which will have served to give a huge upwards boost to public sector deficits and borrowing. Figures 8, 9 and 10 all show this projected outcome, and such forecasts were constructed in 2018 before the pandemic struck. They will be significantly worse now.

Figure 8: Ageing will lead to a massive rise in deficits and borrowing

Baseline projections of the primary balance and PSND

Source: OBR

Figure 9: US government outlay and revenue projections have multiplied over the last 50 years

Source: CBO

Figure 10: US federal debt outstanding is projected to skyrocket, primarily due to ageing

Source: CBO

So, what of the future? Most of the countries where growth has been strongest, such as Germany and China, are now facing a shift from an improving dependency ratio and a sharply growing working age population, to the reverse, a declining WAP and worsening dependency. Overall growth is the result of a combination of an increasing WAP, and an increase in productivity per worker. If the WAP is now beginning to decline in much of the West and Asia, then, unless productivity per worker enjoys a miraculous recovery, growth may subside to even lower levels than in the past. This means that we will not be able to grow out of our problems of deficit and debt, unless technology, e.g. AI, robotics, etc., generates a massive increase in productivity per worker; past disappointing figures for productivity increases in recent years makes this seem very unlikely. The alternatives, then, involve greater taxation, less welfare, notably reduction in state pensions, more inflation, or default. So, for example, a probable outcome will be higher taxes, especially on the rich, corporations, land and noxious carbon and other pollutants. None of these are politically palatable. If we think of politicians maximising their political chance for re-election, then our view is that greater inflation will be part of the optimal political mix. In recent decades, central bankers have been the best friends and supporters of Ministers of Finance. As public sector debt ratios have increased, the largest persistent increase of such ratios ever in peace times, the continuing decline in nominal interest rates has allowed debt-service ratios to remain stable, even to decline slightly. This symbiotic friendship is heading for a sharp divorce. The future for inflationary targetry will be much more difficult and problematic than in the past.

That said, there will be some more beneficial side-effects. As the labour markets tighten everywhere, we expect investment in Western countries to rise, in order to maintain competitiveness, which in previous decades could be achieved by out-shoring. So, we expect there to be some recovery in productivity per worker. Similarly, the recovery in labour bargaining power and the coming increase in taxation, especially on the rich, will lead to a waning of inequality. In a sense, the reversal of the previous trends in globalisation and demography will, we expect, lead to some reversal in the nominal trends that have been so prominent in recent decades.

But what seems so clearly obvious to us is simply not expected, or accepted, by the current macroeconomic mainstream, who envisage, ‘lower for longer’ and a weak and disinflationary economy for as far as the eye can see.

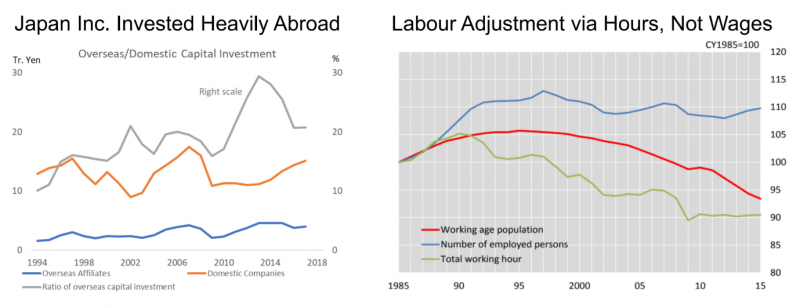

Perhaps the main reason why the mainstream doubts that demographic trends will have the effects that we propose, is that Japan has been at the spearhead of demographic change, with a rising ratio of old retirees, and a falling working age population, without this having any effect in increasing inflation, inflation expectations or nominal interest rates, even while unemployment there remains very low. But there are a number of factors that need to be considered relating to Japan. First, productivity per worker in Japan has been doing much better than in almost any other country. With their WAP falling at 1% per annum, with the increase in GDP per head rising at 1% per annum, this implies an increase in productivity per worker of 2% per annum, significantly better than in most other countries. We will all be lucky if we can in future do as well as Japan in this respect. Second, the earlier ageing of Japan’s workforce occurred at a time when the global availability of labour, elsewhere in Asia, was overflowing. Japanese corporations took full advantage of this latter by offshoring their production of goods and some services abroad, enabling them to maintain their competitivity and to reduce their workforce in Japan quite sharply, so the workforce in Japan moved strongly into the service sector, where they had little bargaining power. Third, the ethos in Japan when faced with a reduction in demand is not to cut employment, but to reduce hours worked. With a rising share of the workforce in part-time sectoral activities, and a decline in hours worked, the unemployment figures significantly overstated the pressure of demand in Japan.

Figure 11: “Why didn’t it happen in Japan?”

Source: METI, Haver Analytics

Other mitigants to our forecast of greater inflationary pressures involve shifting production to those parts of the world where the working age populations are still rising sharply; that is Africa and India. Quite how the world will handle Africa over coming decades is a really major question. In both cases, we emphasise the problem of the competence and capacity of governance and administration as the major determinant of whether these areas can take up (part of) the mantle of China. Besides a switch of production to these areas of still growing working age populations, other mitigants involve being more parsimonious on benefits to the old, raising retirement ages and more participation of the elderly in the workforce, and the benefits of improved technology. All of these will, we trust, happen in part, but there are limits to their capacity of offset the current adverse demographic and globalisation trends, and we do not think that they can do more than reduce inflationary pressures.

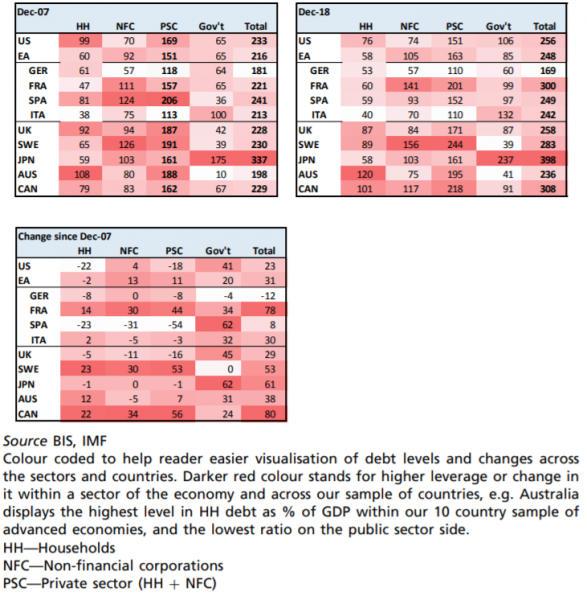

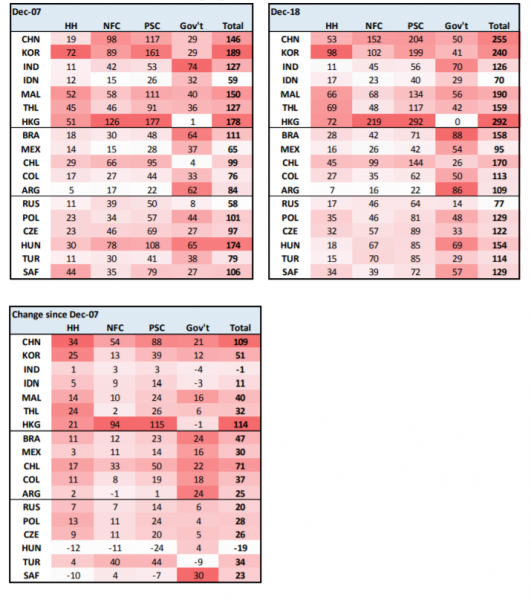

Since we doubt whether such mitigants can restrain inflation in future, once the Coronavirus epidemic is firmly behind us, we expect inflation to recur. If central banks are to meet their inflation target, this latter would, under normal circumstances, lead them to raise their interest rates. But there is a problem. This is that debt ratios, both in the public and private sectors, in most countries are so high that any significant rise in nominal interest rates would likely tip those economies back into recession, which would make everything worse. Figures on the debt trap in which we have now found ourselves, are shown in Tables 5 and 6. Concerns about the effects of rising interest rates under such conditions will lead to political pressures on central banks to allow inflation significantly in excess of present target levels.

Table 5: The debt trap

Debt in the AEs rose even further between the GFC and the pandemic

Table 6: Debt has grown in the EMEs too – North Asia, Brazil and SAF need attention

The decades from 1990 until 2020 have been the glory years for central bankers. The future will be far more difficult. Best of luck!

Goodhart, C. and M. Pradhan, The Great Demographic Reversal. Ageing Societies, Waning Inequality, and an Inflation

Revival (London: Palgrave Macmillan, 2020).