The Covid-19 pandemic has accelerated the shift to digital payments. In some cases, it may be undermining the acceptance and availability of cash. If this trend persists, it carries risks that unbanked and underbanked people will be left – further – behind. Low-income and vulnerable groups, in particular, often do not have basic or trustworthy identification credentials, making it more challenging for them to access digital payments, and for the public sector to disburse government-to-person payments efficiently. Going forward, central banks will need to navigate multiple policy trade-offs. In particular, general purpose central bank digital currencies (CBDCs) and progress in digital identification can help fill the gap by ensuring access to a basic, trustworthy means to pay digitally and facilitating financial inclusion.

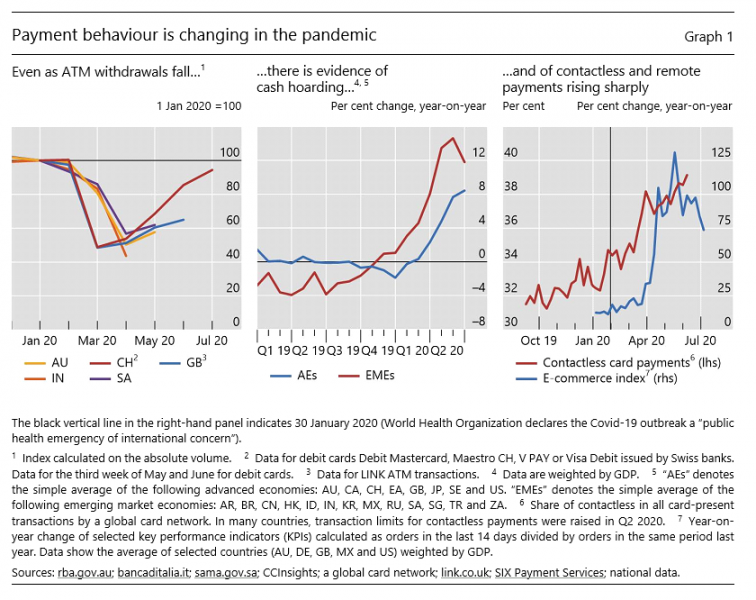

The pandemic and resulting economic crisis have led to marked changes in the use of cash and in retail payment behaviour. These changes in payment behaviour are visible through several channels (BIS (2020)). First, public concerns about viral transmission through cash2 and the temporary closure of many non-essential stores have led to a temporary decline in cash withdrawals (Graph 1, left-hand panel). At the same time, fewer opportunities to use cash and the economic uncertainty in the pandemic have resulted in higher cash holdings (centre panel). This can be attributed, in part, to higher precautionary holdings of cash, a trend that has been observed in previous periods of uncertainty (eg the Great Financial Crisis of 2007–09). Meanwhile, social distancing and increased transaction limits for contactless card payments have coincided with an increased use of contactless payments at the point of sale (right-hand panel).3 Meanwhile, the surge in e-commerce (right-hand panel) has driven increased remote use of payment instruments (eg card-not-present) in the domestic context, while travel restrictions have affected cross-border payments. For example, e-commerce spending in the United States grew by 93% year on year in May 2020 and e-commerce as a share of total retail sales reached a record of 33% in the United Kingdom in April and May 2020 (Mastercard (2020a)), while volumes of cross-border payments in international card schemes fell by over 40% year on year in April 2020 (Mastercard (2020b), Visa (2020)).

If the acceptance of cash decreases, households without access to digital payment means could face barriers to making and receiving payments. The additional decline in cash use due to the pandemic could accelerate a reduction in automated teller machines (ATMs) and physical bank branches. A reduction in access to cash could disproportionately impact groups of people who do not have access to digital payment mechanisms. This includes senior citizens, individuals with special needs, (undocumented) migrants, people living in or moving out of extreme poverty or homelessness, inhabitants of rural and remote areas, and those with limited financial capability (Ceeney et al (2019)). Many of these groups lack access to bank accounts, (contactless) payment cards and to mobile devices for remote payments. As a result, they rely on cash to make and receive payments. Public entities and international organisations are therefore considering the need for preserving access to cash as well as improving digital financial inclusion.

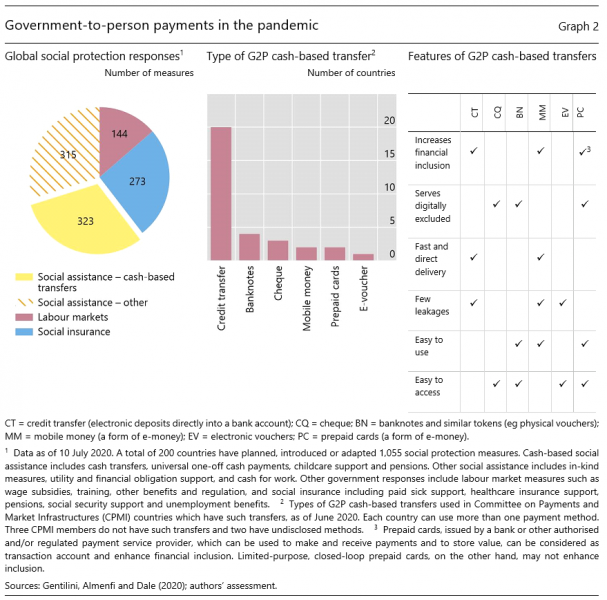

Government transfers during the pandemic have highlighted both progress and shortcomings in payments. As of 10 July 2020, a full 200 countries had planned, introduced or adapted social spending measures in response to the pandemic (Gentilini, Almenfi and Dale (2020)). The majority of these responses are social assistance measures, which are weighted towards cash-based transfers (Graph 2, left-hand panel). Most governments have relied on credit transfers – electronic deposits directly into a recipient’s bank account – to make their government-to-person (G2P) payments (centre panel). Credit transfers enable fast and direct delivery at lower cost than paper-based means. They also increase transparency, as governments can monitor that the full amount of the payment is delivered to the recipient. Furthermore, credit transfers can improve longer-term financial inclusion by potentially acting as an on-ramp to transaction accounts and other financial services (right-hand panel). Mobile money and general purpose prepaid cards can have similar benefits. However, during the pandemic, some governments have reverted to traditional (token-based) payments such as banknotes, cheques and limited-purpose prepaid cards alongside credit transfers. These token-based payments help to serve the digitally excluded in the short term, but are slower, suffer higher “leakages” (ie fraud and losses) and do not aid long-term financial inclusion.

G2P payment programmes face challenges to identify the rightful beneficiary and ensure that beneficiaries receive their funds quickly, safely and cheaply. An estimated 1 billion people worldwide do not have basic identification (ID) credentials, and many more have IDs that cannot be trusted because they are of poor quality or cannot be reliably verified. Most of the affected individuals live in lower-middle-income and low-income economies. Further, an estimated 3.4 billion people have some form of ID but with limited ability to use it in the digital world. And even the 3.2 billion people with a legally recognized identity may not be able to use that ID effectively and efficiently online (McKinsey Global Institute (2019). Lack of ID makes it difficult for citizens to access financial services, for financial service providers to on-board customers and for governments to efficiently transfer funds to the rightful beneficiary. Additional barriers to financial services include high fees, geographical distance from bank branches, inability to access digital services due to the cost of obtaining connection devices and data, lack of mobile or broadband internet coverage, and of lack of digital literacy.

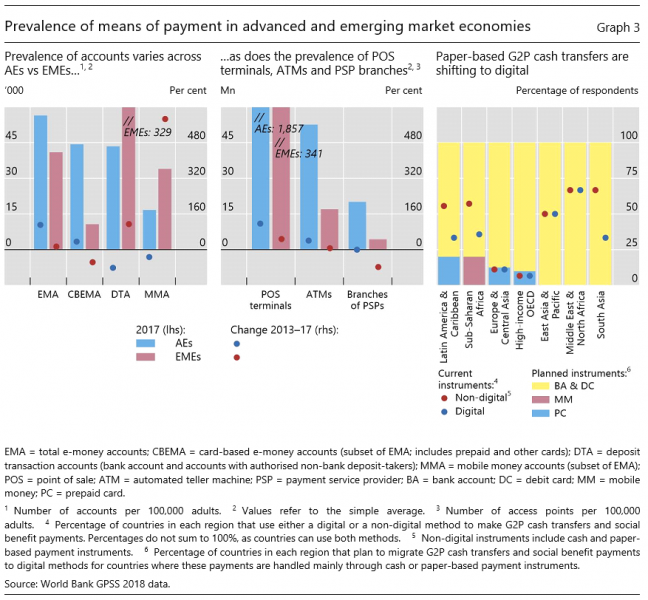

Governments have used a variety of payment instruments to reach unbanked and underbanked people during the pandemic. Alongside traditional paper-based payment methods, governments have used new methods to reach the unbanked, the underbanked or those who have not provided their bank account details to the government during the pandemic. In particular, improvements in access to non-bank transaction accounts, POS terminals and ATMs in recent years (Graph 3, left-hand and centre panels) have allowed new methods for G2P transfers. The governments of Indonesia, Italy and Korea have allowed recipients to pick up banknotes from collection offices. Even in highly banked countries, the absence of a comprehensive and interlinked government payment programme has presented challenges to distributing funds to large portions of the population at short notice. For example, in the United States the government has made 120 million credit transfers, mailed 35 million paper cheques and sent 3.7 million prepaid cards. As of early June 2020, in the US an estimated 30–35 million eligible people had not yet received G2P payments (US House Committee on Ways & Means (2020)), and 1.1 million payments (for USD 1.4 billion) had been made to deceased individuals (US GAO (2020)).

Onboarding of financially excluded people is challenging in normal times and even more so during times of crisis. G2P credit transfers require a smooth functioning payment system supported by a conducive legal and regulatory framework (Rutkowski et al (2020)). Yet creating a digital payment system in the midst of a pandemic is not feasible. Instead, governments have scaled up established social transfer programmes, often alongside other actions to support digital payments (Boakye-Adjei (2020)). For example, Brazil has used its existing allowance programme for poor families to disburse Covid-19 payments as well as starting an emergency aid programme through a partnership with state-owned banks to reach 54 million financially vulnerable citizens. Recipients were required to open a digital bank account via a mobile wallet4 with their national ID number. In India, the government was able to quickly provide Covid-19 relief through 204 million accounts operating under one of its existing financial inclusion programmes (Jerving (2020)). In many cases, programmes are already under way to shift G2P payments to digital instruments such as bank accounts, mobile money and prepaid cards in the future (Graph 3, right-hand panel).

Digital innovation presents opportunities to improve the access to and use of safe and reliable payments. New technologies can improve existing payment systems, increase access to digital payments via new access modes, and support new payment products and services, as well as greater interoperability between systems. The Committee on Payments and Market Infrastructures (CPMI) and World Bank (2020) identify application payment interfaces (APIs), big data, biometric technologies, cloud computing, contactless technologies, digital ID, distributed ledger technology (DLT) and the internet of things as new technologies that could improve payment services and financial inclusion. At the same time, digital innovation alone does not guarantee increased access to basic, trustworthy and low-cost payments. Private providers may be deterred from providing basic accounts to the financially excluded segments due to relatively thin profit margins and little scope for cross-selling. In addition, new payment channels could charge higher fees to merchants and users if they are launched by technology firms with substantial market power and large established networks. Moreover, central banks face important policy trade-offs around short vs long-term policy measures, ensuring privacy vs integrity, and the appropriate role of the public and private sector.

General purpose CBDCs could enhance inclusion in the medium term if inclusion features prominently in CBDC designs. Both advanced economy (AE) and emerging market economy (EME) central banks are investigating general purpose CBDCs (see Boar, Holden and Wadsworth (2020) for a survey and Auer, Cornelli and Frost (2020b) for a stock-take). In EMEs, general purpose CBDCs could improve financial inclusion by providing a low-cost means of payment and acting as an on-ramp to broader financial services. Meanwhile, several AE central banks are considering these CBDCs in light of declining cash use and potential reduced access to cash. In the future, a widely used general purpose CBDC could enable universal G2P payments. It could complement efforts by governments or private sector entities (under public oversight) to establish a universal digital ID system leading to greater financial inclusion. Like cash, an inclusive CBDC should present low technical access hurdles so that all users can access it. Multiple interfaces and physical payment tokens, prepaid CBDC cards or dedicated universal access devices should be considered (Miedema et al (2020)). Options should also be user-friendly for children, seniors, and groups with special needs, such as the visually impaired. Accompanying educational programmes might also be beneficial.

There may be trade-offs between token- and account-based CBDCs. Both forms have their relative merits and disadvantages when it comes to improving financial and digital inclusion. Account-based CBDCs require individuals to present valid ID, which as discussed could reduce access in some jurisdictions. Moreover, linking personal ID to a CBDC could generate data privacy concerns. Alternatively, identification is not strictly needed for a token-based CBDC; instead, ownership of a token-based CBDC is linked to “knowledge” such as a digital signature.5 This design could improve access to financial services, substitute for cash in countries where access to cash is cumbersome, enable a degree of anonymity and reduce the need for financial accounts. Yet a token-based CBDC without formal identification presents integrity risks and would have limited usefulness for G2P payments due to opportunities for fraud. For these reasons, central banks may lean toward account-based CBDC designs or a mixed system that allows for both token- and account-based access.6

On balance, digital innovation and CBDCs can support improved access to safe transaction accounts, but they are no panacea. The CPMI and the World Bank have developed a framework to harness the potential of digital innovation while mitigating its accompanying risks. This includes incorporating key actions relating to fintech into their guidance on payment aspects of financial inclusion (CPMI-World Bank (2020)). But to reach all members of society, innovations in payments and identification should be part of a broader payments and financial inclusion strategy, with an accordingly tailored design. Policymakers might also consider policies for ensuring access to and acceptance of cash. Mindful of the policy trade-offs, central banks can foster more inclusive payments in the post-pandemic world.

Auer, R and R Böhme (2020): “The technology of retail central bank digital currency”, BIS Quarterly Review, March, pp 85–100.

Auer, R, R Böhme, and A Wadsworth (2020): “An introduction to public-private key cryptography in digital tokens”, BIS Quarterly Review, March, p 73.

Auer, R, G Cornelli and J Frost (2020a): “Covid-19, cash and the future of payments”, BIS Bulletin, no 3,

3 April.

Auer, R, G Cornelli and J Frost (2020b): “Rise of the central bank digital currencies: drivers, approaches, and technologies”, BIS Working Papers, no 880, August.

Bank for International Settlements (BIS) (2020): “Central banks and payments in the digital era”, Annual Economic Report 2020, Chapter III, June.

Boakye-Adjei, N (2020): “Covid-19: boon and bane for digital payments and financial inclusion”, FSI Briefs, no 9, July.

Boar, C, H Holden and A Wadsworth (2020): “Impending arrival – a sequel to the survey on central bank digital currency”, BIS Papers, no 107, January.

Brown, M, N Hentschel, H Mettler and H Stix (2020): “Financial innovation, payment choice and cash demand – causal evidence from the staggered introduction of contactless debit cards”, Oesterreichische Nationalbank, Working Papers, no 230, April.

Ceeney, N, M Bloom, J Daley, D Hensley, M Kalia, P Kenworthy, R Lloyd, L Malenczuk and S Williams (2019): Access to Cash Review: Final Report, March.

Committee on Payment and Market Infrastructures (CPMI) and World Bank (2020): Payment aspects of financial inclusion in the fintech era, April.

European Central Bank (ECB) (2019): “Exploring anonymity in central bank digital currencies”, In Focus, no 4, December.

Gentilini, U, M Almenfi and P Dale (2020): Social protection and jobs response to Covid-19: a real-time review of country measures, version 12, 10 July.

Jerving, S (2020): “Cash transfers lead the social assistance response to COVID-19”, Inside Development, 14 April.

Mastercard (2020a): “Mastercard research shows surge in digital payments as e-commerce reaches new heights around the world”, 18 June.

Mastercard (2020b): “Mastercard updates second-quarter 2020 operating metrics”, 8 June.

McKinsey Global Institute (2019): “Digital identification: A key to inclusive growth”, 17 April.

Miedema, J, C Minwalla, M Warren and D Shah (2020): “Designing a CBDC for universal access”, Bank of Canada, Staff Analytical Notes, 2020-10, June.

Rutkowski, M, A Garcia Mora, G Bull, B Guermazi and C Grown (2020): “Responding to crisis with digital payments for social protection: short-term measures with long-term benefits”, World Bank Blogs, March.

Skingsley, C (2018): “Considerations for a cashless future”, speech, 22 November.

US Government Accountability Office (US GAO) (2020): “Covid-19: opportunities to improve federal response and recovery efforts”, 25 June.

US House of Representatives Committee on Ways & Means (2020): “Economic impact payments issued to date”, 5 June.

Visa (2020): “Visa Inc. Fiscal second quarter 2020 financial results”, 30 April.

We thank Stijn Claessens, Giulio Cornelli, Olivier Denecker, Dirk Ettlinger, Ernest Gnan, Chad Harper, Ruth Judson, Heidrun Kolb, Jesse McWaters, Tamas Nagy, Harish Natarajan, Oya Pinar Ardic Alper, Andrew Reiskind and Hyun Song Shin for comments, suggestions and data input. We thank Ilaria Mattei for outstanding research assistance, and Louisa Wagner and Tom Minic for editorial support. The views expressed in this paper are those of the authors and not necessarily those of the Bank for International Settlements.

Scientific evidence has suggested that the risk of using cash is low compared with touching other surfaces (Auer, Cornelli and Frost (2020a)).

Contactless payments allow users to pay at the point of sale (POS) with contactless cards or mobile wallets without physically entering a personal identification number (PIN) in a device or providing a signature, both of which require contact with a physical surface. Brown et al (2020) examine the impact of rising access to contactless payment cards on demand for cash transactions.

Mobile wallets enable end users to securely access, manage and use a variety of payment instruments issued by one or more payment service providers (PSPs) via an application (app) (CPMI-World Bank (2020)).

See Auer and Böhme (2020) on policy trade-offs in CBDC design, and Auer, Böhme and Wadsworth (2020) on digital signatures.

See ECB (2019) for a proposal on how to tier token- and account-based access. A recent stocktake of central bank research efforts indicated that CBDCs appear more likely to be based on account-based access (Auer, Cornelli and Frost (2020b)).