The accelerated decrease in the use of cash driven by the Covid-19 pandemic has strengthened the possibility of central banks issuing some pragmatic form of retail CBDC as an improved electronic version of cash. Such pragmatic approach requires designing CBDCs in such a way that they serve as means of payment but do not replace bank deposits as store of value, hence preserving financial intermediation. This paper discusses how different CBDC attributes (anonymity, remuneration, value-added services or caps on the holdings) can limit the substitutability between bank deposits and CBDCs in different situations.

The Covid-19 crisis has brought about a number of changes in economic behaviour as a result of the lockdown and the need of maintaining social distancing. Two of the most prominent changes are the increase in e-commerce transactions and the generalization of credit card payments, preferably through contactless technology. Both trends have reduced the use of cash as a means of payment, generating a certain stigma for banknotes.

These trends happen at a time when there is a debate on the possibility of central banks issuing a digital form of cash (the so-called central bank digital currencies, CBDCs), which would obviously overcome the drawbacks of cash as a disease transmitter as well as its limitations in e-commerce, hence the renewed interest on CBDCs as a result of the pandemic. The initial debates were mostly academic1, but the discussion rapidly moved to the policy arena2. A few central banks are developing pilots on use cases, with Sweden and China as the frontrunners.

Many central banks that analyzed the topic over recent years were hesitant to move forward, because of the problems related to anonymity and the likely disruption of financial intermediation. In very simplistic terms, if kept anonymous CBDCs will raise issues of AML related transactions; if identified, they will compete with bank deposits and probably disrupt financial intermediation as we know it. Furthermore, the accumulation of functions in central banks that CBDCs imply may jeopardize their independence, which is already under scrutiny. Confronted with this dilemma, many central banks decided to keep their projects on hold.

In this context the announcement by Facebook of the launch of Libra in June 2019 reignited interest in CBDCs for many central banks. The threat of a powerful BigTech issuing a stablecoin that may compete with fiat currencies triggered a reaction in the central banking community: on the one hand, the authorities raised questions on the nature of Libra and its regulatory treatment; and, on the other hand, they looked back at plans for CBDCs with a more positive attitude. This fresh look at CBDCs was accompanied by a more pragmatic approach, with more nuanced proposals that lessen the dilemmas implied in the first, more academic proposals. In particular, some of these new proposals focus on modalities that rely on public-private partnerships rather than full provision by the central bank. There is also increasing elaboration on variants that limit the extent of the dilemmas posed by anonymity.

All this debate was stimulated by the Covid-19 crisis. The stigma of cash, compounded with the above-mentioned reasons, is convincing many central banks that they should offer a means of payment that links them directly with the population and does not rely entirely on private providers. Furthermore, for many countries the payments space is dominated by a few foreign international card schemes, which is an additional factor, since the Covid crisis raised the value of national self-reliance on critical services in the authorities’ preferences. It is important to clarify that not all the authorities have the same view in this respect. Some of them might not see a significant problem in relying on a few foreign credit card providers for the retail payments infrastructure, to the extent that they are efficient and function according to local regulations. But after Covid the number of countries whose authorities are concerned on national sovereignty and the importance of preserving a role for the central bank in the provision of retail means of payment has probably increased3.

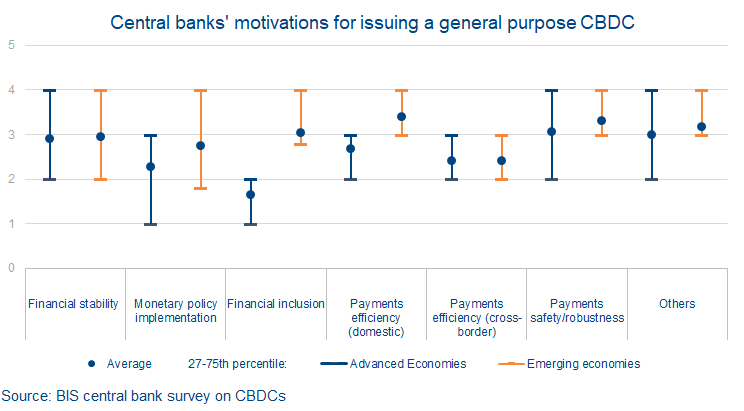

One reason mentioned by some central banks4 for the provision of CBDCs is the need to offer an alternative for retail users that do not want or cannot afford to have a payment card, or even a bank account. According to this view, it is the obligation of the central bank to provide an affordable means of payment that does not depend on private firms’ solutions that are costly and may not be appropriate for certain segments of the population. Financial inclusion considerations are often mentioned in this context. In general, central banks also mention the safety and robustness of payments as one of the main motivations for issuing CBDCs (see figure).5

The question many central banks are asking themselves is therefore how to preserve the role of sovereign / legal tender money while not disrupting financial intermediation. And this question is tightly linked to the distinction between the role of money as a means of payment vs a store of value. If we want CBDCs to replace cash but not bank deposits, then we should design an instrument that is a means of payment and not a store of value. It is true that cash can be a store of value and bank deposits are also a means of payment. But their main role can be identified with means of payment in the case of cash and store of value in the case of deposits. The key question in this regard is how to design CBDCs so that these main roles are preserved.

This is especially important at a time where there is an increasing offer of digital forms of money (e-money products, crypto-assets and stablecoins, etc.) and it is faster and easier than ever to transfer funds between different instruments, due to developments such as instant payments and open banking. In such a context retail bank deposits are already subject to increased competition and volatility, and CBDCs could amplify the implications of this volatility for financial intermediation.

Cash has always served both as a means of payment and a store of value, but its functionality as a store of value is limited due to handling and security costs. Although cash is stored in huge amounts (especially for illegal transactions or tax evasion), it is cumbersome and costly, which sets implicit limits on its hoarding. Even with negative interest rates banks are depositing reserves in the central bank instead of storing cash, which clearly shows its limits as a store of value.

An electronic version of cash would in principle reduce these costs and facilitate its use as store of value. This change may have profound implications in the use of cash and its degree of substitutability with banks’ deposits. To the extent that CBDCs are a modality of cash much easier to store than banknotes, their potential to crowd out deposits would be amplified. This is particularly true in periods of low or negative interest rates, assuming that CBDCs retain the no-yield feature of cash (in the next section we explore the implications of yield bearing CBDCs for this debate).

The high substitutability of CBDCs with banks’ deposits raises particular problems in times of financial uncertainty or instability. In a crisis situation, be it idiosyncratic or systemic, deposits’ holders will have huge incentives to shift deposits to CBDCs as the safest form of store of value, with very little sensitivity to interest rates differentials. In this world, the old logistical complications of cash withdrawals will not operate, which implies a huge incentive for bank runs. Many central banks that have been analysing CBDCs have stressed this drawback in their analysis.6

A number of design choices affect the functionality of retail CBDCs as a store of value and, therefore, their potential to crowd out commercial bank deposits and disrupt financial intermediation. Explicit limits on the amount of money that can be held in a CBDC are obviously the most straightforward way of restricting its store of value function. Yet other CBDC attributes, such as the remuneration or the degree of anonymity, are also relevant for its attractiveness as a store of value and can thus influence users’ behaviour and indirectly limit the amount of CBDC holdings.

When considering different design choices that can be used to limit the store of value function of a CBDC, central banks should carefully assess the effectiveness of each option to limit the substitution of bank deposits under different scenarios, including periods of low interest rates and contexts of economic or financial stress, where bank runs are more likely to happen. This is important because retail CBDCs should be designed in a way that prevents not only the crowding out of bank deposits under normal circumstances (i.e. the risk of structural disintermediation) but also the risk of a leakage of bank funding in crisis situations.

Another factor that should be considered is how these design choices interact with other valuable attributes of a CBDC, and particularly those that are relevant for its use as a means of payment. In some cases, there are trade-offs between limiting the store of value function of a CBDC and preserving or enhancing its payment functionalities. Taking into account these factors, in the following paragraphs we discuss the implications of different design choices that can limit the store of value function of a CBDC.

Token-based CBDC models can provide anonymity for the holders and more closely resemble cash, as opposed to identified, account-based models that are more similar to deposits. To the extent that anonymity and security are inversely related, it can be argued that anonymous, token-based CBDCs will be less attractive as a store of value, given the difficulty for the holders to make a claim in case of theft or loss. However, since physical and digital assets are not secured in the same way, and ensuring a certain degree of security does not entail the same costs in the physical and the digital world, anonymity may not be sufficient to prevent a substitution effect between bank deposits and CBDCs. Indeed, even if the levels of security of cash and a theoretical CBDC were the same, the latter would still present advantages in terms of the convenience of handling and storing.

In any case, the possibility of a fully anonymous CBDC does not seem realistic considering the implications for AML/CFT, and technical solutions that allow for semi-anonymity or partial identification, with AML limits potentially embedded, are increasingly under discussion7. This definitely undermines the relevance of anonymity as a design choice to limit the store of value function a CBDC.

Stability and remuneration are obviously key attributes when comparing between different means of storing of value. Therefore, below-market remuneration reduces the attractiveness of a CBDC relative to bank deposits; and it is in theory possible to set an interest rates spread such that, for given market conditions, the substitution effect is minimized. Non yield-bearing CBDCs may satisfy such condition under a normal market environment and if interest rates are sufficiently high. However, if interest rates are close to zero or the financial sector is under stress, with bank deposits perceived as riskier, the interest rates of CBDCs might need to enter into negative territory, and, in certain circumstances, be extremely penalizing to prevent bank runs. This would mean diverting CBDCs from an important feature of cash and other payment methods, which is the preservation of value in nominal terms, and would thus undermine the use of CBDCs as a means of payment. In addition, setting negative interest rates on a central bank liability directly held by citizens can be perceived as an expropriation and be a challenge for the public perception of the central bank. As a consequence, political pressure could end up compromising its independence.

A solution to the above-mentioned problem would be to set a remuneration structure that preserves the payment function of a CBDC up to a certain amount of holdings per agent, which would be subject to neutral or relatively attractive interest rates, and then impose an unattractive remuneration on the remaining holdings. In such a two-tiered interest rate structure, the threshold between the two tiers could be close to the average monthly net income of households, to cover the normal payment function of money8. The central bank could commit not to impose negative interest rates on the “payment tier” of the CBDC, whereas the second tier (the store of value one) could be subject to very unattractive rates during a financial crisis.

If well implemented, this configuration could in principle be effective in addressing the risk of crowding out deposits, both structurally and in crisis situation, while preserving at the same time the main intended function of the CBDC. However, a tiered structure obviously involves certain degree of complexity, not just from a technical perspective, but also for how citizens (and particularly vulnerable segments) perceive and understand a CBDC. This can be challenging for an instrument conceived as an improved electronic version of cash — i.e., simple and universal — and would require at least an educational effort and a clear communication policy from the central bank.

A more straightforward approach to minimize the use of CBDCs as a store of value would be to set limits on the amount of money that each individual can held in this instrument. This would involve some technical complexity if central banks do not directly distribute a CBDC to the end users but rely on private third-parties (e.g. banks and other payment service providers) for the customer-facing activities. These public-private configurations have been referred to as hybrid or synthetic CBDCs9. If individuals can simultaneously use CBDC wallets from different providers — something desirable from a competition perspective — some centralized or coordinated mechanism would be needed to effectively apply the total ceiling per individual set by the central bank.

Another practical problem is what happens with payment transactions if the recipient has already reached the CBDC limit, or would do so with the incoming amount.10 If transactions are blocked on this basis, this would undermine the payment function of the CBDC, to an extent that depends on the specific set limit. This problem could be overcome by requiring each holder to designate an alternative bank or payment account to which incoming transfers that exceed the CBDC ceiling would be redirected.

In any case, this practical problem shows that setting limits on the amount of CBDC holdings involves an inherent trade-off between the extent to which a CBDC can be used as a means of payment and the risk of bank deposits being displaced in certain circumstances. This trade-off is also relevant when deciding over the specific threshold of a two-tiered remuneration system. In theory, flexible ceilings that can change over time would allow central banks to optimize the trade-off conditioned on the market circumstances. Yet this in turn would increase the uncertainty and perceived complexity over a CB instrument intended to be a digital version of cash, and could again compromise the political independence of the central bank.

Finally, the range of value-added services linked to, or available through, a CBDC also affects its potential use and hence its degree of substitutability to cash, bank deposits and other instruments. For instance, the possibility of making direct debits, scheduling recurring payments, visualizing and analyzing transactional data or accessing non-payment financial services would allow CBDCs to serve use cases (beyond the basic payments made in cash) for which bank accounts are currently the norm. This is not so much related to the store of value attributes of a CBDC (i.e. security, stability, remuneration) but rather to its advanced transactional functionalities, which are also a factor behind the demand for bank deposits.

In fully public CBDC models, the extent of these functionalities will be decided by the central bank, and would probably be limited given the central banks’ lack of experience and skills in intensive consumer-facing activities. In hybrid (public-private) CBDCs, the services will be a function of the central bank requirements and the choices made by the private distributors. Among those, banks would probably be interested in differentiating CBDC wallets from bank accounts, while non-bank distributors may try to do the opposite so that they can develop a more comprehensive financial offering around the CBDC product. It is difficult to foresee which strategy would prevail, but it would depend crucially on the regulatory approach.

In any case, although a CBDC with limited (cash-like) functionalities would reduce the substitutability of bank deposits under normal circumstances, in extraordinary ones this cannot limit the attractiveness as store of value of a central bank-issued instrument.

The accelerated decrease in the use of cash, a result of the Covid-19 pandemic, and the increasing threat of private forms of digital money have strengthened the possibility of central banks issuing some form of retail CBDC. At the same time, although disruptive CBDC models have been proposed in the literature, as a new monetary policy tool or as a way of moving away from the current fractional reserve financial system, these are increasingly discarded and the debate is now focused on more pragmatic variants that allow central banks to preserve the role of legal tender money in a cashless economy and to provide a public alternative to private retail payment solutions. In this regard, CBDCs are sometimes presented as a tool for financial inclusion, by providing a universal financial instrument accessible to unbanked individuals, but, given the electronic nature of CBDCs, this generally depends on those individuals having access to digital technologies.

Pragmatic CBDC models aim to create a digital version of cash, while preserving the distinct function of bank deposits and the role of financial intermediation in channelling credit to the real economy. A pragmatic approach is also likely to involve some form of public-private collaboration, by which the central bank relies on private intermediaries (banks and non-banks) for the more intensive consumer-facing activities (e.g. onboarding or custody).

For these pragmatic models to work properly it is key to ensure that CBCDs function as means of payment but do not replace bank deposits as a store of value. In this paper we have discussed how different CBDC attributes (anonymity, remuneration, value-added services or caps on the holdings) can serve to this purpose. Among these, the most obvious means to ensure this separation is to set caps on CBDCs holdings. But this may face practical difficulties such as how to impose the limits when an individual holds CBDCs in wallets offered by different providers or what to do with payments to accounts that exceed the caps.

Another possibility that is receiving increasing attention is to set different tiers of CBDCs holdings, with a penalizing interest rate above a certain threshold. This may function in normal times, but would probably require extremely penalizing (negative) rates in a crisis or a bank run, which may create problems from the point of view of the central bank objective of preserving the value of money. Indeed, the debate on whether CBDCs should be remunerated or not is related to a broader policy debate. There seems to be consensus that a yield-bearing CBDC may improve the transmission mechanism of monetary policy, but to the extent that it is used aggressively in deflationary situations risks also raising criticism as a modality of financial repression.

As opposed to caps on balances or tiered structures, a non-yield bearing CBDC without limits on holdings can be seen as a basic, by-default configuration. In this case, the separation between the means of payment and the store of value functions depends crucially on the value added services provided by bank deposits as compared to CBDCs, such as direct debits or access to other financial services. The substitutability between deposits and CBDCs would thus depend on the extent to which regulation and competition dynamics allow banks and other financial intermediaries to differentiate between deposits and CBDCs. However, in a crisis situation value-added services may become irrelevant as compared to the safety of central bank money.

One topic for further analysis is the cross-border dimension of this debate. The decision to open access to non-residents may have profound implications on the feasibility of the above-mentioned options to separate the means of payment from the store of value functions of CBDCs. Non-residents may have different reasons than residents for holding CBDCs. Tourists may be interested in the payments function whereas other non-residents may have a preference for storing foreign currency, especially in dollarized economies. Their sensitivity to some of the potential CBDC features mentioned above (anonymity, caps, yield, value-added services…) may differ from that of residents, creating arbitrage opportunities. All these issues deserve a separate analysis.

Adrian and Mancini-Griffoli (2019): “The rise of digital money”, IMF Fintech Notes 19/01.

Bank of England (2020): “Central Bank Digital Currency: Opportunities, challenges and design”, Discussion Paper, March 2020.

Barrdear, J. and Kumhof, M. (2016): “The macroeconomics of Central Bank issued digital currencies.” Staff Working Paper No. 605, Bank of England.

Bindseil (2020): “Tiered CBDC and the financial system”, ECB Working Paper Series 2351, January 2020.

BIS (2018): “Central Bank Digital Currencies”, Report by the Committee on Payments and Markets Infrastructure and the Markets Committee, March 2018.

Boar et al. (2020). “Impending arrival–a sequel to the survey on central bank digital currency”. BIS Paper, no. 107.

ECB (2019): “Exploring anonymity in central bank digital currencies”, In Focus, no 4, December 2019.

Fernández de Lis (2020): “Central Bank Digital Currencies: the cross-border dimension”, The International Banker, March 2020.

Gouveia et al. (2017): “Central Bank Digital Currencies: assessing implementation possibilities and impacts,” BBVA Research Working Papers 17/04.

Mersch (2020): “An ECB digital currency: a flight of fancy?”, Speech by Yves Mersch, Member of the Executive Board of the ECB and Vice-Chair of the Supervisory Board of the ECB, at the Consensus 2020 virtual conference, 11 May 2020.

Riksbank (2018): “The Riksbank’s e-krona project”, Report 2, October 2018.

SUERF (2018): “Do We Need Central Bank Digital Currency? Economics, Technology and Institutions”, Edited by Ernest Gnan and Donato Masciandaro, SUERF Conference Proceedings 2018/2.

See Barrdear, J. and Kumhof, M. (2016).

See BIS (2018) and Gouveia et al (2017).

At the same time, central banks are increasingly aware of the cross-border implications of CBDCs. We will not explore this issue here. See Fernández de Lis (2020).

See Riksbank (2018).

The graph shows the distribution of CB responses from “Not so important” (1) to “Very important” (4). See Boar et al. (2020).

See SUERF (2018) and Mersch (2020).

See ECB (2019).

See Bindseil (2020).

See Adrian and Mancini-Griffoli (2019).

See Panetta (2018) in SUERF (2018).