This note discusses the economics and politics of issuing COVID-19 perpetual bonds with the European Central Bank as the buyer. The case is analyzed applying a general framework where a fiscal monetization produces losses in the central bank’s balance sheet, without a permanent increase in the money base. If an independent central bank acts as a long-sighted policymaker, an optimal helicopter monetary policy can be identified. At the same time, if the government in charge is made up of career-concerned politicians and citizens are heterogenous, then the policy mix will produce distributional effects, and conflicts between politicians and central bankers will be likely. Political pressures will arise and the helicopter money option will be unlikely.

The spread of the new coronavirus (COVID-19) in early 2020 led to some of the most significant declines in stock prices (Baker et al. 2020, Cahn and March 2020, Ramelli and Wagner 2020), contractions of real economic activities (Leiva-Leon et al. 2020) and deteriorations in expectations (Gormsen and Koijen 2020) seen in recent human experience (Barro et al. 2020, Breitenfellner and Ramskogler 2020, Danielsson et al. 2020), without mentioning the long-run macroeconomic effects of global pandemics (Jorda et at. 2020, Alfani 2020).

In economic thinking, the COVID-19 pandemic forces swept away many of the conventional taboos, such as the radical idea of a helicopter drop – that is, printing money and handing it out to people with no strings attached (Financial Times 2020, Yashiv 2020). The term uses the fanciful imagery that was originally invented by Milton Friedman (1968). Also the head of the French central bank Francois Villeroy de Galhau has floated the idea of printing money and giving it directly to companies (Financial Times 2020b).

Moreover over the past months media attention has zoomed on a new approach to macroeconomics, dubbed Modern Monetary Theory, whose proponents claim that governments can always print money without intertemporal budget constraints (Mankiw 2019), which implies that helicopter money is always a viable option. However, what we today call “unprecedented monetary policies” have historical precedents (Ugolini 2020).

The debate about helicopter money involves two separate policy issues. The first is how to create a financial backstop for households and firms through monetary cash transfers. The second is whether and how to involve the central bank in financing this backstop through direct monetization.

Direct cash handouts have already happened in two instances. In February 2020, the government of Hong Kong transferred HKD 10,000 (USD 1,270) to all residents financially affected by the virus as part of its overall policy response (Quah 2020). Similarly, the government of Singapore provided small cash payments to all adult Singaporeans (Financial Times 2020). Other direct cash handouts have also been announced. Moreover, in 2009, the Australian government implemented a similar policy when it sent cheques to most taxpayers (Grenville 2013). However, fiscal cash handouts are not automatically helicopter money, and the same is true for any general mix of monetary and fiscal policies under which expansionary fiscal measures are financed by creating a monetary base (Carter and Mendes 2020). As such, we need a definition to avoid ambiguities (Blanchard and Pisani-Ferry 2020).

Given that the state and the central bank have separate balance sheets, we assume that helicopter money is in action when there is an outright money-financed fiscal transfer that produces losses in the central bank’s balance sheet (Gali 2020). Our definition implies that a direct central bank money transfer is neither a necessary nor a sufficient condition for a helicopter money action, while some proposals suggested that a direct channel is more likely to be effective due to both higher consumer spending and higher inflation expectations (Muellbauer 2014). This is true even though some analyses cast doubt on whether it makes any difference that transfers come from the central bank or the government (Van Rooij and De Haan 2016). Needless to say that any central bank role as public debt manager does not imply any helicopter money, provided that – as in the case of the Bundesbank (Deutsche Bundesbank 2018) – the central bank does not grant any loan nor does it take any state security into its own portfolio acting as public deb agent.

Moreover, we can have helicopter money without a permanent increase in non-interest-bearing central bank liabilities (Reichlin et al. 2013, Buiter 2014a, Borio et al. 2016, Bernanke 2016, Agarwal and Chakraborty 2019). Finally, this form of helicopter money differs from conventional and unconventional central bank asset purchases financed by issuing central bank reserves, as it represents an intended loss on the central bank’s balance sheet. In this case, the corresponding public liabilities are irredeemable.

In other words, they are viewed as a permanent asset by the holder and as a capital liability by the issuer, but without any permanent change in the overall money base. Intended central bank losses are more likely to be interpreted as a credible one-shoot monetary action than a change in the money base growth. Table 1 summarizes the different options.

Table 1: Monetary Policy Options, Money Base Growth and Central Bank’s Balance Sheet

| MONETARY POLICIES |

PERMANENT MONEY BASE GROWTH | CENTRAL BANK’S BALANCE SHEET LOSSES |

| Central Bank Asset Purchases | NO | Random and Unintended Effect |

| Hard Helicopter Money | YES | NO |

| Soft Helicopter Money | NO | Systematic and Intended Effect |

Source: Masciandaro, 2020

However, the economics of a helicopter money option do not address crucial political issues that such an option involves. Extant research (Turner 2015, Bernanke 2016) emphasizes that, in general, political concerns are perhaps the most important reason for viewing helicopter money as a last-resort policy – it represents a source of risk to the central bank’s independence.

Before the 2008 financial crisis, the independence of central banks had become the benchmark for evaluating the effectiveness of monetary institutions around the world. This institutional design was supported by a broad consensus (Cecchetti 2013, Bayoumi et al. 2014, Goodhart and Lastra 2017, Issing 2018). When the financial crisis emerged, the boundaries between monetary, banking and fiscal policies became blurred, triggering a debate on the shape of central bank regimes (Nier 2009, Cecchetti et al. 2011), especially with regard to central bank independence (Alesina and Stella 2010, Cukierman 2008 and 2013, Cecchetti 2013, Stiglitz 2013, Taylor 2013, Buiter 2014b, Balls et al. 2016, Sims 2016, Blinder et al. 2017, De Haan and Eijffinger 2017, Issing 2018, Rogoff 2019).

The mixing of a fiscal backstop and helicopter monetization is a case of policy blurring that can affect the relationship between politicians and central bankers. Therefore, we analyse the possible effects of a helicopter money option on central bank independence using the concept of political pressure (Binder 2018). We use this concept as a proxy for potential demand for reforming the current institutional setting. In general, we share the perspective that political cost-benefit analyses eventually shape central bank governance. Such drivers create dynamic institutional cycles with ups and downs (Masciandaro and Romelli 2015) during which the central bank’s independence can exhibit different degrees of resilience in terms of how difficult is to change constitutions and laws (Alesina and Grilli 1992, Blinder 2010).

The remainder of this article is organised as follows. Section two presents the theoretical framework (Masciandaro 2020) with its interactions among the relevant macro players – citizens, the government and an independent central bank – after which the optimal helicopter monetary policy is defined. Section three examines the importance of heterogeneity among citizens when politicians are in charge. Monetary policy can produce inequalities that trigger political pressures on the central bank. In both sections, the framework is applied in a discussion of European perpetual bonds with the European Central Bank acting as the buyer. The conclusions are presented in section four.

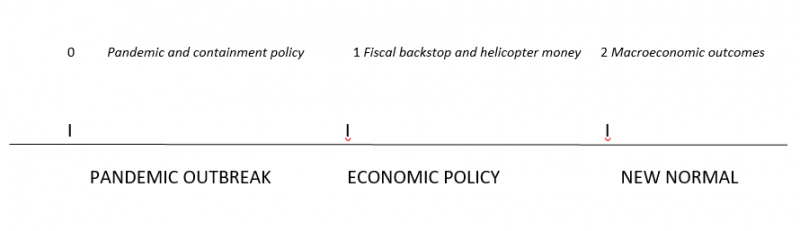

The economy consists of a population of citizens, a government and a central bank. The citizens are risk neutral, and they draw utility from consumption and disutility from labour. Moreover, each citizen can have financial assets and liabilities. If a pandemic occurs, policymakers have to react by implementing both fiscal and monetary policies. The sequence of events is as follows (see Figure 1).

Figure 1: Pandemic, Fiscal Deficit and Helicopter Money

Initially a pandemic breaks out and, consequently, the government designs and implements a containment policy. The starting point is the special nature of the pandemic-related recession. As a result of the pandemic, each national government faces an unpleasant dilemma between two public goals (Baldwin and Weder di Mauro 2020).

First, there is a need to protect public health by implementing a containment policy or social-distancing measures with the aim of minimizing the expected loss of life (Atkeson 2020). However, given the interactions between economic decisions and epidemics (Eichenbaum et al. 2020), any containment policy has economic costs that simultaneously affect the three fundamental pillars of a modern market economy: aggregate supply (Baldwin 2020a and 2020c, Del Rio-Chanona et al. 2020, Goodhart and Pradan 2020, Koren and Peto 2020), aggregate demand (Andersen et al. 2020, Del Rio-Chanona et al. 2020, Fornaro and Wolf 2020), and the banking (Acharya and Steffen 2020) and financial sector (Alfaro et al. 2020, Baker et al. 2020, Schoenfeld 2020), including the shadow-banking system (Perotti 2020).

Citizens suffer economic and financial losses that dampen their balance sheets. The losses that negatively affect both the asset value and the ability of households and firms (De Vito and Gomez 2020) to remain safe and sound borrowers. We assume that the government can absorb financial losses by implementing a fiscal backstop using cash transfers with the aim of keeping liquidity running (Baldwin 2020b). Temporary nationalisations can be implemented where needed (Becker et al. 2020). Financial markets and banks become a vehicle for public policy (Draghi 2020), as the historical experience tell us (Horn et al. 2020), where the government interventions are completely different from those used to rescue financial institutions during the 2008-2009 financial crisis (Igan et al. 2019). In most European countries, governments are facing or will face high expenditures to smooth out the negative recessive effects on households and firms. A high volume of public finance is needed to bridge corporate liquidity shortages and/or financial needs, and to compensate for temporary and/or permanent wage losses (Gnan 2020).

The possible outcomes in terms of losses can take the form of two opposite scenarios. At one extreme, no cash monetary transfers are implemented. In this no-transfer scenario, citizens completely lose their assets and their creditworthiness. At the other extreme, the fiscal backstop expansion that covers the bailout is complete.

How can the cash transfers be financed? The government can raise taxation or issue debt, where the latter can be purchased by either citizens or the central bank. The government finances its policy by making a simultaneous decision regarding taxation and the issuance of new debt, knowing at the same time the central bank choices. The new debt, in turn, becomes an asset in the portfolios of citizens and the central bank.

Disposable income and assets finance consumption. Such assumption can be particularly relevant during a pandemic: lockdowns produce material deprivation and households can draw on both income and wealth to address the unexpected shock. Combining income and wealth in a single index of deprivation it is possible to measure across countries how large and similar are the shares of the population that are likely to suffer from the containment measures (Gambacorta et al. 2020) becoming potential recipients of a fiscal backstop.

Finally, we need to consider welfare losses that may be caused by financial or monetary externalities. On the one side, the containment dampens the citizens’ assets, thereby triggering further financial externalities. In the real world, the less the government is involved in supporting the economy, the more private balance sheets are likely to deteriorate.

However, the helicopter money is not a free lunch. In other words, it may create monetary externalities. We assume that the backstop monetization is associated with increasing monetary stability risks, such that that the monetary expansion associated with the central bank’s losses can threaten the monetary stability goal when the pandemic-related recession ends.

The last step is the identification of the optimal helicopter monetary policy. We assume that as the central bank is independent from politics, it acts as a long-sighted social planner. As such, its actions should be consistent with the normative benchmark.

The motivation behind our assumption is well known. The role of central bank design emerged through the application of a game-theoretical approach following the discovery of the general time-inconsistency problems that characterize economic policy (Kydland and Prescott 1977, Calvo 1978). In this context, possible solutions to the problem of monetary policy effectiveness include an independent central bank (Sargent and Wallace 1981, Barro and Gordon 1983) or a conservative central banker (Rogoff 1985). At the same time, both concepts highlighted the importance of monetary stability in policy makers’ goal functions. In this vein, the delegation of monetary policy to non-elected central bankers can be motivated by showing that bureaucrats are preferable to politicians for determining technical policy, while elected politicians retain decisions regarding purely redistributive policies under their direct control in order to please their voters (Alesina and Tabellini 2007).

If we focus on the central bank’s decisions, the optimal level of helicopter money has well-defined properties. It increases: a) if the labour supply is relatively elastic, given that the corresponding tax-distortion risk is high; b) if the cost of debt servicing is high and c) if the monetary instability risks are low.

In the European Union setting, one example could be a special application of the Common European Debt option (Bruegel 2020). In light of the COVID19 pandemic, a European Transfer Plan could be designed in which all national needs related to the pandemic recession are aggregated (Bènassy-Quèrè et al. 2020a, Biancotti et al. 2020). Such a fiscal backstop could be financed through European Union assets (Garicano 2020) by issuing COVID Perpetual Bonds (Giavazzi and Tabellini 2020) via a specific vehicle (Amato et al. 2020) or, alternatively, the ESM (Bènassy-Quère et al. 2020b), with the European Central Bank (ECB) acting as buyer of these bonds. The ECB could credit the governments’ accounts with a reduction in its capital (Gali 2020).

In order to apply our analysis, the ECB’s action must be motivated by an independent evaluation of its Board that a decision to hold or permanently keep such Perpetual Bonds on its balance sheet (and the corresponding losses) will not harm its capacity to pursue its monetary-stability goal in the medium term. It must also believe that this will be an effective European economic tool. In so doing, the ECB will consider the constraints in increasing the tax revenues as well as the costs of debt issuance for the different European Union members with its likely domino effects. In this respect, it would be prudent to avoid triggering the fifth wave of rapid global debt accumulation and the consequent Euro redenomination risk, as the four previous waves ended with widespread financial crisis (Kose et al. 2020). In parallel, the COVID-19 pandemic represents an unprecedented shock for the labour market (Boeri et al. 2020, Fujita et al. 2020), which will deter any policymaker from financing a fiscal backstop through income taxes and/or value-added taxes; either a wealth-tax option (Landais et al. 2020) or a levy on financial assets (Gros 2020) cannot be excluded a priori, notwithstanding their consistency with a fiscal backstop cannot be taken for granted.

This could be a case of a European helicopter money, but would this European policy mix be politically feasible? In this regard, the cost/benefit analyses of the national governments are crucial.

In general, what is the fiscal backstop that a government can design? All else equal, including the uncertainty that stems from the policy hesitation in addressing the epidemic (Muller 2020) as well as the failure to prepare in advance to address rare events (Mackowiak and Wiederholt 2018), two situations can arise. Theoretically, if the government is a standard benevolent policymaker, its choices will be consistent with the social-planner decisions described in the previous section that aim to maximize economic efficiency. In other words, fiscal backstop and helicopter monetary policies will be both coordinated and optimal levers. The same is true if politicians are in charge but the citizens are completely homogeneous. However, even if the Economic and Monetary Union has efficient policymakers, the coordination outcome is not a given, as the Union does not yet have a device to achieve it (Reichlin and Shoenmaker 2020).

If politicians are in charge and citizens are heterogenous, different economic policies have relevant redistributive effects. In fact, the net transfers implied by efficient policies can be positive for some and negative for others. Cash money transfers and bond remuneration can influence the welfare of individual citizens differently when they are heterogeneous. However, as we noted before, if a policy task has distributional effects, the politicians would like to control those effects (Alesina and Tabellini 2007).

The distributional effects enter the picture because the mix of a fiscal backstop and helicopter money produces the “three D” (distributional, directional, duration) effects (Goodhart and Lastra 2017). The distributional effects result from changes in interest rates. The directional effect captures the impact of public policy on a certain sector and/or constituency of the economy (Brunnermeir and Sannikov 2013). The duration effect measures the monetary policy’s effect on overall public-sector liabilities, including the central bank’s balance sheet. The duration effect is associated with the dimensions and risk profile of the central bank’s balance sheet with its increasing relevance in the perimeter of monetary policy (Curdia and Woodford 2011, Reis 2013).

Helicopter monetization is associated with changes in the central bank’s balance sheet. At the same time, a fiscal backstop produces directional effects depending on how the concrete cash monetary policy is designed, while the distributional effect is associated with the corresponding debt policy. All in all, the overall economic policy strategy has redistributive consequences for citizens as well as political spillovers.

The redistributive effects are relevant as long as the policies are chosen through the political process (i.e. when the citizens are voters). In this regard, we consider majority voting with voter preferences that are associated with the economic consequences of a fiscal backstop financed via a helicopter monetary policy. The leverage of the median voter will tell us whether the subsidized citizens represent the majority or a minority of the population. At the same time the financial wealth of the median voter signals whether the wealthy voters represent the majority or a minority of the population. Each voter’s preferences can differ from those of the central bank because of these two terms, representing the political distortion due to citizen heterogeneity. More specifically, given the fiscal backstop, the number of citizens against the helicopter money will be higher if: a) the majority of voters are wealthy, b) the interest rate is higher, c) the monetary stability risks are higher.

A perception of an unfair monetary policy can contribute to various forms of resentment and lead to hostility against the central bank. Moreover, the more the politicians in charge accommodate the demand for a level of helicopter monetization that differs from the central bank’s optimal level, the greater the likelihood of political pressure. Notably, the political pressure can be considered as a proxy for the contingent demand for central bank reform. This interpretation can be confirmed by observing that the political pressure seems to be uncorrelated with legal – or de jure – central bank independence thus far (Binder 2018).

The motivation is straightforward. Political pressures on the central bank may be relevant in shaping the actual monetary policy decisions, if the government in charge can threaten in some way the central banker role. For example if the institutional setting is such that any incumbent government in extraordinary times can retain the option to override the central banker’s decision, the central banker can have the temptation to accommodate the political wishes in order to avoid being overridden (Lohman 1992). Political pressures can trigger monetary policy uncertainty.

In the case of the European Union, the hostile sentiments against the ECB’s monetary policies can be a factor to consider when explaining the various forms of nationalism, populism and Euroscepticism (Morelli 2020). Some researchers argue that the rise of populism may harm the consensus in favour of central bank independence (De Haan and Eijffinger 2017, Goodhart and Lastra 2017, Rajan 2017, Rodrik 2018). From an empirical point of view, the relationship between one aspect commonly attributed to populism – namely nationalism – and central bank independence has been empirically examined (Agur, 2018), while the relationships between both right-hand and left-hand populism and central bank independence have been discussed from a theoretical perspective (Masciandaro and Passarelli 2019). Moreover, if we assume that a correlation holds between the opinions on the so called “Corona Bond” issuing and the hostility against any kind of ECB monetization, the current debate – for example in Germany (Waltenberger 2020) – can offer interesting insights.

All in all, the more the citizens are heterogeneous and the more the elected representatives are career-concerned politicians, the more it will be true that the helicopter money that the independent central bank would like to implement will not fit the political preferences. In such situations, political pressures on the central bank are more likely and a helicopter monetary policy becomes less likely.

This article discussed the design of relationships between a fiscal backstop implemented using cash transfers and a helicopter monetary policy that produces losses in the central bank’s balance sheet without a permanent change in the money base. The analysis led to two results. If an independent central bank acts as a long-sighted policymaker, an optimal helicopter monetary policy can be identified. The features of such a policy can be defined by taking monetary-instability risks, the costs of issuing public debt and overall macroeconomic features into account. However, if the government in charge is made up of career-concerned politicians and citizens are heterogenous, then the policy mix will produce distributional effects. Conflicts between politicians and central bankers will be more likely and these, in turn, may trigger political pressures on the central bank. As such, helicopter money strategies are unlikely in such situations. The framework was applied in a discussion of the economics and politics of perpetual bonds with the European Central Bank as the buyer.

Abrams B.A., 2006, How Richard Nixon Pressured Arthur Burns: Evidence from the Nixon Tapes, Journal of Economic Perspectives, 20(4), 177-188.

Acharya V. and Steffen S., 2020, Stress Tests for Banks as Liquidity Insurers in a Time of COVID, Vox, March, 22.

Alfani G., 2020, Pandemics and Asymmetric Shocks, Vox, CEPR, April 9.

Alfaro L., Chart A., Greenland A. and Schott P., 2020, Aggregate and Firm-Level Stock Return During Pandemics, in Real Time, NBER Working Paper Series, n. 26950.

Agur I., 2018, Populism and Central Bank Independence: Comment, Open Economies Review, 29, 687-693.

Alesina A. and Grilli V., 1992, The European Central Bank: Reshaping Monetary Politics in Europe”, in M. Canzoneri, V. Grilli and P.R Masson (eds.), Establishing a Central Bank: Issues in Europe and Lessons from the US, Cambridge, Cambridge University Press.

Alesina A. and Stella A., 2010, The Politics of Monetary Policy. Technical Report, National Bureau of Economic Research.

Alesina A. and Tabellini G., 2007, Bureaucrats or Politicians? Part I: A Single Policy Task, American Economic Review, 97(1), 169-179.

Amato M., Belloni E., Falbo P. and Gobbi L., 2020, Transforming Sovereign Debts into Perpetuities through a European Debt Agency, mimeo.

Andersen A.L., Hansen E.T., Johannesen N. and Sheridan A., 2020, Consumer Responses to the COVID-19 Crisis: Evidence from Bank Account Transaction Data, Covid Economics, 1(7), 88-114.

Atkeson A., 2020, How Deadly is COVID-19? Understanding the Difficulties with Estimation of its Fatality Rate, NBER Working Paper Series, n. 26965.

Baker S.R., Bloom N., Davis S.J., Kost K., Sammon M. and Viratyosin T., 2020, The Unprecedented Stock Market Reaction to Covid-19, Covid Economics, 1(1), 33-42.

Baldwin R., 2020a, The Supply Side Matters: Guns versus Butter, COVID- style, Vox, CEPR, March 22.

Baldwin R., 2020b, Keeping the Lights On: Economic Medicine for a Medical Shock, Vox, CEPR, March 13.

Baldwin R., 2020c, The COVID Concussion and Supply-Chain Contagion Waves, Vox, CEPR, April 1.

Baldwin R. and Di Mauro W., 2020, Mitigating the COVID Economic Crisis: Act Fast and Do Whatever it Takes, Vox eBook, CEPR Press, London.

Ball E., Howat J. and Stansbury A., 2016, Central Bank Independence Revised, mimeo.

Bank of Canada, 2020, Policy Update. Economics and Strategy, March.

Barro, R. T. and Gordon, D.B., 1983, Rules, Discretion and Reputation in a Model of Monetary Policy, Journal of Monetary Economics, 12, 101-121.

Barro R.J., Ursùa J.F. and Weng j., 2020, The Coronavirus and the Great Influenza Pandemic: Lessons from the “Spanish Flu” for the Coronavirus’s Potential Effects on Mortality and Economic Activity, NER Working Paper Series, n. 26866.

Barrot J.N., Grassi B. and Sauvagnat J., 2020, Sectoral Effects of Social Distancing, Covid Economics, 1(3), 33-102.

Bayoumi T., Dell’Ariccia G., Habermeier K., Mancini-Griffoli T. and Valencia F., 2014, Monetary Policy in the New Normal, IMF Staff Discussion Note, April, n. 3.

Becker B., Hege U. and Mella-Barral P., 2020, Corporate Debt Burdens Threaten Economic Recovery After COVID-19: Planning for Debt Restructuring Should Start Now, Vox, CEPR, March 21.

Bènassy-Quèrè A., Marimon R., Pisani-Ferry J., Reichlin L., Shoenmaker D., Weder di Mauro B., 2020a, Covid-19: European Needs a Catastrophe Relief Plan, Vox, CEPR, March 11.

Bènassy-Quèrè A., Boot A., Fatàs A., Fratzscher M., Fuest C., Giavazzi F., Marimon R., Martin P., Pisani-Ferry J., Reichlin L., Shoenmaker D., Teles P., Weder di Mauro B., 2020b, Covid-19: A Proposal for a Covid Credit Line, Vox, CEPR, March 21.

Bernanke B.S. 2016, What Tools Does the Fed have left? Part.3: Helicopter Money, Brooking Institutions.

Biancotti C., Borin A., Cingano F., Tommasino P. and Veronese G., 2020, The Case for a Coordinated COVID-19 Response: No Country is an Island, Vox, CEPR, March 18.

Binder C.C., 2018, Political Pressure on Central Banks, Haverford College, Department of Economics, mimeo.

Blanchard O. and Pisani-Ferry J., 2020, Monetisation: Do Not Panic, Vox, CEPR, April 10.

Blinder A.S., 2010, How Central Should the Central Bank Be?, Journal of Economic Literature, 48(1), 123-133.

Blinder A., Ehrmann M., de Haan J. and Jansen D., 2017, Necessity as the Mother of Invention: Monetary Policy After the Crisis, Economic Policy, 90.

Boeri T., Caiumi A. and Paccagnella M., 2020, Mitigating the Work-Safety Trade-Off, Covid Economics, 1(2), 60-66.

Borio C., Disyatat P. and Zabai A., 2016, Helicopter Money: The Illusion of a Free Lunch, Vox, CEPR, May 24.

Boot A., Carletti E., Kotz H.H., Krahnen J.P., Pelizzon L. and Subrahmanyam M., 2020, Coronavirus and Financial Stability 3.0: Try Equity, Vox, March 3.

Braun B., 2016, Speaking to the People? Money, Trust and Central Bank Legimitacy in the Age of Quantitative Easing, Review of International Political Economy, 23(6), 1064-1092.

Breitenfellner A. and Ramskogler P., 2020, How Deep Will It Fall? Comparing the Euro Area Recessions of 2020 and 2009, SUERF Policy Notes, n.150.

Bruegel, 2020, COVID-19 Fiscal Response: What Are the Options for the EU Council?, by Gregory Claeys and G.B. Wolff, Blog Post, March 26.

Brunnermeier M.K., and Sannikov Y., 2013, Redistributive Monetary Policy, Jackson Hole Symposium, September 1st, 2012, The Changing Policy Landscape, Federal Reserve Bank of Kansas City, pp. 331-384.

Buiter W.H., 2014a, The Simple Analytics of Helicopter Money: Why it Works – Always, Kiel Institute for the World Economy, Economics Discussion Paper, n.24.

Buiter W.H., 2014b, Central Banks: Powerful, Political and Unaccountable, CEPR Discussion Paper Series, n. 10223.

Calvo, G.A., 1978, On the Time Consistency of Optimal Policy in a Monetary Economy, Econometrica, 46(6), 1411-1428.

Carter T.J. and Mendes R., 2020, The Power of Helicopter Money Revised: A New Keynesian Perspective, Bank of Canada, Staff Discussion Paper Series, n. 1.

Chan K. and Marsh T., 2020, The Asset Markets and the Coronavirus Pandemic, Vox, CEPR, March 3.

Cecchetti S.G, 2013, Central Bank Independence – A Path Less Clear, Bank of International Settlement, October 14th, mimeo.

Cecchetti S. G., Lamfalussy A., Caruana J., Carney M. J., Crockett A., Papademos L., and Subbarao D., 2011, The Future of Central Banking Under Post-Crisis Mandates, BIS Paper, 55.

Cukierman A., 2008, Central Bank Independence and Monetary Policymaking Institutions: Past, Present and Future, European Journal of Political Economy, 24, 722-736.

Cukierman A., 2013, Monetary Policy and Institutions before, during and after the Global Financial Crisis, Journal of Financial Stability, 9(3). 373-384.

Curdia V. and Woodford M., 2011, The Central Bank Balance Sheet as an Instrument of Monetary Policy, Journal of Monetary Economics, 58(1), 54-79.

De Haan J. and Ejiffinger S., 2017, Central Bank Independence under Threat?, CEPR Policy Insight, n.87.

Del Rio-Chanona R.M., Mealy P., Pichler A., Lafond F. and Farmer J.D., 2020, Supply and Demand Shocks in the COVID-19 Pandemic: An Industry and Occupation Perspective, Covid Economics, 1(6), 65-103.

Danielsson J., Macrae R., Vayanos D. and Zingrand J.P., 2020, The Coronavirus Crisis is no 2008, Vox, CEPR, March 26.

De Vito A. and Gomez J.P., 2020, COVID-19: Preventing a Corporate Cash Crunch among Listed Firms, Vox, CEPR, March 29.

Deutsche Bundesbank, 2018, The Market for Federal Securities: Holder Structure and the Main Drivers of Yield Movements, Monthly Report, July, 15-38.

Draghi M., 2020, We Face a War Against Coronavirus and Must Mobilise Accordingly, Financial Times, March 25.

Eichenbaum M., Rebelo S.T. and Trabandt M., 2020, The Macroeconomics of Epidemics, NBER Working Paper Series, n. 226882.

Favaretto F., Masciandaro D., 2016, Doves, Hawks and Pigeons: Behavioural Monetary Policy and Interest Rate Inertia, Journal of Financial Stability, 27(4), 50-58.

Financial Times, 2020a, Coronavirus: The Moment for Helicopter Money, March 20.

Financial Times, 2020b, French Central Banker Floats Printing Money to Hand to Companies, April 8.

Fornaro L. and Wolf M., 2020, Coronavirus and Macroeconomic Policy, Vox, CEPR, March 10.

Friedman M., 1969, The Optimum Quantity of Money, in M. Friedman, The Optimum Quantity of Money and Other Essays, Chapter One, Adline Publishing Company, Chicago.

Fujita S., Moscarini G. and Postel-Vinay F., 2020, The Labour Market Policy Response to COVID-19 Must Save Aggregate Matching Capital, Vox, CEPR, March 30.

Gali J., 2020, Helicopter Money: The Time is Now, in Baldwin R. and Di Mauro W., (eds), Mitigating the COVID Economic Crisis: Act Fast and Do Whatever it Takes, Chapter 6, Vox eBook, CEPR Press, London.

Gambacorta R., Rosolia A. and Zanichelli F., 2020, All in It Together, but with Differences: The Finance of European Households through the Pandemic, Vox, CEPR, April 15.

Garicano L., 2020, The COVID-19 Bazooka for Jobs in Europe, in Baldwin R. and Di Mauro W., (eds), Mitigating the COVID Economic Crisis: Act Fast and Do Whatever it Takes, Chapter 14, Vox eBook, CEPR Press, London.

Giavazzi F. and Tabellini G., 2020, Covid Perpetual Eurobonds: Jointly Guaranteed and Supported by the ECB, Vox, CEPR, March 24.

Gnan, E., 2020, A “European Capitalization and Development Fund” (ECDF) to Facilitate Europe’s Post-Corona Recovery, SUERF Policy Notes, n.145, 1-9.

Goodhart C.A. and Lastra R., 2017, Populism and Central Bank Independence, CEPR Discussion Paper Series, n. 2017.

Goodhart C.A. and Pradan M., 2020, Future Imperfect after Coronavirus, Vox, CEPR, March, 27.

Gormsen N.J. and Koijen R., 2020, Coronavirus: Impact on Stock Prices and Growth Expectations, Vox, CEPR, March 23.

Grenville S., 2013, Helicopter Money, Vox, CEPR, February 24.

Gros D., 2020, A Corona Financial Solidarity Levy, Vox, CEPR, April 22.

Horn S., Reinhart C. and Trebesch C., 2020, Coping with Disasters: Lessons from Two Centuries of International Response, Vox, CEPR, March 20.

Igan D., Moussawi H., Tieman A., Zdzienicka A., Dell’Ariccia G. and Mauro P., 2019, The Long Shadow of the Global Financial Crisis: Public Interventions in the Financial Sector, IMF Working Paper Series, n.164.

Issing O., 2018, Central Bank Independence – Will It Survive?, in S. Eijffinger and D. Masciandaro (eds), Hawks and Doves: Deeds and Words, CEPR, London.

Jordà O., Singh S.R. and Taylor A.M., 2020, Onger-Run Economic Consequences of Pandemics, Covid Economics, 1(1), 33-42.

Koren M. and Peto R., 2020, Business Disruptions from Social Distancing, Covid Economics, 1(2), 13-31.

Kose M.A., Nagle P., Ohnsorge F. and Sugawara N., 2020, Global Waves of Debt: Causes and Consequences, World Bank.

Kydland, F.E. and Prescott, E.C., 1977, Rules Rather Than Discretion: The Inconsistency of Optimal Plans, Journal of Political Economy, 85(3), 473-491.

Landais C., Saez E. and Zucman G., 2020, A Progressive European Wealth Tax to Fund the European COVID Response, Vox, CEPR, April 3.

Leiva-Leon D., Pèrez-Quiròs G. and Rots E., 2020, Real Time Weakness of the Global Economy: A First Assessment of the Coronavirus Crisis, CEPR Discussion Paper Series, n. 14484.

Lybek T., Morris, J., 2004, Central Bank Governance: A Survey of Boards and Management, IMF Working Paper Series, n.226.

Lohmann, S., 1992, Optimal Commitment in Monetary Policy: Credibility versus Flexibility, American Economic Review, 82, 273-286.

Mackowiak B. and Wiederholt M., 2018, Lack of Preparation for Rare Events, Journal of Monetary Economics, 100, 35-47.

Mankiw N.G., 2019, A Skeptic’s Guide to Modern Monetary Policy, AEA Meeting, January, mimeo.

Masciandaro D., 2020, Covid-19 Helicopter Money: Economics and Politics, Covid Economics, 1(7), 23-45.

Masciandaro D. and Passarelli F., 2019, Populism, Political Pressure and Central Bank (In)dependence, Open Economies Review, https://doi.org/10.1007/s11079-019-09550-w.

Masciandaro D. and Romelli D., 2015, Ups and Downs of Central Bank Independence from the Great Inflation to the Great Recession: Theory, Institutions and Empirics, Financial History Review, 22(3), 259-289.

Molnar K., Santoro S., 2014, Optimal Monetary Policy when Agents are Learning, European Economic Review, 66, 39-62.

Morelli M., 2020, The Paradox of Endogenous Nationalism and the Role of Quantitative Easing, SUERF Policy Note, 140, March.

Motta M. and Peitz M., 2020, EU State Aid Policies in the time of COVID-19, Vox, CEPR, April 18.

Muellbauer J., 2014, Combatting Eurozone Deflation: QE for the People, Vox, CEPR, December 23.

Muellbauer J., 2020, The Coronavirus Pandemic and US Consumption, Vox, CEPR, April 11.

Muller H., 2020, COVID-19: Governments Must Avoid Creating Additional Uncertainty, Vox, CEPR, March 14.

Nier E.W., 2009, Financial Stability Frameworks and the Role of Central Banks: Lessons from the Crisis, IMF Working Paper Series, n.70.

Perotti E., 2020, The Coronavirus Shock to Financial Stability, Vox, CEPR, March 27.

Quah D., 2020, Singapore’s Policy Response to COVID-19, 2020, in Baldwin R. and Di Mauro W., (eds), Mitigating the COVID Economic Crisis: Act Fast and Do Whatever it Takes, Chapter 11, Vox eBook, CEPR Press, London.

Ramelli S. and Wagner A., 2020, What the Stock Market Tell Us about the Consequences of COVID-19, Vox, CEPR, March 12.

Rajan R., 2017, Central Banks’ Year of Reckoning, Project Syndicate, December 21.

Reichlin L., Turner A. and Woodford M., 2013, Helicopter Money as a Policy Option, Vox, CEPR, September 23.

Reichlin L. and Shoenmaker D., 2020, Fault Lines in Fiscal-Monetary Policy Coordination, Vox, CEPR, March 26.

Reis R., 2013, Central Bank Design, Journal of Economic Perspectives, 27(4). 17-44.

Rodrik D., 2018, In Defence of Economic Populism, Project Syndicate, January, 8.

Rogoff, K., 1985, The Optimal Degree of Commitment to an Intermediate Monetary Target, Quarterly Journal of Economics, 100(4),1169-1189.

Rogoff K.S., 2019, How Central Bank Independence Dies, Project Syndicate, May 31st, mimeo.

Roth F., Gros D. and Nowak-Lehmann D.F., 2014, “Crisis and Citizens” Trust in the European Central Bank – Panel Data Evidence for the Euro Area: 1999-2012”, Journal of European Integration, 36(3), 303-320.

Sargent, T.J and Wallace, N., 1981, Some Unpleasant Monetarist Arithmetic, Quarterly Review, Federal Reserve Bank of Minneapolis, Fall, 1-17.

Schoenfeld J., 2020, The Invisible Risk: Pandemics and the Financial Markets, Covid Economics, 1(6), 119-136.

Schnellenbach J. and Schubert C., 2015, Behavioral Political Economy: A Survey, European Journal of Political Economy, 40, 395-417.

Sims C.A., 2016, Fiscal Policy, Monetary Policy and Central Bank Independence, Economic Policy Symposium Proceedings, Jackson Hole, Federal Reserve Bank of Kansas City.

Stiglitz J.E., 2013, A Revolution in Monetary Policy: Lessons in the Wake of the Global Financial Crisis, The 15th C.D. Deshmukh Memorial Lecture, Mumbai, January 3rd.

Taylor J.B., 2013, The Effectiveness of Central Bank Independence vs Policy Rules, Business Economics, 48(3), 155-162.

Turner A., 2015, The Case for Monetary Finance – An Essentially Political Issue, 16th Jacques Polak Annual Research Conference, November, mimeo.

Ugolini S., 2020, The Normality of Extraordinary Monetary Reactions to Huge Real Shocks, Vox, CEPR, April 4.

Van Rooij M. and De Haan J., 2016, Will Helicopter Money be Spent? New Evidence, DNB Working Paper Series, n.538.

Waltenberger I., 2020, The Range of Different Opinions and Moods in Germany on Collective “Corona Bonds”, SUERF Policy Notes, n. 155, 1-7.

Yashiv E., 2020, Breaking the Taboo: The Political Economy of COVID-Motivated Helicopter Drops, Vox, CEPR, March 26.

Department of Economics and Baffi Carefin Centre, Bocconi University, and Member of the SUERF Council of Management.