This note provides an overview of the state of play regarding the development of central bank digital currencies across the world. It describes the leading central banks current initiatives and outlines the main aims and design features of their CBDC projects.

The rapid development in technology and digitalization has potentially far reaching effects on payments and the concept of “money”. Money has come a long way since its origins, from coins and paper representation to electronic bank accounts.

Today, the development of cross-border stablecoins like Facebook Libra or central bank digital currency has introduced a new chapter in the history of money and payments, which comes with a number of challenges and opportunities in the legal and regulatory spheres as well as with regard to financial stability, monetary policy and financial market operations (post-trading processes).2 The announcement of Libra by Facebook has been a “wake-up call” for central banks worldwide, highlighting that there is a need for digital currencies that satisfy consumers’ desire for sending money (across borders) as easily as text messages.3

This paper discusses how different central banks worldwide approach and view the topic of central bank digital currency (CBDC).

In doing so, it is necessary to clearly distinguish between distributed ledger technology (DLT) and blockchain. DLT is a technological approach to record and share data across different and decentralized data stores (ledgers). It enables the storage and sharing of transactions and their synchronization through the distributed network with different participants. A blockchain is a special type of DLT with a specific type of data structure, cryptographic techniques and algorithmic methods to store and share data across the distributed network in form of data blocks.4 All cryptocurrencies or their transactions are use cases of DLT or blockchain technology.

Before we describe the various central banks CBDC activities individually in more detail, the following table compares some key features of CBDC of eight central banks, which currently are in the lead in the development of CBDC.

| People’s Bank of China | European Central Bank | Bank of Canada | Monetary Authority of Singapore | Sveriges Riksbank | Hong Kong Monetary Authority | Bank of Thailand | Central Bank of The Bahamas | Bank of England | |

| Money supply |

PBoC controls issuance and redemption |

ECB controls issuance and redemption | BoC controls issuance and redemption | MAS controls issuance and redemption | Issuance directly by Riksbank | HKMA controls issuance and redemption | BOT controls issuance and redemption | Central bank controls issuance and redemption | Central bank controls issuance and redemption |

| Value | 1:1 to CNY | 1:1 to EUR | 1:1 to CAD | 1:1 to SGD | 1:1 to SEK | 1:1 to HKD

|

1:1 to BAHT | 1:1 to BSD / USD | 1:1 to pound sterling |

| Reserve | Institutions maintain 100% reserve ratio | Institutions maintain 100% reserve ratio | Institutions maintain 100% reserve ratio | Institutions maintain 100% reserve ratio | Institutions maintain 100% reserve ratio | Institutions maintain 100% reserve ratio | Institutions maintain 100% reserve ratio | – | Institutions maintain 100% reserve ratio |

| Sector | Retail & financial sectors | Retail & financial sectors | Financial sector | Financial sector & other industries in exploring phase | Retail sector | Financial sector | Financial sector | Retail and financial sector | Household and business sector |

| Technical solution | DLT solution under consideration | DLT (R3 Corda) | DLT (R3 Corda) | DLT (R3 Corda) | DLT solution under consideration | DLT (R3 Corda) | DLT (R3 Corda) | DLT solution under consideration | DLT under consideration |

The People’s Bank of China (PBoC) is expected to launch its central bank digital currency named Digital Currency Electronic Payment (DCEP) in Q1 2020.5

The project of creating a CBDC was started in 2014 and has been accelerated more recently as Facebook announced its project of issuing a currency – Libra –, which would be backed by a basket of mainly U.S. dollar-denominated reserves.6 Rumors that the DCEP would be launched as early as November 11, 2019, a popular shopping holiday in China, turned out not to be true, however.7

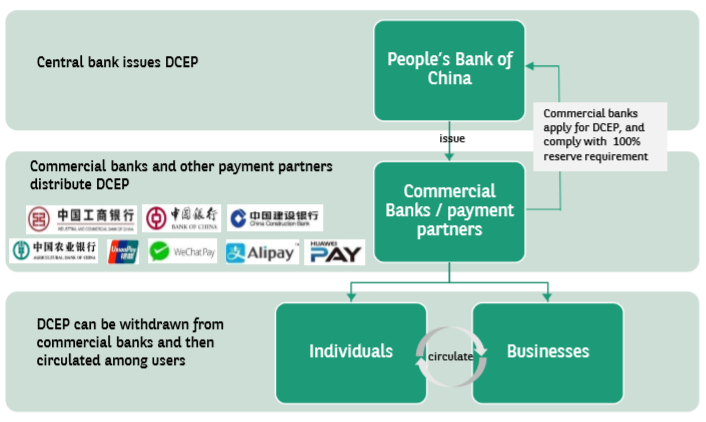

The DCEP will be issued by the PBoC as an encrypted digital legal tender pegged in a 1:1 ratio to Chinese yuan (CNH and CNY)-denominated fiat reserves (M0 – cash in circulation). For their holdings of digital currency, financial institutions need to maintain a 100% reserve ratio. The DCEP will be based on a two-tier system for issuance and redemptions.8 The first layer contains the issuance and redemption of digital currency via commercial banks (China Construction Bank, the Industrial and Commercial Bank of China, Bank of China, Agricultural Bank of China) and payment service providers (WeChat, Alipay and Tencent). In the second layer, commercial banks and payment service providers are responsible for releasing and sharing the digital currency to the public, i.e. consumers and businesses, which put the currency in circulation. The PBoC intends to substitute paper money by its digital currency without changing its – also two-tier – monetary issuance and circulation system.9

Technical Architecture

Source: BNP Paribas: „The NEW Era of Currencies of China: Digital Currency Electronic Payment (DCEP), mimeo.

The following areas of application of the digital currency are in consideration10:

According to BNP Paribas Hong Kong, the reasons for launching DCEP comprise, inter alia11:

In order to comply with anti-money laundering and anonymity requirements, the PBoC plans to install limits for wallet handling at different levels. If users register with a mobile phone number, the wallet limit is at its lowest level to enable small daily transactions. The limit can be raised by disclosing more personal information. Furthermore, tax fraud will become more difficult in digital transactions which are traced by the government. PBoC claims to aim for a state of “classified supervision” in which illegal activities are prevented and anonymity is respected (according to the PBoC).13

On 16.04.2020 a test-interface of the DC/EP wallet by the Agricultural Bank of China (ABC) was published, which has started the testing phase. It is reported, that the test is carried out in four Chinese cities (Xiong’An, Suzhou, Chengdu and Shenzen).14

Test-Interface:

Source: https://www.ledgerinsights.com/china-digital-currency-wallet-dcep-cbdc/

The ECB should be “ahead of the curve” on digital currency, ECB President Christine Lagarde said at her first press conference in office. Given developments in stablecoins projects, there was clearly a demand the ECB had to respond to, she said.15

Already before that, Lagarde had pointed out that in the case of new technologies and digital currencies as well, it was necessary to be alert to possible risk factors regarding financial stability, privacy or illegal operations associated with those technological developments. Appropriate regulation should ensure that such technology is used for the public good. But it is also important to recognize the advantages of innovation and allow them to develop.16

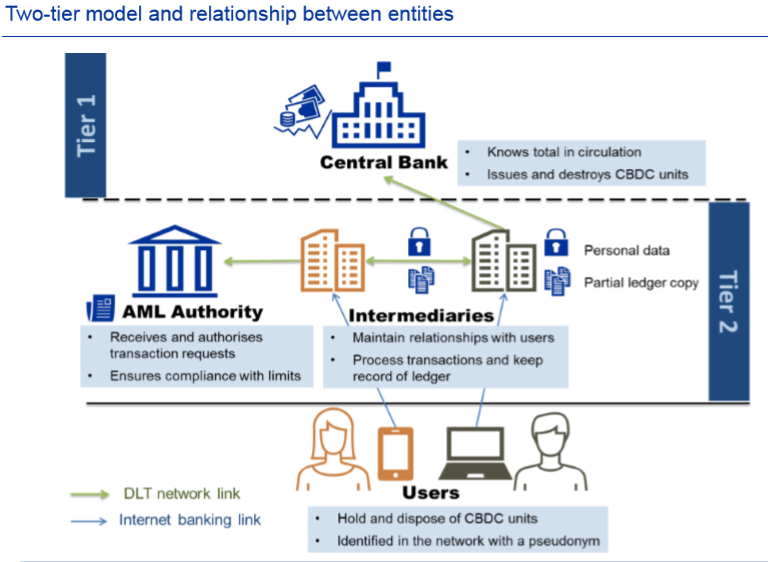

In December 2019, the European System of Central Banks (ESCB) published the proof of concept (POC) for a central bank digital currency based on DLT with the anonymity option, which is developed by the ESCB’s EUROchain research network with the support of Accenture and R3 Corda. The proof of concept of the ECB shows the possibility to develop a payment system with central bank digital currency which enables simple payments and also retains privacy for lower-value transactions. In case of high-value transactions, consumers will need to be subject to AML/CFT (anti-money laundering/countering the financing of terrorism) checks. The architecture is based on a two-tier system: The central bank releases digital currency to intermediaries that have access to a central bank account for reserve balances held at the central bank to distribute digital currency to the retail market. The reserve balance of the intermediaries will be debited by the central bank for the creation of new digital currency.17

In this scenario, the central bank is the only organization to issue digital currency (a 1:1 conversion to fiat reserves) and redeem it. Intermediaries, on the other hand, perform the transactions for consumers and offer custodial services. For AML/CFT checks, the AML authority checks the identities of users participating in high-value transactions and blocks processing for disqualified users.

Every user needs an intermediary who provides pseudonyms to their customers which serve as network addresses for digital currency payments. As mentioned before, AML/CFT checks are only applied for high-value transactions. In order to prevent the AML authority from gaining access to data on low-value transactions, the architecture allows for “anonymity vouchers”. Regardless of the account balances, the AML authority provides to its users a limited number of these vouchers each month. In a low-value transaction, the intermediary of the payer can remove vouchers from the payer’s reserves and attach them to the transaction to keep it anonymous (one voucher per digital currency unit). The transaction details will not be displayed to the AML authority and can therefore be validated without checks. The focus for the use of this DLT solution are retail payments and the settlement of securities in the financial market.18

Source: https://www.ecb.europa.eu/paym/intro/publications/pdf/ecb.mipinfocus191217.en.pdf

The Bank of Canada (BoC) and the Monetary Authority of Singapore (MAS) have started to research cross-border and cross-currency settlement systems under their “Jasper” and “Ubin” projects.).19

The BoC started its blockchain project “Jasper” in 2016 to explore digital currencies and blockchain for institutional use. The project is a cooperation between the BoC and R3 Corda, six private Canadian banks and Payments Canada.

A major objective of the project is the investigation of the use of DLT for the settlement of large-value interbank transactions, which sum up to billions of dollars per day.20

The project includes a simulation of a fund transfer using DLT. Participants transfer cash collateral to a specific account at the BoC, which in turn distributes the appropriate amount of digital currency, which is called “CAD-coin”, to the account of the participants. The participants can then send CAD-coin to each other in real time or back to the BoC in case of redemption and conversion to fiat money (Canadian dollars). In comparison to central bank money in settlement accounts, participants keep their CAD-coin in wallets within the DLT. Therefore, the updating of settlement accounts in case of transactions does not take place immediately.

The coin is equivalent to a deposit receipt that enables the holder to transfer their claim on their reserves at the central bank. All participants have to maintain a 100% reserve ratio.

Another focus of the project is to explore the advantages of integrating “cash on ledger” with other assets like foreign exchange and securities for delivery-versus-payment settlement.

As Jasper is aimed at institutional clients, securities clearing and settlement are the main use cases for this project. (Trading has been thought to be out of scope.) Clearing is not complicated, given that DLT is most useful for updating accounts and keeping record of who is the owner of an asset. Settlement, by contrast, is much more complex because the question of how to move the money must be answered.21 With CAD-coin, a value can be sent on the same ledger, which reflects the transactions on account balances. Therefore, the digital currency can achieve clearing and settlement on the same ledger.22

A similar approach was taken by the Monetary Authority of Singapore (MAS).

Project Ubin is a collaborative project of the Monetary Authority of Singapore (MAS), R3 Corda, the country’s financial regulatory authority, a group of Singaporean banks and Deloitte. Its objective is to explore the use and benefits of DLT and blockchain for the clearing and settlement of payments and securities. The aim is to tokenize the Singapore dollar (SGD) on a DLT “SGD-on-ledger” and to evaluate the benefits to Singapore’s financial ecosystem. In comparison to the currently used real-time settlement funds transfer system, MEPS+, which uses SWIFT and intraday automated collateralization, SGD-on-ledger is a specific-use coupon that is issued on a 1:1 basis in exchange for Singapore dollars. These coupons are only usable in a certain domain, e.g. for the settlement of interbank debt, and they have no value beyond this use case. Participants can exchange coupons back into fiat money.23

The SGD-on-ledger has three key properties:24

SGD-on-ledger enables banks and other financial institutions to execute the exchange and final settlement of tokenized digital currency and securities simultaneously, which increases efficiency in the operational settlement process across different blockchain platforms.25

Ubin is currently in its fifth phase, which has the objective of enabling “broad ecosystem collaboration” across different sectors. To this end, the MAS investigates and tests the possibility to integrate its blockchain-based prototype network with commercial blockchain applications of more than 50 companies in the financial and nonfinancial sector to examine the potential advantages and use cases of the network.26

As mentioned before, the MAS and the BoC have successfully executed cross-border and cross-currency payments and settlements with central bank digital currencies. This initiative provides global communities in the financial industry with a framework and design for deeper research on CBDC and DLT.27

The circulation and use of physical banknotes and coins has been decreasing significantly in Sweden. The Riksbank is one of the leading central banks worldwide investigating technological developments in electronic money and payment systems. It is also exploring the need of making the Swedish crown available also in electronic form, the so-called “e-krona”. The introduction of an “e-krona” has not been decided yet, as its consequences still need to be thoroughly investigated.28

Over the past decades, cash payments have been continuously declining in Sweden. In the household and retail sectors, the use of cash fell from 39% in 2010 to 13% in 2018. In fact, the Riksbank does not rule out that Sweden could become a cashless society in the foreseeable future.29

However digital payment has brought up new challenges to the central bank, as all kinds of payments accessible to the general public are issued and controlled by private agents. Therefore, the Swedish monetary system could be at risk of losing trust and competitiveness, if it does not provide public payment services as an alternative to private market solutions. The “e-krona” could provide a neutral and competitive infrastructure as a complement to cash.30

The e-krona would ensure that the general public still has access to central bank money and that payments function smoothly even if private payment systems fail, e.g. in crisis situations. Furthermore, it could foster competition, innovation and at the same time reduce fees charged to the general public.31

The Riksbank has presented two possible models for the e-krona:32

From a legal perspective, the account-based version of the e-krona is equivalent to deposits, and the value-based version can be compared to e-money.

Both models are based on a register so that it is possible to record transactions and monitor the ownership of the e-krona.

The idea of the e-krona is to make it available for small payments between private companies, consumers and authorities. It represents a direct claim on the Riksbank, with a 1:1 peg to the Swedish crown, which can be accessed by the general public, financial institutions and companies in real time, 24 hours a day and 365 days a year. The e-krona does not incur interest but contains a built-in function to enable interest in the future. The e-krona would be issued directly by the Riksbank and this step is similar to a claim on the Risksbank in the same way as cash.33

Physical banknotes and coins would continue to exist as a kind of backstop in case of system failure and to prevent money laundering. The launch of the Swedish digital currency is not expected before 2021.34

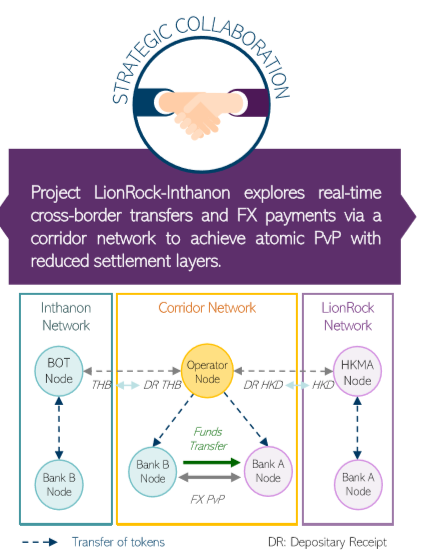

The Hong Kong Monetary Authority (HKMA) and the Bank of Thailand (BOT) are planning to launch a two-tier digital token for cross-border transfers of funds in real time. The use of blockchain-backed token technology should help to improve the settlement of currencies between the two economies, providing banks with more competitive exchange rates for the Hong Kong dollar and the Thai baht.35

Project LionRock was launched by the HKMA with the three note-issuing banks located in Hong Kong, the Hong Kong Interbank Clearing Ltd. and the R3 consortium to explore the implications and advantages of introducing a CBDC on a DLT infrastructure for interbank payments and corporate payments.

It also comprises a general evaluation of CBDC as the basis of a payment system and of the delivery-versus-payment function for securities settlement.36

Given that the prospect of issuing a CBDC for retail payments in Hong Kong is limited – as there are already many retail payment systems like credit cards, debit cards, FPS (fast payment system) around – the focus of LionRock is on wholesale payment and settlement.37

In other words, unlike, for instance, PBoC’s DCEP, which focuses on the replacement of physical money, LionRock aims at an improvement of cross-border transactions and payments between banks and companies by reducing the involvement of various intermediaries.38

The objective of BOT’s project “Inthanon” is the development of a CBDC prototype for interbank and cross-border settlements.39 The project was launched in collaboration with the R3 consortium and eight participating bank and consists of 3 phases. In the second phase of the project two areas are covered. The first one is the realization of a delivery-versus-payment (DVP) mechanism for bond trading to strengthen the post-trading operation workflows like coupon payments. The second one involves the integration of regulatory compliance and data reconciliation into the payment processes on a DLT platform.40

The digital currency is issued by the BOT in a ratio of 1:1 to the baht. Participants need to convert their balances into cash tokens on the DLT (100% reserve ratio). The creation of tokens is entirely demand driven, meaning that tokens are created when participating banks instruct a fund transfer. To exchange their tokens (“detokenization”), participants have to send the digital currency to the BOT, which transfers the appropriate amount from the collateral account to the requesting participant’s regular account.41

The Central Bank of The Bahamas (CBB) is planning to launch its central bank digital currency – project “Sand Dollar” – in 2020. The project’s pilot phase started in December 2019 as a continuation of the Bahamian Payments System Modernization Initiative (PSMI), the goals of which are:42

The aim of project “Sand Dollar” is the creation of a CBDC to be used in the domestic retail and wholesale sector, including payment settlement at the interbank level and clearing house transactions. The main stakeholders are the central bank, the general public, financial intermediaries, the public sector (national insurance board) and other general businesses. The central bank’s role includes the issuance of the digital currency, monitoring of holdings and sponsoring a centralized KYC (know your customer)/identity infrastructure. Even though the central bank will not provide front-end customer services and applications, it will maintain the ledger for all holdings of each user of the digital currency. The central bank will also maintain a KYC register for identification and profile data, which allows individuals to provide data for the register, if they do not maintain such information within banks or licensed intermediaries. Intermediaries can provide mobile payment wallets or can be sponsors of credit unions, money transfer businesses and payment services providers. The system will also offer an “offline functionality” in case of connectivity problems between the islands. Users will be able to perform a “pre-set” dollar transaction, when the connection to the “Sand Dollar” ledger is interrupted.43

The CBDC is not designed as a substitute to traditional banking deposits but should facilitate higher volumes of transactions, as the individual payment wallets are linked to deposit accounts of domestic financial institutions. In the retail sector, the general public can have payment wallets without having a bank account, however the functions are limited. Any kind of business use, however, needs to be linked to a bank account. Like physical cash, the digital currency would be a liability of the Central Bank of the Bahamas; it would be pegged to reserves in Bahamian dollars (BSD) at a 1:1 ratio. As the BSD is pegged 1:1 to the USD, this ratio is also valid for the CBDC. However, the anonymity feature of cash is not implemented, although the “Sand Dollar” platform gives strict attention to confidentiality and data protection.44

Although the Bahamas attracts fintech companies specializing in blockchain technology, it has been proposed that the CBDC will be based on a blockchain. One point is certainly necessary, broad range of education programs for the public and stakeholders will have to be organized to clarify the potential impact of the introduction of a CBDC on the economy and society. Furthermore, the project will seek to involve private banks and payment services to establish interoperability standards.45

Momentary, the BOE offers electronic accounts to banks and financial institutions and the public can get central bank money form of banknotes. In case of releasing a CBDC to the public, it could have a deep implication on the monetary policy and stability. At the moment, the BoE is not planning to create a CBDC, but has started research to be able to understand the potential implications of a central bank issuing a digital currency.46

However, speaking at the Economic Policy Symposium in 2019, Governor Mark Carney said that a central bank digital currency could replace the dominance of the U.S. dollar as the global hedge currency. The U.S. dollar had been a dominant player in the world order, but increasing globalization and trade disputes had a continuous and stronger impact on national economies. One possible replacement to the U.S. dollar could be a new “Synthetic Hegemonic Currency (SHC)” via a network of central bank digital currencies, Carney suggested, which could curtail the domineering role of the U.S. dollar in international trade.47

According to the recent paper by the BOE, if a CBDC is created in the UK, it will be denominated and backed 1:1 to pounds sterling. Furthermore, the BOE monitored a declining use of physical banknotes to 28% of total payments and increasing use of privately issued money.48

For the BOE the question occurs if it should provide the public with electronic money like CBDC, as the bank is the issuer of the safest and most trusted form of money in the economy.49

A CBDC can provide different opportunities to the BOE for maintaining monetary and financial stability:50

Technical Architecture

The architecture is momentarily a design and provides a basis for further exploration of new opportunities and challenges. This platform model would create a fast and highly secure technology platform going alongside the Real Time Gross Settlement (RTGS) service to provide minimum necessary functionality for CBDC payments. Retail sector “Payment Interface Providers” could connect to this platform to provide CBDC payment services to the public. The BOE is not intended to build their platform on a DLT and there is no reason why not using a conventional technology like centralized technology. But DLT should be investigated regarding new potential innovations.51

The following central banks are exploring the issue of CBDC but have not yet initiated concrete development steps.

U.S. Federal Reserve System (Fed)

The U.S. central bank investigates the digital dollar regarding advantages and risks without actively developing one itself. In November 2019, Fed Chairman Jerome Powell noted that a CBDC may offer benefits to other nations, but not necessarily to the U.S.A. For instance, some countries are witnessing a rapid decline in physical banknotes and coins, while the demand for cash in the U.S. has remained constant. The Fed had not yet identified “potential material benefits” of a CBDC, Powell said.52 Fed has not published more information on their plan regarding CBDC.

Banco Central de Venezuela

The government of Venezuela says it is using cryptocurrencies as an additional payment method at the national and international level. Moreover, the finance ministry and the central bank of Venezuela are investigating whether cryptocurrencies can be held as reserves. These efforts followed a request by government-run Petroleos de Venezuela SA, which intends to send Bitcoin and Ether to the central bank and have the monetary authority pay the oil company’s suppliers with the tokens. As U.S. sanctions have largely isolated Venezuela from the international financial system, the country continues its efforts to use digital currencies to meet its payments. Plans to launch the world’s first sovereign crypto have failed.53

Bank of Korea

The Bank of Korea’s Financial Affairs Division has been following trends and developments in CBDC but are of the opinion that there is no demand for central bank digital currencies in developed countries like Korea. The reason for this is that compared to other countries’ less developed payments technologies, the Korean financial and payment infrastructure (AT credit card) is sophisticated enough to meet the future challenge and requirements in this area, it is argued.54

Bank of Japan

Given the fast development in the financial market driven by new technologies, the Bank of Japan is seeking to identify legal challenges (private law, Bank of Japan Act, competition law, AML/CFT regulations and criminal law) with regard to the issuance of CBDC. Personal data protection is also an issue which has to be addressed. According to the Bank of Japan, the legal framework under which it operates would have to be adapted if it were to issue CBDC, because at the moment it only covers the issuance of banknotes and coins. However, the Bank of Japan is currently not planning to issue its own CBDC.55

Banque de France

There have been reports that the Banque de France is planning to test central bank-issued digital currency in 2020 as an answer to payment solutions provided by private companies like Facebook Libra. A call for projects is expected to be launched in the first quarter.56 In March 2020 Banque de France is calling for applications with focus on experiments with the use of digital Euro. It intends to identify potential use cases for the CBDC in the following fields:57

Banque the France considers the call for application as the initial phase of a more comprehensive program of experimentation on CBDC.

The application phase will last to 15 May 2020 and Banque de France will chose max. 10 applications (either individual or a group). According to the selection criteria, there is no specific technology to be used, but it should be innovative.58

Retailers and tech companies provide more and more digital payment systems like Apple pay, which can be seamlessly integrated into the traditional banking systems. In contrast to the early times, when payment systems were offered by traditional banks only, nowadays digital payment systems can also be offered by non-banks like tech-companies (Apple or AliPay) and startups (N26, Revolut, M-Pesa, etc…). Traditional banks and financial institutions are becoming under pressure to lose their business of providing payment services, as new fintech companies also offer other different services supported by technological innovation and thus providing an ecosystem with their own digital payment possibilities like e-wallets for quick and easy payments. Besides the occurrence of SARS-CoV-2 virus, which causes the Covid-19 disease worldwide has strengthen the request for cashless payments in the population and retailers, although it is not proven that physical cash money transmits SARS-CoV-2.

For central banks there is a challenge to meet the trend of cashless payments. Many countries intend to move to digital payments and the number of central banks considering an introduction of a CBDC is increasing. CBDC invokes the question about the role of central bank money in the economy, access to central bank liabilities and structure of financial intermediaries. For the introduction of CBDC it is important to consider the following aspects. A CBDC must be safe and accessible like cash for the population and regard the importance of anonymity and data protection. Central banks must also ensure the fulfillment of AML and CFT requirements and policy requirements of the public. Therefore, the introduction of CBDC need to be analyzed for each country and the associated trade-offs have to be identified.

DLT – Distributed ledger technology

PBoC – People’s Bank of China

ECB – European Central Bank

BoC – Bank of Canada

MAS – Monetary Authority of Singapore

HKMA – Hong Kong Monetary Authority

CBDC – Central bank digital currency

DvP – Delivery versus payment

SGD – Singapore dollar

HKD – Hong Kong dollar

USD – U.S. dollar

BHT – Thailand baht

CAD – Canadian dollar

BSD – Bahamian dollar

KYC – Know your customer

AML – Anti-money laundering

CFT – Countering the financing of terrorism

RTGS – Real Time Gross Settlement

Bank of England: Central bank digital currencies

https://www.bankofengland.co.uk/research/digital-currencies

last modified March 12, 2020

Bank of England: Central Bank Digital Currency: opportunities, challenges and design

https://www.bankofengland.co.uk/paper/2020/central-bank-digital-currency-opportunities-challenges-and-design-discussion-paper

last modified March 12, 2020

Bank of Japan: Summary of the Report of the Study Group on Legal Issues regarding Central Bank Digital Currency

http://www.boj.or.jp/en/research/wps_rev/lab/lab19e03.htm/

last modified December 24, 2019

Bank of Thailand: INTHANON Phase I

https://www.bot.or.th/Thai/PaymentSystems/Documents/Inthanon_Phase1_Report.pdf

Banque de France: CENTRAL BANK DIGITAL CURRENCY EXPERIMENTS WITH THE BANQUE DE FRANCE: CALL FOR APPLICATIONS

https://www.banque-france.fr/sites/default/files/media/2020/03/30/fact_sheet_-_central_bank_digital_currency_30_march_2020.pdf

last modified March 30, 2020

BeingCrypto: Swedish Central Bank Outlines 6-Step Digital Currency Plan

https://beincrypto.com/sweden-central-bank-outlines-6-step-digital-currency-plan/

last modified November 22, 2019

Binance Research: First Look: China’s Central Bank Digital Currency

https://research.binance.com/analysis/china-cbdc

last modified August 28, 2019

BIS: The Bahamian Payment System Modernisation: Advancing Financial Inclusion Initiatives

https://www.bis.org/review/r190321a.pdf

last modified March 18, 2019

Bloomberg: Maduro Says Venezuela to Activate Crypto Payment Method ‘Soon’

https://www.bloomberg.com/news/articles/2019-09-30/maduro-says-venezuela-to-activate-crypto-payment-method-soon

last modified September 30, 2019

BNP Paribas: „The NEW Era of Currencies of China: Digital Currency Electronic Payment (DCEP), mimeo

CCN: China Clarifies Digital Currency Launch Rumors but Barely Kills the Hype

https://www.ccn.com/china-digital-currency-rumor-launch/

last modified November 13, 2019

CCN: Hong Kong, Thailand Central Banks Partner up on Digital Currency Initiative

https://www.ccn.com/thursday-hong-kong-thailand-central-banks-partner-digital-currency/

last modified May 16, 2019

Central Bank of the Bahamas: PROJECT SAND DOLLAR, A Bahamas Payments System Modernisation Initiative

https://www.centralbankbahamas.com/download/022598600.pdf

last modified December 24, 2019

Coindesk: Fed Reserve Evaluating Digital Dollar But Benefits Still Unclear, Says Chairman

https://www.coindesk.com/fed-reserve-evaluating-digital-dollar-but-benefits-still-unclear-says-chairman

last modified November 20, 2019

Coindesk: UK Central Bank Chief Sees Digital Currency Displacing US Dollar as Global Reserve

https://www.coindesk.com/bank-of-england-governor-calls-for-digital-currency-replacement-to-the-dollar

last modified August 23, 2019

Cointelegraph: IMF Chief Christine Lagarde: We Should Be Open to Cryptocurrencies

https://cointelegraph.com/news/imf-chief-christine-lagarde-encourages-open-cryptocurrency-regulation

last modified September 4, 2019

Crowdfund Insider: Bank of Korea Official: No Need for a Central Bank Digital Currency in Developed World

https://www.crowdfundinsider.com/2019/10/153590-bank-of-korea-official-no-need-for-a-central-bank-digital-currency-in-developed-world/

last modified October 31, 2019

Crypto World Journal: Blockchain Technology to Be Used by Hong Kong and Thailand to Deploy Tokens for Cross-Border Trade

https://www.cryptoworldjournal.com/blockchain-technology-to-be-used-by-hong-kong-and-thailand-to-deploy-tokens-for-cross-border-trade/

last modified December 12, 2019

European Central Bank: Exploring anonymity in central bank digital currencies

https://www.ecb.europa.eu/paym/intro/publications/pdf/ecb.mipinfocus191217.en.pdf

last modified December 2019

Finextra: ECB Exec: Libra has been a “wake up call” for central bankers

https://www.finextra.com/newsarticle/34424/ecb-exec-libra-has-been-a-wake-up-call-for-central-bankers

last modified September 18, 2019

Fortune: Why China’s Digital Currency Is a ‘Wake-Up Call’ for the U.S.

https://fortune.com/2019/11/01/china-digital-currency-libra-wakeup-call-us/

last modified November 1, 2019

Hong Kong Monetary Authority: Fintech collaboration between Hong Kong Monetary Authority and Bank of Thailand https://www.info.gov.hk/gia/general/201905/14/P2019051400361.htm

last modified May 14, 2019

Monetary Authority of Singapore: Project Ubin: Central Bank Digital Money using Distributed Ledger Technology

https://www.mas.gov.sg/schemes-and-initiatives/Project-Ubin

last modified November 20, 2019

Monetary Authority of Singapore: Project Ubin: SGD on Distributed Ledger

https://www.mas.gov.sg/-/media/MAS/ProjectUbin/Project-Ubin–SGD-on-Distributed-Ledger.pdf

last modified 2017

OECD: China’s Belt and Road Initiative in the Global Trade, Investment and Finance Landscape

https://www.oecd.org/finance/Chinas-Belt-and-Road-Initiative-in-the-global-trade-investment-and-finance-landscape.pdf

last modified 2018

1DECP: DCEP: China’s own digital currency

http://www.1dcep.org/?p=363&lang=en

last modified October 31, 2019

Reuters: ECB should be ’ahead of the curve’ on digital currency: Lagarde

https://www.reuters.com/article/us-ecb-policy-cryptocurrency/ecb-should-be-ahead-of-the-curve-on-digital-currency-lagarde-idUSKBN1YG1SD

last modified December 12, 2019

R3: CAD-coin versus Fedcoin

https://www.r3.com/wp-content/uploads/2017/06/cadcoin-versus-fedcoin_R3.pdf

last modified November 15, 2016

SCMP: Hong Kong, Thailand to roll out two-tier tokens in digital currency prototype to speed up cross-border trade settlement

https://www.scmp.com/business/banking-finance/article/3040582/hong-kong-thailand-roll-out-two-tier-tokens-digital

last modified December 4, 2019

Sveriges Riksbank: E-krona

https://www.riksbank.se/en-gb/payments–cash/e-krona/

last modified December 13, 2019

Sveriges Riksbank: E-krona project, report 2

https://www.riksbank.se/en-gb/payments–cash/e-krona/e-krona-reports/e-krona-project-report-2/

last modified October 2018

The Block: Report: Bank of France to test digital currency in 2020

https://www.theblockcrypto.com/linked/49253/report-bank-of-france-to-test-digital-currency-in-2020

last modified December 4, 2019

The Cryptonomist: China: the launch of the digital currency in 2020

https://en.cryptonomist.ch/2019/11/11/china-launch-of-digital-currency-in-2020/

last modified November 11, 2019

The Federal Reserve: Digital Currencies, Stablecoins, and the Evolving Payments Landscape

https://www.federalreserve.gov/newsevents/speech/brainard20191016a.htm

last modified October 16, 2019

Tokenpost: Bank of Thailand’s DLT-focused Procject Inthanon advances to Phase III

https://tokenpost.com/Bank-of-Thailands-Project-Inthanon-advances-to-Phase-III-2700

last modified July 19, 2019

Worldbank: Distributed Ledger Technology (DLT) and Blockchain

http://documents.worldbank.org/curated/en/177911513714062215/pdf/122140-WP-PUBLIC-Distributed-Ledger-Technology-and-Blockchain-Fintech-Notes.pdf

last modified 2017

The views expressed in this note are the author’s only and do not necessarily reflect official views of the Oesterreichische Nationalbank or the Eurosystem.

https://www.federalreserve.gov/newsevents/speech/brainard20191016a.htm

https://fortune.com/2019/11/01/china-digital-currency-libra-wakeup-call-us/

https://en.cryptonomist.ch/2019/11/11/china-launch-of-digital-currency-in-2020/

BNP Paribas: „The NEW Era of Currencies of China: Digital Currency Electronic Payment (DCEP), mimeo.

BNP Paribas: „The NEW Era of Currencies of China: Digital Currency Electronic Payment (DCEP), mimeo.

https://cointelegraph.com/news/imf-chief-christine-lagarde-encourages-open-cryptocurrency-regulation

https://www.ecb.europa.eu/paym/intro/publications/pdf/ecb.mipinfocus191217.en.pdf

Ibid.

https://www.r3.com/wp-content/uploads/2017/06/cadcoin-versus-fedcoin_R3.pdf

Ibid.

Ibid.

Ibid.

https://www.mas.gov.sg/-/media/MAS/ProjectUbin/Project-Ubin–SGD-on-Distributed-Ledger.pdf

Ibid.

Ibid.

https://www.mas.gov.sg/-/media/MAS/ProjectUbin/Project-Ubin–SGD-on-Distributed-Ledger.pdf

https://www.riksbank.se/en-gb/payments–cash/e-krona/e-krona-reports/e-krona-project-report-2/

Ibid.

Ibid.

Ibid.

Ibid.

https://beincrypto.com/sweden-central-bank-outlines-6-step-digital-currency-plan/

https://www.info.gov.hk/gia/general/201905/14/P2019051400361.htm

https://www.ccn.com/thursday-hong-kong-thailand-central-banks-partner-digital-currency/

https://tokenpost.com/Bank-of-Thailands-Project-Inthanon-advances-to-Phase-III-2700

https://www.bot.or.th/Thai/PaymentSystems/Documents/Inthanon_Phase1_Report.pdf

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

https://www.theblockcrypto.com/linked/49253/report-bank-of-france-to-test-digital-currency-in-2020

Ibid.