Disclaimer: This policy brief is based on van der Cruijsen and de Haan (2025). The views expressed in this note are those of the authors only and do not necessarily reflect those of DNB or the ESCB.

Abstract

Payment literacy is essential for people being able to independently participate in the payment system, as well as for the correct and secure use of payment methods. Yet, surprisingly little research has been conducted on this topic. We develop a payment literacy index based on true-false questions and find that although, on average, respondents answered most of the statements correctly, there is ample room for improving payment literacy. And this pays off. Higher levels of payment literacy are associated with greater trust in the payment system and in banks. Furthermore, more literate people are more likely to independently handle their payments and to adopt new digital payment methods.

The digitalisation of the payment system presents challenges for a diverse group of consumers (Broekhoff et al., 2023). Policymakers and banks are looking for ways to help people deal with their payments independently and safely. We measure payment literacy, provide insight into the factors that influence it, and explore why it matters. More specifically, we examine how payment literacy is related to trust in the payment system and to the use of payment instruments and the ability to make payments independently.

We have designed a survey to measure payment literacy. At the end of 2024, the survey was distributed to members of the Dutch Centerpanel aged 16 and over, and was fully completed by 2,327 respondents. The Dutch payments landscape offers a wide range of payment methods, and acceptance rates are high. This makes it a suitable setting for our study. To measure payment literacy, we asked respondents to indicate whether twenty statements about payments and fraud in the payment system were true or false. To discourage guessing, we included the option “I don’t know.” The statements cover both cash and digital payments, the offline and online environments, and fraud. In doing so, we contribute substantially to the limited body of research on payment literacy (Marcotty-Dehm and Trütsch, 2021; Cwynar et al., 2022). Respondents received a score of 1 for each correct answer and 0 for each incorrect answer or “I don’t know” response. Payment Literacy (PL) total is the average score across all twenty statements.

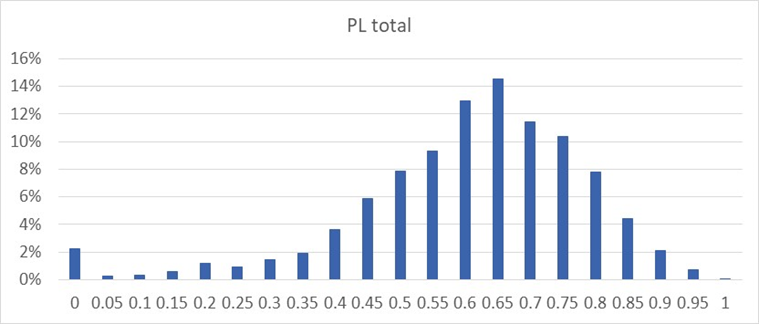

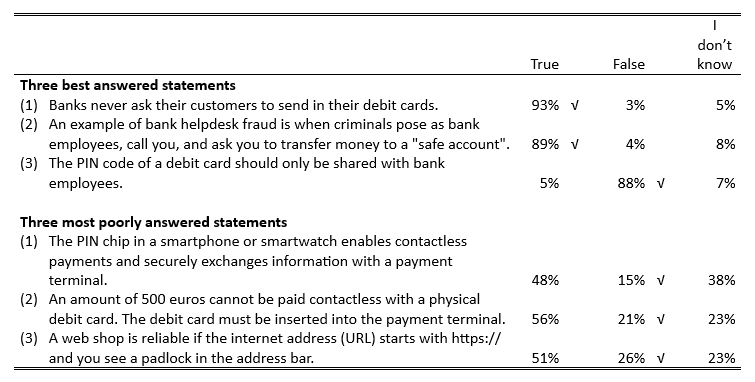

Although, on average, respondents answered most of the statements correctly, there is ample room for improvement. Figure 1 shows the distribution of the PL total score. The average score is 0.6. Table 1 presents the three statements that were answered correctly least often, as well as the three that were answered correctly most often. Let us begin with the three best-answered statements. Many people know that banks never ask their customers to send in their debit cards. In addition, a large share of people is aware of what bank helpdesk fraud is and that they should never share their debit card’s PIN code with bank employees. However, it is important to highlight that not everyone possesses this crucial knowledge. Turning to the three most poorly answered statements, only 15% of people know that the chip in a smartphone or smartwatch enabling contactless payments is not called a PIN chip. It is called a Near Field Communication (NFC) chip. Additionally, only 21% know that it is possible to pay €500 contactless. Finally, just 26% are aware that a webshop with a URL starting with https:// and a padlock icon in the address bar is not necessarily trustworthy.

Figure 1. Distribution of payment literacy score

Source: Centerpanel, 22 November – 17 December 2024.

Notes: weighted observations.

Table 1. Statements to measure knowledge of payments

Source: Centerpanel, 22 November – 17 December 2024.

Notes: weighted observations. The symbol √ indicates the correct answers.

Payment literacy is related to the desire to be well informed about payments, the information sources people use, indirect experiences with fraud, and personal characteristics. The more people want to be well informed about digital payments and payment fraud, the higher their payment literacy tends to be. For example, someone who considers it very important to be well informed about digital payments scores 0.12 points higher on the PL total than someone who finds this very unimportant. In contrast, a stronger desire to be well informed about cash payments is associated with lower payment literacy. The internet is the most popular source of information about payments and fraud: 54% of people include it in their top three information sources. Banks rank second, and family members third. Knowledge levels vary depending on the information sources used. For instance, people who include banks in their top three information sources score higher than others. Conversely, those who rely on social media for payment information tend to have slightly lower payment literacy. People who know someone who has experienced payment fraud score higher than those who do not. Men score higher than women, and people under 35 score higher than those aged 65 and over. Payment literacy is also higher among those with higher vocational or university education compared to those without. It increases with income and is relatively high among homeowners (used as a proxy for wealth). Unsurprisingly, people working in financial institutions have higher payment literacy scores than others.

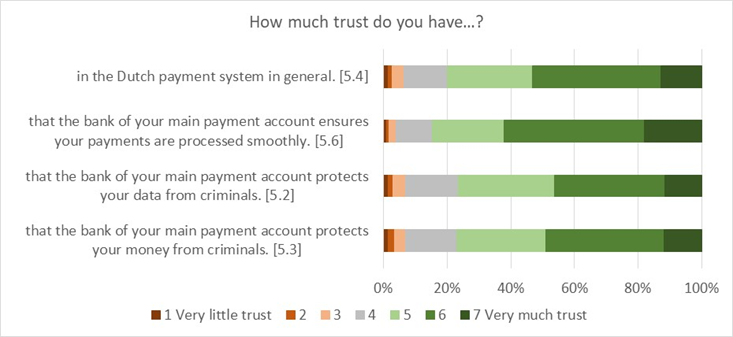

We find a positive association between payment literacy and trust in the payment system and in banks. While overall trust in the payment system and banks is quite high, not all Dutch people express the same level of trust (see Figure 2). The four types of trust in our research are measured on a scale from 1 “very little trust” to 7 “very much trust”. To illustrate the positive relationship between payment literacy and trust, someone with the maximum payment literacy score reports 1.0 point more trust in their own bank’s ability to ensure that payments are processed smoothly than someone with the lowest score. This person also has 0.9 points higher trust in the payment system, 0.7 points higher trust in their bank’s ability to protect data, and 0.8 points higher trust in their bank’s ability to protect money.

Figure 2. Trust in the payment system and banks

Source: Centerpanel, 22 November – 17 December 2024.

Notes: weighted observations. The average answers are shown between brackets.

Payment literacy is positively associated with payment experience. For example, people with the highest payment literacy score are 18 percentage points (pp) more likely to have experience with contactless debit card payments, and 19 pp more likely to have experience with online payments, compared to those with the lowest score. We also find a link between payment literacy and payment behaviour. Compared to someone with the lowest payment literacy score, a person with the highest score is 25 pp less likely to most often use traditional debit card payments, and 27 pp more likely to most often use contactless debit card payments. The higher their level of payment literacy, the more likely people are to make payments independently. People with the maximum PL total score are 6 pp less likely to need help with cash payments than those with the minimum score. The effect is 8 pp for both digital point-of-sale (POS) payments and online payments.

Our findings offer valuable insights for policymakers and financial institutions aiming to strengthen financial inclusion and trust across different socio-demographic groups. They underscore the importance of targeted policies to enhance payment literacy and outline practical ways to achieve this goal. A key starting point is raising awareness of the benefits of being payment literate. For instance, how it empowers individuals to take advantage of new payment technologies and better recognize fraudulent practices. Building on this foundation, our research can help refine initiatives such as public campaigns and training programs by identifying which aspects of payment literacy are underdeveloped, which population groups need extra support, and which information sources people turn to when learning about payments.

Broekhoff, M., C. van der Cruijsen, N. Jonker, J. Reijerink, G. Umuhire & W. Vinken (2023). Digitalisation of the payment system: a solution for some, a challenge for others. DNB report, January.

Cwynar, A., B. Świecka, K. Filipek & R. Porzak (2022). Consumers’ knowledge of cashless payments: development, validation, and usability of a measurement scale. Journal of Consumer Affairs 56(2), 640–665.

Marcotty-Dehm, N. & T. Trütsch (2021). Financial literacy and payment behaviour: evidence from payment diary survey data.

van der Cruijsen, C. & J. de Haan (2025). Payment literacy pays off: higher trust and financial inclusion. De Nederlandsche Bank Working Paper 831.