The macroeconomic effects of climate change are increasingly studied yet the complex relationship between climate change and inflation remains a puzzle waiting to be solved. Using global panel regressions, we identify the causal impacts of changes in climate on inflation. We then assess possible implications of projected future warming. We find that higher average temperatures increase inflation non-linearly over 12 months. Based on these empirical results, we estimate that the 2022 summer heat extreme could have increased food inflation in Europe by 0.7 (0.4-0.9) p.p. Warming as projected for 2035 would amplify the impacts of such extremes by 50%. Moreover, an increase in temperatures consistent with warming projected for 2035 could push up food and headline inflation in the absence of historically unprecedented adaptation. Due to non-linearities in the temperature-inflation-relationship, future climate change could also alter the seasonality of inflation. Our results suggest that climate change could pose risks to price stability by having an upward impact on inflation, altering its seasonality, and amplifying the impacts caused by extremes.

Central banks are paying increasing attention to the consequences of climate change and climate action, including for price stability. Yet, research on the role of climate change “physical risks” for inflation is still in its infancy.1 Estimates are lacking especially when it comes to the impact on future inflation from projected climate change. This constitutes a barrier to effective and balanced assessments of both physical and transition risks related to climate change. Our study, published as an ECB Working Paper, addresses these issues by providing empirical estimates of historical climate impacts on inflation and combining them with state-of-the-art physical climate models to estimate the implications for inflation from temperature increases consistent with projected future warming.

In our study we use global panel regressions to identify the impacts of a variety of climate shocks on inflation, flexibly across different seasons and regions. Our empirical setup uses a dataset of monthly consumer price indices across 121 countries, and climate indices defined based on granular meteorological data. We study the impacts of increases in monthly mean temperatures, temperature variability, exposure to dry and wet conditions, and extreme precipitation. By interacting the climate shocks with historic monthly mean temperatures, we can flexibly account for non-linearities in the reaction of inflation, depending on the season and region in which the shocks occur.2 Our empirical estimates are robust to several tests and alternative specifications, presented in more detail in our paper.

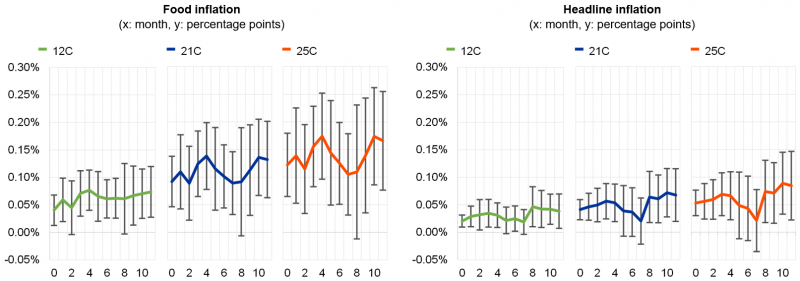

We empirically find a non-linear response of headline inflation to average monthly temperature increases, such that temperature increases in hotter months and regions cause larger inflationary impacts (Chart 1). This finding is consistent with previous results published in the literature, but by using interaction terms our framework allows for a flexible and unifying description of this heterogeneity across both seasons and regions. This non-linearity is such that increases in average temperatures in the hottest month of the year cause upwards inflationary pressures in all regions of the world as well as in the coldest months at lower latitudes. At higher latitudes, the effects of a temperature increase in the coldest months is mostly negligible and can even be negative at the highest latitudes. By using lagged climate measures, we find that the impacts of a 1°C increase in monthly temperatures persist across the entire twelve months following the initial shock.3 In addition to the impacts arising from average temperatures, we also assess impacts from daily temperature variability. We find upward pressure on inflation which depends on the magnitude of the seasonal cycle, with larger impacts at lower latitudes where the seasonal cycle is less pronounced. Our results also suggest that excess dry conditions have some significant upward pressure on inflation when occurring in hot months or regions, but these are generally less persistent or significant.

We find that the effects on headline inflation predominantly arise through food inflation (Chart 1). Effects for food inflation are approximately twice as large as for headline inflation, likely reflecting, besides a generally greater volatility in food inflation, the greater vulnerability of the agricultural sector to climatic shocks. The impact of temperature increases on food inflation is likely to arise through supply-side mechanisms given the considerable evidence for impacts on agricultural production from changes in mean temperature, temperature variability as well as precipitation characteristics.

Chart 1: Cumulative impact of a 1°C increase in monthly mean temperatures

Source: Kotz et al., 2023. Notes: Panels show the impact depending on the baseline temperature. For example, 25°C corresponds to the historical monthly mean temperatures in July in Spain.

To assess inflation impacts of temperature increases consistent with future projected warming, we combine our empirical results with projections of state-of-the-art climate models. We focus on the role of average temperature due to the persistence of its effects across low- and high-income countries and price aggregates, as well as due to the stronger response of warming to increases in greenhouse gases in the atmosphere compared to other climate variables. We calculate average projected warming from 21 climate models for 2035 and 2060, under an optimistic and a pessimistic emission scenario.4 We then evaluate our empirical equation for temperature increases consistent with average future warming in these years, essentially applying our model elasticities to projected warming. We use a similar procedure to evaluate the impact of the European heat extreme in summer 2022. The assessment of how such extremes would be amplified under future warming assumes that similarly extreme summer temperatures would come on top of projected average warming in the respective month.

Our results suggest that temperature increases consistent with projected increases in average temperatures over the next decades could push up inflation. Estimating the net impacts from temperatures consistent with average warming occurring in the next 15 to 40 years with our central empirical specification shows upward inflationary effects across the world. Temperature increases consistent with warming projected for 2035 are estimated to cause annual increases in food inflation of 0.9-3.2 p.p., and of 0.3-1.2 p.p. for headline inflation. The range describes the uncertainty across empirical specifications, climate models and emission scenarios. We consider the impacts we estimate as the effects of future weather conditions on inflation which would occur (i) in the absence of historically unprecedented adaptation via socioeconomic development or adjustment to warmer climatic conditions, (ii) without a targeted monetary policy response, and (iii) abstracting from any possible interactions with macroeconomic developments.

The way in which actual 2035 temperature increases will impact inflation depends on the extent to which economies adapt to a warmer climate. For example, a gradual adjustment process of the economy or individual sectors to increasing temperatures could potentially reduce the inflationary effects of additional warming. Future adaptation that could dampen the effect of warming on inflation include for example the adoption of space cooling to limit the impact of heat stress on labour productivity, or crop switching to limit agricultural productivity losses – two channels that are likely to have a high relevance for the impact of warming on inflation. Such future adaptation therefore offers an opportunity to limit the effects, and it becomes increasingly likely that such adaptation is implemented as awareness of climate change and its impact increase. Although the empirical evidence indicates that adaptation to temperature shocks has been limited historically, we explore the potential of adaptation via adjustment to changing temperatures to reduce these future impacts. We do so by using empirical models in which temperature shocks are defined relative to a 30-year moving average rather than a constant baseline, and by evaluating potential impacts using future temperatures defined in this way. Results using this method indicate that adaptation via adjustment could substantially reduce future impacts, especially in a low-emission scenario.

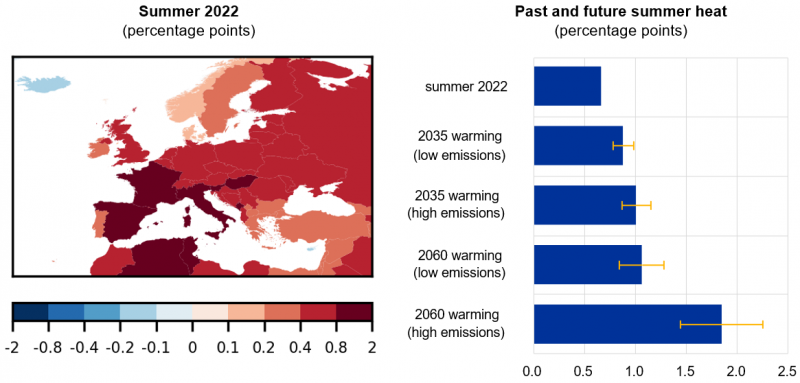

The impact of extreme heat will likely be amplified under future climate change. The heat extreme of the 2022 summer in Europe is a prominent example in which combined heat and drought had wide-spread impacts on agricultural and economic activity. We estimate that the anomalous heat over June-August 2022 alone caused a cumulative impact of 0.7 (0.4-0.9) percentage points on annual food inflation and 0.3 (0.2-0.4) percentage points on annual headline inflation in Europe, with larger effects across Southern Europe (Chart 2).5 Our results also suggest that in an equivalent extreme summer in 2035 (i.e., in the upper tale of the temperature distribution, shifted for 2035 climate) the impact on food inflation could be amplified by around 50%.

Chart 2: Estimated impacts of present and future summer heat extremes on food inflation in Europe

Source: Kotz et al., 2023. Notes: “Low emissions” on the right-hand side refers to RCP2.6, while “high emissions” refers to RCP8.5. Error bars represent the uncertainty range across empirical specifications and climate models.

The non-linear dependency of the effects on the historical mean temperature implies that climate change could also alter the seasonal dynamics of inflation. The effects from average projected warming on food inflation are relatively constant throughout the year across the tropics but vary considerably across seasons in Northern mid-latitudes where they can be twice as large in summer compared to winter. This relationship is grounded in the dependency of effects on the historical monthly mean temperatures, with warming in generally colder months adding less or even not at all to inflationary pressures. This seasonal heterogeneity would alter the usual seasonality of inflation, resulting in an amplification of seasonal variability across most of the global south and the USA, and reductions in seasonal variability across most of Europe (excluding Spain) and the higher northern latitudes.

Overall, the estimated inflationary impacts on food and headline inflation from increasing temperatures could have implications for both price stability and wider societal welfare. Upward pressures on food inflation from a changing climate would add pressures to incomes and could impact inflation expectations, thereby requiring monetary policy to react. These effects will be heterogenous across regions and will be generally larger in the global south. In addition to the effects that could arise from average future warming, the chaotic nature of temperature anomalies implies short-term, more rapid prices rises could stem from exceptionally hot summers such as in Europe in 2022. The increasing intensity of such hot extremes with climate change will amplify their impact. Such additional shocks to prices – happening at unpredictable intervals but with increasing intensity – could increase inflation volatility and make inflation forecasting more difficult, thereby posing additional challenges for central banks. Importantly, these challenges could increase considerably if future emissions are not mitigated, thereby providing yet another strong incentive for rapid mitigation of greenhouse gases to limit future warming. Beyond mitigation, adaptation to a changing climate (including through technological changes) could dampen the inflationary impact of future warming, as suggested by our additional estimates that define temperature shocks relative to a 30-year moving average.

Our results also point to further research needs, including on impacts from other types of climatic changes – for example tropical cyclones, floods, droughts -, and on other price aggregates. While this work has identified several climatic measures with significant historical impacts on headline and food inflation, some limitations persist in providing a comprehensive and general relationship between climate and inflation. A wide range of potential sources of climatic effects was not considered here, including for example tropical cyclones and sea level rise, which could cause damage to infrastructure and production. Similarly, more local impacts from extreme rain or drought might not be sufficiently captured here as we study effects at country level. These effects could nevertheless be relevant for inflation if they affect production chains, disrupt transportation (e.g., due to low river water levels) or destroy crops in crucial parts of the growing season. In addition, beyond food and headline inflation we find a limited response of other price aggregates to the climate measures we utilise. Yet, impacts of weather shocks on other price aggregates are certainly plausible. For example, electricity prices could become more sensitive to weather shocks with increasing shares of renewable electricity generation.

Earlier studies of the topic include Parker, 2018; Faccia et al., 2021; Mukherjee and Ouattara, 2021; Ciccarelli et al., 2023; and Cevik and Jalles, 2023.

Our findings are robust to a number of alternative specifications. For example, when accounting for the income level of a country, we find no considerable difference between impacts in high- or low-income countries.

For the euro area, we find aggregate impacts on food inflation of 0.8 p.p. in our central specification (using HICP country weights for the aggregation).