This article discusses when a liquidity risk regulation of credit lines is needed and provides welfare-economic guidance to the Basel III liquidity risk framework. Credit lines arise from the optimal contracting between banks and firms, in which banks reneging on some credit lines arise as a contract feature. Banks finance drawdowns with pre-arranged and ex-post funding. Pre-arranged funding is key to sustaining lending and reducing bank reneging. Firms that do not obtain financing are liquidated. In the presence of externalities generated by firm liquidations, competitive banks choose insufficient pre-arranged funding compared to a constrained social planner. The constraint efficient allocation can be restored by imposing a regulatory liquidity ratio, whose optimal level depends on economic fundamentals.

Credit lines are widely used by firms for liquidity risk management. For instance, around 40% of firms’ financing comes from credit lines in Spain (Jimenez et al., 2009). In these contracts, firms can draw down funds at will up to an agreed limit at committed pricing terms. In addition, undrawn credit line balances in banks are vast. For instance, these represent more than 40% of the total used balances on bank credit lines and term loans combined in the US. (Greenwald et al., 2020). Thus, the lending flexibility of credit lines significantly exposes banks to liquidity risk, especially after adverse macroeconomic shocks. For instance, recent papers document a sizable drawdown increase after the COVID-19 outbreak (Greenwald et al., 2020). Moreover, banks with higher liquidity risk restrict credit line usage through stricter responses to covenant violations (Acharya et al., 2020). Hence, credit lines provide only partial insurance to firms as banks could renege on some of them, negatively affecting cash-strapped firms. For instance, firms needing liquidity could reduce investment spending or sell assets in place; see Campello et al. (2010).

This article provides insights into the following questions: Do partial-insured credit lines require a special regulation? If yes, what are the main determinants of such regulation?

Gutierrez (2023) provides a contract-theoretic model of credit lines. In the setup, firms sign credit line contracts with banks to meet a contingent liquidity need and avert liquidation. When contracting, parties agree on a pricing scheme (an interest rate if funds are used and a fee if funds are not) and bank pre-arranged funding. Banks finance drawdowns from credit lines with pre-arranged and ex-post funding: they finance them first with cash reserves (created with pre-arranged funding) and, if needed, raise ex-post funding. However, in high liquidity need states, bank revenues shrink, making it unfeasible for banks to raise enough ex-post funding to meet all drawdowns. Thus, banks renege on some credit lines, causing the liquidation of some firms.

Pre-arranged funding reduces bank reneging but implies higher ex-ante costs for banks. As bank pre-arranged funding is junior to ex-post funding (e.g., bank equity versus short-term debt), the bank can dilute providers of pre-arranged funding to raise more ex-post funding and meet more drawdowns. However, as pre-arranged funding finances cash reserves, banks must forego higher returns elsewhere, making it costly maintaining liquidity buffers.

If high liquidity need states are rare, bank reneging arises as a contract feature. When contracting in an ex-ante stage, the parties acknowledge that a low level of bank pre-arranged funding causes credit lines to not fully insure firms against liquidity shocks in high liquidity need states. However, if such states are rare, the contract can save on costly levels of bank pre-arranged funding, leaving firms only partial-insured in high liquidity need episodes.

Such a contract feature is consistent with empirical evidence. Credit lines have financial covenants that allow banks to withhold funds if firms do not comply with them. For instance, by exploiting the collapse of the asset-backed commercial paper market, Acharya et al. (2020) show that banks facing greater liquidity risk have a stricter response to covenant violations, allowing them to restrict firms from accessing their lines. Thus, credit lines only provide partial insurance, as banks are more likely to renege on them when liquidity risk spikes.

In the setup, firms that do not get funding face liquidation. In particular, firms needing funding are forced to fire-sale their specialized assets in a secondary market.

In a context where liquidation implies a negative price pressure on the equilibrium liquidation value, the private optimal contract is constrained-inefficient. This assumption captures a fire sale scenario with insufficient natural buyers of specialist assets. As a result, banks do not internalize this fire-sale externality and, as a result, choose low levels of pre-arranged funding and tend to renege on credit lines too often. This market failure rationalizes the regulation of credit lines.

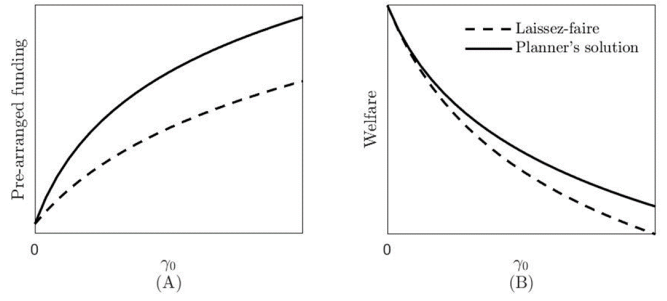

In fact, in the absence of fire-sale externalities, credit lines do not need a special regulation. As can be appreciated in Figure 1, in the absence of a fire-sale externality, pre-arranged funding in the laissez-faire regime coincides with the choice of a constrained social planner (panel A), as the welfare attained for each case (panel B). However, as the intensity of the fire-sale externality increases, higher welfare is achieved by the planner. In particular, when choosing pre-arranged funding, competitive banks do not internalize the value of additional insurance, which, by avoiding some additional liquidation, prevents fire-sale losses for all firms. Therefore, banks choose insufficient pre-arranged funding compared to a constrained efficient allocation chosen by the social planner that considers such a positive effect of bank pre-arranged funding. Thus, the optimal private arrangement provides too little insurance.

Figure 1: Effect of the intensity of the fire-sale externality (γ0) on welfare and pre-arranged funding for each solution

Gutierrez (2023) shows that the planner’s solution can be implemented using minimum liquidity ratios, as in the Basel III liquidity risk framework (BCBS, 2013). In particular, a minimum requirement on bank pre-arranged funding (per committed undrawn funds in credit lines) that coincides with the planner’s choice can restore constrained-efficiency. In this way, banks are forced to hold more significant amounts of pre-arranged funding. As bank pre-arranged funding is used to create cash reserves, the optimal requirement on pre-arranged funding can be interpreted as the Basel III Liquidity Coverage Ratio (LCR).

Such a regulation increases the cost of credit lines but improves welfare. In particular, it increases the insurance of credit lines (higher lending) in high liquidity need states, which helps to ease the detrimental effect of excessive liquidations of firms.

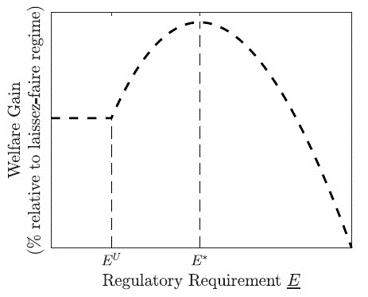

The analysis also shows that a stringent liquidity regulation does not necessarily increase welfare even under fire-sale externalities. Specifically, high requirements of pre-arranged liquidity can be translated into credit lines with excessive insurance, making them only costlier without having a significant impact on reducing costly liquidations (see Figure 2 for liquidity requirements E > E*). On the contrary, a low pre-arranged funding requirement may not impact welfare, as banks may currently hold more pre-arranged liquidity; i.e., the requirement will not be binding on equilibrium (see Figure 2 for liquidity requirements E > EU).

Figure 2: Effect of a minimum pre-arranged funding regulatory requirement on welfare

Finally, the comparative static analysis informs how liquidity requirements on undrawn credit lines could be tuned up for different economies. According to the model, the optimal minimum requirement should be increased under the following conditions: lower cost of maintaining liquidity buffers, higher costs of liquidating firms, or more frequent high liquidity need states in which firm liquidations are more likely.

Acharya, V., Almeida, H., Ippolito, F., and Perez-Orive, A. (2020). Bank lines of credit as contingent liquidity: Covenant violations and their implications. Journal of Financial Intermediation (44):100817.

Basel Committee on Bank Supervision. (2013). Basel III: The liquidity coverage ratio and liquidity risk monitoring tools.

Campello, M., Graham, J. R., and Harvey, C. R. (2010). The real effects of financial constraints: Evidence from a financial crisis. Journal of Financial Economics, 97(3):470–487.

Greenwald, D. L., Krainer, J., and Paul, P. (2020). The Credit Line Channel. Working Paper Series, 2020-26, Federal Reserve Bank of San Francisco.

Gutiérrez, J. E. (2023). Optimal Regulation of Credit Lines. Banco de España Working Paper No. 2323.

Jiménez, G., Lopez, J. A. and Saurina, J. (2009). Empirical analysis of corporate credit lines. The Review of Financial Studies, 22(12):5069–5098.