Stablecoins have emerged as a novel form of privately issued digital money that promises a stable and secure way to park funds in cryptocurrency markets. Their potential for wider adoption is fueled by various use cases in the crypto universe and emerging real-world applications. However, leading stablecoin issuers are vulnerable to runs driven by negative information about reserve quality, liquidity, operational risks, technological risks, and custodial risks. The fragility of stablecoins, along with their potential impact on the stability of traditional financial markets, has attracted significant regulatory attention. This policy brief discusses the lessons for stablecoin adoption, fragility, and appropriate regulation through the lens of a theoretical model. It addresses regulatory concerns related to excessive adoption, reserve management, and disclosure, and it explores strategies to reduce fragility.

Stablecoins are digital assets that reside on a blockchain in the cryptocurrency universe and are pegged to a reference asset like the US dollar. Financial regulators around the world were first alerted to stablecoins after social media platform Facebook announced in June 2019 that it would launch its own digital currency called “Libra” backed by a basket of currencies. This was a wake-up call for central banks and the regulatory community, which sparked an extensive policy discussion (G7 2019; FSB 2019; Brainard 2019; Cœuré 2019). While the Facebook Libra project was ultimately discontinued after regulatory headwinds, the emergence of other stablecoins and the rapid expansion of the cryptocurrency market kept regulators alerted. Importantly, stablecoins serve as a critical link between crypto markets and traditional financial markets due to the stablecoin issuers’ large holdings of commercial paper and treasuries (Barthelemy, Gardin and Nguyen 2021; Kim 2022). Therefore, the potential for widespread stablecoin adoption, their fragility, as well as their impact on financial stability and the monetary system remains a major concern for policymakers.1

Until recently, stablecoins have been largely unregulated, and the regulatory response to the emergence of stablecoins is still evolving, especially at the international level. Stablecoins are also one of the driving forces behind the debate about Central Bank Digital Currencies (CBDCs), which can be seen as an insurance policy against the rapid growth of difficult-to-regulate stablecoins (Arner, Auer and Frost 2020; Landau and Brunnermeier 2022; FSR 2022). At the same time, tightly regulated stablecoins issued by insured depository institutions and by narrow banks can be a substitute for a CBDC.

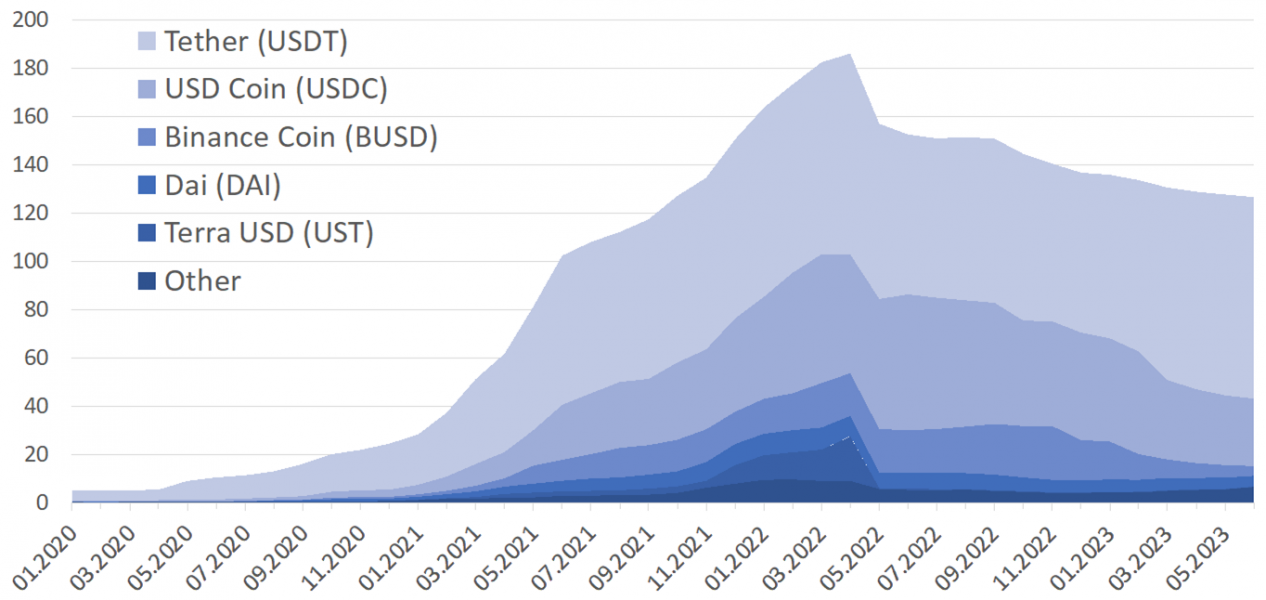

The leading stablecoins in cryptocurrency markets are pegged one-to-one to the US dollar. Figure 1 shows the total market capitalization of the US dollar pegged stablecoins and the breakdown by issuer since January 2020. After a rapid expansion in 2020 and in 2021, when the market grew nearly five-fold, it experienced a significant correction during the crypto market turmoil in May 2022. Following a brief recovery, the development of the stablecoins market has been subdued with significant reductions in the market capitalizations of the second and third largest stablecoins USD Coin (USDC) and Binance Coin (BUSD). This is largely due to a renewed turmoil in the cryptocurrency market in November 2022, when the FTX cryptocurrency exchange went bankrupt, and to increased pressure from regulatory actions and lawsuits affecting the issuance and exchange of BUSD and USDC, which are associated with the Binance and Coinbase cyptocurrency exchanges.2 Over the same period, the dominant stablecoin issuer, Tether, has not only gained market share, but its coin, USDT, has also reached an all-time high with a market capitalization of more than 83bn US dollars. As a result, the already concentrated stablecoin market has become even more concentrated, with a Herfindahl-Hirschman Index of 49% in June 2023.

Figure 1: Market capitalization of Top Stablecoins in Billion US Dollars

Note: This figure shows the end of month market capitalization in billion US dollars of the leading stablecoins pegged to the US dollar over the period from January 2020 to June 2023. Source: coingecko.com.

The fragility of the existing stablecoin arrangements is highlighted by the destructive run on the algorithmic stablecoin Terra USD (UST), which began on May 9, 2022. UST was the fastest growing stablecoin in early 2022, fueled by an unsustainable lending boom on Terra’s blockchain-based Anchor lending protocol (Liu, Makarov and Schoar 2023). In early May, UST reached a market capitalization of 18.7bn US dollars and traded in a narrow band around its peg to the US dollar. After a wave of redemptions starting on May 9, UST de-pegged, followed by a rapid and sustained price collapse over the next few days, leading to a halt in its blockchain and a wipeout of its market capitalization, as shown in Figure 1.

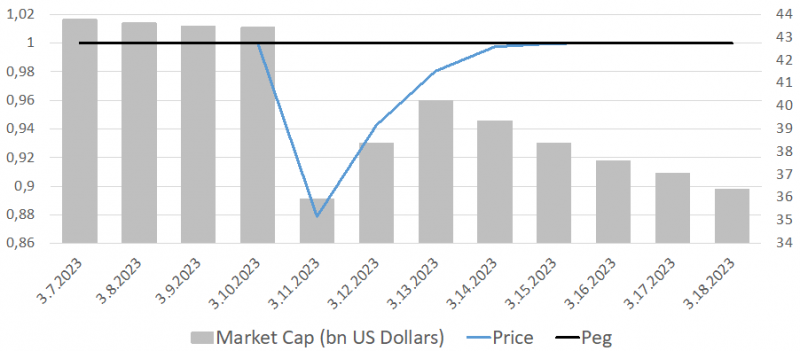

Another recent example highlights that the inherent fragility of stablecoin arrangements also extends to the leading stablecoins USDT, USDC and BUSD, which are mostly backed by fiat currency assets.3 In March 2023, the second largest stablecoin, USDC, experienced a multi-day de-pegging after it was revealed that its issuer, Circle, held large uninsured deposit balances at Silicon Valley Bank (SVB). Figure 2 shows the de-pegging of USDC at the beginning of the U.S. Regional Banking Crisis when SVB and Signature Bank collapsed, and the price of USDC dropped to 0.87 cents on March 11, 2023. The magnitude of the price drop was broadly in line with Circle’s exposure, which held 3.3bn US dollars of its reserves at SVB.4 The swift announcement by U.S. regulators to protect all uninsured deposits arguably helped Circle meet the massive redemption requests shown in Figure 2. This stabilized USDC and allowed its peg to be restored in the following days. Interestingly, the distress of USDC did not spread to other stablecoins that were known not to bank with SVB.

Figure 2: Price of USD Coin in US Dollars and Market Capitalization in Billion US Dollars

Note: This figure shows the USD Coin price and its peg to the US dollar (left axis), and the market capitalization in billion US dollars (right axis) over the period from March 7, 2023 to March 18, 2023. The data frequency is daily (8am Coordinated Universal Time, UTC). Source: coingecko.com.

From the perspective of stablecoin holders, the risk of devaluation of their coins is related to the quality and liquidity of the reserves held by the issuer, as well as exposure to operational, custodial and technological risks, such as cyber-attacks, which can cause significant losses that quickly deplete the small capital buffers of stablecoin issuers. Similar to money market funds, most issuers engage in some degree of maturity and liquidity transformation. While the actual risk exposure is often difficult to assess due to the lack of detailed and verifiable information about issuers’ asset holdings, self-reported information suggests that issuers hold assets with varying degrees of credit risk, as well as concentrated uninsured deposits. In addition, there are other complexities that create uncertainty. For example, the largest stablecoin issuer, Tether, is domiciled in the Cayman Islands, resulting in an unclear bankruptcy process in the event of insolvency.

Despite the inherent vulnerability of stablecoins to runs, stablecoin holders are attracted to this new form of privately issued digital money because it offers attractive use cases in the crypto universe and real-world applications. Cryptocurrency investors can use stablecoins to reduce their trading costs and increase their transaction speed when exchanging different crypto assets and when trading between cryptocurrency exchanges. Stablecoins also serve as an important source of collateral in crypto markets and can be lent out to earn interest. In addition, stablecoins offer a higher level of privacy, which is particularly beneficial for illicit actors. Other potential use cases outside the crypto universe include low-cost remittances and access to a substitute for volatile fiat currencies under devaluation pressure, coupled with the advantage of being immune to capital controls and financial repression.

In a recent working paper, Bertsch (2023) develops a theoretical model to study the adoption and fragility of stablecoins. A stablecoin issuer operates a unilateral exchange rate peg that is vulnerable to runs (Morris and Shin 1998). The model has three dates. At the initial date, consumers decide whether to invest their cash in stablecoins or in insured bank deposits. Consumers know that the stablecoin may be devalued at the interim date in the event of a run. Nevertheless, the decision to hold stablecoins at the initial date may still be attractive because consumers take into account the likelihood that stablecoins will be the preferred means of payment for the consumption good they wish to purchase at the final date. This is important because consumers face higher transaction costs if they do not possess the money accepted at the point of sale. In other words, a payment preference combined with transaction costs creates incentives to have the right money on hand. Consequently, consumers who have a higher probability of purchasing their good at the final date from a seller with a payment preference for stablecoins rather than bank deposits will be more inclined to adopt stablecoins at the initial date, despite the risk of a devaluation at the interim date. From a practical perspective, these are the consumers who are most interested in trading in the crypto universe, who have a strong preference for anonymity (e.g., when purchasing web services such as a VPN), who value the convenience of stablecoins relative to other means of payment, or who benefit from potential transaction cost advantages for specific use cases such as remittances.

In equilibrium, consumers with a high probability of encountering a seller with a preference for stablecoins find it optimal to adopt the coins at the initial date, while others choose to hold bank deposits. Not surprisingly, a lower likelihood that the stablecoins experience a run and devaluation at the interim date encourages adoption of stablecoins at the initial date, implying a link between fragility and adoption. What is more, adoption can also affect fragility, because a wider adoption changes the composition of coin holders. In particular, new adopters have less to gain from stablecoins and are therefore more flighty. The resulting composition effect is destabilizing. Other factors that increase the fragility of the stablecoin issuer include a lower liquidity of its reserves, higher bankruptcy costs, and lower seignorage income. Conversely, higher transaction costs, which are a prominent feature of crypto markets plagued by congestion effects, are stabilizing. The same holds for positive network effects. Similarly, a stablecoin lending market promotes both stability and adoption, as the chance of earning a return makes holding the coins more attractive and its holders less flighty. However, these positive effects can be undermined if stablecoin lending is exploited by speculators.

In response to widespread concerns about a rapid and potentially excessive adoption of stablecoins, the working paper identifies two mechanisms that can lead to inefficiently high adoption. The first mechanism relates to the “Tether scenario,” where a wider adoption of stablecoins for new use cases raises fragility concerns due to the destabilizing decomposition effect. The second mechanism relates to the “Facebook Libra scenario,” where a key concern for regulators is the potential for rapid and widespread adoption leading to a disintermediation of banks. In the first case, the marginal stablecoin adopter does not internalize the externality it imposes on other coin holders by destabilizing the stablecoin, and in the second case, it does not internalize the network effects that undermine the role of bank deposits as a means of payment. From a policy perspective, both scenarios warrant a gradual approach that monitors the effects of wider stablecoin adoption, paying attention to the link between the use cases for stablecoins and the flightiness of the coin holders.

An extension of the theoretical model with a moral hazard problem allows to analyze the issuer’s incentives for risk-shifting with and without the possibility to commit to a certain level of portfolio risk. Since the stablecoin issuer’s choice takes into account how the level of portfolio risk affects the likelihood of destructive stablecoin runs and adoption, a regulatory disclosure regime may allow the issuer to credibly commit to a low-risk portfolio choice, but it does not guarantee the implementation of the socially optimal level of portfolio risk. This justifies the introduction of additional regulation, such as capital requirements and measures to improve the quality of reserve assets and to reduce exposure to operational and technological risks.

Due to their inherent fragility and technical limitations in payment processing, today’s stablecoin arrangements are not yet able to support a privately issued digital money that can serve as an effective and widely accepted medium of exchange beyond specific use cases. But with increased stability, technical innovation and the entry of new players, the already significant stablecoin market can continue to grow. Financial regulators have begun to take steps to regulate crypto assets and stablecoins. However, the global nature of cryptocurrency markets, the diversity of stablecoin use cases, and the speed of innovation, especially in decentralized finance, could lead to a bifurcated market consisting of unregulated stablecoins and regulated stablecoins, which could take the form of CBDCs.

Arner, Douglas W., Raphael Auer, and Jon Frost, “Stablecoins: Risks, Potential and Regulation,” BIS Working Papers No. 905, 2020.

Barthelemy, Jean, Paul Gardin, and Benoît Nguyen, “Stablecoins and the Financing of the Real Economy,” Banque de France Working Paper No. 908, 2023.

Bertsch, Christoph, “Stablecoins: Adoption and Fragility,” Sveriges Riksbank Working Paper Series No. 423, 2023.

Brainard, Lael, “Digital Currencies, Stablecoins, and the Evolving Payments Landscape,” Speech by Lael Brainard, Member Board of Governors of the Federal Reserve System, at the conference on “Digital Currencies, Stablecoins, and the Evolving Payments Landscape”, October 2019.

Cœuré, Benoît, “Digital Challenges to the International Monetary and Financial System,” Panel remarks by Benoît Cœuré, Member of the Executive Board of the ECB, at the Banque centrale du Luxembourg-Toulouse School of Economics conference on “The Future of the International Monetary System”, September 2019.

FSB, “Regulatory Issues of Stablecoins,” Financial Stability Board, October 2019.

FSB, “Assessment of Risks to Financial Stability from Crypto-assets,” Financial Stability Board, February 2022.

G7, “Investigating the Impact of Global Stablecoins,” G7 Working Group on Stablecoins, October 2019.

Kim, Sang Rae, “How the Cryptocurrency Market is Connected to the Financial Market,” Mimeo, 2022.

Landau, Jean-Pierre and Markus K. Brunnermeier, “The Digital Euro: Policy Implications and Perspectives,” Report prepared for the European Parliament at the Request of the Committee on Economic and Monetary Affairs, January 2022.

Liu, Jiageng, Igor Makarov, and Antoinette Schoar, “Anatomy of a Run: The Terra Luna Crash,” NBER Working Paper 31160, 2023.

Morris, Stephen and Hyun Song Shin, “Unique Equilibrium in a Model of Self-Fulfilling Currency Attacks,” The American Economic Review, Volume 88 (3), 1998.

Other concerns include privacy and BigTech dominance. At the time of writing, the launch of the PayPal USD stablecoin and of the Worldcoin project (which is similar to Facebook’s Libra project and introduces a global identification system based on iris scans) are receiving considerable attention.

In February 2023, New York regulators halted the issuance of BUSD, while the U.S. Securities and Exchange Commission (SEC) and the U.S. Commodity Futures Trading Commission (CFTC) filed lawsuits against Binance (on March 27, 2023, the CFTC charged Binance and its founder for willfully evading federal law and operating an illegal digital asset derivatives exchange: https://www.cftc.gov/PressRoom/PressReleases/8680-23; on June 5, 2023, the SEC filed 13 charges against Binance entities and its founder: https://www.sec.gov/news/press-release/2023-101) and Coinbase (on June 6, 2023, the SEC charged Coinbase with operating as an unregistered securities exchange, broker, and clearing agency, following earlier insider trading charges: https://www.sec.gov/news/press-release/2023-102).

Issuers provide self-reported information on their reserves with varying degrees of granularity and frequency. While USDT, USDC and BUSD claim to be fully backed, USDT’s reserves include precious metals, secured loans and other investments, including crypto assets such as Bitcoin: https://tether.to/en/transparency/#reports.

For more details see: https://www.circle.com/blog/an-update-on-usdc-and-silicon-valley-bank.