Special government bonds to fund the transition to sustainability have proliferated. It is argued here that use-of-proceeds sovereign green bonds issued by an investment-grade country have no environmental impact, and fail to achieve other policy objectives. Performance-linked bonds contribute to policy commitment and accountability, but are hard to price and calibrate. Implementing effective environmental policies is the best way to mobilize sustainability financing.

Many governments, especially in Europe, have issued sustainability bonds, with the general aim of contributing to the financing of the transition to a sustainable economy. Much is claimed for them, and the sums involved are large. Now that evidence from diverse country experience has accumulated, it is worth assessing how well these instruments in fact achieve policy objectives, and thinking again about their optimal design.

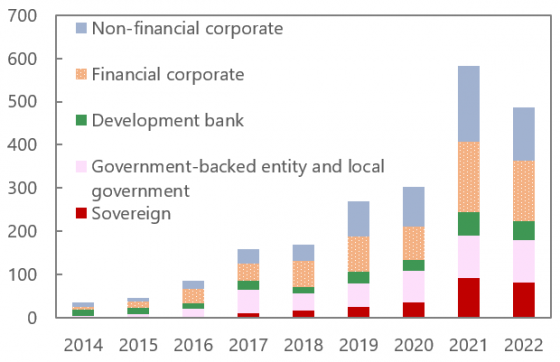

The most popular design for sovereign sustainability instruments is that of a Sovereign Green Bond (SGB), the proceed from whose sale the government uses to finance its projects promoting environmental sustainability and especially those addressing climate change. A typical project might be the construction of low-carbon public transport infrastructure. Governments have been scrupulous in reporting on the environmental impact of the supported projects, and subjecting these reports to an independent Second Party Opinion (SPO). Some governments have issued analogous bonds linked to ‘social’ projects. All these bonds are identical to conventional bonds in terms of payoffs. The annual volume of SGB issuance is now substantial, although dwarfed by issuance by non-sovereigns (chart 1).

Chart 1: Annual green bond issuance (US$ billions)

Source: Climate Bond Initiative.

The main alternative design is that of a Sovereign Sustainability-Linked Bond (SSLB), which is characterized by the inclusion of a contingency provision: if the country performs well relatively to targets for some environmental Key Performance Indicators (KPIs) at certain test dates, the issuer is rewarded by a reduction in the coupon, thus lowering funding costs. Poor performance may be penalized through an increase in the coupon. The proceeds are not earmarked. So far, only Chile and Uruguay have issued SSLBs (although issuance by firms including parastatals is growing rapidly).

Governments have set out their objectives in issuing sustainability bonds—using either approach—in so-called framework documents, and the investor presentations and reports released by national Debt Management Offices (DMOs). These materials emphasizes that sustainability bonds contribute to:

Particularly for SGBs, the impact reports are praised as a means to enhance the transparency of government action in this area. The fact that the DMO needs to work closely with operational ministries to identify suitable projects and track implementation is valued as a mechanism for promoting intra-government communication.

For SSLBs, the performance-contingent payoff is meant to reinforce the government’s commitment to its sustainability targets and the plausibility of its promises; they make the government ‘put its money where its mouth is.’ Furthermore, the variable element provides some insurance against policy slippages: if the government fails to implement policies to achieve its KPI targets, the investors at least enjoy a higher coupon.

The main limitation of SGBs in achieving these objectives is that the assignment of proceeds to uses is purely notional, at least for an investment-grade issuer such as most European governments. In such cases, money is fungible, that is, particular inflows are not connected to particular outflows. Project spending takes place long before or after the receipt of proceeds, which are anyway managed with the rest of government liquidity. The project themselves are planned far in advance of the respective bond issue, and the form of financing does not affect their design. (Indeed, it would be highly undesirable to tie the quantity of investment and project design to the form of financing.) Any greenium achieved is submerged in total funding costs. The impact of SGBs is zero.

Therefore, SGBs do not make a special contribution to transition financing, and their advertising of the government’s green intention is not backed by a ‘credibility mechanism.’ The impact reports may include useful information about the contribution of the nominated projects, for example, in reducing Greenhouse Gas (GHG) emissions, but they thereby reveal the irrelevance of the funding design. Claims to enhance ‘transparency’ are undercut by the fungibility of both funding and GHG emissions: the government may support some excellent projects, but their contributions may be heavily outweighed by the effects of other policies (e.g., by effectively subsidizing the use of lignite), which may maintain or increase national GHG emissions. Highlighting only the former is not transparent. Better internal coordination could be achieved just as well without going to the trouble of issuing a bond.

Regarding market development, it is question begging to assert that SGBs help to set an example of good instrument design. Also, development banks are better placed than national governments to establish standard practice because they have a mandate to provide global public goods. In any case, sovereign issuers were late to the game of developing the sustainable finance market, as shown in Chart 1.

On the supply side, increasing the stock of SGBs outstanding is constrained by the availability of suitable projects. It turns out to be time consuming and complex to find and document eligible projects. Hence, only the largest countries can issue SGBs in the quantity needed to establish a benchmark bond, and even they struggle to issue according to a regular schedule.

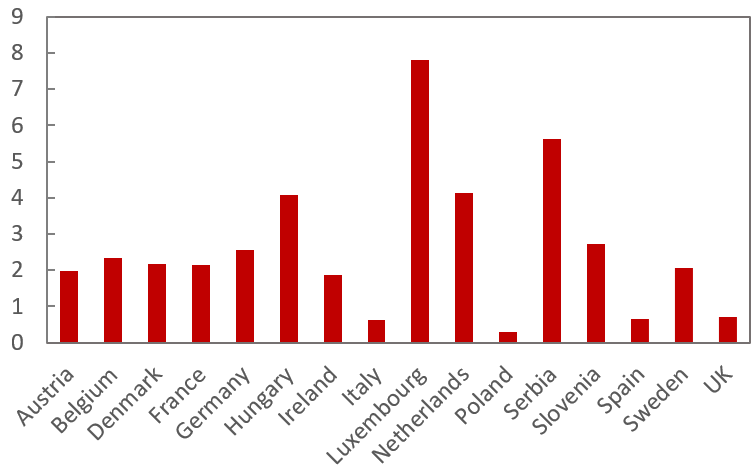

By regulatory fiat, SGBs allow investors to meet formal obligations to invest in green assets (perhaps crowding out impactful green financing). But they do not satisfy the needs of investors who wish to see an impact. Nor are they of use to investors who wish to hedge climate change-related risk, since the payoff is the same as on conventional bonds. The expansion of the investor base, especially for medium- to large-sized European countries, has so far been marginal. Both supply- and demand-side factors condemn SGBs to remain a niche product (Chart 2).

Chart 2: SGBs/government marketable debt (percent; selected European counties; end-2022)

Source: DMOs, and author’s calculations.

Partly for these reasons, investors do not seem to be willing to pay significantly more for a SGB than for a conventional bond. The greenium on SGBs amounts to at best a few basis points. For example, the primary market greenium on German SGBs (which are convertible into conventional bond on demand) has been about 2 basis points (0.02 percent), which translates into a minimal saving even on issue sizes of ten or twenty billion euros. Furthermore, the primary market greenium is a gross amount: calculation of the net benefit needs to deduct the costs of the SPOs and extra staff time devoted to preparing and following up on SGB issues. No public information is available on these costs.

Performance-based SSLBs seem to be free of most of these limitations. Rather than asserting that proceeds are somehow assigned to certain projects, SSLBs fund the government as a whole, in a way that reinforces the government’s long term commitment to achieving sustainability. Advertisement of the commitment through issuing SSLBs is not ‘cheap talk.’ SSLBs can help fund a comprehensive sustainability program implemented mainly through regulation, adjustment to net taxes, and compensation of affected groups (such as the lump-sum transfers offsetting a carbon tax, as recently implemented by Austria), aimed at achieving national objectives. Thus, the design of SSLBs reflects the governance principle that the government should be held accountable for the country’s overall performance, to be influenced using all tools at its disposal, not for a few well-chosen projects.

SSLBs, like SGBs, constitute default-free sustainability instruments, but can be issued in much larger quantities and through regular tenders because they are not linked to identified eligible projects—even a relatively small issuer can establish benchmark bond(s). They are therefore more conducive to market development and to achieving debt management objectives. Also, the administrative costs are lower.

SSLBs can meet investor demand for sustainability assets: they provide dedicated environmentalist investors with an instrument that is genuinely impactful in the real world. However, SSLBs do not provide insurance against climate change itself, which depends on global emissions.

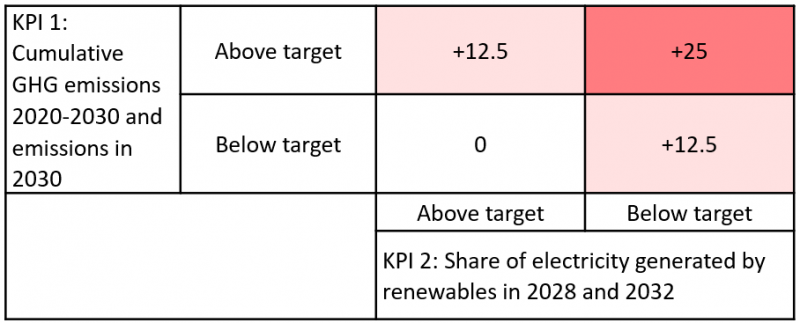

The commitment mechanism in SSLBs implies that the government may have to pay a penalty in some circumstances, including circumstances where the government is under fiscal pressure. This possibility raises the question of whether the government will then stick to its commitment or try to renege, explicitly or implicitly. Especially if the party in power has changed since the time of issuance, a government that has missed a KPI target may be tempted to put forward some excuse about force majeure and change the terms ex post, or it could manipulate measurement of the KPI. Both Chile and Uruguay included in their SSLB tests the achievement of targets for reducing GHG emissions in line with their respective ‘national defined contributions’ under the Paris Accord. However, GHG emissions are an aggregated based on complex measurement and estimation procedures. Therefore, a government may be suspected of biasing measurement in its favor.1 Perhaps to offset this concern, both countries included tests based on more readily observable KPIs, namely, the share of renewables in electricity production (Chile—chart 3) and forest cover (Uruguay).

Chart 3: Chile SSLB design: coupon step-up contingent on KPI performance (basis points)

Source: Public Debt Management Office, Chile.

Policy risk is just one of the uncertainties that complicate the design and pricing of SSLBs, and which may ultimately limit their attractiveness to investors and governments. It is very difficult to project the probability distribution of climate KPI outcomes over the medium term, which depends on myriad economic, technology, and political factors. Investors will want to be compensated for taking on these risks. Some investors may be put off entirely.

The risks can be reduced by making the possible adjustments in the coupon very small; postponing the test date into the far future; or setting targets that are so ambitious or unambitious that the outcome is almost certain—but if taken too far, such wheezes make the contingent element negligible and thus vitiate the commitment mechanism.2 The performance-linkage has to be designed and calibrated in a way that balances the desire to make the sustainability link substantive against the need to make the bond easy to price and attractive to a wide investor base.3

We are left with a conundrum: governments may shy away from issuing SSLBs precisely because they may be costly. SGBs may be appealing because they cost no more than conventional bonds while giving the impression of busyness, but incorporate poor fiscal governance and nontransparency.

Governments, at least of investment grade countries, do not need sustainability financing to pursue sustainability policies. What governments need is the political will to devote resources to implementing these policies. There is emerging evidence that companies and countries that are demonstrably less exposed to transition and physical risks from climate change enjoy lower funding costs on conventional bonds.4 Hence, even for debt management purposes, action affecting real life consumption and investment counts for much more than instrument design.

The possibility of ‘gaming’ emission reports is a general problem—see for example Lepere, M., Aikman, D., Dong, Y., Drellias, E., Havaldar, S. D., & Nilsson, M. (2023). Emissions gaming? A gap in the GHG Protocol may be facilitating gaming in accounting of GHG emissions. (No. 1 ed.) King’s College London.

Some corporate sustainability bonds have been criticized for their unambitious targets—see for example Bryan, K. (2023). Sustainability bond market stumbles as investors get picky. Financial Times.

It may be politically easier for a government to issue bonds with only ‘upside’ contingencies, such as a coupon reduction if targets are met, rather than suffer a penalty if targets are not met. Also, based on experience with ‘catastrophe’ bonds, it might be more acceptable to investors if strong performance were rewarded with a maturity extension rather than a coupon reduction.

See Bingler, J. A., (2022). Expect the worst, hope for the best: The valuation of climate risks and opportunities in sovereign bonds. ETH Economics Working Paper Series 22/371, and Ferriani, F. (2023). Issuing bonds during the Covid-19 pandemic: is there an ESG premium? SUERF Policy Brief No 542.