We examine when it’s a good idea for a central bank to take a “leaning against the wind” (LAW) approach to managing financial stability risks. To do this, we use a model that explicitly takes into account occasional financial crises and how people form expectations about house prices. We find that while LAW reduces the frequency and severity of financial crises, it makes inflation less stable by increasing the impact of supply shocks under prolonged financial cycles, induced by partly backward-looking house price expectations and long-term household debt. LAW also leads to lower average inflation, which may cause the policy rate to reach its lower bound more often. Our study suggests that using the LAW approach may only be a good idea if the central bank places more emphasis on output stability or if financial cycles aren’t as long-lasting as we typically see.

A long-standing debate among economists and policymakers is whether central banks should take financial imbalances into account when making monetary policy decisions, in particular by pursuing a “leaning against the wind” (LAW) policy, i.e. by keeping interest rates above the levels implied by their flexible inflation-targeting frameworks. In a recent paper (Kockerols, Kravik and Mimir, 2023), we investigate systematic LAW policy in an environment with empirically disciplined endogenous financial crises based on credit imbalances, prolonged financial cycles, occasionally binding effective lower bound (ELB) episodes, and monetary policy additionally responding to house prices only when they are rising.

The discussion around LAW policy has led to two main perspectives with different arguments. Proponents of LAW policy argue that they are necessary to protect the economy from future financial crises, especially in light of the vulnerabilities created by events such as the Global Financial Crisis and the Covid-19 pandemic. This perspective is supported by studies like Gambacorta and Signoretti (2014), Cúrdia and Woodford (2016), and Caballero and Simsek (2020), which explore the potential benefits of implementing LAW policies under different conditions. These studies suggest that monetary policy reacting to financial imbalances can help stabilize the economy and reduce the likelihood of financial crises. They argued that if expected inflation were to remain unaffected by an asset price bubble, which would be the case if the bubble was not too long lasting, then reacting only to expected inflation would not prevent bubble-induced macroeconomic volatility.

On the other hand, critics of LAW policy argue that their costs outweigh the benefits. Earlier discussion of the topic highlight two practical problems of the approach. First, the early identification and precise measurement of price bubbles in real time was difficult, if not outright impossible; second, even if such price misalignments were observed, it was argued, monetary policy would not be able to deal with them adequately. This was because the interest rate adjustments necessary to contain asset price bubbles could not be easily calibrated based on theory. Moreover, the increase in interest rates needed to curb an asset price bubble could be substantial, with a significant negative impact on growth and inflation, thus jeopardising the mandatory objectives of monetary policy and affecting its credibility. Recent studies critical of LAW policy include Svensson (2017a) and Kockerols and Kok (2021), which question the desirability of LAW policy by asserting that the costs of implementing such policies are larger than the benefits. These studies emphasize the potential negative impacts of LAW policies, such as higher inflation volatility and reduced economic growth.

The role of persistent financial cycles is crucial when considering the effectiveness of LAW-type monetary policy. Addressing the limitations in earlier studies, our analysis incorporates the persistence of financial cycles by including partly backward-looking (hybrid) house price expectations and long-term household debt as in Gelain et al. (2013), which prolong the fluctuations in house prices and household debt as observed in real data. This approach allows us to better understand the implications of LAW policy under long-lasting financial cycles and to evaluate their potential benefits and drawbacks.

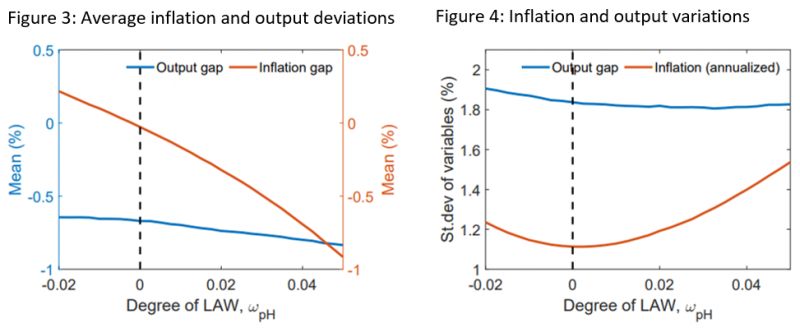

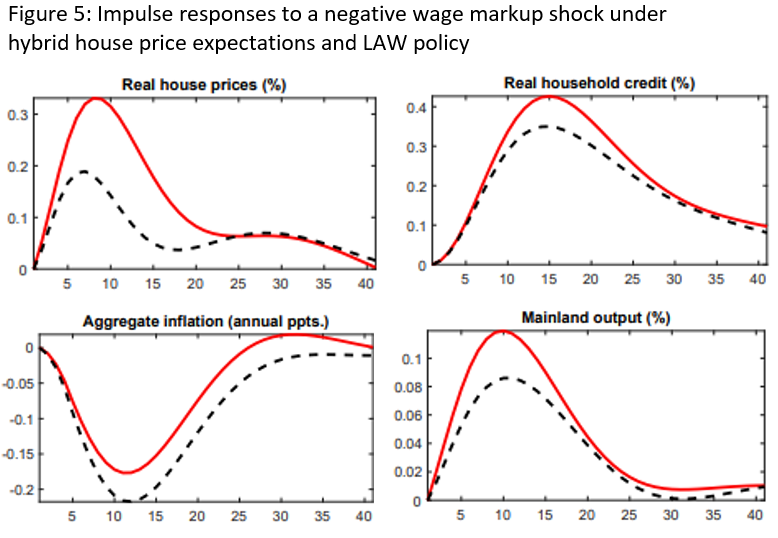

Taking into account the persistence of financial cycles is essential when assessing the desirability of LAW-type monetary policy. For instance, studies such as Boissay et al. (2021) find LAW policy to be optimal in a model with rational house price expectations. However, our findings suggest that systematic LAW is not favorable, primarily due to the higher inflation volatility it induces under prolonged financial cycles. This result stems from the amplification of supply shocks under monetary policy reacting to house prices, which highlights the importance of considering persistent financial cycles when evaluating the desirability of LAW policies.

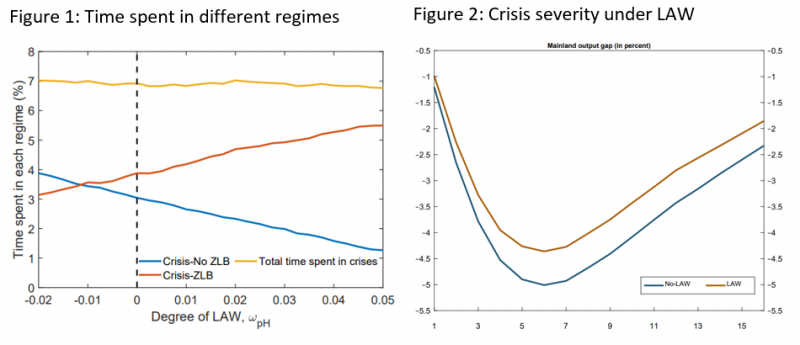

Using a regime-switching medium-scale New Keynesian (NK) DSGE model of a small open economy, our results show that while reducing the frequency and severity of financial crises (Figures 1 and 2),

a monetary policy strategy that attempts to systematically tame long-lasting financial cycles leads to excessive inflation volatility in normal times (Figure 4) by amplifying the effects of supply shocks over the business cycle (Figure 5).

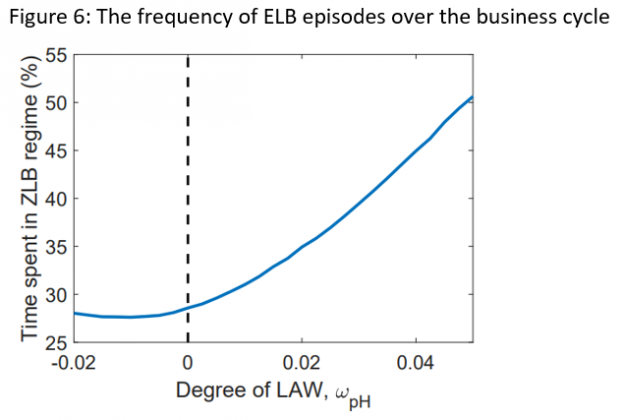

Moreover, systematic LAW leads to more frequent episodes of a binding ELB due to the lower average inflation it induces (Figures 5 and 6).

However, the persistence of the financial cycle plays a central role in these findings. Under rational house price expectations, which generate financial cycles that are not as long-lasting, systematic LAW becomes optimal due to the lower volatility of inflation it brings. This is a result of its dampened countercyclical impact on housing collateral and domestic demand. Our findings indicate that a tradeoff between responding more to output and responding to house prices arises under systematic LAW, as house prices are procyclical over the business cycle. Therefore, a policy rule that responds to output essentially responds to house prices as well, and our results confirm this conjecture and document this tradeoff.

LAW is only advisable if the policymaker cares more about output stability relative to inflation stability or if financial cycles are less persistent, exclusively under systematic LAW. In this case, LAW dampens house price volatility and is countercyclical in response to supply shocks. The countercyclical effect of house prices acts through the collateral channel and manifests itself in higher inflation volatility under persistent financial cycles. Under rational house price expectations, the same collateral channel leads to a reduction in inflation volatility.

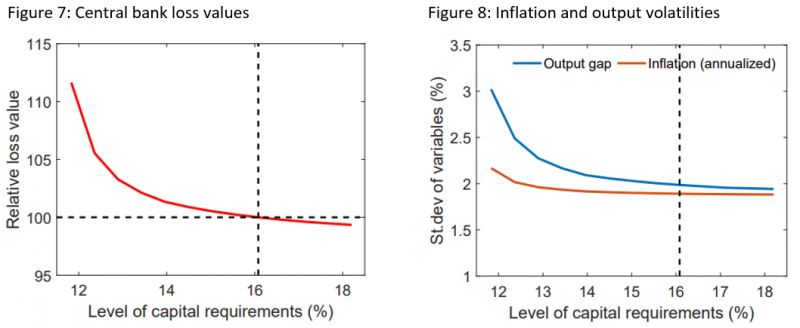

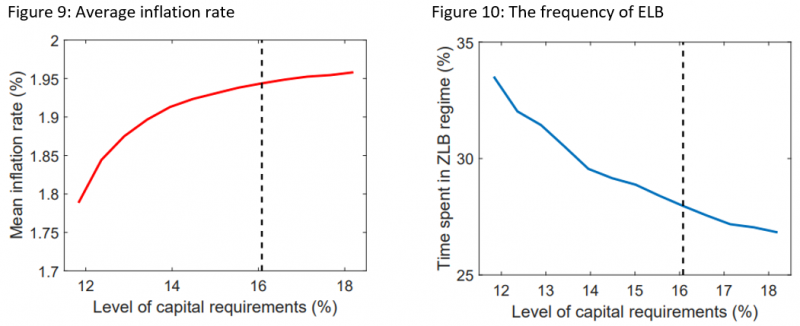

Macroprudential policy in the form of long-run bank capital requirements is a better way to address risks to financial stability, and the benefits increase with higher requirements in normal times (Figure 7). Capital requirements lower both output and inflation volatility (Figure 8), reduce the frequency of ELB by raising average inflation rate and are therefore a natural complement to LAW by monetary policy.

Boissay, F., F. Collard, J. Galí, and C. Manea (2023): “Monetary policy and endogenous financial crises”, BIS Working Papers, No 991.

Caballero, R. J. and A. Simsek (2020): “Prudential monetary policy,” Tech. rep., National Bureau of Economic Research.

Cúrdia, V. and M. Woodford (2016): “Credit Frictions and Optimal Monetary Policy”, Journal of Monetary Economics, 84, 30–65.

Gambacorta, L. and F. M. Signoretti (2014): “Should monetary policy lean against the wind?”, Journal of Economic Dynamics and Control, 43, 146–174.

Gelain, P., K. J. Lansing, and C. Mendicino (2013): “House Prices, Credit Growth, and Excess Volatility: Implications for Monetary and Macroprudential Policy”, International Journal of Central Banking, 9, 219–276.

Kockerols, T. and C. Kok (2021): “Leaning Against the Wind”, Macroprudential Policy and the Financial Cycle”, International Journal of Central Banking, 17(5), 177-235.

Kockerols, T., E. Kravik, and Y. Mimir (2023): “Leaning against persistent financial cycles with occasional crises”, ESM Working Papers, No 56.

Svensson, L. E. (2017a): “Cost-benefit analysis of leaning against the wind”, Journal of Monetary Economics, 90, 193 – 213.