We investigate the effect of the greenhouse gas (GHG) emissions of firms on bank loans using bank–firm matched data of Japanese listed firms. Previous findings suggest that climate risks priced in corporate bonds or syndicated loans are statistically significant but economically minor. We uncover bank lending behavior in terms of the loan amount, i.e., quantity of credit, considered to have a more direct effect on firm investment decisions. We show that banks significantly decrease loans to firms with higher GHG emissions. In addition, we find that banks with greater leverage and a lower return on assets are more likely to decrease loans to firms with high GHG emissions.

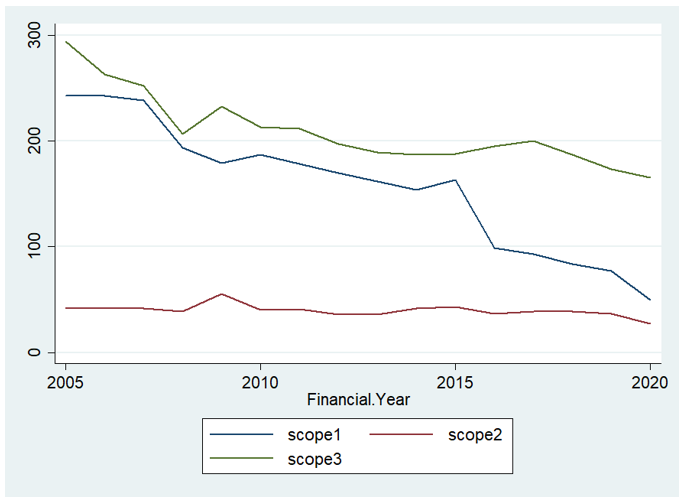

Facing an urgent challenge of environmental problems, central banks such as the European Central Bank and Bank of Japan (BOJ) have embarked on “green” monetary policies in recent years (European Central Bank (2022), Bank of Japan (2021)). To understand better the effects of these green policies, it is helpful for policy makers to recognize possible channels through which the behavior of financial intermediaries impacts on climate risk. For instance, in Japan, the intensity of greenhouse gas (GHG) emissions from listed firms has substantially decreased since the second half of the 2000s, as seen in Figure 1. A natural and worth examining question to this finding is: whether and, if any, how and with what mechanism had the banking sector contributed to the greener firm behavior?

Figure 1: Average Intensity of Japanese Firms

Note: The line plots the simple average intensity of GHG emissions of Japanese firms based on the data from Trucost. Scope 1 is emissions from directly emitting sources that are controlled by a company. Scope 2 emissions are those from the consumption of purchased electricity or other sources of energy generated upstream from a company’s direct operations. Scope 3 emissions are all other emissions associated with a company’s operations that are not directly owned or controlled by the company.

In a recent paper of ours – Takahashi and Shino (2023) – we investigate whether the greenhouse gas emissions of borrowing firms affect loans to them using bank-firm level loan data for Japanese listed firms from 2006 to 2018. In particular, we focus on the heterogeneous behavior across banks with different financial characteristics and examine whether the credit risk or reputation risk channel is a dominant factor to explain GHG emission effects. The credit risk hypothesis considers that firms with high GHG emissions are exposed to higher transition and physical risks. The reputation risk hypothesis emphasizes that investors with greater exposure to high GHG emissions firms are not preferred in capital markets and thereby incur higher costs of funding. Although those two hypotheses are not mutually exclusive, it does provide some policy implications to investigate which of these two channels dominates.

In what follows, we explain the relationship between GHG emissions and bank lending and then turn to the heterogenous effect across different banks’ characteristics. Finally, we show suggestive evidence of why the GHG emissions matter for bank lending and discuss policy implications.

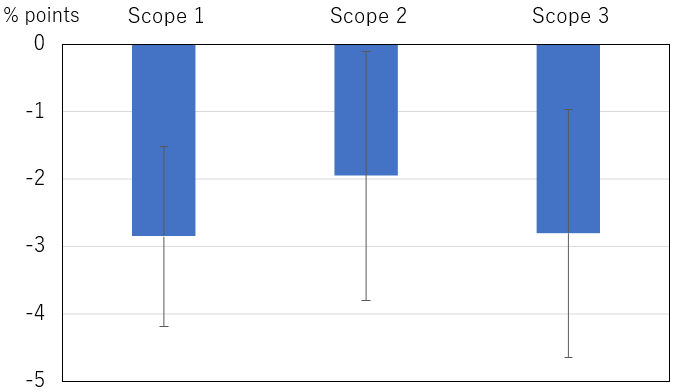

First, we examine the relationship between firms’ GHG emissions and bank loans. Figure 2 shows the impact of GHG emissions on bank loans for scope 1, 2 and 3. They indicate that the effect of GHG emissions is negatively significant and an increase of one standard deviation in GHG emissions for scope 1 decreases bank lending by -2.9 percentage points. This is also economically significant given that the median growth rate of bank loans is zero during the sample period. We also conducted robustness checks by controlling for bank- and sectoral time varying unobserved effects and find that the impact of GHG emission for scope 1 is significant while GHG emissions for scope 2 and 3 do not have significant effects. We also find that the emission intensity – defined as emissions per sales – affects significantly bank loans.

We have learned from a long strand literature and the history of financial crises that not always all banks behave homogenously. For example, if banks consider that firms with high GHG emissions are exposed to larger physical and transitional climate risks that bring with them additional costs, banks with low profitability or unsound balance sheets may be less willing to lend to these highly risky firms to avoid incurring further losses from risky lending. To examine whether this heterogeneous effect exists, we estimate the impact of the interaction effect between GHG emissions and low profitability (or high leverage) bank indicator. We find that the interaction effects between low profitability or high leverage dummies are significant, indicating that less financially unhealthy banks are more sensitive to borrowers’ GHG emissions by around 20%. This result also suggests that banks take into account the credit risks of high emitters because those effects have more substantial impact on banks with weak financial condition.

Figure 2: Effect of GHG Emissions on Loans

Note: The figure provides the estimated impact of one standard deviation increase in GHG emission level on bank loans based on the estimation results for the panel regression with the growth rate of bank loans at the bank-firm level as the dependent variable. The error bars indicate 95% confidence intervals.

We further investigate which of the two channels is more dominant to explain the negative effect of high GHG emissions on bank loans: credit risk or reputation risk. More specifically, we can expect that banks with more transparency in terms of disclosure of the banks’ exposure to climate risks would be under higher pressure to avoid misconduct than those that do not disclose any information. Although there is an issue of the self-selection problem, it is plausible to consider that banks with high transparency are exposed to larger reputation risk. Therefore, if reputation risk is a main driving force, more transparent banks are more sensitive to borrowing firms’ GHG emissions than non-transparent ones.

To test this hypothesis, we use the Bloomberg ESG environment disclosure score, an index indicating how well a firm discloses information related to climate risks compared to the industry standards and large environment score corresponds to the associated firm’s high transparency. If the reputational channel is dominant, banks with higher ESG disclosure score are more sensitive to firms’ GHG emissions. We obtain results indicating that the interaction effect between banks’ ESG disclosure score and firms’ GHG emissions is not significant. In other words, banks did not change their behavior depending on the degree of their own transparency. This result is suggestive evidence that the reputation risk would not be a main driving factor for the effect of GHG emissions on lending even though the estimation errors on the interaction effects are not small.

We find that loans to firms with higher levels of GHG emissions and intensity are likely to decrease more than those to firms with lower GHG emissions. In addition, the effect of GHG emissions on loans is larger for loans from banks with high leverage and low profitability, which implies that lending banks consider high GHG emissions as being associated with higher future credit costs. Finally, banks with high ESG environment disclosure score are not necessarily more sensitive to borrowing firms’ GHG emissions than low disclosure score banks, which suggesting that the reputational channel would not drive the effect of GHG emissions. These results have some policy implications. First, banks were very keen to know about the environmental consequences of their lending even before the introduction of ’Green operations’ by the BOJ in 2021. Second, lending behavior to brown firms significantly varies across banks. This implies that when a new policy related to green finance is introduced, it is likely to affect the lending behavior of banks heterogeneously.

Bank of Japan. 2021. “Outline of Climate Response Financing Operations.”

European Central Bank. 2022, July 4. “ECB takes further steps to incorporate climate change into its monetary policy operations.” [Press release].

K. Takahashi and J. Shino. 2023. “Greenhouse Gas Emissions and Bank Lending.” BIS Working Papers, No. 1078.