The opinions expressed in this paper are those of the author and do not necessarily reflect the views of the Banca d’Italia or the Eurosystem.

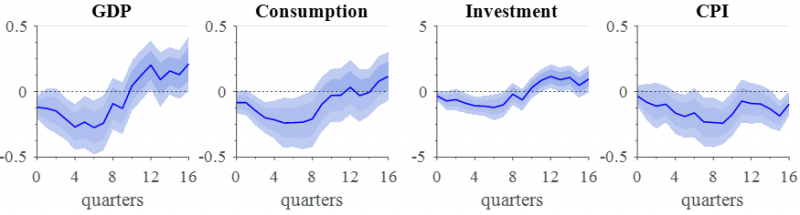

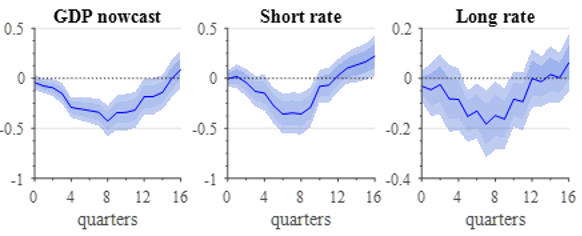

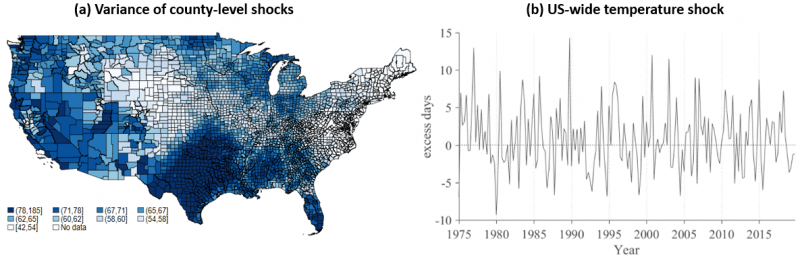

The constructed US-wide shock is then used to study the average response of key economic variables to temperature variations between 1975q1 to 2019q4, using local projections. Figure 2 shows the impacts on the US economy up to 16 quarters after the shock: exceptional temperatures have a negative effect on GDP, which increases over time reaching a trough after 2 years, with a strong impact coming from private investment. Moreover, shocks reduce the Consumer Price Index (although with a lag), suggesting that demand-side effects are predominant. Temperatures also induce a significant reaction by the Federal Reserve and financial markets, displayed in Figure 3: in line with the response of GDP, the Fed’s economic nowcasts (produced within the set of Greenbook Forecasts) are also revised down, tracking the downturn as time passes (first picture). This induces an expansionary monetary policy reaction as short rates also fall, with effects spreading out to the long-end of the yield curve (second and third picture).