References

Aguiar, M. and E. Hurst (2005). Consumption versus Expenditure. Journal of Political Economy 113(5), 919–948. Publisher: The University of Chicago Press.

Aguiar, M. and E. Hurst (2007). Life-Cycle Prices and Production. American Economic Review 97(5), 1533–1559.

Bems, R. and J. di Giovanni (2016). Income-Induced Expenditure Switching. American Economic Review 106(12), 3898–3931.

Burstein, A., M. Eichenbaum, and S. Rebelo (2005). Large Devaluations and the Real Exchange Rate. Journal of Political Economy 113(4), 742–784.

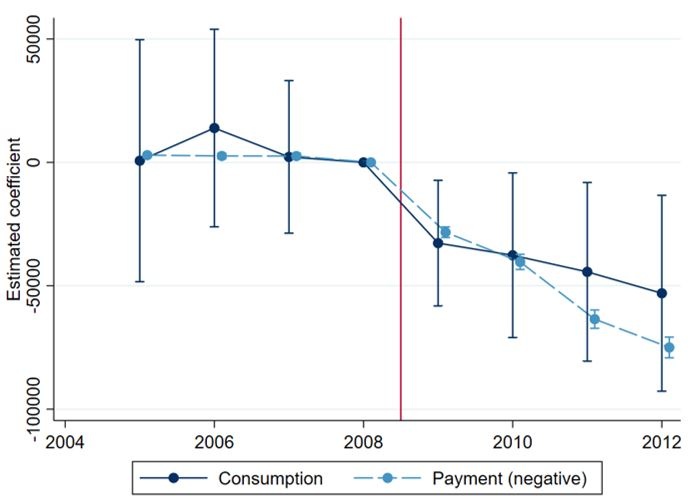

Gyöngyösi, Gy., J. Rariga, and E. Verner (2022). The anatomy of consumption in a household foreign currency debt crisis. ECB Working Paper Series No 2733/September 2022.

Hárs, A. (2016). Emigration and Immigration in Hungary after the Regime Change By International Comparison. In Z. Blaskó and K. Fazekas (Eds.), The Hungarian Labor Market 2016, pp. 39–54. Budapest: Institute of Economics, Centre for Economic and Regional Studies, Hungarian Academy of Sciences.

Jaimovich, N., S. Rebelo, and A. Wong (2019). Trading down and the business cycle. Journal of Monetary Economics 102, 96–121.

Melzer, B. T. (2017). Mortgage debt overhang: Reduced investment by homeowners at risk of default. The Journal of Finance 72(2), 575–612.