What are the micro drivers of the economy’s reaction to large macro shocks? In this policy brief, we show that very large exporters react more strongly to common shocks, which largely determines the macro response. Using data for French exporters, we show that during 1993-2020, top exporters explain over 40% of aggregate fluctuations. Large exporters drove the exports collapses in the Great Financial Crisis (GFC) and the Pandemic. The collapse of French exports in 2020 was driven by the greater responsiveness of major exporters to demand shocks, with disruptions in global value chains playing a secondary role.

Changes in the performance of a handful of very large firms matters for aggregate outcomes in granular economies (Gabaix, 2011). The “micro to macro” approach, linking micro behaviour to macro outcomes, has considerably advanced our understanding of macro aggregates such as business cycles, comparative advantage (Gaubert & Itskhoki, 2020), and the international transmission of shocks (Di Giovanni et al., 2012).

Since changes in the performance of these large firms matter for the macroeconomy, it is paramount to understand their roots. Why do large firms perform differently than the smaller ones? While the literature has focused on the role of idiosyncratic shocks (Kramarz et al., 2019), a complementary view poses that large firms have differential reactions to common shocks affecting all firms. This approach posits that macro shocks lead to heterogeneous reactions, in particular by the largest firms, which in turn determine the macro reaction to the initial shock. In a recent paper (Bricongne et al., 2022a) we analyse the contribution of the largest exporters to aggregate export fluctuations over a long period spanning 1993-2020, and focusing on two large-scale macro shocks: the Global Financial Crisis and the covid-19 Pandemic. We rely on the universe of detailed firm-level export data collected by the French Customs office, containing export values by destination country at a finely-defined product codes and, crucially, available at a monthly frequency.

We decompose aggregate export growth (at quarterly frequency for the sake of readability) into an unweighted average of firm export growth rate and a granular residual. The latter captures the covariance between firm size and firm growth. If the response to macro shocks were uncorrelated with firm size, then the granular residual would be zero. The granular residual is not zero and, furthermore, it explains a large share of aggregate export fluctuations: 42% of the variance of aggregate export growth. Moreover, the coefficient of correlation between unweighted average firm growth and the granular residual is close to 0.5. This implies that large exporters tend to do worse than the average firm in times of downturn, and better than average in times of upturn (see Bricongne et al., 2022b for the evolution of these variables during 1993-2020).

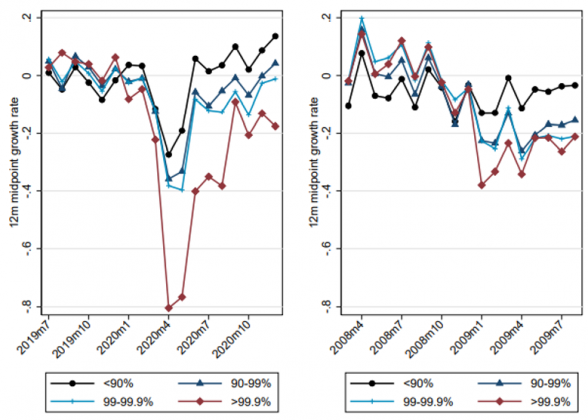

The overreaction of large firms to macro shocks is sizeable and clearly seen in the case of the two largest macro global shocks of the past decades, in which the collapses of French exports were of similar magnitude (-17.4% for 2009/2008 and -16.3% for 2020/2019). Not only are the two export collapses almost entirely explained by the intensive margin (firms that continue to export), but they were also caused by the largest exporters, whose export growth rates were significantly lower than those of the average exporter. The top exporters declined by substantially more than the average exporter, controlling for composition effects in terms of sectors and destinations. Such pattern holds in both crises. Interestingly, in both events the largest exporters also experienced a slower recovery than those in the bottom 90%. This is shown in Figure 1 where we plot the 12-month midpoint growth rate of exports for French firms at different point of the size distribution.

Figure 1: 12-month midpoint growth rates by exporter-size bins

Note: Each line shows the weighted average mid-point growth rates of firms in each of four bins of the pre-crisis exporter-size distribution, which equals the aggregate bin-level mid-point growth rate. For each size bin, we focus on the set of continuing exporters, keeping the set of exporters in each size bin fixed over time.

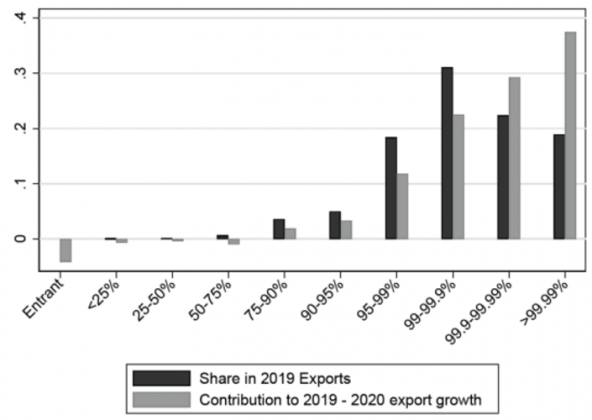

We now zoom in the export collapse of April and May 2020 in Figure 2. Given the large concentration of exports, we choose particularly fine bins at the top of the distribution. For instance, the top 1% (roughly 1,000 firms) account for over 70% of total exports. The black bars show the share of aggregate exports in April and May 2019 accounted for by each size bin.

We then compare the pre-crisis export share of each bin with its contribution to the aggregate export collapse between April and May 2019 and April and May 2020, measured as the change in total exports of a bin divided by the change in aggregate exports. If all firms grew at the same rate, the contribution of each bin would equal its pre-crisis share. While growth rates by size bin were very similar prior to both shocks, Figure 2 shows that the small group of «Superstar» exporters disproportionately explains the slump in exports during Covid. The top 0.1% of exporters contributed 67% to the collapse in aggregate exports, while their pre-crisis share was only 41%. Within the top 0.1%, the 10 largest exporters alone account for around one third of the export collapse, while they exported 19% of the total pre-crisis values. The message is the same as in Figure 1. The negative relationship between pre-crisis size and export adjustment to the crisis holds also within the set of 1,000 largest exporters.

Figure 2: Export share in 2019 and contribution to 2019-2020 trade growth, by size bin

Note: Pre-crisis export share and contribution to the aggregate export collapse between April and May 2019 and April and May 2020. Exporter-size bins are constructed using the 2019 export value by firm.

The Covid-19 Pandemic provides us with an excellent laboratory to study the role of heterogeneous reactions to aggregate shocks. The shock was sudden and exogenous. While sanitary measures were imposed in most French trade partners, their timing offer variation that we can exploit, thanks to the use of monthly frequency data, to measure both supply and demand shocks.

Large firms are indeed more likely to be more engaged in complex GVCs and more likely exposed to supply disruptions caused by systemic shocks (Baldwin & Freeman, 2022): our aim is to understand whether the larger GVC exposure of top exporters can explain their stronger reaction to the shock, not whether GVCs are important per se. We complement the export data with information on firm-level imports and sales, and measure GVC exposure of each exporter with the ratio of imported intermediate inputs to sales (IIS ratio) and supply shock exposure using information on lockdowns in the origin countries of imports. We develop a flexible regression framework that relates growth rates in each market (defined as a product-destination pair) to size bin dummies. The data reveals that adding GVC measures to our regressions does not affect the magnitude and significance of the exporter size-bin dummies. In other words, large exporters overreaction was not due to their deep engagement in GVCs.

On the contrary, we do find convincing evidence of a demand channel, which is not driven by the sector or destination composition of exporters. Instead, we estimate a larger elasticity of large firms to destination-country lockdowns. In particular, we regress the midpoint growth rate at the firm-product-country-month level on the Oxford Stringency Index (Hale et al, 2021) in each origin country at each month. Identification exploits variation in export growth of the same firm across destinations with varying degrees of lockdowns, fully controlling for product-level shocks. The regression fully controls for firm-level supply shocks, originating both in France and abroad, by including firm*month fixed effects. On average, going from no lockdown to full lockdown reduced the midpoint growth rates by 0.6 points. However, the effect is strongly heterogeneous, being almost double for firms in the top 0.1% (1.0) with respect to the bottom 99.99% (below 0.5).

Identifying the role of large firms for macroeconomic aggregates is a lively and critically important area of research. It has a variety of implications for the framing of economic policies. Our results show that the response of aggregate exports to large macroeconomic shocks is largely driven by the large weight of large firms in the economy and their greater sensitivity to these shocks. The very high contribution of export champions to commercial success may thus turn into a vulnerability in the event of a sudden downturn in the business cycle.

Baldwin, R. & Freeman, R. (2022), Global supply chain risk and resilience, Vox-EU column 6 April.

Bricongne J.C., Carluccio J., Fontagné L., Gaulier G. & and Stumpner S. (2022a), From Macro to Micro: Large Exporters Coping with Common Shocks, Bank of France Working Paper 881, July.

Bricongne J.C., Carluccio J., Fontagné L., Gaulier G. & and Stumpner S. (2022b), Vox.eu column, 27 July. https://new.cepr.org/voxeu/columns/large-firms-react-more-strongly-macro-shocks-and-it-matters.

Di Giovanni, J., Levchenko, A. & Méjean, I. (2012), The role of firms in aggregate fluctuations, Vox-EU column 16 November.

Di Giovanni, J., Levchenko, A. A. and Méjean, I. (2020), Foreign shocks as granular fluctuations, Technical report, National Bureau of Economic Research Working Paper 28123.

Gabaix, X. (2011), The granular origins of aggregate fluctuations, Econometrica, 79(3): 733-772.

Gaubert C. & Itskhoki O. (2020), Superstar firms and the comparative advantage of countries, Vox-EU column 14 August.

Hale, T., Angrist, N., Goldszmidt, R., Kira, B., Petherick, A., Phillips, T., Webster, S., Cameron-Blake, E., Hallas, L., Majumdar, S. and Tatlow (2021), A global panel database of pandemic policies (Oxford COVID-19 government response tracker), Nature Human Behaviour.

Kramarz, F., Martin, J. & Méjean, I. (2019), Idiosyncratic risks and the volatility of trade, Vox-EU column 11 December.