This SUERF policy brief includes research content published by J.P. Morgan on 08/05/2022. J.P. Morgan has granted SUERF a limited right to re-publish this research on an information only basis. J.P. Morgan has no liability in any regard for the publication of this SUERF policy brief or SUERF’s decision to reproduce any J.P. Morgan research content contained herein. It is not an offer to buy or sell any security/instruments or to participate in a trading strategy or trading activity; nor does it constitute any form of personal financial advice or investment recommendation by J.P. Morgan. This information should not be relied upon for any reason whatsoever by any natural or legal person. For important current standard disclosures that pertain to J.P. Morgan’s research please refer to J.P. Morgan’s disclosure website: https://www.jpmm.com/research/disclosures.

Natural gas has become an unexpected driver of the global macroeconomic and market outlook.

Russia is the world’s largest exporter of natural gas, supplying ~25% of global exports (through pipeline and LNG) with a staggering 77% of that supply flowing to Europe. The Russia-Ukraine war has constrained supplies and disrupted import and export patterns, leading to significant price volatility.

These dynamics along with heightened geo-political uncertainty has led to a significant deterioration in the macro outlook for Europe, prompting our Economists to forecast a contraction in 4Q22-1Q23 of -0.5%q/q ar.

Current global natural gas supply and demand is very tight. In addition to constrained supply from Russia, labor and material shortages have also contributed to decreased global capacity and surging prices. These dynamics are expected to persist for the rest of the year and into 2023.

The macro environment has dramatically changed the flow of natural gas supply across the world:

Replacing Russian gas supplies is complicated and difficult, especially for Europe. Countries such as Germany are struggling to meet demand despite cutting consumption by 10-20%. Despite attempts to replace the supply losses from Russia through other sources – including increasing supply from Norway and the Netherlands, as well as the deployment of LNG import infrastructure – Russian gas supplies are still expected to be needed to meet winter 2022/2023 demand.

Weather is a primary demand driver for natural gas. With temperatures rising across Europe and the US, demand for gas used in cooling has increased:

Arun Jayaram, Head of JPM’s U.S. Exploration and Production and Oilfield Services and Equipment Research teams, forecasts natural gas demand to grow by 4% YoY for 2022 – likely related to the heat.

In addition to extreme heat, US Gas storage levels – which are now 10% lower than last year – are also exacerbating the supply demand imbalance.

Storage has become a more prominent factor in the outlook given its relationship to energy security. In Europe, countries with the highest storage levels and more energy security include Portugal (100%), Poland (98%) and the UK (98%). In contrast, countries that are reliant on Russian gas, have, on average, lower storage levels with Italy at 66% and Germany at 65%.

And the situation is not expected to improve dramatically anytime soon. The commodities strategy team highlights that there is a looming threat of a full-scale shutoff of natural gas flows on Nord Stream 1 to Europe. “The primary concern for storage is severely colder than normal winter weather for Europe, which could lead to more residential and commercial heating-related demand. Overall, there could be up to a 90% surge in demand relative to that of the summer season, potentially causing NorthWest Europe to run out of natural gas this winter season.”

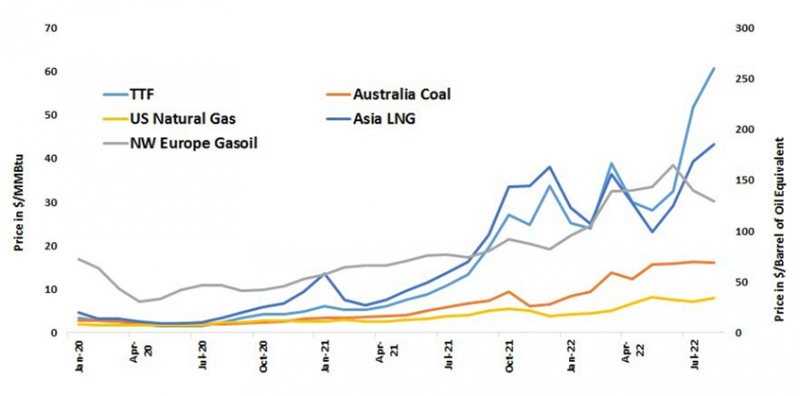

The shortages of natural gas and high prices should trigger switching to other fuel sources. The European Commission had initially asked EU countries to cut gas usage by 15% by March 2023, while the final plan agreed to allows for country-specific targets and a less ambitious cut of ~10% in aggregate. Measures included in the plan emphasize that member states should prioritize switching, especially in the industrial sector, to renewables or coal, oil or nuclear power if needed (Figure 1).

Figure 1: Global Energy Costs – Northwest European natural gas prices are so high, that even with the Coal prices being up ~300% and gasoil prices up ~200% from this time last year, switching to either fuel would make economic sense

**TTF is the benchmark natural gas market representing the supply and demand balance of Northwest Europe

** Both axes represent different units for prices

Sources: JPM Commodities Strategy Team

We go deeper on the economics of energy switching, with Shikha Chaturvedi, Head of Global Natural Gas and Natural Gas Liquids Strategy.

We believe that companies are already turning to other fuel sources for power generation. This fuel switch for power generation is from gas to coal-fired:

In recent months we have seen underperformance in natural gas industrial demand relative to our expectations – including a ~10% decrease in demand this summer – likely reflecting higher prices. This suggests that some additional fuel switching is most likely occurring in the industrial sector.

Looking ahead, Shika Chaturvedi notes, “Even if Northwest Europe can persevere through the winter season, refilling storage during summer 2023 will likely be far more difficult than we have observed during summer 2022.“ She cites that “Asian LNG demand, led by weakness in Chinese LNG demand, has made Europe’s refill of natural gas storage this injection season far easier“ and that dynamic will not persist next year as “increased LNG demand will keep the global market tight, making it more difficult for Europe to compete for LNG.“

While our European Utilities Credit team notes that “Europe [is] facing the real prospect of insufficient energy supplies to meet demand in 2H22.” While, all parts of the utility sector value chain are likely to be affected by any systemic shortages of energy, the team notes that “negative impacts may well be manageable for large parts of the industry through either direct balance sheet support, or indirect support via energy market intervention.” Most recently, the EU managed to “broker a deal on a gas savings plan ahead of winter despite diverging views. Member states have agreed to coordinate savings and redistribute supply across the region, with the aim of mitigating rationing risk and preparing for a worst-case scenario of a complete halt of Russian gas supply.

Cross Asset Strategy: Catching up with Shikha Chaturvedi, Head of Global Natural Gas Strategy (August 1, 2022 | Tom Salopek & Shikha Chaturvedi et al.)

Global Commodities – US Natural Gas: Record heat evaporates Freeport storage cushion (July 28, 2022 | Shikha Chaturve- di et al.)

Oil Weekly: Recession is not priced in (July 27, 2022 | Natasha Kaneva et al.)

Global LNG Analyzer: Nord Stream 1 restarts operations, but utilization remains low (July 25,2022 | Mark Busuttil et al.)

JPM Natural Gas Reservoir: Updated U.S. NatGas Supply-Demand Model; Forecasting Oct End Storage at 3.39 Tcf, But Looser Conditions in 2023 (August 1, 2022 | Arun Jayaram et al.)

North American Utilities: Thoughts into 2Q22: Summer Breeze Makes Utes Feel Fine (July 26, 2022 | Jeremy Tonet et al.)

The EU gas savings plan ahead of a long winter (August 5, 2022 | Marco Protopapa)

At the Gas Market Crossroads: Utility Credit Sector Risks May Peak in H2 22. Impacts Manageable for Most, but Sector UW is Most Prudent ( July 20, 2022 | William Wade et al.)

Euro area: Expansion runs out of gas (July 26, 2022 | Greg Fuzesi et al.)