References

Arellano, C (2008): “Default risk and income fluctuations in emerging market economies”, American Economic Review, vol 98 (3), pp 690-712.

Arslanalp, S and L Sunder-Plassman (2022): “Sovereign Debt Repatriation During Crises”, IMF Working Paper No 2022/077.

Arslanalp, S and T Tsuda (2014a): “Tracking global demand for advanced economy sovereign debt”, IMF Economic Review, vol 62 (3), pp 430-464.

Arslanalp, S and T Tsuda (2014b): “Tracking global demand for emerging market sovereign debt”, IMF Working Paper No 14/39.

Bianchi, J, J Hatchondo and L Martinez (2018): “International reserves and rollover risk”, American Economic Review, vol 108 (9), pp 2629-2670.

Eaton, J and M Gersovitz (1981): “Debt with potential repudiation: theoretical and empirical analysis”, Review of Economic Studies, vol 48 (2), pp 289-309.

Fahri, E, and J Tirole (2018): “Deadly embrace: sovereign and financial balance sheets doom loops”, Review of Economic Studies, vol 85 (3), pp 1781-1823.

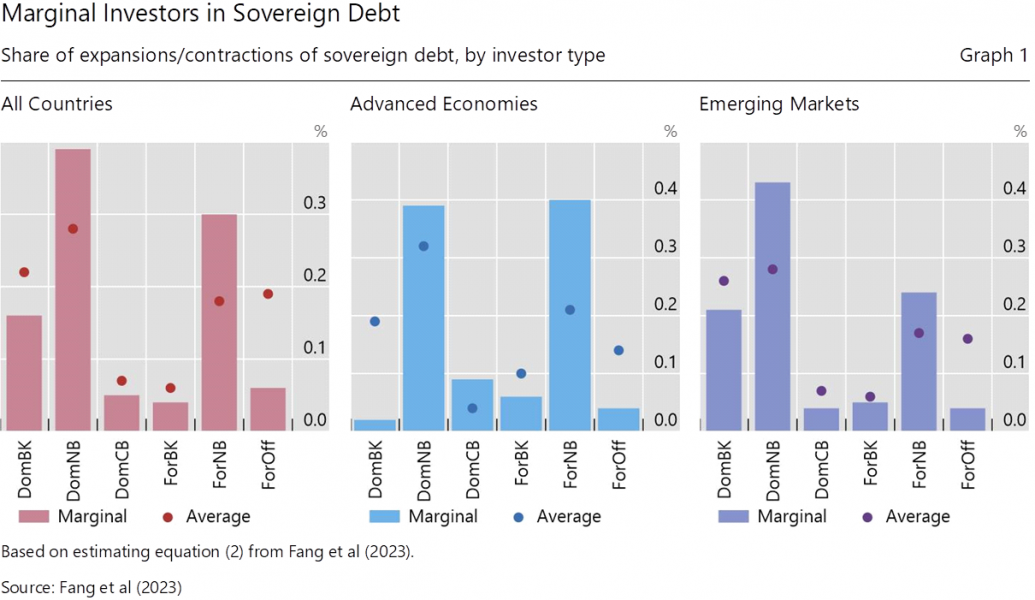

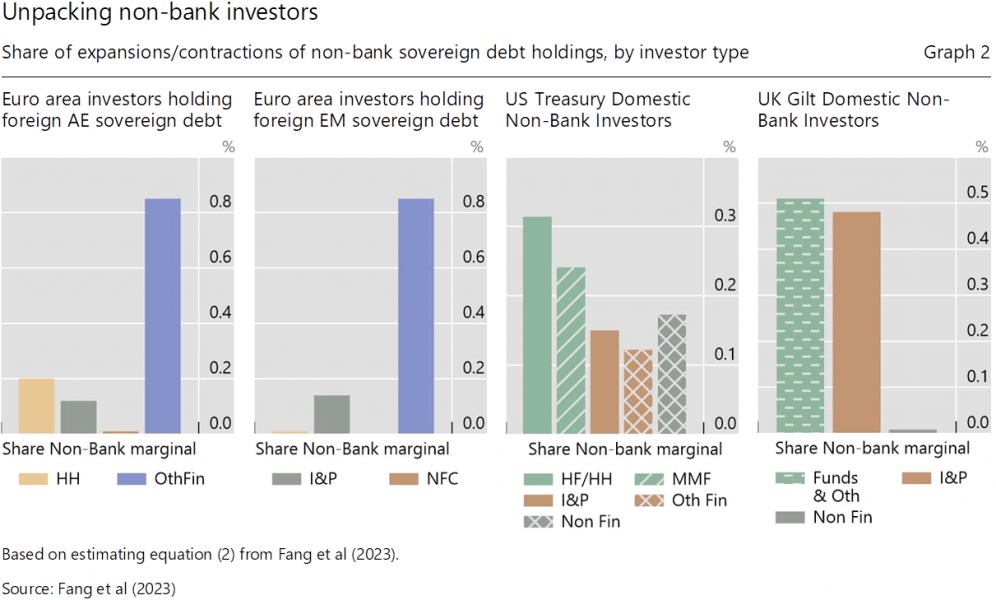

Fang, X, B Hardy and K Lewis (2023): “Who holds sovereign debt and why it matters”, NBER Working Paper No 30087, BIS Working Paper No 1099.

Gennaioli, N, A Martin and S Rossi (2014): “Sovereign default, domestic banks, and financial institutions”, Journal of Finance, vol 69 (2), 819-866.

Ghosh, A, J Ostry and C Tsangarides (2017): “Shifting motives: explaining the buildup of reserves in emerging markets since the 1980s”, IMF Economic Review, vol 65, pp 308-364.

Koijen, R, and M Yogo (2019): “A demand system approach to asset pricing”, Journal of Political Economy, vol 127 (4), pp 1475–1515.

Koijen, R, and M Yogo (2020): “Exchange rates and asset prices in a global demand system”, NBER Working Paper No 27342.