This column is based on a recent Bank of Finland Discussion Paper (2/2023).

Analyses of zombie firms have emphasised the role of bank financing as the reason for zombie survival. This conclusion was made despite no comparative analysis of the sources of external finance for zombie firms. The first analysis of this sort shows – surprisingly – that there is no connection between zombie survival and bank financing. The result is not sensitive to the choice of the many definitions of zombie firms in the literature. Instead, a role is found for owners (i.e. equity funders) in keeping zombies alive in the (often correct) anticipation of recovery.

Zombie firms – mature firms that are unprofitable but remain in the market rather than exiting through bankruptcy or takeover – have attracted increasing attention over the past few years, particularly in the context of whether or not low interest rates and other policy measures have contributed to their increasing number. The COVID-19 pandemic gave further impetus to this debate: the large-scale support measures put in place to support the corporate sector may have shielded many firms from the process of creative destruction, leading to a misallocation of resources towards unproductive firms longer term.

The literature generally finds that the prevalence of zombie firms has increased, with banks rolling over loans to non-viable firms seen as being a key factor behind the rise in zombie firms. An early contribution to the literature is by Caballero et al (2008) who link Japan’s lost decade to weakly capitalised banks keeping credit flowing to insolvent borrowers as a way for to remain compliant with capital standards. Many recent papers focus on the euro area, with Acharya et al (2019), for example, finding that the European Central Bank’s Outright Monetary Transactions programme did not fully translate into growth but instead zombie lending by weakly capitalised banks.

My recent paper is the first in the zombie literature to consider non-bank sources of finance. The role of non-bank providers of finance has been extensively studied in the corporate finance literature but has so far been overlooked in the literature on zombie firms. Using survey data, as opposed to just financial statement, credit registry and/or market data, it is possible to: identify non-bank sources of zombie funding; identify firms’ (self-reported) most important financing relationships; and go a step further in distinguishing between zombie firms and weak firms misclassified as zombies: firms’ self-reported purposes for applying for external finance allows firms with permanently weak balance sheets and cashflow to be distinguished from firms with temporarily low earnings due to new investment. Survival analysis techniques help shed light into the extent to which access to different sources of finance allow firms to become zombies or keeps firms from exiting zombie status through bankruptcy or by recovering (i.e. becoming productive once more).

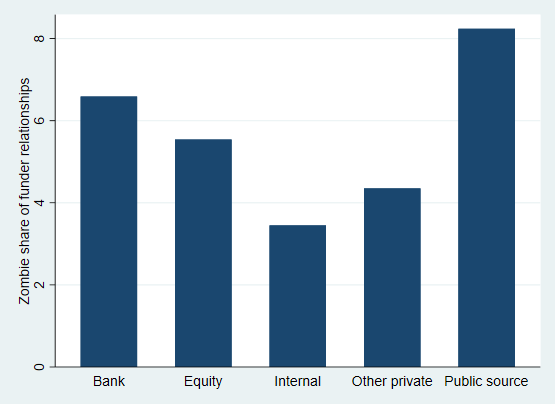

Using Finnish data, the study finds that banks are overwhelmingly the largest funder of firms classified as zombies using the definitions proposed in the literature, perhaps justifying the focus of the literature on bank funding. This, however, may simply be due to banks’ share of the credit market: banks are in the middle of the pack when it comes to the share of zombies as a percentage of all borrower relationships (Figure 1). Out of the firms reporting to be predominantly funded by publicly-owned financial institutions, over 8% were classified as zombies compared to around 6.5% and 5.5% among firms funded by banks and by equity, respectively.

Figure 1: Zombie firms as a share of total firm relationships by funder type

Notes: The data is based on a credit conditions conducted (in Finnish) by a number of organisations including the Bank of Finland. The survey question that this chart data is based on translates into “Who is your main financier (select only one)?” or “What is your most important source of external finance?” As proposed in Adalet McGowan et al (2017), a zombie firm is defined as a firm aged ten or over that has an interest coverage ratio of less than one for at least three consecutive years. The interest coverage ratio is calculated as the ratio of operating profits to interest expenses. The labelling of the funding sources are as follows. Banks refers to private, regulated banks; public sources refer to publicly-owned financial institutions; other private refers to non-bank financial institutions; internal funds refers to funds generated by the firm’s activities; equity refers to owner’s equity.

Contradicting the results of the existing literature, no statistically significant relationship is found between zombie firms and banks or bank characteristics. The result is not sensitive to the choice of zombie definition even though the overlap between the different definitions proposed in the literature can be small. Among external sources of finance, only one statistically significant relationship is found: equity funding is associated with an increased likelihood of zombie status compared to firms predominantly reliant on turnover.

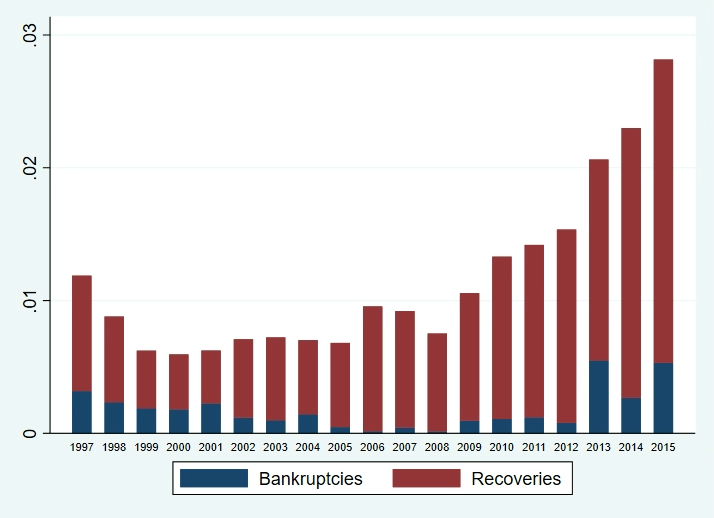

Changes in the number of zombie firms are driven equally by the number of firms becoming zombies and the number of firms leaving zombie status. No funding source is found to be associated with a higher risk of a healthy firm becoming a zombie. However, all external funding sources, apart from non-bank financial institutions (so called shadow banks), are associated with a longer zombie lifetime. Further, equity funders (that is, the firm’s owners) prolong zombie lifetime by more than any other source. The results show, for example, that only a quarter of zombies financed by banks persist beyond five years, whereas three-quarters of equity-financed zombies make it beyond the five-year mark. Exit out of zombie status is overwhelmingly due to recovery and becoming a healthy firm as opposed to bankruptcy (Figure 2).

Figure 2: Entries and exits out of zombie status

Notes: Zombie firms are defined as in Figure 1. Bankruptcy dates are from the Finnish Business Register.

The observation that the stock of zombie firms is driven as much by exits as entries into zombie status begs the question: are we capturing genuine zombies or just viable firms facing temporary liquidity squeezes and/or credit constraints? It would be desirable for a bank or non-bank lender to continue to fund the latter sort.

A number of approaches have been proposed in the literature to better distinguish zombie firms from financially distressed firms more broadly, given that existing zombie definitions e.g. those based on firm performance (e.g. Adalet McGowan et al 2017) or measures of financial support (e.g. Caballero et al 2008) may capture both. For example, Alvarez et al (2023) define a financially distressed firm based on firm performance, with a subset of financially distressed firms identified as zombie firms if the firm had received new credit.

Using survey data, it is possible to go beyond testing for the sensitivity of the results to whether the financially distressed firm was awarded new credit or not. Firms’ self-reported purposes for applying for new external finance can be used to try to distinguish between firms with low earnings due to investment and those with balance sheet and cashflow problems. Narrowing the definition of zombie firms based on firms’ purposes for new credit applications makes little difference to the results.

The results challenge the perceived wisdom of a link between zombie firms and banks, at least in jurisdictions, such as Finland, that have a highly capitalised banking sector (e.g. IMF 2023) and a relatively efficient insolvency framework (e.g. Becker and Ivashina, 2021). Indeed, the early literature on zombies (Caballero et al 2008 and Peek and Rosengren 2005) was based on a highly unique institutional setting. Instead, the results suggest that equity investors continue to fund firms classified as zombies based on definitions proposed in the literature in the (often correct) anticipation of firms recovering. As discussed in Nurmi et al (2022), a firm’s exit decision is forward-looking and also based on the present value of future net income as opposed to just current returns. Where non-bank sources of funding are relevant, tackling the zombie problem for example via regulatory scrutiny of the quality of banks’ assets (as argued in e.g. Storz et al 2017) as way to avoid prolonged weakness in long-run growth may not be particularly effective. In addition, calls for policy action under e.g. the EU Capital Markets Union to broaden SMEs’ access to funding sources could have unintended consequences for the prevalence of zombie firms or at least in the estimates of them.

Acharya, Viral V, Eisert, T, Eufinger C and C Hirsch (2019), “Whatever it Takes: The Real Effects of Unconventional Monetary Policy”, The Review of Financial Studies, 32(9), pp. 3366–3411.

Adalet McGowan, M Andrews, D and V Millot (2017), “The Walking Dead? Zombie Firms and Productivity Performance in OECD Countries”, OECD Working Paper 1372.

Alvarez, L, Garcia-Posada M and S Mayordomo (2023), “Distressed firms, zombie firms and zombie lending: a taxonomy”, Journal of Banking and Finance, 149, 106762.

Becker, B and I Ivashina (2021), “Corporate Insolvency Rules and Zombie Lending, ECB Forum on Central Banking 2021.

Caballero, R J, Hoshi, T and A K Kashyap (2008), “Zombie Lending and Depressed Restructuring in Japan”, American Economic Review, 98(5), pp. 1943-1977.

International Monetary Fund (2023) “Finland: Financial System Stability Assessment”, IMF Country Report No. 2023/039.

Nurmi, S, Vanhala, J and M Virén (2022). “Are zombies for real?”, International Journal of Industrial Organization 85, 102888.

Peek, Joe, and Eric S. Rosengren, 2005, “Unnatural selection: Perverse incentives and the misallocation of credit in Japan,” American Economic Review, 95(4), pp. 1144-1166.

Storz, M, Koetter, M, Setzer, R and A Westphal (2017), “Do We Want These Two to Tango? On Zombie Firms and Stressed Banks in Europe”, European Central Bank Working Paper Series 2104.