This Policy Brief is based on ECB Working Paper Series No 3074. The views expressed in this paper are those of the authors and do not necessarily reflect the views of the European Central Bank, the Eurosystem, the Bank of England, or any of its respective committees. Acknowledgements: The authors acknowledge the comments and suggestions provided by an anonymous referee and the editorial board of the ECB Working Paper Series, which contributed to improving the manuscript. The authors thank the participants of the workshop, “EMIR Data Analytics for Research, Financial Stability, and Supervision”, held at Banca d’Italia in June 2024, as well as the participants of the DGMF Seminar at the ECB in February 2025. They also thank G. Ferrara, L. Rousová, A. Sowinski, and E. Telesca for the valuable discussion.

Abstract

Sudden spikes in margin calls can lead to severe liquidity strains on non-bank financial institutions (NBFIs), prompting asset fire sales that can heighten systemic risk. We propose a framework to assess NBFIs’ preparedness to cope with derivative margin calls and monitor entities whose net margin outflows are large relative to their liquid assets. We apply the framework to euro area investment funds during the Covid-19 crisis and the 2022-23 monetary policy tightening. We find that, while the pandemic triggered abrupt margin shocks, an increase in rates caused more gradual yet sizable liquidity demands. As a result, distressed funds sold equities and government bonds, propagating stress across markets. Contagion to banks was limited, but we observe some concentrated exposures in a few counterparties. Our framework provides actionable metrics for risk monitoring and stress testing and aligns with the FSB agenda to enhance NBFI resilience to liquidity shocks.

Financial markets over the past decade have been repeatedly shaken by liquidity stress events that originated outside the traditional banking system (Bardoscia et al., 2021; Jansen et al., 2024; Jukonis et al., 2024; Alfaro et al., 2025). The March 2020 “dash for cash” episode, the 2021 collapse of Archegos, the stress in commodity markets in 2022, and the UK gilt turmoil in late 2022 all had a common feature: sudden liquidity demands from margin calls on derivatives and collateralised trades.

In the derivatives market, initial margin is the upfront collateral collected to cover potential future exposure and can be posted in cash or high-quality liquid assets (HQLA), such as government bonds. Variation margin settles current mark-to-market gains and losses and is paid only in cash, typically daily or at a higher frequency.

Post-global financial crisis reforms strengthened the use of initial and variation margins to reduce counterparty credit risk. While these reforms succeeded in limiting the build-up of opaque exposures, they also introduced a new procyclical channel of contagion. In periods of high volatility, margin requirements can rise sharply, forcing institutions to source cash or high-quality collateral at very short notice.

Banks can usually absorb these pressures through regulatory liquidity buffers and access to central bank liquidity facilities. By contrast, non-bank financial institutions (NBFIs), such as investment funds, insurers, and pension funds, can have a more fragile liquidity profile with less reliable liquidity backstops, and can struggle to raise liquidity in stressed markets. Forced asset sales to meet margin calls can deepen price moves, thereby amplifying market turmoil, and transmit stress across sectors.

To assess this risk, we developed a monitoring framework to measure NBFIs liquidity preparedness, i.e. their ability to respond to sudden margin and collateral calls under financial stress. We combine granular derivatives data collected under the European Market Infrastructure Regulation (EMIR) with portfolio holdings of cash and HQLA, and construct liquidity preparedness indictors to identify entities that face unexpectedly high liquidity pressure. We then analyse the selling behaviour of NBFIs and map potential channels of contagion to the wider financial system. This approach informs the ongoing international policy debate aimed at enhancing NBFI resilience to liquidity shocks (Financial Stability Board, 2024).

When markets move abruptly, derivative margin calls can arise faster and larger than expected. We introduce a new analytical framework to assess the systemic risk that could result when NBFIs are not prepared to cope with these liquidity needs. We do so in two stages. First, we identify entities likely to be short of cash and liquid assets relative to their margin obligations. Second, we evaluate how stress could spread within the financial system through asset sales and counterparty links.

We develop two indicators that can be used to identify or assess liquidity risks related to margin calls. When these indicators are monitored at a high frequency, they can provide early-warning signals; when they are used ex-post, they can help to quantify the severity of a given stress episode. For each NBFI, the indicators compare daily net margin outflows (i.e. those paid minus those received) with assets that can be liquidated quickly. One indicator relates total initial and variation margins to the cash and HQLA available for each NBFI (liquidity indicator). The other focuses on variation margin relative to cash only (VM-liquidity indicator), recognising that these margins must be settled in cash.

An entity is classified as distressed when its today’s margin demand is unusually large relative to its own recent history. The emphasis on “unusual” is deliberate: a large but well-anticipated and somehow pre-funded margin call can be managed, while a smaller but unexpected one is more likely to trigger a dash for cash episode. This classification is entity-specific in the sense that it accounts for NBFIs’ strategies and sizes, keeping the focus on preparedness.

Once distressed NBFIs are identified, we can assess the systemic risk associated to their asset sales, by combining the distress signal with up-to-date portfolio holdings. If a large number of distressed NBFIs sell the same asset class at the same time, liquidity strains can intensify and spillover across financial institutions, as prices undershoot. If assets sales are proportional to portfolios compositions and spread evenly across assets, the risk of a market-wide liquidity shortfall is contained. In practice, distressed entities often liquidate the most liquid instruments or collateral-eligible securities first to raise cash quickly, rather than selling assets as a proportion to their overall portfolio composition. Yet, this amplifies price movements and makes market liquidity to evaporate when it is most needed. By highlighting these pressure points, our framework can contribute to a timely risk assessment.

Stress does not get transmitted only through prices; it also propagates through interconnections across financial institutions. Using trade-repository data, we map counterparty networks to identify those banks and dealers most exposed to margin inflows from distressed NBFIs, where a missed or delayed payment could create liquidity shortfalls. Most links are small and diversified, but pockets of concentration exist. Identifying these fault lines contributes to strengthening systemic risk management, informing supervisory dialogue, and improving the design of stress tests for intermediaries at the core of market plumbing.

Our framework is simple and does not need to rely on heavy modelling of margins and HQLA. It stitches together portfolio-level margin flows stemming from euro-area derivatives reporting, granular cash and HQLA holdings, and a securities database to classify HQLA consistently. These features make the indicators transparent, reproducible, and quick to update across quiet and stressed periods. The same building blocks can feed system-wide scenarios assessing, for example, the resilience of NBFIs to margins doubling over two days or to volatility spikes in a specific asset class. As our framework focuses on liquidity preparedness, asset sales and network linkages, it can provide policymakers and supervisors with tools to assess cash or HQLA needs, monitoring vulnerable asset segments during periods of stress, and identify counterparty risks.

We apply our framework to two case studies: the Covid-19 market turmoil and the 2022-2023 monetary policy tightening. The first event shows how an exogenous volatility spike can trigger extreme, synchronised margin calls. The second case study illustrates how a more gradual and, to some extent, anticipated shift in financing conditions can influence NBFI liquidity needs through their derivative exposures. In this analysis, we focus on euro area investment funds, but the exercise could be extended to other non-banks where comparable data exist.

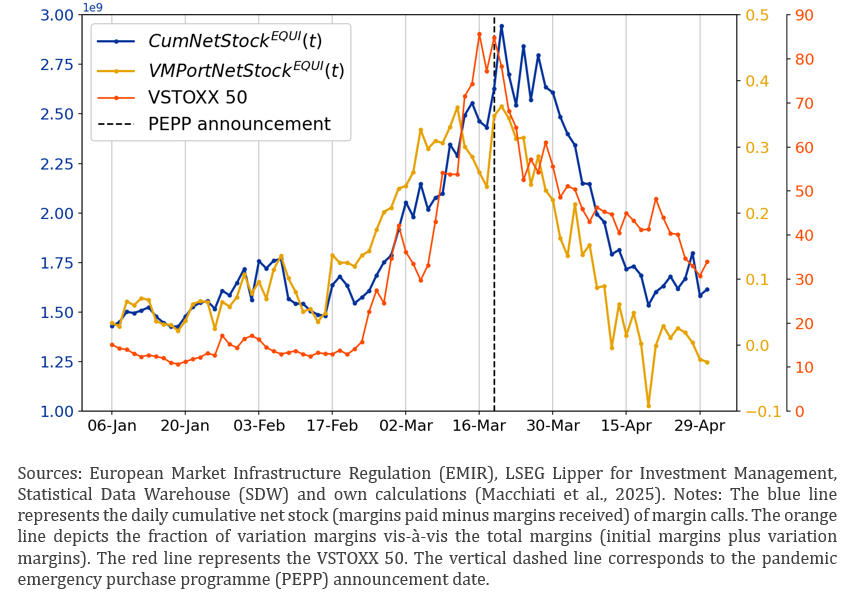

The Covid-19 crisis triggered the most severe stress in financial markets since the global financial crisis. In March 2020, equity and bond volatility surged and derivative margins rose significantly. For euro-area equity derivatives, required margins roughly quadrupled within weeks, and variation margin (which can be paid only in cash) reached nearly 40% of total margin stocks at their peak (Chart 1).

Chart 1. Net margin outflows of equity derivative portfolios of euro area investment funds vs. equity index volatility between January and April 2020

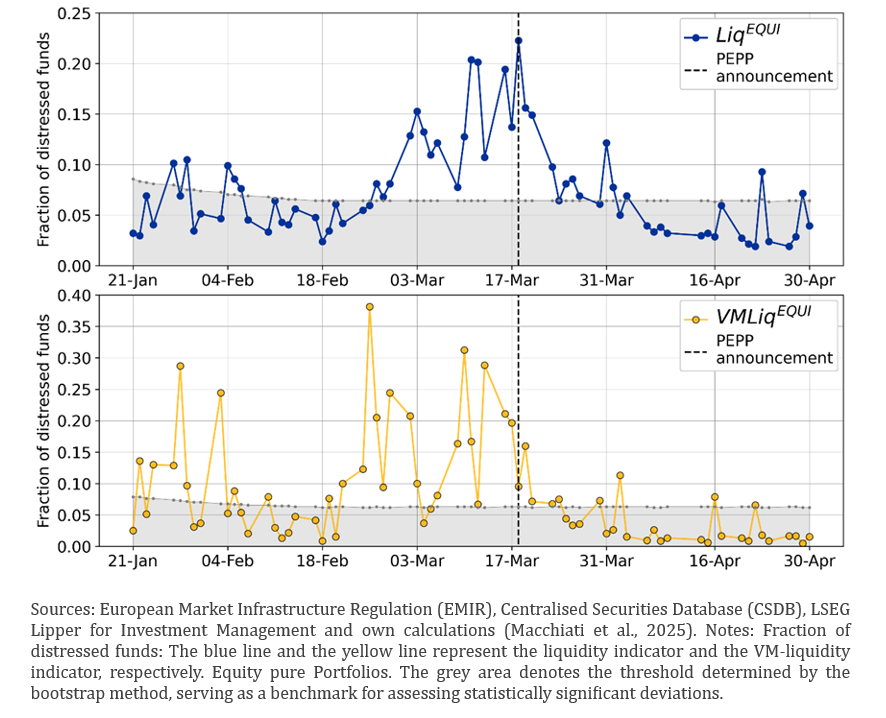

The share of distressed funds rose sharply, reflecting margin outflows that were unusually large relative to each fund’s own recent outflows and liquid buffers. Almost a quarter of investment funds were classified as liquidity-distressed at the height of the Covid-19 turmoil. Up to 40% of funds faced cash shortfalls relative to their margin demands (Chart 2). Selling behaviour seemed to be driven by dash for cash as distressed funds tended to not sell assets proportionally to their portfolios but preferred to sell assets that could be liquidated quickly. Equities featured prominently in these disposals, consistent with the need to raise cash fast and the relative immediacy of execution in equity markets. The result was a feedback loop between margin demands, asset sales, and prices. The sell-off eased after policy interventions, with the ECB announcing its Pandemic Emergency Purchase Programme (PEPP), which stabilised markets.

Chart 2. Fraction of distressed investment funds with an equity derivative portfolio

between January and April 2020

The persistent change in interest rates through mid-2022 to late-2023 delivered a slower, but sustained build-up of pressures. As the ECB raised rates, margin requirements on interest-rate and, at times, FX derivatives increased around monetary policy decision dates. Distress rose gradually, in line with the fraction of strained funds which also increased progressively, reflecting cumulative cash demands over time. Unlike during Covid-19, distressed funds frequently sold government bonds – Level 1 HQLA – to raise cash quickly, which is consistent with rate-driven collateral needs in fixed-income markets: when policy rates change, changes in collateral valuations in fixed income securities can generate margin needs. Distressed funds’ sales were not proportional to their portfolio holding, indicating targeted disposals rather than broad de-risking.

Our network analysis shows that most banks and dealers facing margin inflows from distressed funds were not significantly strained. Yet a small tail of concentrated relationships stands out. These pockets of risk, where large inflows are tied to a few counterparties, show where a missed or delayed payment could translate into meaningful liquidity stress for systemic intermediaries.

This analysis shows that the speed of a shock shapes liquidity risk contagion. The COVID-19 crisis triggered abrupt, system-wide margin calls that generated acute stress among NBFIs. By contrast, monetary policy tightening created slower-moving pressures that nonetheless tested thin liquidity buffers. Moreover, the clustering of distress signals, convergence of asset sales, and concentration of counterparty exposures jointly determine how a localized liquidity squeeze can escalate into a systemic event.

Margin-driven liquidity pressure could lead to systemic risk if significant margin calls need to be met with cash, crowded liquidation choices happen on given asset classes, and concentrated links to systemic intermediaries occur.

Recent shocks have shown how abrupt asset price volatility turns procyclical margins into immediate cash demands. Also, an increase in rates builds the same pressure more slowly as collateral and margin needs cumulate over time. In both cases, the spillover does not come from solvency issues, but from the mismatch between how fast cash is needed and how quickly portfolios can be turned into cash without large losses. Amplification depends on which market segment sales concentrate. If many market participants sell the same instruments at the same time, market depth gets thinner, prices overshoot, and margins ratchet higher, creating a self-reinforcing spiral. Systemic risk therefore emerges from common asset holdings and common liquidation strategies, even when individual sales look prudent in isolation.

Network structure then determines the shape of transmission. Most counterparty exposures to distressed funds are small, but pockets of risk exist, meaning that a small set of concentrated relationships can transmit liquidity stress to banks and dealers at the core of market intermediation. This tail of concentration is where local stress can scale up: a missed margin payment or a delayed settlement at a nexus counterparty can force balance-sheet adjustments elsewhere, tightening financing conditions precisely when demand for liquidity is highest. By design, margins protect counterparties, but they may create sudden liquidity demands that could exceed NBFIs’ preparedness.

Expectations and preparedness are the key factors to determine the final outcome. While anticipated margin demands can be pre-funded, unexpected ones force disorderly sales. From a system-wide perspective, an appropriate level of liquidity preparedness, including the availability of credible and diversified sources of cash, pre-positioned collateral, and realistic assumptions about market depth, can attenuate amplification even when aggregate shocks are large. Conversely, thin liquidity buffers can create vulnerabilities at a macro level.

Our findings underscore the need to strengthen NBFI resilience by fully mapping margin-driven liquidity risk into (macro)prudential tools. It is important to monitor these vulnerabilities, using high-frequency, simple indicators. At the micro level, distress indicators and liquidity preparedness metrics facilitate improvements on governance and the creation of contingency funding. At the macro level, the same indicators feed system-wide surveillance, identifying entities under stress, potential market segment sales, and concentrated counterparty links. This can help refine risk maps and calibrate regulatory tools.

Operationally, supervisors can run regular liquidity stress tests for margin shocks alongside redemption and valuation scenarios. Because our framework yields fund-specific measures of net margin outflows relative to liquid assets, it can anchor realistic scenarios and produce consistent readouts of which entities would be strained, which assets face selling pressure, and which intermediaries are most exposed to liquidity risks. These tests may be useful to calibrate the level of appropriate liquidity preparedness as well as the diversification of funding sources. For example, broader access to banks’ contingent credit lines, repo markets, or liquidity backstops tailored to NBFIs can help reducing forced asset sales related to margin calls.

This approach aligns with the FSB’s recommendations on liquidity governance, preparedness and scenario analysis, proposing observable indicators that allow cross-border comparisons and coordinated responses during crises (Financial Stability Board, 2024). Delivering this agenda requires better data. Even when daily, entity-level margin flows are available, gaps remain in high-frequency holdings, cash and collateral positions of NBFIs.

Alfaro L., Bahaj S., Czech R., Hazell J., Neamtu, I. “LASH risk and Interest Rates”, Bank of England Staff Working Paper No. 1073,2025.

Bardoscia M., Ferrara G., Vause N., & Yoganayagam M. (2021). “Simulating liquidity stress in the derivatives market”, Journal of Economic Dynamics and Control, 133, 104215, 2021.

Financial Stability Board. “Liquidity preparedness for margin and collateral calls: Final report”, 2024, https://www.fsb.org/uploads/P101224-1.pdf

Jansen K., Klingler S., Ranaldo A., Duijm P. “Pension liquidity risk”, De Nederlandsche Bank Working Paper No. 801, 2024.

Jukonis, A., Letizia E., and Rousova L. “The Impact of Derivatives Collateralization on Liquidity Risk: Evidence from the Investment Fund Sector”, International Monetary Fund Working Paper No. 2024/026, 2024.

Macchiati V., Cappiello L., Giuzio M., Ianiro A., Lillo, F. “When margins call: liquidity preparedness of non-bank financial institutions”, ECB Working Paper No. 3074, 2025.