This policy brief is based on ECB Working Paper Series No 3106. The views expressed are those of the author and not necessarily those of the institutions the author is affiliated with.

Abstract

Public debt levels have reached historical highs, reigniting concerns about whether fiscal policy can still provide effective macroeconomic stabilization. This Policy Brief presents new empirical and theoretical evidence showing that fiscal multipliers decline when public debt is high because larger debt stocks lower households’ intertemporal marginal propensities to consume (iMPCs). Combining reduced-form estimates for the United States and OECD countries with a quantitative Heterogeneous-Agent New Keynesian (HANK) model, the analysis demonstrates that higher public debt raises equilibrium real interest rates and shifts wealth toward low-MPC households. These forces reduce the responsiveness of consumption and output to fiscal stimulus. The findings highlight that the composition of debt holdings and the distribution of wealth — not merely the average debt-to-GDP ratio — are crucial for understanding the effectiveness of fiscal policy in high-debt environments.

In recent years, the global economy has entered a period of persistently high public indebtedness. Following the financial crisis, the pandemic, and the energy shock, government debt ratios in many advanced economies have exceeded 100 percent of GDP. This raises a fundamental question: does fiscal policy lose strength when debt is high? The traditional answer, rooted in representative-agent models, focuses on solvency and sustainability. In that view, the level of debt matters because it constrains the government’s future tax capacity. Yet in economies populated by heterogeneous households who face borrowing constraints and idiosyncratic risk, debt also affects the way fiscal policy transmits to aggregate demand. Public debt changes the incentives of households to consume or save, thereby influencing the marginal propensity to consume that determines how additional income is spent.

The research summarized here, based on Grancini (2025), studies how rising public debt weakens the power of fiscal policy through its effects on household behaviour. It combines new empirical evidence for the United States and OECD countries with a quantitative HANK model calibrated to match the U.S. wealth distribution and fiscal structure. Both approaches point to the same conclusion: the higher the stock of debt, the smaller the fiscal multiplier.

The empirical analysis begins with the United States over the period 1950–2023. Using local-projection methods developed by Jordà (2005) and the narrative fiscal shocks of Ramey and Zubairy (2018), the study estimates state-dependent fiscal multipliers that vary with the ratio of domestically held public debt to GDP. The results show a clear and statistically significant pattern: when the debt ratio is low, a one-percent increase in government spending raises output by roughly one percent; when debt is high, the same increase yields an output gain of about half that magnitude. The difference remains robust across alternative specifications and control variables, indicating that the relationship cannot be attributed simply to cyclical conditions.

This pattern extends beyond the United States. A panel of 24 OECD countries, using exogenous fiscal shocks identified by Guajardo et al. (2014), confirms that fiscal expansions are systematically less potent in high-debt states. Countries in the top decile of the domestic-debt distribution experience output responses that are markedly weaker than those in the bottom decile. The cross-country evidence reinforces the idea that public debt dampens fiscal power even in the absence of liquidity crises or binding fiscal limits.

Two mechanisms appear to be at work. Higher debt increases the real interest rate required to equilibrate savings and investment, and it redistributes wealth toward agents with greater saving capacity. Both mechanisms reduce the share of households whose consumption reacts strongly to temporary income gains. Fiscal stimulus therefore produces a smaller rise in aggregate demand and output when debt is large.

To understand why debt weakens fiscal transmission, the paper develops a HANK model that captures the joint behaviour of households, firms, and fiscal policy. In this framework, government bonds serve as liquid assets that households use for self-insurance against income risk. When the government issues more debt, these bonds become more abundant, enabling households to smooth consumption and reduce their dependence on current income. The economy consequently features fewer liquidity-constrained agents and a lower aggregate marginal propensity to consume.

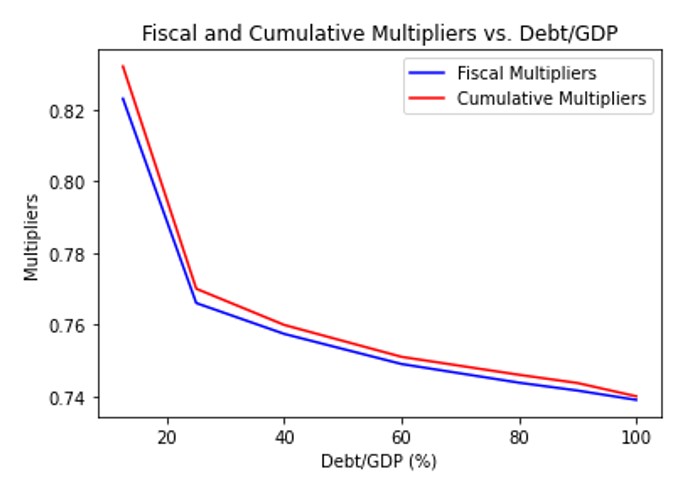

The model reproduces the empirical finding that fiscal multipliers fall with the level of debt. In the calibrated U.S. economy, the impact multiplier declines from about 0.8 when debt equals 20 percent of GDP to 0.7 when debt reaches 100 percent. The decline is gradual and continuous rather than abrupt. Importantly, the mechanism operates even when fiscal policy remains fully sustainable and there is no crowding-out of private investment. High debt alters behaviour through interest-rate and distributional effects, not through financial stress.

A decomposition of the model’s steady states identifies two channels. The factor-price channel operates through higher real interest rates that make saving more attractive. The insurance channel operates through the reallocation of wealth toward richer, less constrained households. Quantitatively, about three-quarters of the fall in the multiplier arises from the factor-price channel, while the remaining quarter reflects changes in the wealth distribution. The interest-rate response of households is therefore the dominant reason why fiscal policy becomes less powerful when debt is high.

Figure 1. Fiscal multipliers decline with higher public debt

Note: A downward-sloping line shows the impact multiplier (vertical axis) against the debt-to-GDP ratio (horizontal axis).

The model also examines how different fiscal rules affect transmission, comparing deficit-financed and balanced-budget regimes. When higher spending is financed by temporary deficits, the government issues new debt and gradually adjusts taxes to stabilize its budget. The resulting path of debt and taxes influences the size of the multiplier. In economies that already carry large debt stocks, the same deficit produces smaller output effects because households expect higher future interest rates and taxes, which both encourage saving. Conversely, when the central bank keeps real interest rates low, fiscal stimulus remains more effective, illustrating the importance of coordination between fiscal and monetary authorities.

The results reveal a subtle policy trade-off. High debt can improve households’ capacity for self-insurance, making the economy more resilient to shocks, but this resilience comes at the cost of a weaker demand response to discretionary fiscal policy. Governments thus face a dual challenge: maintaining debt sustainability without eroding the stabilizing role of fiscal instruments.

Empirical microdata support this mechanism. Using the euro-area Household Finance and Consumption Survey for 2020, the study finds that countries where households hold a larger share of domestic government bonds display lower average MPCs. A ten-percentage-point increase in resident-held debt corresponds to a two-point decline in the average MPC. This cross-sectional pattern mirrors the model’s predictions and underscores the relevance of debt composition for macroeconomic outcomes.

The central message of this research is that public debt affects fiscal policy not only through solvency constraints but also through behavioural channels operating at the household level. When debt is high, households are wealthier, real interest rates are higher, and marginal propensities to consume are lower. Fiscal expansions therefore yield smaller output gains even if the government’s fiscal position remains sustainable. In this sense, the notion of fiscal space should be broadened beyond the budget constraint to include the capacity of fiscal policy to influence demand.

The analysis provides a unifying explanation for why empirical estimates of fiscal multipliers differ across time and countries. Variations in debt levels, interest-rate regimes, and wealth inequality generate heterogeneous responses that cannot be captured by models assuming representative households. By integrating micro-level consumption behaviour into macroeconomic analysis, the paper offers a new perspective on the limits of fiscal policy in the era of high debt. Understanding these mechanisms is essential for designing credible fiscal frameworks that maintain both sustainability and stabilization capacity in the years ahead.

Grancini, S. (2025). Public Debt, iMPCs & Fiscal Policy Transmission. ECB Working Paper No. 3106.

Achdou, Y., Han, J., Lasry, J.-M., Lions, P.-L., Moll, B. (2022). Income and Wealth Distribution in Macroeconomics. Review of Economic Studies.

Aiyagari, S. R., McGrattan, E. R. (1998). The Optimum Quantity of Debt. Journal of Monetary Economics.

Auclert, A., Bardóczy, B., Rognlie, M., Straub, L. (2021). Using the Sequence-Space Jacobian to Solve and Estimate Heterogeneous-Agent Models. Econometrica.

Auclert, A., Rognlie, M., Straub, L. (2024). The Intertemporal Keynesian Cross.

Broner, F., Clancy, D., Erce, A., Martin, A. (2022). Fiscal Multipliers and Foreign Holdings of Public Debt. Review of Economic Studies.

Cho, D., Rhee, D.-E. (2023). Government Debt and Fiscal Multipliers in the Era of Population Aging. Macroeconomic Dynamics.

Ilzetzki, E., Mendoza, E. G., Vegh, C. A. (2013). How Big (Small?) Are Fiscal Multipliers? Journal of Monetary Economics.

Kaplan, G., Moll, B., Violante, G. L. (2018). Monetary Policy According to HANK. American Economic Review.

McKay, A., Reis, R. (2016). The Role of Automatic Stabilizers in the U.S. Business Cycle. Econometrica.

Ramey, V. A., Zubairy, S. (2018). Government Spending Multipliers in Good Times and in Bad. Journal of Political Economy.

Woodford, M. (1990). Public Debt as Private Liquidity. American Economic Review.