References

Admati, A., Demarzo, P., Hellwig, M., and Pfleiderer, P. (2018). “The Leverage Ratchet Effect.” Journal of Finance, 73 (1), 145-198.

Forni, M., Gambetti, L., Lippi, M., and Sala, L. (2017). “Noisy news in business cycles.” American Economic Journal: Macroeconomics, 9(4), 122-152.

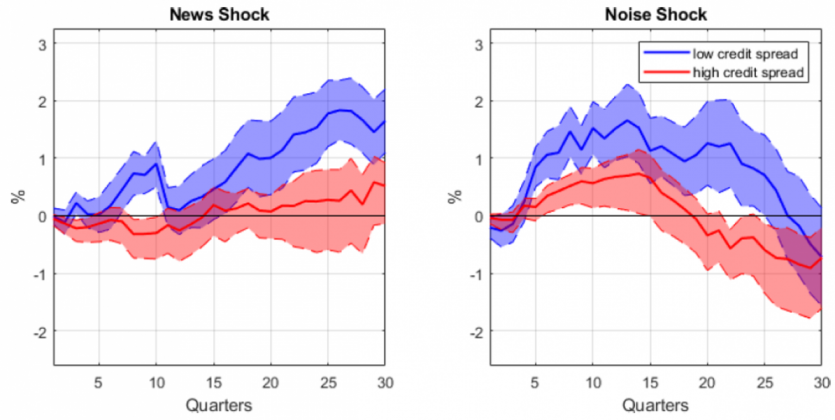

Gerba, E., Leiva-León, D. and Poeschl, J. (2023) “When credit expansions become troublesome: The story of investor sentiments.” Danmarks Nationalbank Working Paper Nº 194.

Jordà, O. 2005. “Estimation and Inference of Impulse Responses by Local Projections.” American Economic Review, 95 (1), 161–182.

Myers, S. (1977). “Determinants of corporate borrowing.” Journal of Financial Economics 5 (2): 147-175.