References

Acharya, V. V. and T. Yorulmazer (2008). Information contagion and bank herding. Journal of Money, Credit and Banking 40(1), 215–231.

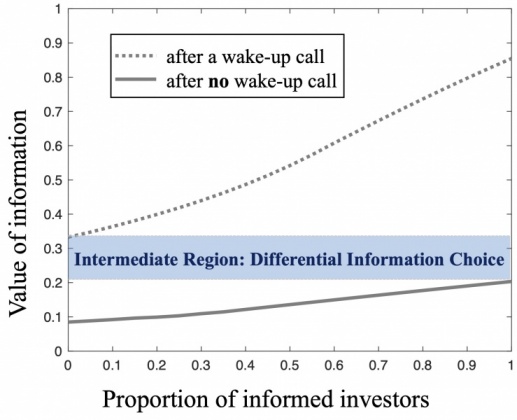

Ahnert, T. and C. Bertsch (2022). A Wake-Up Call Theory of Contagion. Review of Finance, Volume 26, Issue 4, Pages 829-854, 2022.

Allen, F. and D. Gale (2000). Financial contagion. Journal of Political Economy 108(1), 1–33.

Allen, F., A. Babus, and E. Carletti (2012). Asset commonality, debt maturity and systemic risk. Journal of Financial Economics 104(3), 519–534.

Ammer, J. and J. Mei (1996). Measuring International Economic Linkages with Stock Market Data. Journal of Finance 51, 1743–1764.

Chen, Y. (1999). Banking panics: The role of the first-come, first-served rule and information externalities. Journal of Political Economy 107(5).

Corsetti, G., P. Pesenti, and N. Roubini (1999). What caused the Asian currency and financial crisis? Japan and the world economy 11(3), 305–373.

Dasgupta, A. (2004). Financial Congtagion Through Capital Connections: A Model of the Origin and Spread of Bank Panics. Journal of the European Economic Association 2, 1049–1084.

Forbes, K. J. (2012). The ’Big C’: Identifying and Mitigating Contagion. The Changing Policy Landscape. 2012 Jackson Hole Symposium, 23–87.

Goldstein, I. and A. Pauzner (2005). Demand Deposit Contracts and The Probability of Bank Runs. Journal of Finance 60(3), 1293–1327.

Goldstein, M. (1998). The Asian Financial Crisis Causes, Cures, and Systematic Implications. Washington D.C.: Institute for International Economics.

Hellwig, C. and L. Veldkamp (2009). Knowing what others know: Coordination motives in information acquisition. Review of Economic Studies 76, 223–251.

Karas, A., W. Pyle, and K. Schoors (2013). Deposit Insurance, Banking Crises, and Market Discipline: Evidence from a Natural Experiment on Deposit Flows and Rates. Journal of Money, Credit and Banking 45, 179–200.

Kiyotaki, N. and J. Moore (2002). Balance-sheet contagion. The American Economic Review 92(2), 46–50.

Kodres, L. E. and M. Pritsker (2002). A Rational Expectations Model of Financial Contagion. Journal of Finance 57(2), 769–799.

Manz, M. (2010). Information-based contagion and the implications for financial fragility. European Economic Review 54, 900–910.

Morris, S. and H. S. Shin (2003). Global games: theory and applications. In M. Dewatripont, L. P. Hansen, and S. Turnovsky (Eds.), Advances in Economics and Econometrics (Proceedings of the Eighth World Congress of the Econometric Society). Cambridge University Press.

Pavlova, A. and R. Rigobon (2008). The Role of Portfolio Constraints in the International Propagation of Shocks. Review of Economic Studies 75(4), 1215–56.