References

Adelino, M., M. A. Ferreira, M. Giannetti, and P. Pires (2022, 06). Trade Credit and the Transmission of Unconventional Monetary Policy. The Review of Financial Studies 36(2), 775–813.

Antras, P. and C. F. Foley (2015). Poultry in Motion: A Study of International Trade Finance Practices. Journal of Political Economy 123(15 May 2014).

Arbatli, E. C., M. Firat, D. Furceri, and J. Verrier (2022). Us monetary policy shock spillovers: Evidence from firm-level data. Technical report, IMF working paper.

Bernanke, B. S. and K. N. Kuttner (2005). What explains the stock market’s reaction to federal reserve policy? The Journal of finance 60(3), 1221–1257.

Berne Union (2021). Export credit & investment insurance industry report 2020: Annual report of the export credit and investment business of berne union members.

Bruno, V. and H. S. Shin (2015). Cross-border banking and global liquidity. The Review of Economic Studies 82(2 (291)), 535–564.

Caldara, D., F. Ferrante, and A. Queralto (2022). International spillovers of tighter monetary policy.

Ca’Zorzi, M., L. Dedola, G. Georgiadis, M. Jarocinski, L. Stracca, and G. Strasser (2020). Monetary policy and its transmission in a globalised world.

Chen, Q., A. Filardo, D. He, and F. Zhu (2016). Financial crisis, us unconventional monetary policy and international spillovers. Journal of International Money and Finance 67, 62–81.

Demirguc-Kunt, A. and V. Maksimovic (2001). Firms as Financial Intermediaries : Evidence from Trade Credit Data. World Bank Policy Research Working Papers (October 2001).

Elliott, D., R. Meisenzahl, and J.-L. Peydró (2023). Nonbank lenders as global shock absorbers: evidence from us monetary policy spillovers.

Fratzscher, M., M. Lo Duca, and R. Straub (2018). On the international spillovers of us quantitative easing. The Economic Journal 128(608), 330–377.

Gilchrist, S., D. López-Salido, and E. Zakrajšek (2015). Monetary policy and real borrowing costs at the zero lower bound. American Economic Journal: Macroeconomics 7(1), 77–109.

Gürkaynak, R. S., B. Sack, and E. Swanson (2005). The sensitivity of long-term interest rates to economic news: Evidence and implications for macroeconomic models. American economic review 95(1), 425–436.

Hanson, S. G. and J. C. Stein (2015). Monetary policy and long-term real rates. Journal of Financial Economics 115(3), 429–448.

Koepke, R. (2019). What drives capital flows to emerging markets? a survey of the empirical literature. Journal of Economic Surveys 33(2), 516–540.

Kuttner, K. N. (2001). Monetary policy surprises and interest rates: Evidence from the fed funds futures market. Journal of monetary economics 47(3), 523–544.

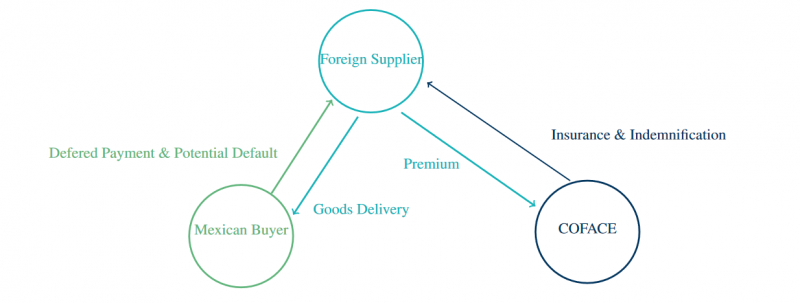

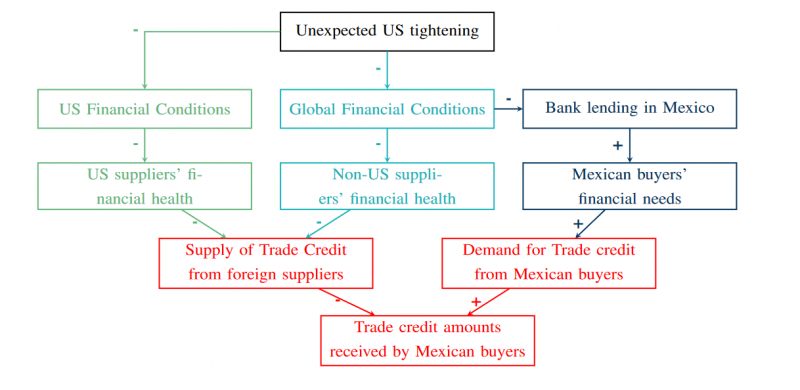

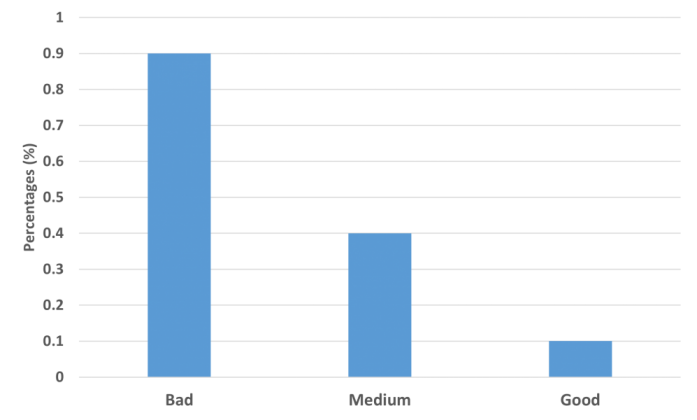

London, M. and M. Silvestrini (2023). US monetary policy spillovers to emerging markets: the trade credit channel. Technical report, Banque de France Working paper Series.

Mishra, M. P., M. K. Moriyama, P. M. N’Diaye, and L. Nguyen (2014). Impact of fed tapering announcements on emerging markets. International Monetary Fund.

Morais, B., J.-L. Peydró, J. Roldán-Peña, and C. Ruiz-Ortega (2019). The international bank lending channel of monetary policy rates and qe: Credit supply, reach-for-yield, and real effects. The Journal of Finance 74(1), 55–90.