This policy brief is based on Banco de España, Working Paper No 2528. The views expressed in this policy brief are those of the authors and do not necessarily represent the views of the Banco de España or the Eurosystem.

Abstract

The natural real interest rate (r*) is a cornerstone of modern monetary policy analysis, frequently interpreted as the equilibrium real rate consistent with full employment and stable inflation. Traditionally linked to long-run structural forces such as productivity growth and demographics, the natural rate has more recently been viewed as endogenous to macroeconomic policy and economic shocks. Nuño (2025) summarizes recent literature to provide a unified framework centered on precautionary saving to explain three channels—fiscal, monetary, and supply-side—that influence r*. This paper synthesizes the core arguments and their implications for monetary policy design and coordination.

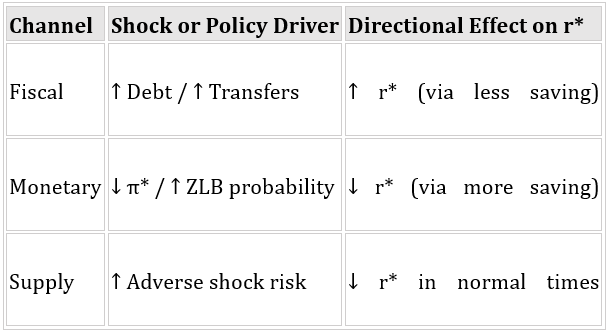

Recent decades have witnessed a persistent decline in real interest rates across advanced economies. While structural explanations such as lower productivity growth and demographic aging have been widely accepted, they do not fully account for the dynamic behavior of r* in response to policy changes and shocks. Nuño (2025) summarizes recent literature that embeds these dynamics within a precautionary savings framework, offering three distinct yet complementary mechanisms:

Each mechanism demonstrates how policies and expectations affect agents’ saving behavior, and in turn, shift the natural rate. The result is a natural rate that is not exogenous and slow-moving, but rather policy-dependent and time-varying.

In models with incomplete markets and heterogeneous agents—especially HANK (Heterogeneous Agent New Keynesian) frameworks—public debt plays a critical role in households’ portfolio choices. With insufficient access to private insurance, agents rely on safe assets to buffer idiosyncratic income shocks. Government bonds serve as a key vehicle for such self-insurance.

Campos et al. (2024) argue that higher public debt reduces the marginal value of precautionary savings by increasing the supply of safe assets. This leads to a lower aggregate demand for self-insurance and thus pushes the equilibrium real rate upward. Conversely, fiscal consolidation or tight debt ceilings restrict the supply of risk-free assets, increasing precautionary saving and depressing r*. Empirical evidence supports this channel. For example, Rachel and Summers (2019) find a positive correlation between debt-to-GDP ratios and r*.

Implication: Central banks must consider the projected public debt level when estimating r* and setting the monetary policy stance. Ignoring this interaction may lead to systematic policy errors and difficulties in achieving price stability.

The second channel centres on the design of monetary policy itself. A reduction in the inflation target (π*) lowers the long-run nominal interest rate (i = r* + π), increasing the likelihood of encountering the ZLB. The anticipation of future liquidity traps prompts agents to increase savings during normal times to smooth consumption in future downturns. This precautionary behaviour, in turn, reduces r* even outside ZLB episodes.

In models where the ZLB is occasionally binding, this channel becomes quantitatively significant. Fernández-Villaverde et al. (2023) formalize this in a HANK model with forward-looking households. A lower inflation target raises the probability of ZLB events, and hence the shadow value of consumption smoothing rises. The result is an ex-ante decline in r* and a non-linear amplification of the ZLB constraint.

Implication: The natural rate is not neutral with respect to the inflation target. Lowering π* to reinforce price stability may, paradoxically, erode monetary policy space. Policymakers should evaluate inflation target choices in the context of their long-term effects on the natural rate and the frequency of ZLB episodes.

The third channel relates to the dynamics of supply shocks—particularly those that are persistent and regime-switching in nature. Examples include energy crises, deglobalization, pandemics, and geopolitical tensions. Nuno et al. (2025) introduce a two-regime New Keynesian model with stochastic switching between normal and adverse cost-push regimes.

In this setting, households facing the risk of negative supply shocks respond by increasing precautionary savings in normal times, thereby reducing the natural rate. When adverse shocks materialize, households dissave in anticipation of recovery, generating temporary upward movements in r*. Thus, expectations about regime-switching can induce fluctuations in r* even in the absence of actual shocks.

Implication: Central banks must account for regime uncertainty and macroeconomic volatility when estimating r*. Anchoring inflation expectations and mitigating volatility may help stabilize r* by reducing the perceived probability of adverse regimes.

Across all three theories, precautionary saving behaviour acts as the central transmission channel. Whether the motive stems from incomplete markets (fiscal theory), anticipation of liquidity traps (monetary theory), or uncertainty about supply-side conditions (supply theory), the effect is the same: changes in economic policy and risk perceptions alter saving behavior, which in turn shifts r*.

The natural rate of interest is not immune to economic policy and expectations. For central banks, the message is clear: achieving price and macroeconomic stability requires a deeper understanding of the forces that shape r* —and a flexible policy framework to adapt accordingly.

Campos, R. G., J. Fernandez-Villaverde, G. Nuno, and P. Paz (2024): “Navigating by Falling Stars: Monetary Policy with Fiscally Driven Natural Rates,” NBER Working Papers 32219, National Bureau of Economic Research, Inc.

Fernandez-Villaverde, J., J. Marbet, G. Nuno, and O. Rachedi (2023): “Inequality and the Zero Lower Bound,” NBER Working Papers 31282, National Bureau of Economic Research, Inc.

Nuno, G., S. Scheidegger and P. Renner (2025): “Monetary Policy with Persistent Supply Shocks,” Banco de España Working Paper, 2529.

Nuno, G. (2025): “Three Theories of Natural Rate Dynamics,” Forthcoming at the Proceedings of the XXVII Annual Conference of the Banco Central de Chile.