References

Bank for International Settlements (BIS) (1995): Guide to the BIS statistics on international banking, April.

Kindleberger, C (1974): The Formation of Financial Centers: A Study in Comparative Economic History, Princeton University Press, New Jersey.

Lane, P and G Milesi-Ferretti (2018): “The external wealth of nations revisited: International financial integration in the aftermath of the global financial crisis”, IMF Economic Review, vol 66, pp 189–222. An updated version of the External Wealth of Nations database is available on the Brookings Institution’s website.

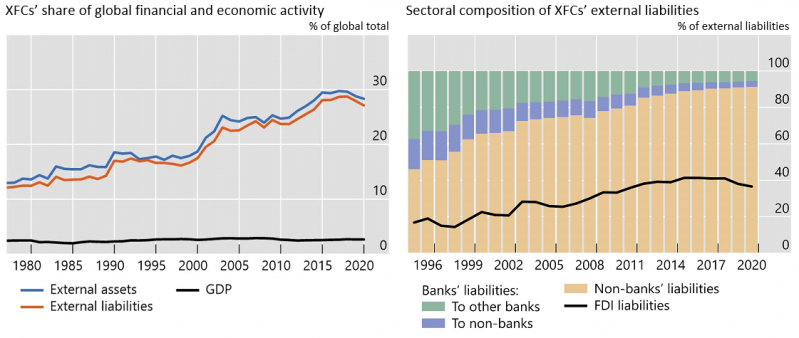

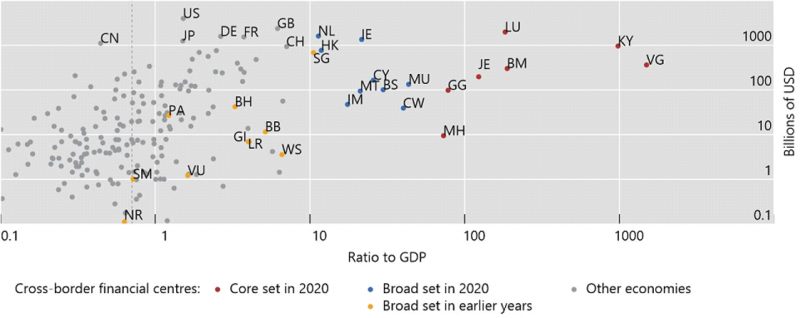

Pogliani, P, G von Peter and P Wooldridge (2022): “The outsize role of cross-border financial centres”, BIS Quarterly Review, June 2022, pp 1-15.

Pogliani, P and P Wooldridge (2022): “Cross-border financial centres”, BIS Working Papers, no 1035, July.

Rose, A and M Spiegel (2007): “Offshore financial centres: parasites or symbionts?”, The Economic Journal, vol 117, October, pp 1310–35.

Weyzig, F (2013): “Tax treaty shopping: structural determinants of foreign direct investment routed through the Netherlands”, International Tax and Public Finance, vol 20, pp 910–37.

Zoromé, A (2007): “Concept of offshore financial centers: in search of an operational definition”, IMF Working Papers, no WP/07/87, April.