This policy brief is based on European Central Bank, Working Paper Series No 3058. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank or the Eurosystem.

Abstract

We provide new evidence on the critical role of monetary policy in shaping credit access for small and medium-sized enterprises (SMEs) and its subsequent impact on economic inequality. We use two extensive datasets- one from a large North European bank and the other from firm level survey data- to explore how private wealth, firm-specific characteristics, and bank behavior interact with monetary policy to influence loan approval rates and long-term financial outcomes. We find that monetary policy has heterogeneous effects on credit access, disproportionately benefiting lower-wealth entrepreneurs during expansionary phases, while exacerbating credit constraints during contractionary periods.

In a recent paper (Delis et al., 2025), we provide novel evidence on the redistributive implications of monetary policy through the lens of the credit channel. This is especially relevant for SMEs due to their dependence on bank loans for working capital, investments, and growth. SMEs are often constrained by their owners’ financial capacity, with wealthier entrepreneurs enjoying easier access to credit due to their ability to provide collateral or absorb financial shocks. In contrast, lower-wealth entrepreneurs face greater hurdles in securing loans, especially during periods of restrictive monetary policy.

The central hypothesis of the paper is that monetary policy can either alleviate or exacerbate wealth disparities through its influence on credit access. Expansionary monetary policy may disproportionately benefit lower-wealth entrepreneurs by relaxing credit constraints, allowing them to grow their businesses and accumulate wealth. Conversely, contractionary monetary policy tightens credit access, particularly for lower-wealth entrepreneurs, reinforcing existing inequalities.

To analyze the interaction between monetary policy, private wealth, and credit access, we use two comprehensive datasets. The first includes loan applications from a large North European bank for the period 2002–2018. This dataset contains over 137,000 loan applications from SMEs across nine European countries, with detailed information on loan applicants (e.g., private wealth, income, education, age, and gender) and firm-specific characteristics (e.g., credit scores, financial statements, and loan characteristics). The second dataset is based on the information gathered from Survey on the Access to Finance of Enterprises (SAFE) for the period 2009–2020 and complements the bank dataset by offering a broader perspective on how monetary policy influences credit markets across different countries and banking systems. The survey sample covers nearly 10,000 family-owned firms across 19 Eurozone countries.

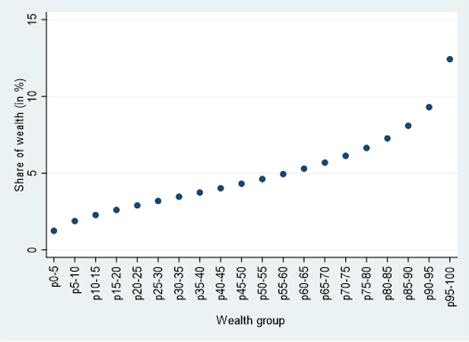

Figure 1 shows the distribution of total wealth among the business owners in the sample of the first dataset per wealth vigintile, with wealth distributed quite unequally. Individuals in the top quartile jointly own 44% of all the wealth in our sample, whereas those in the bottom quartile jointly own 11.5%. Looking further into the tails, the top vigintile owns about 12.5% of all wealth, whereas the bottom vigintile only 1.5%.

Figure 1. Distribution of wealth among the business owners in our dataset from the large euro area bank

Notes: Histogram of owners’ private wealth as reported to the large euro area bank to which they apply for a business loan. Wealth is the euro amount of owners’ total wealth other than the assets of the firm (this includes all movable assets, e.g., financial assets in bank accounts, stocks, bonds, etc.) and minus any household debt the owner might privately have.

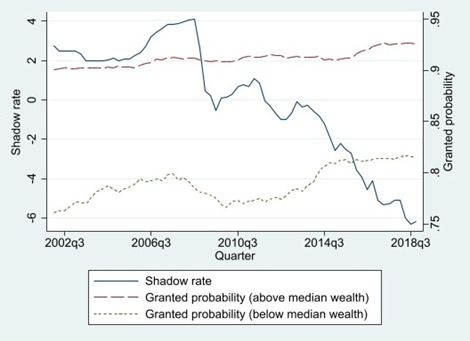

Figure 2 plots the shadow rate – our main measure of monetary policy shocks (Wu and Xia, 2016)- and the average unconditional approval likelihood over the sample period, separately for owners with private wealth above and below the sample median. The data suggests that the approval likelihood of owners with below-median private wealth is lower, and is affected much more by monetary policy, than that of owners with above-median private wealth.

Figure 2. Monetary policy and small firms’ loan approval rates

Notes: The shadow rate is reported in percentage points, whereas the approval ratio is reported as the ratio of approved loan applications to total loan applications in a given quarter.

In our data we have access to the credit score that the firms received at the time of their loan applications, allowing us to assess their creditworthiness as estimated by the bank (Berg, 2018). The credit score perfectly predicts the bank’s origination decision establishing a clear cutoff point: loans are approved for applicants above this threshold and rejected for those below it. Observing the credit score is an important element of our identification method as it enables us to disentangle the effect of owners’ private wealth on monetary policy transmission from the effect of the firms’ net worth and creditworthiness on monetary policy transmission.

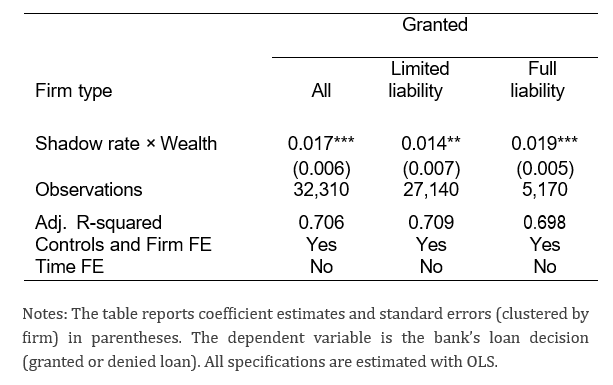

Our first set of empirical results around the credit score cutoff point shows that contractionary monetary policy –measured either by the shadow rate or by exogenous monetary policy shocks (Altavilla et al., 2019)– is associated with lower loan approval rates (Table 1). From the estimates of column 1, we see that a one standard deviation increase in the shadow rate (equal to 3.3 percentage points) is associated with a decrease in the loan approval rate by 2.3 percentage points. Importantly, we find that this effect varies significantly with the private wealth of the business owner. For business owners at the 25th percentile of the wealth distribution (poorer entrepreneurs), a one standard deviation increase in the shadow rate is associated with a 4.3 percentage points lower probability of the bank granting a loan. Compared to the unconditional approval probability of 84.5%, this is an economically meaningful effect of monetary policy. In contrast, for business owners at the 75th percentile of the wealth distribution (richer entrepreneurs), the marginal effect of the shadow rate on loan approval is practically zero.

Next, we examine the collateral role of private wealth. Under full liability, private wealth serves as an explicit source of collateral. Under limited liability, banks need to persuade (or incentivize) the owner to use private wealth to co-finance a risky project or avoid default, making private wealth an implicit form of collateral. Consistent with this, we find that the role of private wealth in the transmission of monetary policy is stronger for firms whose owners are fully liable (column 3) than for firms whose owners are protected by limited liability (column 2).

Table 1. Monetary policy, wealth, and loan decisions

In Delis et al. (2025), we look additionally at loan amounts and prices (loan spreads). We find that tighter monetary policy is associated with smaller loans and higher spreads. But, in line with our baseline results, we find that wealth mitigates the effect of monetary policy. This implies that corporate loans to poorer business owners are smaller and have higher spreads and this negative effect is stronger when monetary policy is tightening (conversely, the negative effect is weaker in periods when monetary policy is expansionary).

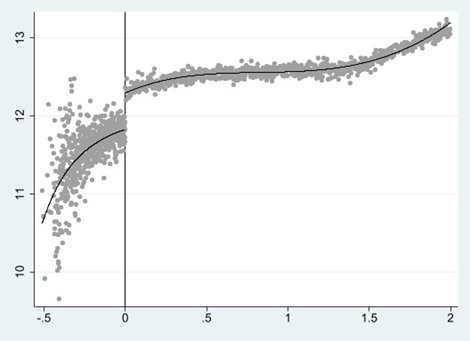

Our second set of results focus on the importance of loan approval for the future income and wealth of the applying entrepreneurs. The main identification challenge in this analysis is that successful businesses are more likely to have their loan applications approved and are also more likely to generate high income and wealth for their entrepreneurs in the future. We use a sharp regression discontinuity design (RDD), which identifies the effect of the bank’s loan decision based on the credit score cutoff point, by comparing marginally approved entrepreneurs to marginally rejected entrepreneurs. Our estimates point to one single clear and sharp cutoff (Figure 3). We find strong evidence that loan approval significantly impacts entrepreneurs’ future income and wealth. Marginally approved entrepreneurs are able to increase their annual income three years later by 7.2% more than marginally rejected entrepreneurs, allowing them to accumulate 5.3% more wealth over this period.

In our third set of results, we validate these results using the second data set which links loan applications to information about the characteristics of the firms’ main banks for multiple euro area countries. By examining the characteristics of a multitude of banks, we can investigate the role of supply-side bank characteristics (e.g., bank liquidity and capital) in the transmission of monetary policy effects on wealth inequality through the credit channel. We find that the impact of private wealth on the transmission of monetary policy is significantly stronger for banks with lower liquidity and capital ratios. In contrast, there is no evidence that firm-level characteristics influence the role of private wealth in the credit channel of monetary policy. The significant role of bank characteristics, rather than firm characteristics, supports supply-side theoretical arguments and empirical findings derived from data from a single bank, as opposed to a demand-side explanation.

Figure 3. Graphical result of the RDD model: Effect on future wealth

Notes: this figure shows the effect of the bank’s decision to grant the loan (credit score above the 0 cutoff) on the loan applicant’s wealth 3 years onward. The figure displays one single cutoff point and a clear discontinuity on the cutoff.

The key implication of our findings is that the credit channel of monetary policy has redistributive effects. Expansionary monetary policy increases the likelihood that banks will approve loan applications, and this effect is relatively greater for applications from poorer entrepreneurs than for those from richer entrepreneurs. Consequently, this enhances the capacity of poorer entrepreneurs to generate additional income and wealth in the future, compared to richer entrepreneurs. Conversely, restrictive monetary policy has the opposite effect. Last, we show that this heterogeneous transmission of monetary policy primarily occurs through banks with low liquidity and low capital, which are less constrained during periods of monetary expansion.

Altavilla, C., Brugnolini, L., Gu¨rkaynak, R. S., Motto, R., and Ragusa, G. (2019). Measuring euro area monetary policy. Journal of Monetary Economics, 108:162–179.

Berg, T. (2018). Got rejected? real effects of not getting a loan. Review of Financial Studies, 31(12):4912–4957.

Delis M., Ferrando A., Mulier K., and Ongena S. (2025) The poor, the rich, and the credit channel of monetary policy. ECB working paper No. 3058.

Wu, J. C. and Xia, F. D. (2016). Measuring the macroeconomic impact of monetary policy at the zero lower bound. Journal of Money, Credit and Banking, 48(2-3):253–291.